Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

Markets cutting through the political haze

The contrast is striking between, on one hand, the low financial volatility and the strong rebound in risk assets, and on the other hand, Donald Trump's chaotic economic policy, geopolitical tensions, and significant signs of cyclical downturn in the U.S. The U.S. economy is experiencing an unprecedented uncertainty shock. Domestic demand appears paralyzed by tariff policy instability and fiscal concerns. The housing sector is grappling with shortages of materials and detrimental immigration policies. The declining labor force participation rate, which masks the underlying rise in the unemployment rate, is troubling. In the Eurozone, Germany's gradual recovery is offsetting the political hesitations in France following the failure of pension reform. The rollout of the infrastructure investment plan in the second half of the year is expected to bolster this renewed optimism. The growth gap between the U.S. and Europe is narrowing. In China, technological innovation remains at the core of industrial policy, with improvements in consumer spending occurring faster than anticipated, despite an economy still marked by deflationary risks.

The Fed's policy is likely to soon reflect the weakening labor market. The tariff shock undermines demand and is therefore not expected to lead to a lasting surge in inflation. Waller and Bowman have mentioned a possible rate cut as early as July, despite a highly divided FOMC. The ECB will closely monitor the euro as inflation has returned to 2%. A final rate cut appears probable. In this context, the steepening of global yield curves reflects monetary easing and budget deficits. The convergence of peripheral debts toward higher-rated debts remains a prevailing trend. The tightening of credit may have gone too far, while the resurgence of primary issuance in the high-yield market is slowing the momentum. The “Magnificent Seven" remain unshakeable, propelling the S&P to record levels, but Wall Street's outperformance is inextricably linked to the weakness of the dollar.

Economic Views

THREE THEMES FOR THE MARKETS

-

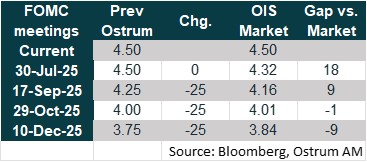

Monetary policy

Central banks remain ready to act. The U.S. Federal Reserve has kept its rates unchanged at 4.25-4.5%. The dot median projections continue to foresee a rate cut of 50 basis points this year. Forecasts for 2026 and 2027 have been revised upward by 25 basis points due to the inflationary effect of tariffs. The ECB will reduce its rates by 25 basis points this summer and could lower them further in the event of a more pronounced slowdown in growth. In China, the PBOC might delay its rate cuts due to the resilience of activity.

-

INFLATION

The U.S. inflation measure preferred by the Fed, the PCE index, slightly increased in May to 2.3% YoY. The core PCE index also rose by 2.7% YoY in May compared to 2.6% YoY in April. In the Eurozone, after reaching 1.9% in May, inflation hit the ECB's target of 2% in June. The point of concern remains the inflation in services, which increased to 3.3% YoY and remains high. The appreciation of the euro and the decrease in energy prices should help keep inflation close to the target. In China, inflation remained at -0.1% in May, reflecting weak domestic consumption.

-

Growth

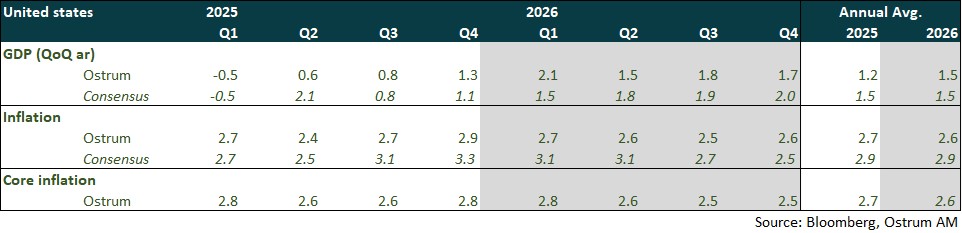

In the United States, Q1 GDP has been revised down to -0.5% GDP, attributed to a revision of consumption to 0.5% GDP (compared to 1.2%). The June employment report shows very few hires outside of the healthcare and government sectors. The decline in the unemployment rate to 4.1% is linked to a decrease in the number of migrants in the labor force. In the Eurozone, after an expected correction in GDP in Q2, growth should begin to benefit gradually from Germany's very ambitious fiscal policy. In China, the rebound in retail sales in May to 6.4% YoY indicates economic resilience boosted by fiscal and monetary support.

ECONOMY: UNITED STATES

A Year Below Potential, Likely Deterioration of the Labor Market

- Demand: Discretionary consumption (notably in services) slowed in Q1. Durable consumption will face the repercussions of tariffs and weakening housing, especially as credit quality deteriorates. Business investment is also uncertain due to the chaos orchestrated by Donald Trump. The external balance is improving, but while imports have decreased, exports fell in May, limiting the improvement. The growth sequence will primarily depend on fluctuations in inventory levels. Looking further ahead to 2026, the sharp slowdown in immigration will hinder growth.

- Labor Market: Employment is expected to slow down. The unemployment rate is projected to rise to 4.5-5% by the end of the year. Job openings are accumulating, but this may reflect a shortage of candidates rather than an abundance of opportunities. The number of individuals holding multiple jobs obscures the underlying weakness perceived by households. The number of unemployment beneficiaries is increasing in June.

- Fiscal Policy: The budget is now under review by the Senate. The House has agreed on a plan that places significant strain on public finances, projecting an additional deficit of $3.3 trillion over the next ten years. The deficit increase will be the largest in 2027.

- Inflation: The rise in tariffs represents more of a demand shock than an inflationary shock, given the weakness in consumption and the slowdown in employment. The decline in rents (real or imputed) will be a significant disinflationary force.

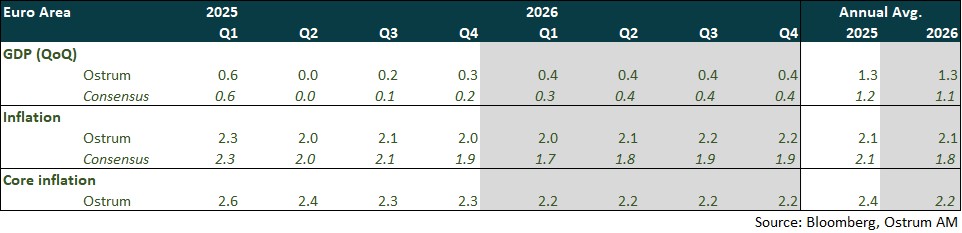

ECONOMY: EURO AREA

Correction expected in the second quarter following the strong acceleration in Q1 (stockpiling by American importers ahead of tariff increases), followed by a recovery in growth supported by the German plan and increased defense spending.

- Activity : Growth was strong in the first quarter due to a rise in exports in anticipation of the increase in US tariffs. This was particularly notable in Ireland. A correction is expected in Q2. Growth is then expected to gradually strengthen, driven by Germany and a significant increase in public investment.

- Domestic Demand: Uncertainty is weighing on household confidence and business leaders' activity outlook, leading them to adopt a cautious approach regarding consumption, investment, and employment. This partially offsets the impact of purchasing power gains and the ECB's monetary easing. Domestic demand is expected to strengthen in the second half of the year, driven by Germany and a significant increase in public investment planned for 2025 (+55%!).

- Fiscal Policy: Germany has announced a budget plan that marks a complete break from its longstanding fiscal prudence, featuring extensive military and infrastructure spending. The room for maneuver for other countries is limited.

- Inflation: Inflation is returning towards the ECB's target of 2%. This is driven by the decline in oil prices, the appreciation of the euro, and moderate domestic demand. Inflation in services remains relatively elevated due to wages. There is a risk of a massive influx of highly competitive Asian products.

- Downside risks to growth in the event of an escalation of trade tensions.

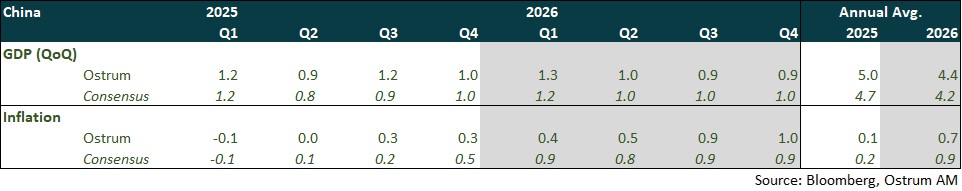

ECONOMY: CHINA

Resilience of the Chinese economy. The economic indicators for May and the June PMI surveys suggest robust Q2 GDP.

- Net exports: Recovery of exports to the United States according to maritime freight data. Chinese exports to the rest of the world remain strong. The significant appreciation of the euro against the yuan (at its highest since 2014) offers opportunities for Chinese exporters. The gradual appreciation of the yuan against the dollar, guided by the PBOC, could mark the beginning of the rebalancing of Chinese growth, provided that deflationary pressures dissipate quickly.

- The new trade agreement of June 27 provides for the lifting of U.S. export controls and China's approval of licenses for critical minerals, while strengthening controls on certain chemicals linked to fentanyl. It is noteworthy that there has not yet been a written and public version of the agreement.

- Demand: Consumption is strengthening, as evidenced by the surprise rebound in retail sales in May at 6.4% YoY. However, this is primarily boosted by the household appliance replacement program (+53% YoY in May!). The Politburo meeting scheduled for late July could lead to additional measures to promote consumption. This could take the form of increased existing subsidies and an expansion of their coverage.

- Monetary policy: We maintain our forecast for rate cuts in the second half of the year. However, positive economic data might encourage the PBOC to delay the cuts until the end of the year.

Monetary Policy

Central banks are plunged into the uncertainty of Trump’s policies.

- THE FED SHOULD LOWER ITS RATES STARTING IN SEPTEMBER.

On June 18, the Fed kept its rates unchanged for the fourth consecutive time, believing it was well-positioned to wait for more visibility on the impact of the policies implemented by the White House. The central bank finds itself in an uncomfortable position: the rising uncertainty related to Donald Trump's policies increases the risk of higher unemployment as well as that of stronger inflation. The median forecasts from the Fed’s monetary policy committee members indicate two rate cuts of 25 basis points this year. The votes are highly divided: 7 out of 19 members wish to maintain rates unchanged for the remainder of the year (up from 4 in March) while 10 others believe that 2 to 3 rate cuts are appropriate. We believe that rates should remain unchanged in July and that the Fed should cut them three times starting in September due to the deterioration in the labor market. Price pressures are expected to be less significant than anticipated by the Fed.

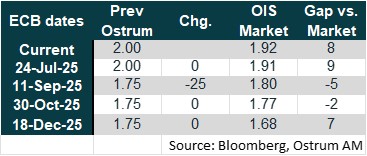

- A FINAL RATE CUT BY THE ECB IN SEPTEMBER.

At the meeting on June 5, the ECB implemented its 8th rate cut, bringing the deposit rate to 2%. The ECB emphasized that the significant reduction in inflation outlook for 2026 (1.6% down from 1.9%) is related to the appreciation of the euro and the decline in oil prices, and is expected to be temporary, as inflation is anticipated to return to 2% by 2027. The ECB is therefore confident in achieving the 2% target in the medium term and believes that the monetary policy cycle is nearing its end. However, the door remains open for further monetary easing given that the ECB continues to view the risks to growth as skewed to the downside due to high uncertainty, particularly regarding trade. We anticipate another rate cut of 25 basis points by the ECB in September. It could lower rates further in the event of a much sharper slowdown in growth due to the trade war or a stronger appreciation of the euro, which would weigh more heavily on inflation and growth through exports.

Market views

Asset classes

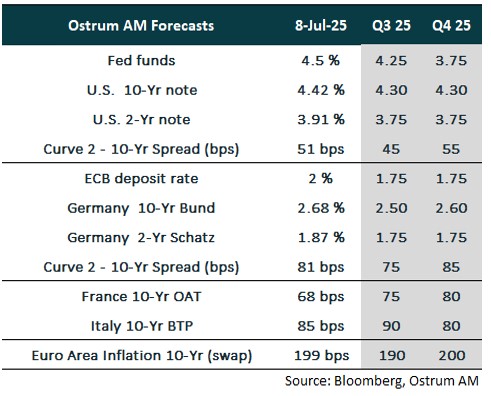

- U.S. Rates: The Federal Reserve is expected to respond to the deterioration in employment starting in September; however, the impact on long-term rates is likely to be limited given the budgetary risk.

- European Rates: The European Central Bank (ECB) is anticipated to lower its rate to 1.75%. The 10-year Bund reflects a more ambitious fiscal policy in Germany and benefits from reallocations from the dollar to the euro.

- Sovereign Spreads: The convergence of peripheral spreads towards core countries is expected to accelerate, with spreads on BTPs and OATs projected at 80 basis points.

- Eurozone Inflation: IInflation expectations remain anchored around the 2% target.

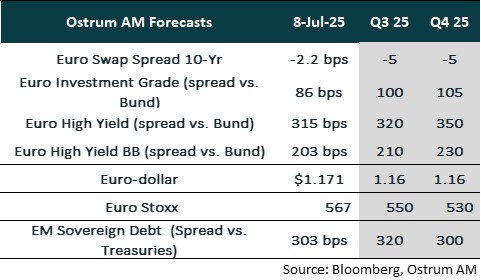

- Euro Credit: Investment-grade credit spreads have tightened significantly, with a modest widening likely.

- Euro high yield: Valuations in the high-yield sector are expected to normalize over the year, with the default rate remaining below the historical average.

- Exchange Rates: Distrust in the dollar has propelled the euro higher, with the single currency expected to approach $1.16 by the end of 2025.

- European equities: Tariffs are likely to weigh on profit margins. The anticipated market decline is somewhat mitigated by upwardly revised earnings multiples.

- Emerging Market Debt: Emerging market spreads have erased the tensions seen in early April and are expected to remain close to their lows for the year.