Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- Climate disasters have cost $18,500 billion in the current century, resulting in a massive wealth transfer between sectors. This value transfer is particularly evident between companies exposed to climate risks, such as those in agriculture or construction, and those offering solutions, like insurance companies and firms specialized in energy transition.

- In June 2025, the Community of Madrid issued its first green bond aligned with the European Union Green Bond Standards, with a huge interest from investors: a final book order that has reached a record of €68bn. Since 2017, the issuer has issued €8bn of sustainability bonds and €5 billion of green bonds, totaling more than €11bn in sustainable bonds issuances. It is currently one of the most committed SSA (Sovereigns, Supranationals, and Agencies) issuers in Europe in this market.

- Chocolate giants are facing increasing ESG risks related to cocoa sourcing. These challenges are exacerbated by extreme climate conditions, such as intense heat and drought in West Africa. The sector is now drawing the attention of sustainable investors, who aim to avoid deforestation and child labor throughout the supply chain. In response to these issues, the companies involved are striving to adopt sustainable practices and diversify their sourcing.

- The European Union is making progress towards its 2030 climate goals, aiming for a 55% reduction in greenhouse gas emissions (GHG) and a 42.5% share of renewable energy. By 2030, net GHG emissions are expected to decrease by 54% compared to 1990 levels. However, the agriculture and transport sectors are lagging behind, and Belgium, Estonia, and Poland have not yet submitted their National Energy and Climate Plans.

Figure of the month

18,500 $bn

Cost of climate disasters in the current century, resulting in a massive wealth transfer between sectors

Chart of the month

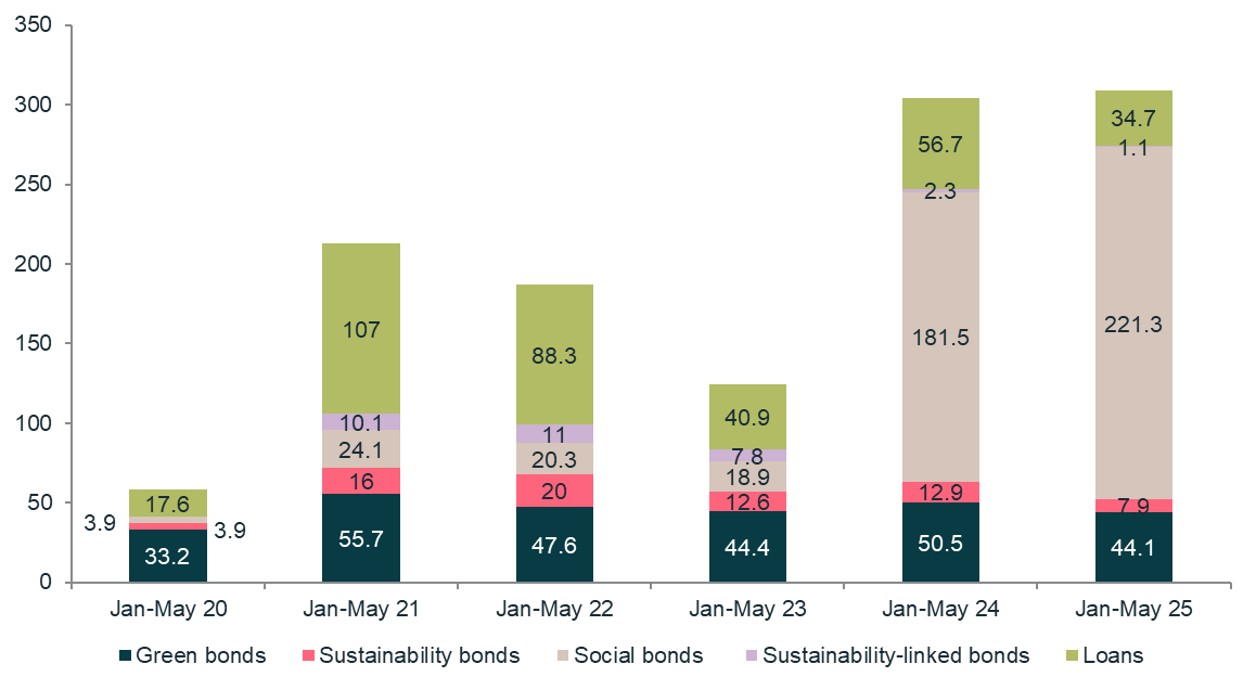

Sustainable debt issuance – United States

Contrary to popular belief, ESG debt sales in the US reached a record high in 2025. While corporate bond issuance fell by 46% (due to trade tensions and anti-ESG positions), social bonds from the government agency Ginnie Mae saw significant increases.

Source: Bloomberg Intelligence, June 2025