Acting For The Climate

Ostrum AM firmly believes that investment has a crucial role to play in combating climate change and as such we support protection of the climate via our responsible investment management policy. Our climate commitment sits at the very center of the way we operate our business, and draws on six areas for action:

- Bolster our sector policy, by excluding sectors and companies that do not comply with certain fundamental responsibility standards, first and foremost our coal sector withdrawal policy.

- Develop a low carbon emission funding strategy.

- Provide a responsible and active investment management approach for our open-ended funds to support our clients in their own climate policies.

- Dialogue with companies to raise awareness on the risks and opportunities resulting from climate change.

- Contribute to financial market initiatives and industry bodies that work to fight global heating.

- Adopt tailored resources with a view to addressing climate challenges i.e. organization, tools, etc.

Focus on financing a low-carbon economy

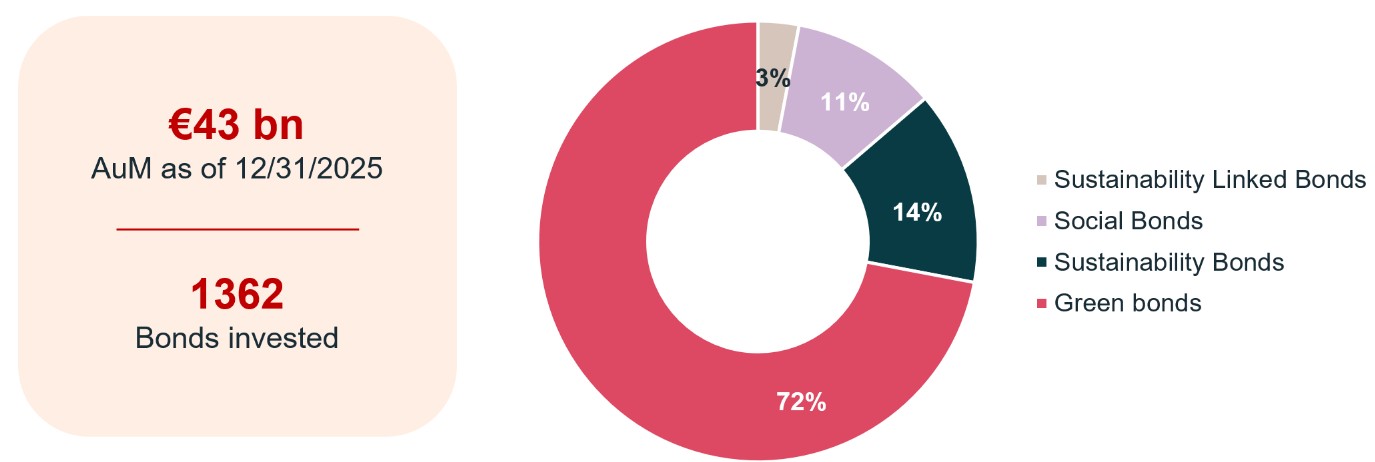

Beyond our SRI management and accreditation policy, we've maintained and strengthened our sustainable bond strategy in 2024, with a view to playing an active role in financing projects that support the fight against climate change, drive the energy transition and foster a strong social impact.

Our exposure to green, sustainability and social bonds

Discover Our Latest Climate Studies