Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Financial markets, upbeat jobs data and easing US inflation;

- Theme – Towards greater EU financing of European defense.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Towards greater EU financing of European defense

- The war in Ukraine, triggered by Russia, the risk of the United States disengaging from NATO, and, more recently, its threats to annex Greenland, an autonomous territory of Denmark, have triggered a brutal wake-up call for Europe. The need to take its own defense into its own hands and no longer depend on the United States;

- After decades of underinvestment, European military spending is rising significantly: +80% in 2025 compared with the period before the war in Ukraine;

- The EU contributes to financing European defense through the issuance of common debt via the SAFE program and a loan of 90 billion euros to Ukraine, which was just approved by the European Parliament;

- Additional common European financing is needed to strengthen Europe’s strategic autonomy. The development of the EU debt market will also give investors a safe European reference asset capable of rivaling the US Treasury market and will reinforce the international role of the euro.

The EU SAFE program

The SAFE program, with a amount of €150 billion, will be funded by joint debt issuances offering attractive financing conditions.

The SAFE program (Security Action for Europe) is an EU loan instrument designed to finance urgent and significant investments by Member States in the defense industry, with a focus on reducing gaps in critical industrial capacities. The program was presented on March 4, 2025 by the European Commission and adopted by the European Council on May 27. With a total amount of €150 billion, payments can be made from the first quarter of 2026 until 2030. The maximum loan term is 45 years, and the repayment of principal can commence after a 10-year grace period.

The European Commission will borrow on capital markets and will lend to Member States on financing terms that are attractive given the EU’s high credit quality (AAA). This program is attractive for countries with rates higher than those of the EU (such as Italy, France, Poland… ), and less well rated than the EU.

These loans are reserved for EU member countries to fund joint purchases of military equipment. Priority is given to the European defense industry.

These loans are reserved for EU member countries. They will fund joint purchases of military equipment involving at least one EU country benefiting from the SAFE program and other EU countries, as well as Ukraine and countries belonging to the European Economic Area and the European Free Trade Association (EEA-EFTA): Norway, Iceland, and Liechtenstein. The European defense industry is prioritized. To be eligible, projects must ensure that at least 65% of the cost of components originates from the EU, Ukraine, or the EEA-EFTA countries.

Other countries may participate in joint purchases: candidate countries seeking EU membership or potential candidates, as well as countries that have signed security and defense partnerships with the EU such as Albania, Canada, Japan, Moldova, North Macedonia, Norway, South Korea, and the United Kingdom.

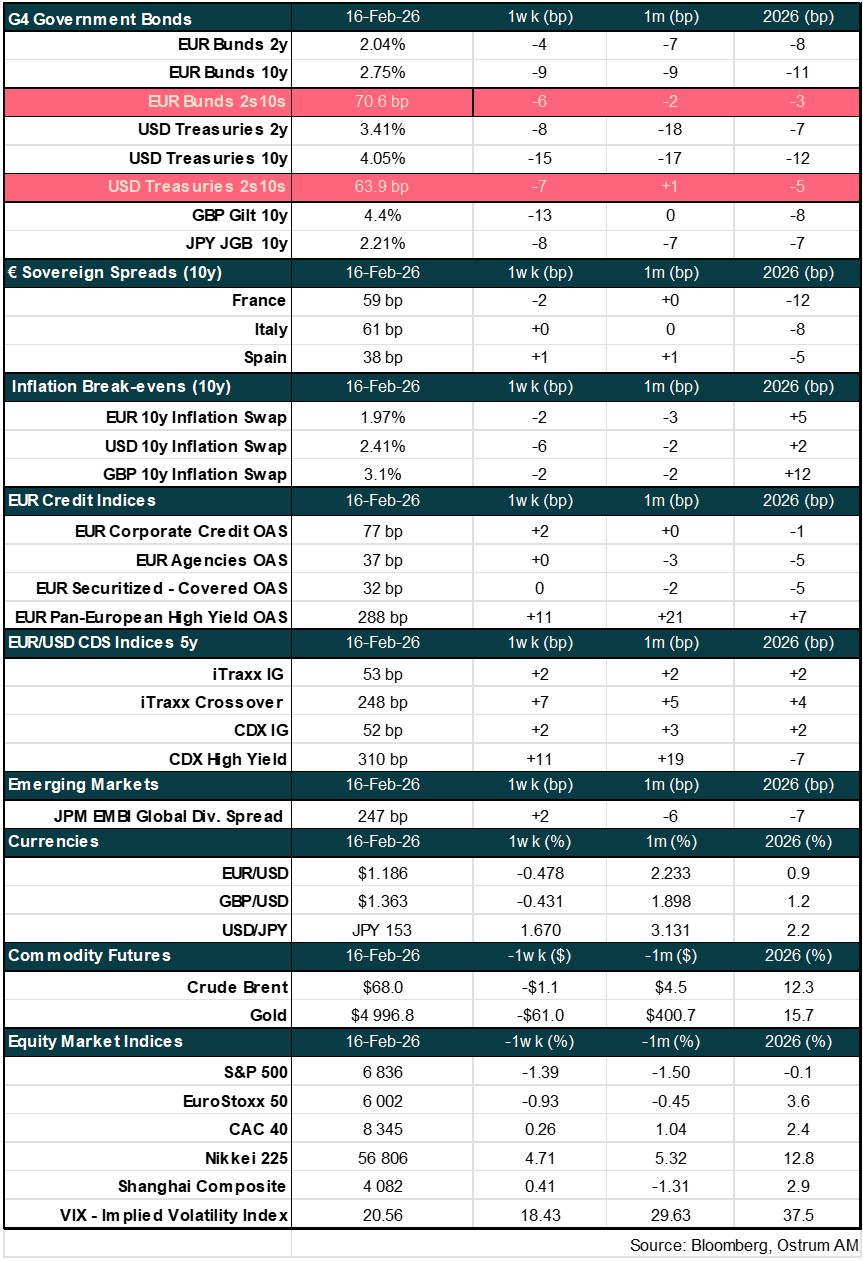

The available funds have been allocated among the countries wishing to benefit from SAFE loans. In January 2026, the European Commission approved the defence investment plans of 16 European countries representing €113 billion in loans. These plans now need to be approved by the European Council and then by the European Parliament. Loan requests from France, Hungary, and the Czech Republic are under review by the Commission (a total of €34.5 billion). As shown in the chart below, Poland will be by far the main beneficiary of EU loans: €43.7 billion, followed by Romania (€16.7 billion), France (€16.2 billion), Hungary (€16.2 billion), and Italy (€14.9 billion). Two-thirds of loan requests come from countries in Central and Eastern Europe, geographically closer to Russia. Relative to GDP, Latvia and Lithuania will be the top beneficiaries of SAFE loans (8.7% and 8.1% of GDP respectively), followed by Hungary (7.9% of GDP), Estonia (5.9%), and Poland (5.2%).

Two-thirds of loan requests come from countries in Central and Eastern Europe, geographically closer to Russia.

After validation of the national investment plans by the European Council and then by the European Parliament, the European Commission will proceed with the first tranche payment at the end of March/beginning of April. A pre-financing of 15% is possible, after which funds will be disbursed in installment according to the progress of the national investment plans.

Towards an increase in SAFE program loans

The SAFE program has been very successful: member states’ demand reached €190 billion, compared with €150 billion available. There are unallocated amounts because some investment plans turned out to be less costly than initially anticipated. Consequently, the loans allocated to the Baltic States are €2.5 billion lower than the initial demand. The European Commission is studying the possibility of new financing for European defense that could include a new SAFE loan program.

EU 90 billion euro loan to Ukraine

The EU quickly put in place a €90 billion loan to Ukraine to bolster its military defense and to fund macro-financial assistance or budget support.

On February 11, the European Parliament approved a €90 billion loan to Ukraine for 2026 and 2027. €60 billion is dedicated to strengthening Ukraine’s defense to address Russia’s ongoing aggression in its fifth year, and €30 billion will be allocated to macro-financial assistance or budget support. Military equipment must come from Ukraine’s defense industries, EU countries, the European Economic Area (EEA), or the European Free Trade Association (EFTA). Targeted exemptions will be possible in cases of urgent delivery needs that cannot be met by the aforementioned countries. In return, Ukraine would commit to continuing democratic reforms and fighting corruption.

The loan is financed by a joint EU borrowing on capital markets. Ukraine will repay the majority of the loan once it has received war-reparations from Russia. The EU reserves the right to use frozen Russian assets on its soil to repay the loan in compliance with EU law and international law. The loan is guaranteed by the EU's long-term budgetary margin, and the costs associated with debt service will be covered by the EU's annual budgets. They are estimated at €1 billion in 2027 and around €3 billion per year from 2028 onward.

Due to the lack of unanimity, the agreement was adopted under the EU's enhanced cooperation framework.

Important point: the Czech Republic, Hungary, and Slovakia did not vote in favor of this loan, so the agreement was adopted under the enhanced cooperation framework of the EU. This mechanism allows EU member states that wish to do so to collaborate in specific areas in the absence of unanimity.

Since the start of the war in Ukraine, the EU has provided €193.3 billion in support to Ukraine, including €3.7 billion from the proceeds of frozen Russian assets, more than any other country.

Calls for an increase in common debt are becoming more numerous and pressing

President Emmanuel Macron and the President of the Bundesbank, Joachim Nagel, are calling for an increase in common debt to finance Europe’s strategic investments.

Over the past few weeks, calls from some leaders and central bankers in favor of a larger European common debt have followed one another. This was notably the case for Emmanuel Macron before the EU competitiveness summit, and for Isabel Schnabel, Christine Lagarde, and the president of the Bundesbank, Joachim Nagel. He opposes the German Chancellor, Friedrich Merz, who argues that common debt should be only a response to an emergency situation like NextGenerationEU, intended to address the COVID-19 crisis.

But the geopolitical environment has changed markedly in the wake of Russia’s war in Ukraine and the United States’ disengagement risk from NATO, or even threats to annex Greenland, an autonomous territory of Denmark. There is an urgency for Europe to act in the face of threats to its sovereignty and competitiveness.

To adopt the ECB and Mario Draghi’s estimates, the EU needs to invest an additional €800 billion per year between 2025 and 2031 to address the ecological and digital transition, or €1,200 billion per year when including defense investments. These joint investments will need to be carried out in public goods that ensure EU security and boost its competitiveness.

Steady increases in European bond issuances will provide a safe European reference asset and strengthen the international role of the euro.

The development of the European debt market will also give investors a safe European asset. The size of the EU debt market has significantly grown since 2020 with the SURE program, NextGenerationEU, and the loans to Ukraine, reaching €720 billion in 2025. The market is expected to continue growing in the coming years, but its size will remain limited, close to the size of the Spanish sovereign debt market. Moreover, the NextGenerationEU program ends at the end of 2026 and will need to be repaid from 2028 through 2058. The SAFE program will follow from 2026 to 2030, but it will be smaller in size. These temporary programs create uncertainty for investors looking to invest in the EU debt market, which translates into EU bond yields being higher than those of countries with equivalent (AAA) credit ratings.

Raising common debt issuance on a regular basis to finance joint strategic investments would thus help create a safe European asset and strengthen the international role of the euro.

Conclusion

The EU is significantly increasing its military spending to ensure its own defense in the face of Russian threats and the risk of the United States disengaging from NATO. Calls for a larger boost to EU common debt to fund the massive joint investments to be made in defense, the climate transition, and the digital sector are becoming more numerous and pressing. There is an urgent need for Europe to act to preserve its sovereignty and competitivity. This will also make it possible to have a safe European reference asset, helping to strengthen the international role of the euro.

Aline Goupil-Raguénès

Chart of the week

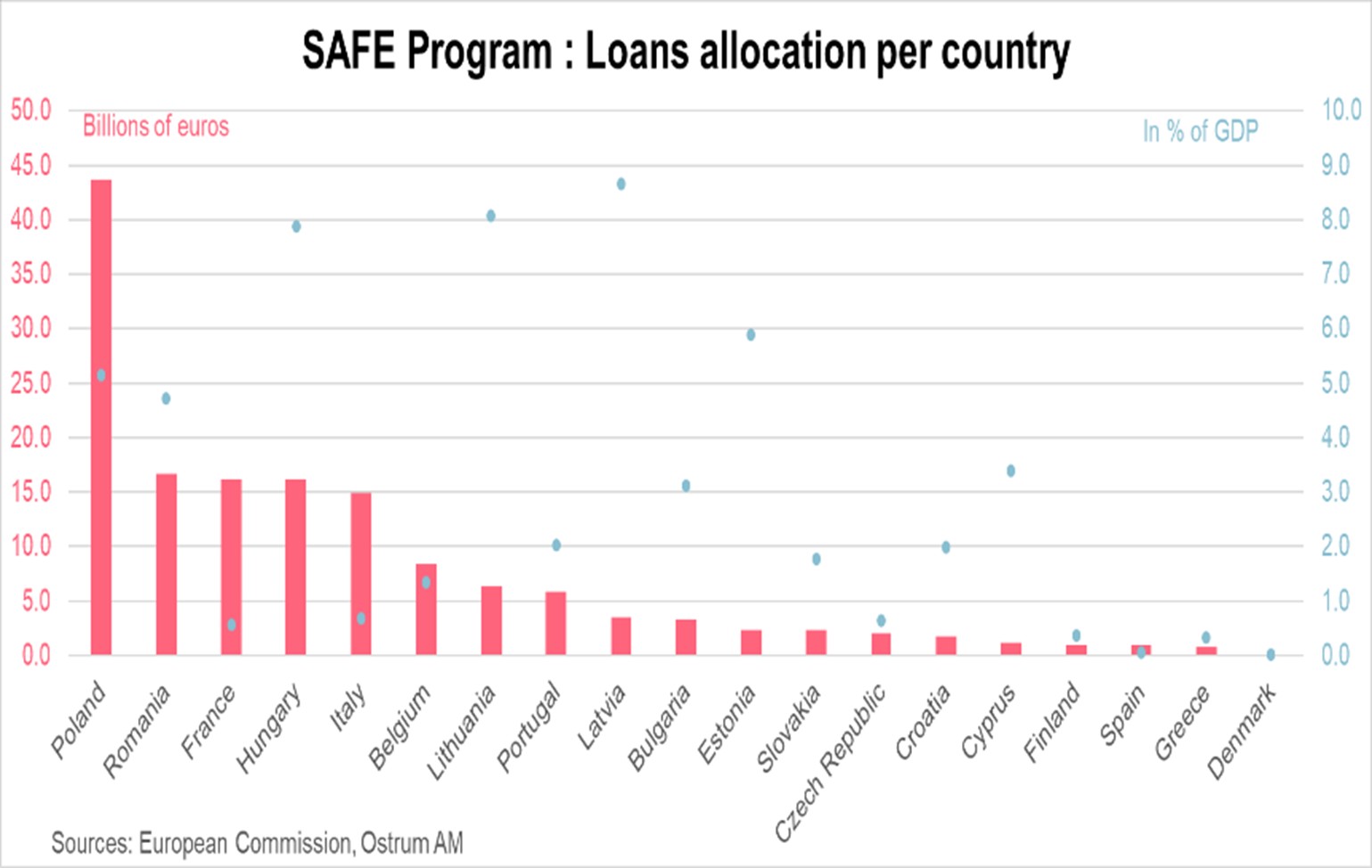

The pace of signing regional trade agreements (RTAs) has accelerated since the adoption of hostile U.S. policies. Since 2020, 115 RTA notifications have been recorded and 69 RTAs have entered into force, marking the strongest acceleration since 1948! When a country signs an RTA, it must notify its existence to the WTO. Each component of an agreement results in a separate notification depending on whether it concerns goods, services, or the subsequent accession of a new member to the agreement. This therefore reflects the total administrative volume of RTAs in force as officially declared to the WTO. Conversely, the number of RTAs in force is independent of the notifications. Since the beginning of the year, several bilateral agreements have been concluded between Canada and China, the EU and India, and between MERCOSUR, the United Kingdom and China—further isolating the United States from global trade. It is in this context that Donald Trump removed the punitive tariffs (on Russian oil) of 25% on India, lowering them to 18%.

Figure of the week

90

American consumers and businesses paid nearly 90% of the costs associated with the rise in U.S. tariffs during the first 11 months of 2025, contradicting Donald Trump’s claims that these costs would be borne by foreign companies.

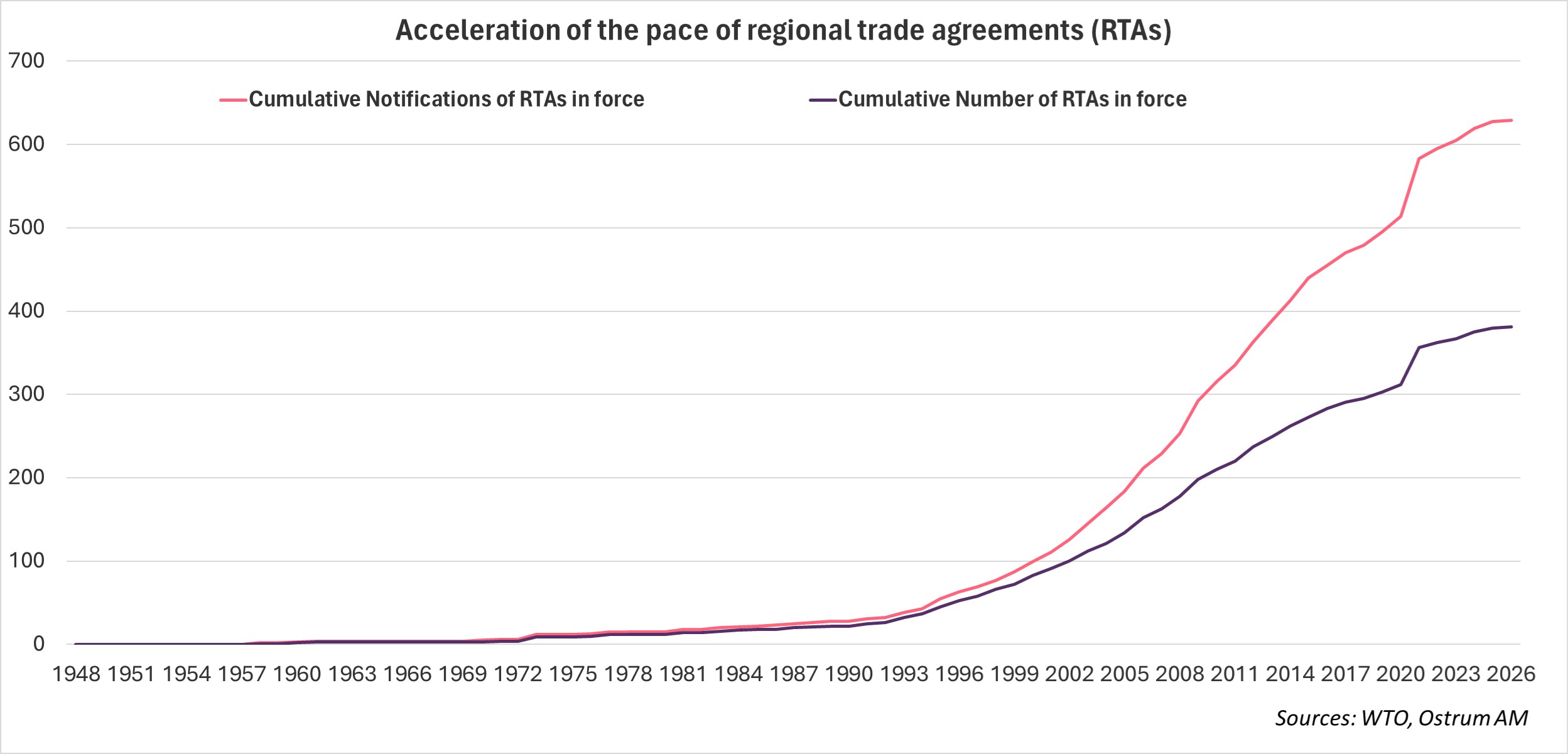

Market review:

- United States: payrolls rise by 130,000 in January, with the unemployment rate falling to 4.3%;

- United States: consumer price inflation moderates to 2.4% in January;

- Equities: disappointments are punished harshly by the market;

- Credit: primary activity remains very brisk, with Alphabet launching a 100-year shadow (sterling) issuance.

The AI Disruption: Markets at a Turning Point?

The anticipated disruptions from artificial intelligence are weighing on tech stocks, driving a shift into bonds. The 10-year Treasury note and the German Bund have broken below 4.20% and 2.80% respectively, even as U.S. employment data beat expectations. Gold slid back below $5,000 as the yen staged a rebound.

Following an intense period of geopolitical headlines, market attention has pivoted back to corporate earnings. A robust US payroll print did not produce the hoped-for rally. Equities appear to be testing corporate resilience in the face of AI-driven disruption, while other themes emerge and risk-off instincts resurface in favour of risk-free assets. Gold, however, also retreated.

US economic releases have left investors puzzled. After a string of weak labor-market indicators (ISM employment components, JOLTS, Challenger survey, unemployment claims), January added 130,000 jobs, with private payrolls rising 172,000. The healthcare and education sectors remain the main job creators, supported by solid construction jobs (+33,000). Most other sectors held or trimmed headcounts. The unemployment rate eased to 4.3%. A softer labor-force recovery is evident as negative net immigration drags the participation rate and payroll growth slows. Inflation data also cooled; January CPI came in at 2.4%, with housing and health costs up 0.2% month-on-month.

In the euro area, Q4 GDP was confirmed at +0.3%. Unemployment rate rose in France, particularly among the young. UK growth was modest at +0.1% in the December 2025 quarter, due to a decline by investment spending and a widening trade deficit.

Markets appear to exhibit familiar knee-jerk reactions to downside risks on equity prices. Software stocks have taken a beating as all AI-exposed businesses come under pressure, while investors reach for safety by bidding up sovereign bonds. US tech giants, once seen as secular winners, face questions about leverage and the ability to monetize AI-enabled infrastructure. The Nasdaq stock index lost around 2% for the week, with a continued rotation into smaller caps. In Europe, equity investors pivot toward energy, commodities, and telecoms, while banks face profit-taking. Disappointments on earnings or outlook revisions are punished severely.

On the bond markets side, demand for long-dated government bonds has revived, with robust JGB bidding contributing to a global rally and a flattening of yield curves. The S&P 500 may close near the week’s trough, as the T-note slips out of its 4.20–4.30% range to finish below 4.10% ahead of a long weekend. Short-end inflation expectations drift lower, with two-year inflation swaps easing. The Bund yield trades just under 2.80%, with limited impact on sovereign spreads.

Credit markets remain solid despite tech issuers such as Alphabet tapping a 100-year bond in sterling and a swiss franc deal. Although spreads trade largely unchanged around 64 basis points over swaps, European high yield has nudged wider on the week.

Axel Botte

Main market indicators