Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: COP28 in a (too) indebted world

- 2023 marks a turning point in global public debt;

- The trajectory of public debt has been significantly revised upwards compared to previous pre-covid projections;

- Rising borrowing costs discourage ESG bonds issuance by non financial enterprises;

- This may hinder the green transition and the achievement of climate goals;

- The interconnection between debt and climate in developing countries increases their vulnerability, requiring significant financial support from rich countries to finance their green transition.

Market review: The Fed plays with the markets again

- Fed: perilous communication to frame expectations;

- Historical monthly performance on stocks and bonds;

- Stabilization in the US dollar;

- Spreads still well oriented.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week : Bond market, US economic scenario, a productivity miracle to come?

- Theme : COP28 in a (too) indebted world

Chart of the week

The fight against climate change requires an unprecedented level of international cooperation in a troubled international context cooperation in a troubled international context.

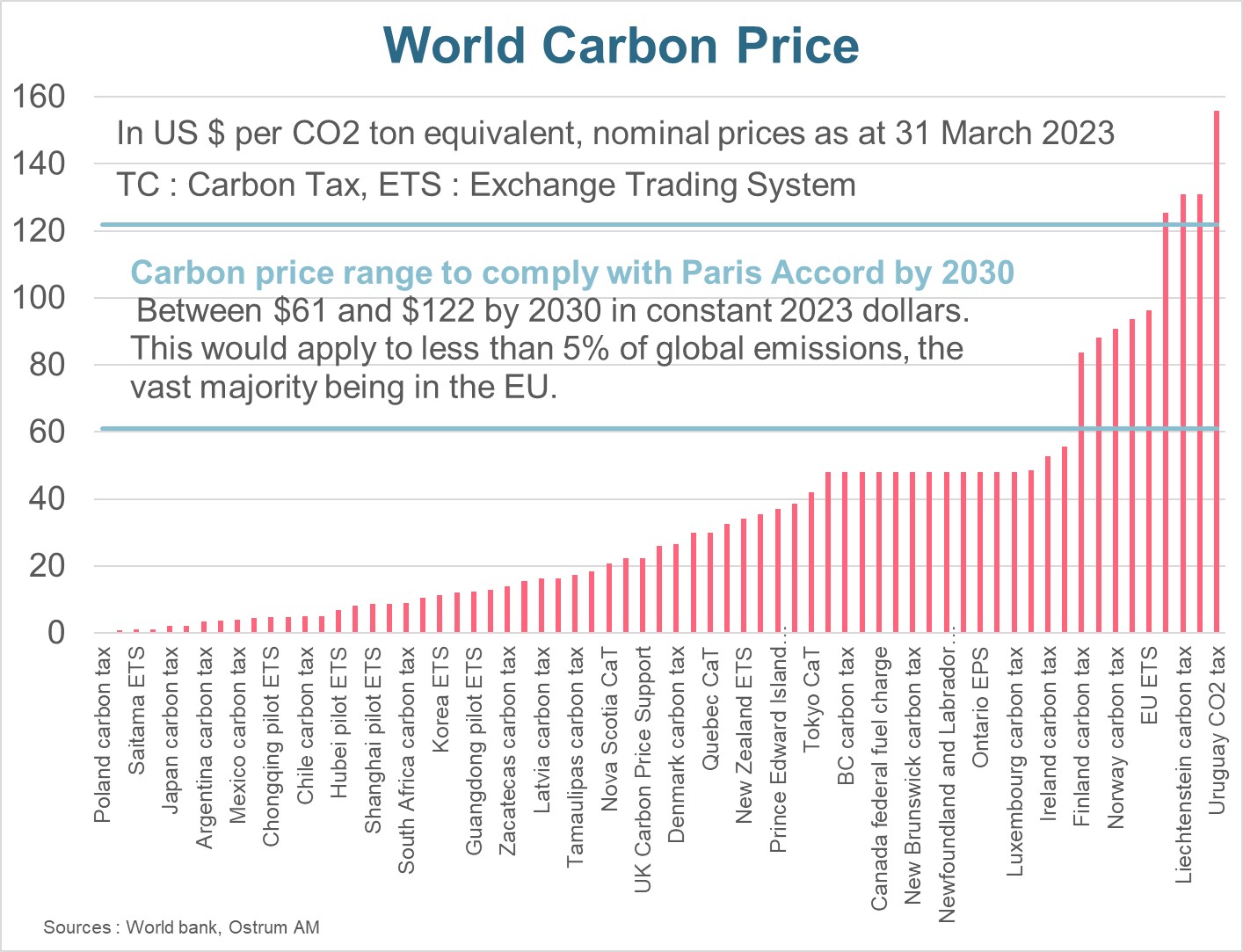

This cooperation will notably take the form of homogenizing carbon prices. The price of carbon is determined either through taxes or through an emissions trading system. Current prices range from 0 in Poland to $160 per tonne in Uruguay.

The price objective per ton of carbon in constant dollars integrated into the Paris agreements is between $61 and $122 by 2030.

At the end of March 2023, less than 5% of global greenhouse gas emissions were covered by a carbon price within this target or above, mainly in European Union countries. This is very insufficient.

Figure of the week

The S&P 500 rose by 8.9% this month, its second-best November since 1980, behind the pandemic-fueled rebound in 2020, according to data compiled by Bloomberg.

MyStratWeekly : Market views and strategy

MyStratWeekly – December 5th 2023