Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets;

- Theme – Gilt market reassured by budget, with some help from the DMO issuance.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Gilt market reassured by budget, with some help from the DMO issuance strategy

- Three years after the ‘Liz Truss’ moment, Chancellor Rachel Reeves had to convince bond markets that fiscal deficits could be reined in.

- The Autumn statement and DMO's reduction of long-term gilt issuance have reassured financial markets. The bulk of the fiscal consolidation is expected to come after the 2029 general elections.

- The £17 billion increase in fiscal headroom will mostly result from a freeze on income tax thresholds after 2028. However, public spending will rise by about £10 billion per annum until 2030-31.

- The DMO's decision to decrease long-term gilt supply has led to a bond market relief rally, with 10- and 30-year yields dropping to around 4.50% and 5.20%, respectively.

- The sustainability of the gilt rally will depend on the BoE's response to stubborn inflation. The Bank of England is expected to cut interest rates on December 18. Fiscal measures aimed at capping energy bills may reduce inflation somewhat in 2026, hence facilitating the BoE’s task.

The UK budget: backloading the adjustment

Reeves’ budget raises the fiscal headroom by £17 billion.

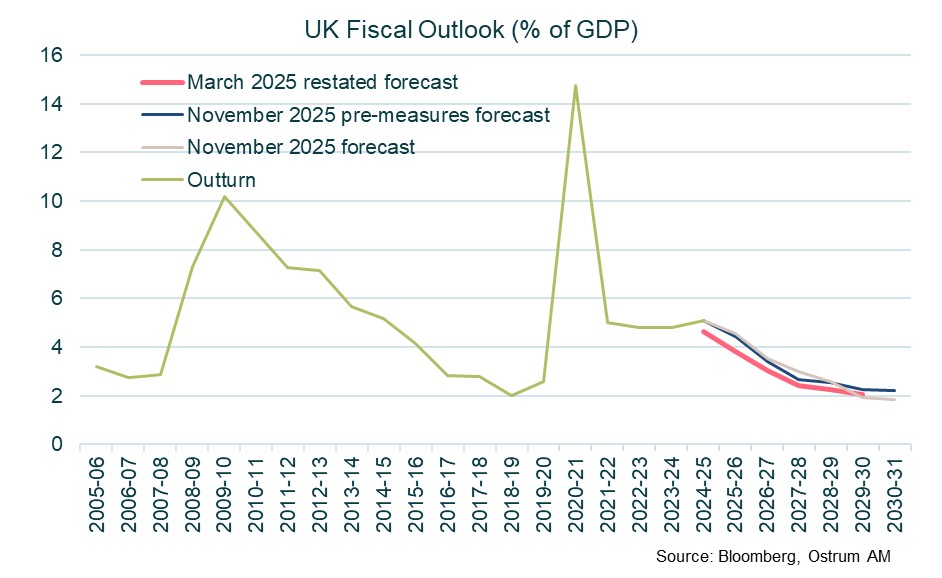

Chancellor Rachel Reeves delivered a budget that increased the headroom relative to the government’s fiscal rules. Fiscal leeway is being rebuilt adding £17 billion to the headroom. The measures presented by Chancellor Reeves add up to 0.4 pp of fiscal consolidation per year over the forecast horizon (ending in fiscal year 2030-31). However, the path to consolidation is somewhat slower than forecasted in March 2025. This is because economic growth has come in below expectations, and the latest fiscal outturn came in higher than anticipated.

Thus, the bulk of the fiscal consolidation is expected to occur after 2028. The adjustment comes therefore at the end of the forecast horizon. The public sector net borrowing was 5.1 % of GDP in the fiscal year 2024-25. According to the OBR, the deficit will diminish to 4.5 % in the fiscal year 2025-26 and continue to fall steadily to less than 2% of GDP after 2029. This suggests that the likelihood of additional tax increases is relatively low.

Government spending is up around £10bn per annum over the entire forecast period. Politically, the scrapping of the two-child benefit cap should fend off any post-budget political fallout within the Labour Party. The government’s next hurdle will likely not come until the May local elections.

UK spending will rise in each year but higher taxes really kick in from 2029 onwards.

The budget hence raises spending in each year of this parliament (ending 2029), whilst the financing of government expenditure comes via backloaded tax increases, and indeed the freezing of income tax thresholds, higher NIC (national insurance contributions) to salary and pension contributions among other smaller tax measures. The budget measures may lower inflation in Q2 2026 by 0.5pp through the reduction of energy bills and fuel duty freeze. Lowering headline inflation has second round effects of lowering inflation expectations, lowering wage demands and lowering indexed regulated price rises in 2027. In the longer-run, the boost to real incomes represents upside risks to inflation.

The Gilt remit: DMO plays it safe

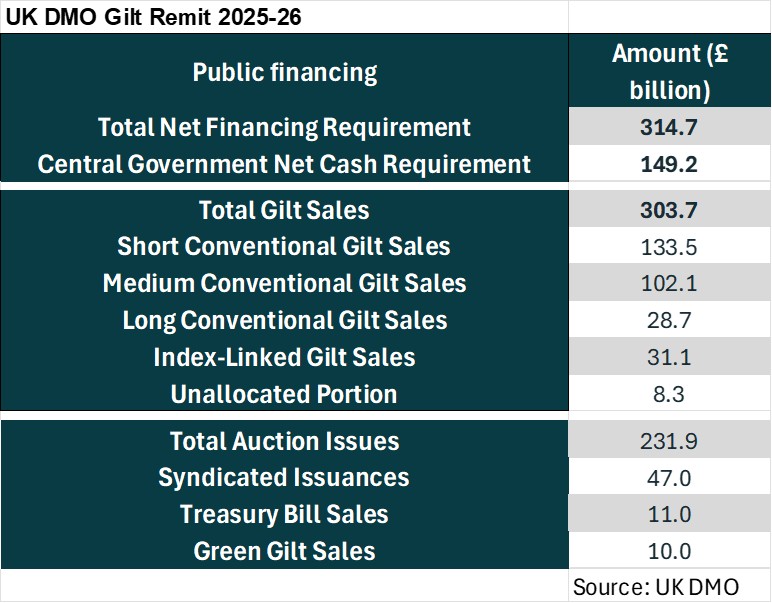

Gilt sales will rise less than forecast, with a focus on short- and medium-term bond issuance.

The UK Debt Management Office (DMO) has released its Gilt remit for the fiscal year 2025-26, forecasting a substantial increase in its Net Financing Requirement (NFR), projected at £314.7 billion. This marks a £5.6 billion rise from earlier estimates, driven largely by the Office for Budget Responsibility's (OBR) revised Central Government Net Cash Requirement (CGNCR), now expected to reach £149.2 billion—up £6.5 billion.

To address this financing demand, the DMO plans to elevate total gilt sales to £303.7 billion, up from £299.1 billion. The distribution of these sales prioritizes short and medium conventional gilts, with sales of short conventional gilts increasing to £133.5 billion and medium conventional gilt sales rising to £102.1 billion. In contrast, long conventional gilt sales are expected to drop slightly to £28.7 billion while index-linked gilt sales will see a marginal uptick to £31.1 billion. An important aspect of the issuance strategy is the unallocated portion, which allows for flexible management, now set at £8.3 billion. The DMO anticipates conducting 64 gilt auctions in the upcoming fiscal year, with total auction issues projected at £231.9 billion, complemented by £47 billion from syndicated issuances. Additionally, plans for Treasury bill sales are in place, contributing £11 billion to the financing strategy.

The gilt issuance breakdown indicates that short conventional gilts will comprise 44% of total issuance, medium conventional gilts 33.6%, long conventional gilts 9.5%, and index-linked gilts 10.2%. Furthermore, the DMO remains committed to sustainable financing, sustaining green gilt sales at £10.0 billion.

The anticipated expansion of the Treasury bill market is expected to commence in January 2026, reflecting a strategic pivot towards increased short-term and medium-term financing to accommodate rising fiscal demands, while managing long-term conventional gilt sales conservatively.

Markets: All eyes on the next BoE meeting

The BoE may cut rates further, despite elevated inflation.

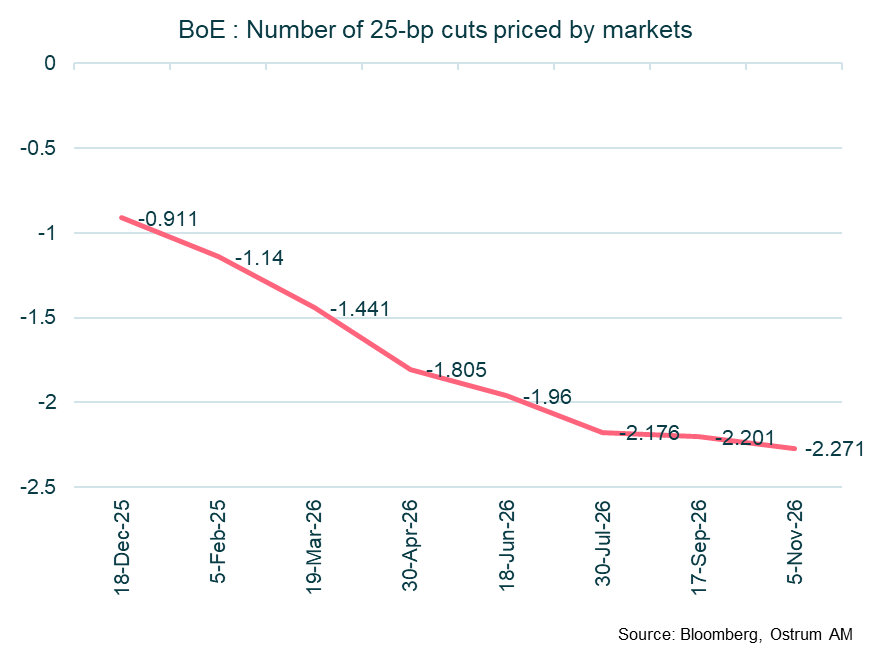

In early November, the BoE acted hawkish whilst talking dovish by keeping rates steady ahead of the budget announcement. The 5-4 vote for a status quo (4 in favor of a 25-basis point decrease) was indeed a clear indication of the policy bias. The fiscal consolidation, though backloaded, should help mitigate high inflation pressures in the medium run.

The Bank of England is therefore widely expected to reduce interest rates at its December meeting. The OIS market is pricing in an 91% chance of a cut on December 18.

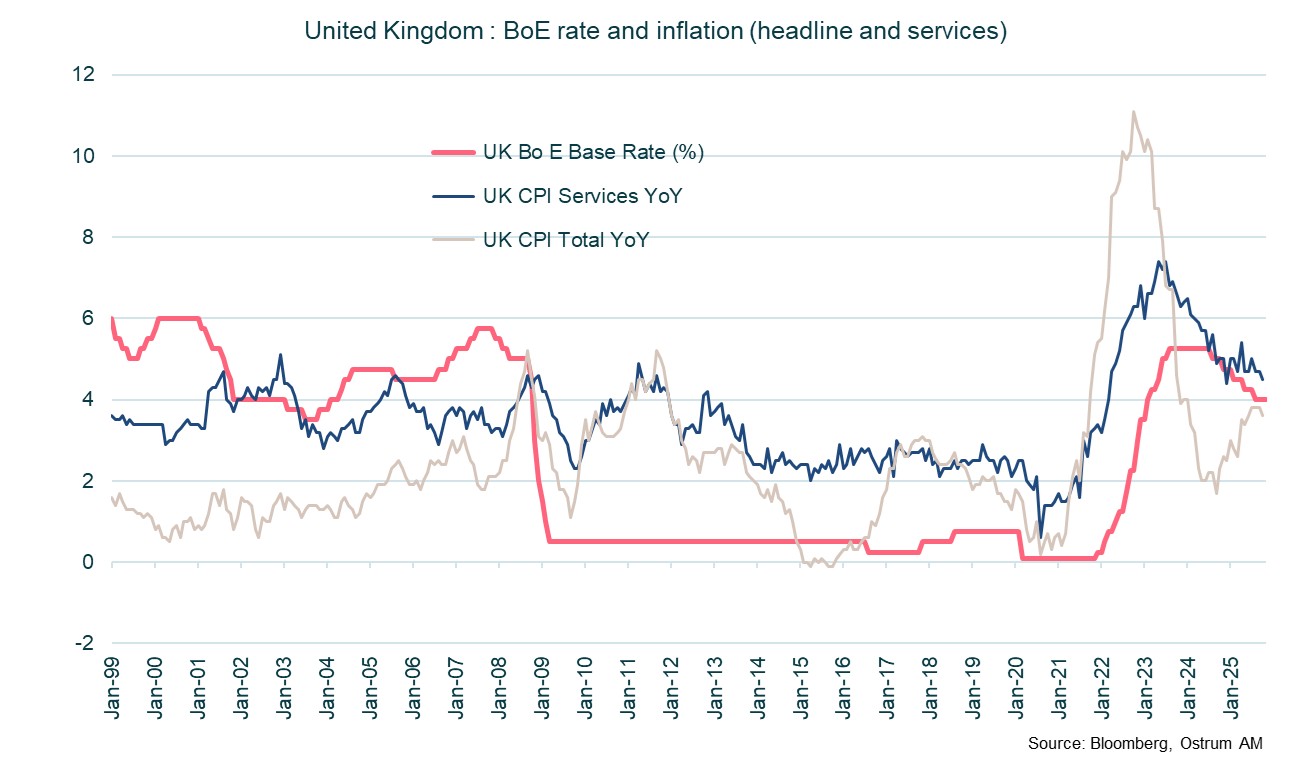

The BoE may therefore continue to turn a blind eye on elevated domestic inflation. It would not be unusual for the BoE to keep monetary policy much looser than domestic price pressures would warrant. Throughout the 2010s, BoE rates were kept close to zero despite persistently high inflation. Service inflation is still running above 4.5% indicating that price pressures are deeply entrenched in the UK economy. Wages have eased at the margin but are nowhere near the levels that would ensure a return to the 2% inflation target (which may require service inflation no higher than 3%). The November labor market and CPI/RPI data will be released on the eve of the BoE December meeting, which is a non-forecast meeting but will take account of the revised fiscal outlook. The near certain cut could be in jeopardy if the inflation picture worsens again, and the front-end rally would evaporate accordingly.

As per the long end of the gilt curve, the decision of the DMO to reduce supply of long-dated bonds sparked a rally. The yield on 10- and 30-year Gilts now trade around 4.50% and 5.20% compared with several peaks above 4.80 % and 5.50 % respectively in 2025. Of course, the Gilt market remains subject to global market trends, but the DMO has managed to rein upside risks.

Conclusion

Three years after the ‘Liz Truss’ moment, markets were eager to hear from Chancellor Reeves about the fiscal outlook. The fiscal measures should raise the headroom by $17 billion through 2031. The freezing of income tax thresholds will raise revenue from 2029 onwards and make up with spending increases. The DMO’s issuance plan which cut long-term bond sales also helped to ease tensions at the back end of the yield curve. Now market participants will have to wait for the BoE’s rate decision to see whether the recent gilt rally can be sustained amid above-target inflation.

Axel Botte

Chart of the week

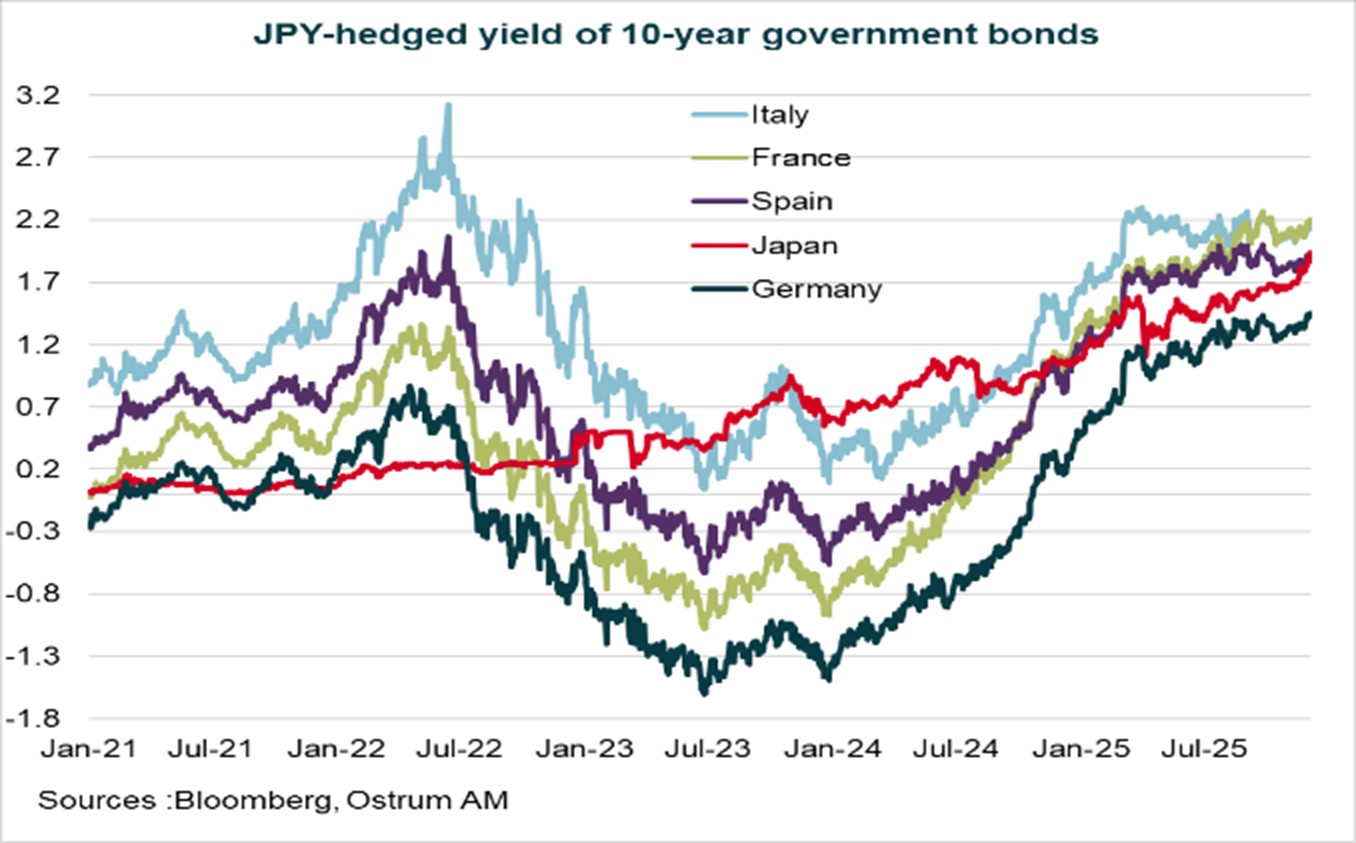

The expected rate hike in Japan could have significant implications for global bond markets. Japanese yields, currently at 1.90% on the 10-year bond, are now comparable to, if not exceeding, those offered by European sovereign bonds once currency risk is hedged over a 12-month horizon. Only the French OAT and the Italian BTP still provide a premium that reflects a considerable credit risk.

If the rate increase stabilizes the exchange rate, Japanese institutional investors may be tempted to arbitrage their investments from USD and EUR back to the Japanese market. Consequently, rising Japanese rates could reverberate throughout global financial markets.

Figure of the week

-32

The ADP employment report indicated 32k job losses in November. Mass layoff announcements have increased in the U.S. private sector.

Market review:

- Fed: Powell to opt for 25 bp cut amid deterioration in labor market.

- Euro area: inflation surprises on the upside at 2.2% in November.

- Equities: U.S. indices fully erase mid-month weakness, bounce to record highs.

- Bonds: JGBs under pressure as BoJ considers rate hike.

A Year-End Rally Disrupted by the BoJ?

The expected easing from the Fed supports risk assets, but the tightening shift from the BoJ could derail them.

The rebound in stocks driven by short covering ahead of Thanksgiving continued last week. Market sentiment remains favorable toward risk, pending an interest rate cut from the Fed. Meanwhile, a tightening appears to be underway in Australia, South Korea, and Japan. The likely tightening by the BoJ is fueling a rise in Japanese rates, while the U.S. dollar, a gauge of risk aversion, adjusts downward. Inflation risks are being overlooked by markets as commodity prices (metals, natural gas) soar.

U.S. surveys (ISM) indicate modest growth in Q4. New orders are slowing. Job losses in the private sector are confirmed by the ADP estimate (-32,000 in November), marking a decline after a brief recovery in October. Announced layoffs concern 71,000 positions in November, meaning the unemployment rate is expected to exceed 4.5% by year-end. Q3 GDP data will not be released, but consumption and investment held steady. Equipment deliveries rose by 0.9% in September, and household consumption is expected to have grown by 3% (annualized) between July and September. However, attention should be paid to the deterioration in consumer credit quality, prompting banks to be more reluctant to lend. Consumer credit is at a standstill.

In the Eurozone, inflation surprised on the upside at 2.2% in November. Excluding energy and food, price increases are at 2.4%, with 3.5% inflation in services. Eurozone growth stands at 0.3% for Q3 (+1.4% year-on-year), driven by stronger-than-expected public and private demand. Household consumption is modestly up (+0.2%), while employment has increased by 0.2% over the quarter.

Regarding financial markets, U.S. stocks have completely erased concerns over valuations of AI-related companies mid-month. The Nasdaq gained 1% for the week, and the Russell 2000 reached a record high. A Fed rate cut seems certain, although Jerome Powell’s discourse and the BoJ's decision the following week could limit upside potential. Earnings expectations remain favorable for 2026. European stocks are rising but the gains are concentrated in a few sectors (banks, automobiles, retail, technology).

In the bond markets, JGBs are pricing in a likely rate hike from the BoJ on December 19, reinforcing the trend initiated by Takaichi's budget plan. The 30-year JGB trades at 3.37%, attracting solid demand at auctions. In the U.S., Kevin Hassett’s appointment as head of the Fed appears increasingly certain. The prospect of a deliberately accommodative policy will support TIPS. The Bund approaches 2.80%. Friedrich Merz has secured the necessary majority for the pension reform. The market can now focus on the German issuance program for 2026, with maturity selection being critical for swap spreads and the slope of the curve. Sovereign spreads are tightening despite political noise in France (75 bps on the OAT). Finally, credit markets are showing signs of outperformance again, with investment-grade credit trading below 70 bps over swaps. High yield has increased by 10 bps over the week.

Axel Botte

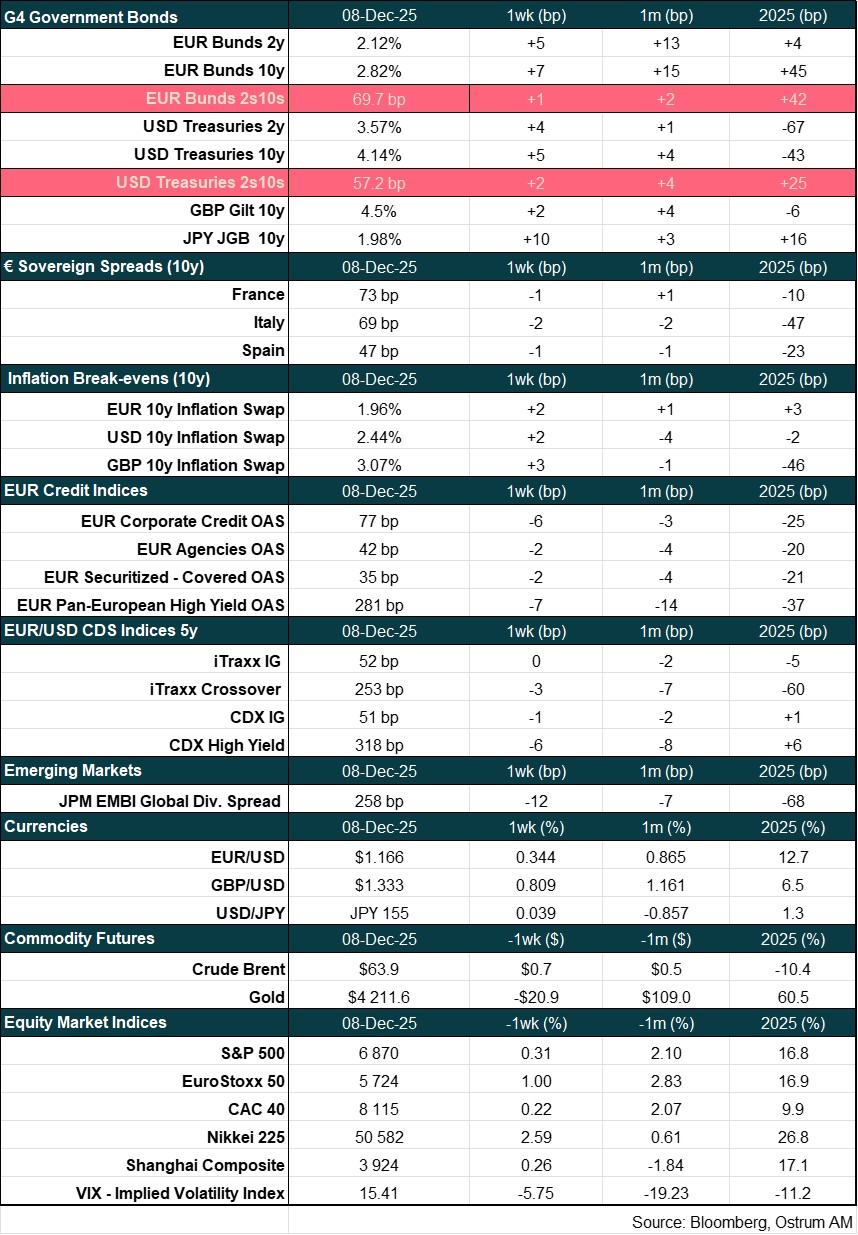

Main market indicators