Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets, activity in the U.S.;

- Theme – The U.S. labor market at a crossroads.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The U.S. labor market at a crossroads.

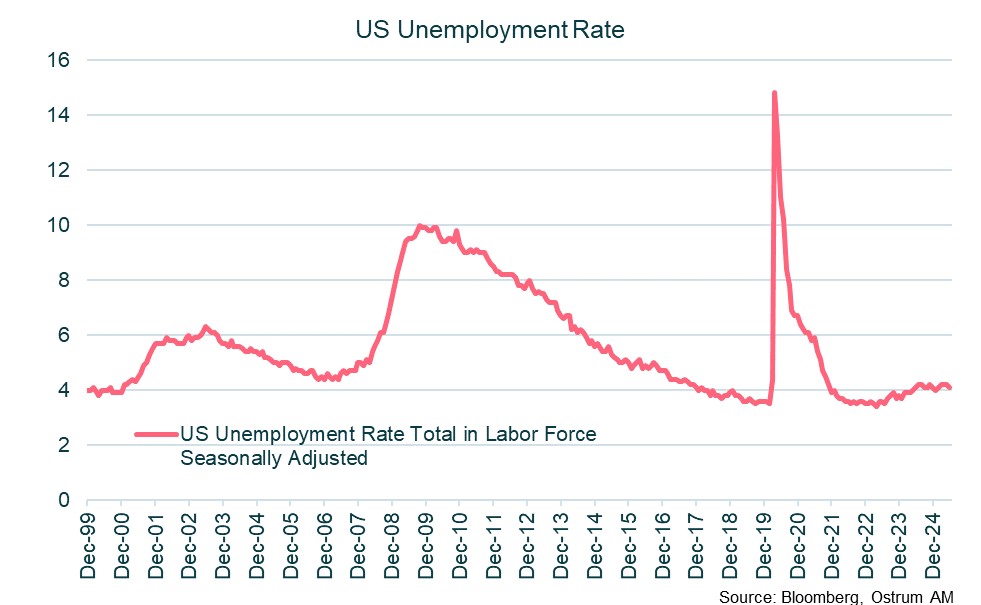

- The June employment report was solid at first glance with non-farm payrolls up 147k and 4.1% unemployment rate;

- However, Fed Governor Christopher Waller is ‘hearing the cracks’ as some indicators paint a bleaker picture of the labor market;

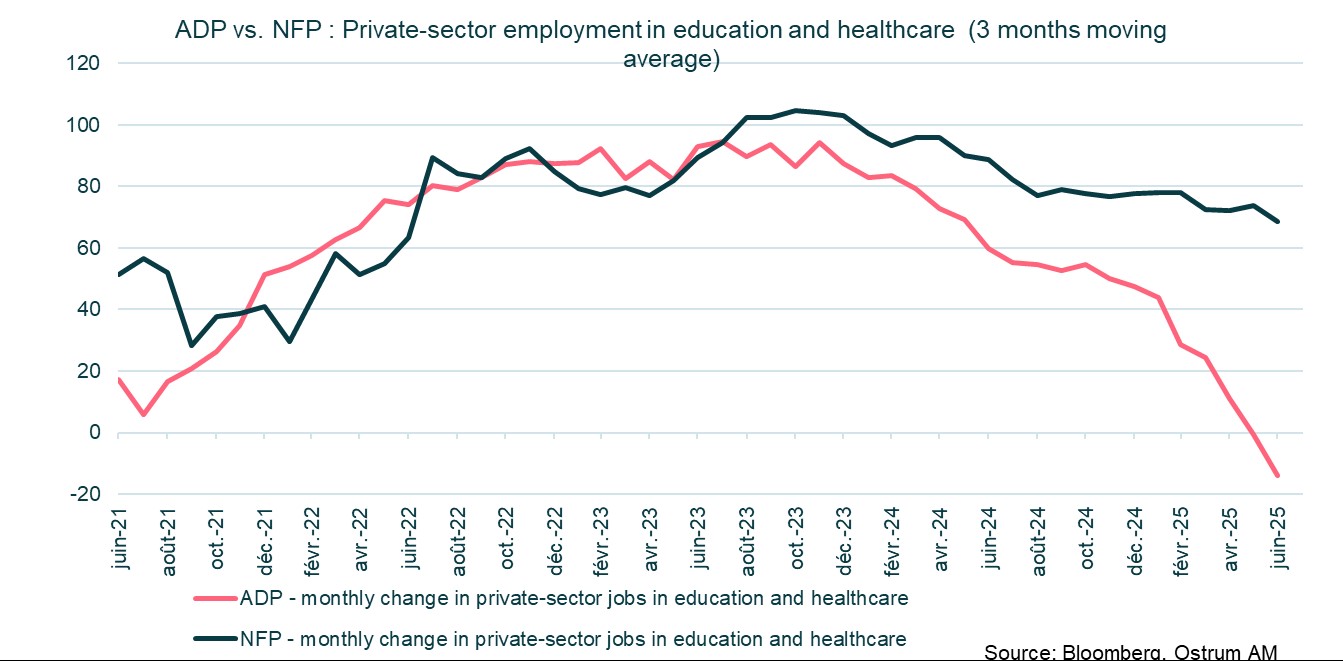

- Indeed, public-sector education and health care made an outsized contribution to June payrolls, which came at odds with other labor market surveys including the ADP report. Overall data quality issues could blur the picture;

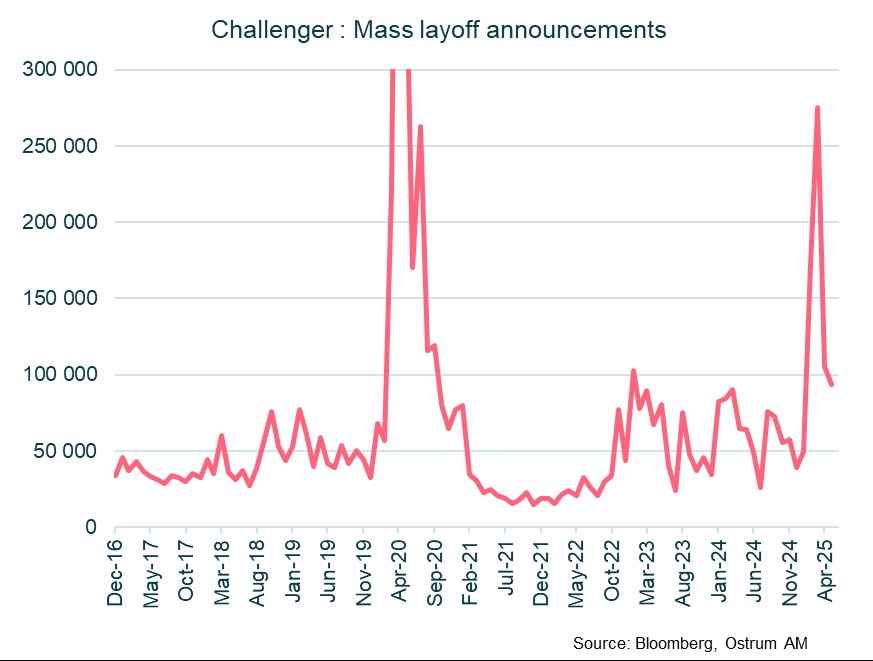

- Steady initial jobless claims data do not point at an acceleration in layoffs. However, mass layoff announcements have increased and hiring has slowed. The duration of unemployment has risen to 23 weeks compared to 20 weeks in 2021-2022. Anecdotal evidence also suggests that young college graduates face a higher-than-normal unemployment rate;

- Furthermore, the drop in the unemployment rate is traceable to a decline in the participation rate. Deportations of foreign-born workers may have played a role in the fall in participation. Lower participation and a reduction in immigration could reduce potential output growth going forward.

Walking on an icy lake

Hearing the cracks despite 4% unemployment rate

The June non-farm payroll report surprised on the upside with an above-consensus 147k increase, near the upper end of the range for the first half of 2025 (102-158k). Likewise, the unemployment rate remains low and even decreased to 4.1% in June. The headline numbers thus suggest that the labor market has been resilient through the slowdown induced by the tariff chaos.

However, beneath the surface, the labor market situation looks much less bright. The Trump Administration’s tariff chaos has instantly turned a 2.5% economy to a stalled economy. Fed business contacts frequently point to heightened uncertainty, impending hiring and spending decisions. The immigration policy is also having a deep impact on the dynamics of the labor market.

Fed Governor Christopher Waller, the most dovish FOMC members, is calling for a rate cut at the July meeting. “If you’re walking on a lake and the ice is frozen, it sounds safe but when you start hearing cracks—and that’s what I feel like—it’s too late once you go through the ice,” Waller said. Governor Michelle Bowman may join Waller and possibly dissent if the FOMC decides to keep interest rates unchanged on July 30th.

Has job data become less reliable?

According to non-farm payroll reports, net hiring has slowed somewhat from last year but stays close to its long-run 10-year average of 150k. The more comprehensive Quarterly Census of Employment and Wages (published by the BLS) however paints a different picture. The QCEW data suggests that the 160k average monthly increase in non-farm payrolls though 2024 may have to be revised down to around 110k. The QCEW survey is published with a 6-month delay (and is revised several times thereafter) but is deemed more reliable than the quick read from the all-important NFP data. The declining response rate to the NFP and household surveys could be a factor in the observed discrepancies across employment estimates. The low response rate has been an issue for some time also for the JOLTS report. The timeliest data may thus have become less reliable.

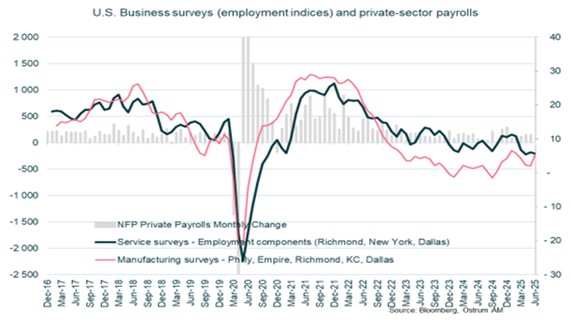

That is less of an issue for markets than for central bankers, especially as some of them are now hearing the cracks. Employment components of business surveys have generally softened contradicting estimates for steady job growth.

The business start-up conundrum

The BLS’ birth-death adjustment adds 614k jobs in 2025

In addition, the BLS makes an adjustment for monthly business starts (the net birth/death model). This is because there is an unavoidable lag between an establishment opening for business and its appearance on the BLS sample. Because new firm births generate a portion of employment growth each month, non-sampling methods are used by statisticians to estimate this growth. This birth/death adjustment is a large source of swings in monthly job creation.

Since the start of the year, the net birth-death adjustment appears to have added 614k new jobs, more than the 552k total increase in non-farm payrolls year-to-date (data is not seasonally adjusted). The data is what it is. But, a boom in business starts would be at odds with the level of uncertainty described by firms, unpredictable tariff policy and renewed hiring difficulties stemming from stricter immigration rules.

Looking into the cracks

As stated above, the ‘solid’ job report in June came with a few caveats.

Firstly, the public-sector employment was surprisingly strong after several months of cuts to federal staff counterbalanced by modest local government hiring. The 73k increase in the public workforce in June is mostly traceable to the education sector (+53k adding federal, state and local government). Thus, roughly half of the June job growth last month came against the backdrop of restrictions to foreign student visas and cutbacks in education grants. This is odd. It could stem from a bad seasonality adjustment.

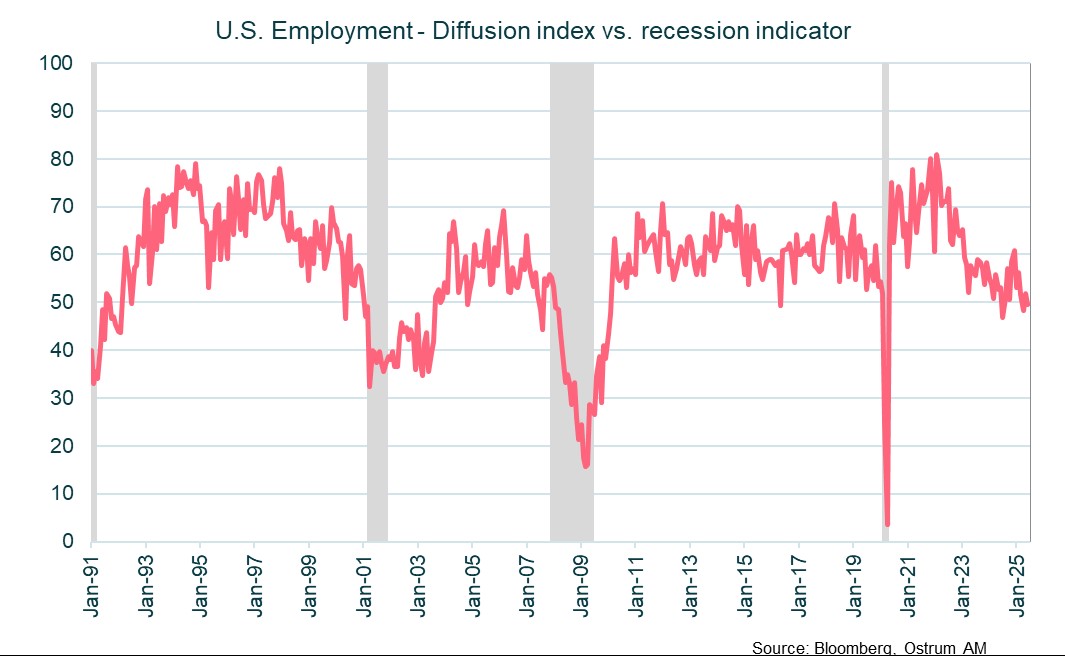

Sub-50 diffusion index rarely observed outside recessions

Secondly, the private-sector job data came in below consensus at 74k vs. 100k in June. In addition, job creation was quite concentrated in a handful of sectors. Education and health care added 51k jobs whilst leisure and hospitality jobs increased by 20k. Employment was flat at best in the rest of the economy.

The diffusion index which measures the number of industries increasing employment compared with industries reducing their workforce even dipped below 50. In other words, a small majority of industries have cut staff in June. A sub-50 diffusion index is extremely rare outside periods of recession.

ADP contradicts NFP data on education and health jobs

Thirdly, the rise in education employment is questionable considering the data from the private ADP report. Education and health shed staff to the tune of 52k in June. There is a stark divergence in estimates for education and healthcare employment in the two reports. Methodologies and sample sizes differ but the ADP employment report has been indicating a sharp slowdown in net hiring in these sectors for more than 9 months now, contrary to steady readings in the non-farm payrolls report. Hence the jury is still out on the U.S. employment situation.

Fourthly, there is a wealth of anecdotal evidence suggesting that jobs have been hard to get lately. The consumer confidence index from the Conference Board provides such metric that correlates with turning point in the unemployment rate. Even college graduates have a hard time entering the job market. On some estimates the unemployment rate of young college graduates is now higher than the national average for the first time ever. Likewise, the high and rising share of multiple jobholders is bad omen. Multiple jobholders now make up 5.4% of the total workforce. Households need extra jobs to make ends meet (as debt delinquencies increase) resulting in an upward bias in non-farm payrolls due to double or triple-counting.

Slower hiring, muted layoffs so far

The slowdown in job creation so far is mainly due to less dynamic hiring, while layoffs remain low. Initial jobless claims hover about 240k per week, still very low by historical standards. Yet continuing claims have increased suggesting that the return to employment for job losers is taking longer than before. The average duration of unemployment is now 23 weeks, up about 3 weeks from 2021-22. Population ageing and persistent mismatches between labor supply and demand in the post covid economy may have raised the duration of unemployment spells permanently. In the 2000s, unemployment duration typically ranged between 15 and 20 weeks at most.

There are much less hiring plan announcements than in years prior. In turn, mass layoff plans have increased in both government under DOGE cutbacks and the private sector. Slower household spending has led to firing in the consumer products sector. In the three months to June, even large U.S. technology companies (including Microsoft, Panasonic, Hewlett Packard, Workday, Indeed…) have announced staff reduction plans. To sum up, the low level of unemployment insurance claims overall points to a slow deterioration in labor market conditions. That said, jobs have become harder to get and rising WARN notices (layoff warnings) and corporate restructuring plans suggest that firms may begin cutting staff in weeks or months ahead. The uncertain business climate makes it more likely that firms will decide to reduce labor demand. The unemployment rate may have further to rise.

The decline in the participation rate is a concern

Mind the long-lasting impact of lower immigration and participation to the labor market

One of the key developments in the labor market this year is the decline in the labor force participation rate. This is the chief reason behind the fall in the unemployment rate in May-June. The ageing of the population explains the longstanding downward trend, but other factors played a role in the recent decline. ICE raids targeting foreign-born workers on worksites certainly had an impact on the participation rate of Latino workers, in particular.

Lower participation and consequently lower employment rate will inevitably weigh on potential output growth going forward. Without immigration, the U.S. economy will have a tough time maintaining the 2% average growth observed over the past 15 years.

Conclusion

The U.S. employment situation is the most talked-about data in financial markets. Headline numbers suggest resilience through the 2nd quarter of 2025 but a closer look reveals some weakness. More industries are shedding labor and job cut announcements have increased even as claims remain stable. Overall, the labor market appears to be slowing more significantly than 150k NFP and 4% unemployment would suggest.

Axel Botte

Chart of the week

The latest survey conducted by the ECB on bank lending reveals a dichotomy between France and Germany. Across the Rhine, business loan demand surged in the second quarter, despite the uncertainty surrounding D. Trump's tariff policies. Contributing factors include fixed investment, inventory levels, working capital needs, and interest rate levels. This contrasts with France, where business loan demand has been declining for three quarters, with a more pronounced drop in Q2 2025. This divergence reflects the implementation of completely opposing budgetary policies. In Germany, public spending and investment are set to significantly increase to finance military and infrastructure expenditures, while in France, uncertainty is high due to upcoming budget consolidation measures aimed at reducing the public deficit to below 3% of GDP by 2029.

Figure of the week

24

July 24, 2025: This is Earth Overshoot Day. It is the date from which humanity is living on ecological credit: it has already consumed all the resources that the planet can renew in a year.

Market review: Immense pressure on Jerome Powell

- ECB keeps rates unchanged, as June outlook confirmed by incoming data;

- Fed: Powell under extreme pressure to cut rates at July FOMC;

- U.S. equity markets hover all-time highs;

- Credit spreads keep tightening as Bund yields rise in wake of ECB decision.

Following the ECB's decision to maintain the status quo, attention now shifts to the Fed and the BoJ. Jerome Powell is under considerable pressure from Donald Trump to lower interest rates. However, the markets seem to overlook these challenges and respond positively to trade agreements, particularly in Japan.

U.S. economic reports show a mix of improvement in service activity alongside a continued deterioration in the housing market. Orders for capital goods indicate a potential downturn in investment during the third quarter. Growth between April and June will ultimately depend on inventory contributions, although consumption finished the quarter stronger than anticipated. The ECB convened this week, with Christine Lagarde keeping rates unchanged while noting that economic data appeared in line with the forecasts communicated in June. Growth stands at 1.5% year-on-year for the first quarter, and inflation hovers around the 2% target. A potential trade agreement following that reached by Japan would reduce uncertainty. Consequently, the status quo at 2% could persist until the third quarter of 2026. Despite projected inflation of 1.6% next year, it seems the ECB is not inclined to lower rates further, as the 2% level allows for maneuvering room in the event of a sharp rise in the euro or a deterioration in economic activity. Economic sentiment indicators continue their slow improvement (IFO, PMI), and corporate credit demand is improving, except in France.

Market volatility appears significantly lower than the prevailing economic uncertainty. This sentiment is bolstering U.S. equities, which are consistently driven by the technology sector. Earnings reports are favorable, with the first third of publications revealing a 8.3% year-on-year growth in profits and a 4% increase in revenues. The trade agreement between Japan and the U.S. has also propelled the Nikkei up by 3.5%. In short, the market is seeking to move past this deleterious period. In Europe, small-cap stocks have seen a slight improvement in relative performance over the past month. Bank leadership continues to assert itself, followed by insurance and some cyclical sectors. As for the bond market, the T-note seems drawn towards the 4.40% mark ahead of a FOMC meeting under Trump's pressure. The likely status quo may not achieve unanimous support. The proposed increase in the debt ceiling will raise questions regarding the refinancing plan set to be unveiled in early August, and again the risk of curve steepening. Following the ECB, the equilibrium value of the Bund appears to have shifted toward the upper end of the 2.50-2.70% range that has prevailed since April. Tensions surrounding German borrowing do not adversely affect sovereign spreads, which remain stable or are declining. The OAT is trading at 68 bps, while the BTP is at 83 bps. Credit continues to attract buying interest, with the average spread on investment-grade bonds at 72 bps over swaps. Protection buyers seem to have capitulated, leading to a significant tightening of the Crossover towards 270 bps. U.S. high yield continues to outperform, along with emerging market debt. The EMBI spread is heading toward 300 bps against Treasuries. As with last year, a rate hike by the BoJ (following the FOMC) could derail risky assets, especially since, as seen in 2021, signs of excess in small-cap U.S. stocks have emerged. The currency market remains oddly inert, with the dollar-yen stabilizing at 147 against the greenback, erasing weakness ahead of the upcoming upper house elections, which will result in Ichiba's resignation in August. The euro serves as the adjustment variable when the dollar shows signs of weakness, currently valued at $1.17.

Axel Botte

Main market indicators