Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- According to a study by Morningstar Sustainalytics reported by Citywire, 262 funds classified under Articles 8 and 9 of the SFDR regulation have changed their names. Among them, 185 have simply modified a few terms, while 75 have completely removed any reference to ESG. This development marks a significant acceleration compared to the previous quarter and comes ahead of the May 21 deadline to comply with the new guidelines regarding fund names published by ESMA.

- Germany has recently changed its stance on nuclear energy, ending a long-standing opposition to move closer to France. This turnaround addresses growing concerns about energy security and the transition to sustainable energies. By supporting the integration of nuclear power into EU legislation, Berlin acknowledges the role of nuclear energy in the fight against climate change, thus paving the way for new opportunities for cooperation with France.

- In April, EDF came back to the sustainable bond market with a new triple-tranche green bond, financing both the existing nuclear assets (about 79% of the group's energy mix) and renewable energy generation assets (including hydroelectric, which is worth about 8% of the energy mix). This duality allows, not only to contribute to the group’s overall investments for the energy transition, but also to satisfy investors who sometimes have specific policies on nuclear issues.

- In May, the Spanish company Iberdrola issued for the first time a green bond aligned with European standards on green bonds (or EU GBS). This issuance was an important success, attracting about €3.7bn of demand (5 times the offer), thus allowing the group to issue at 3.5%, an interesting greenium for its financing strategy.

Figure of the month

58%

Combined assets of Article 8 and 9 SFDR funds amount to € 6 Tr, representing 58% of the fund market in the European Union

Chart of the month

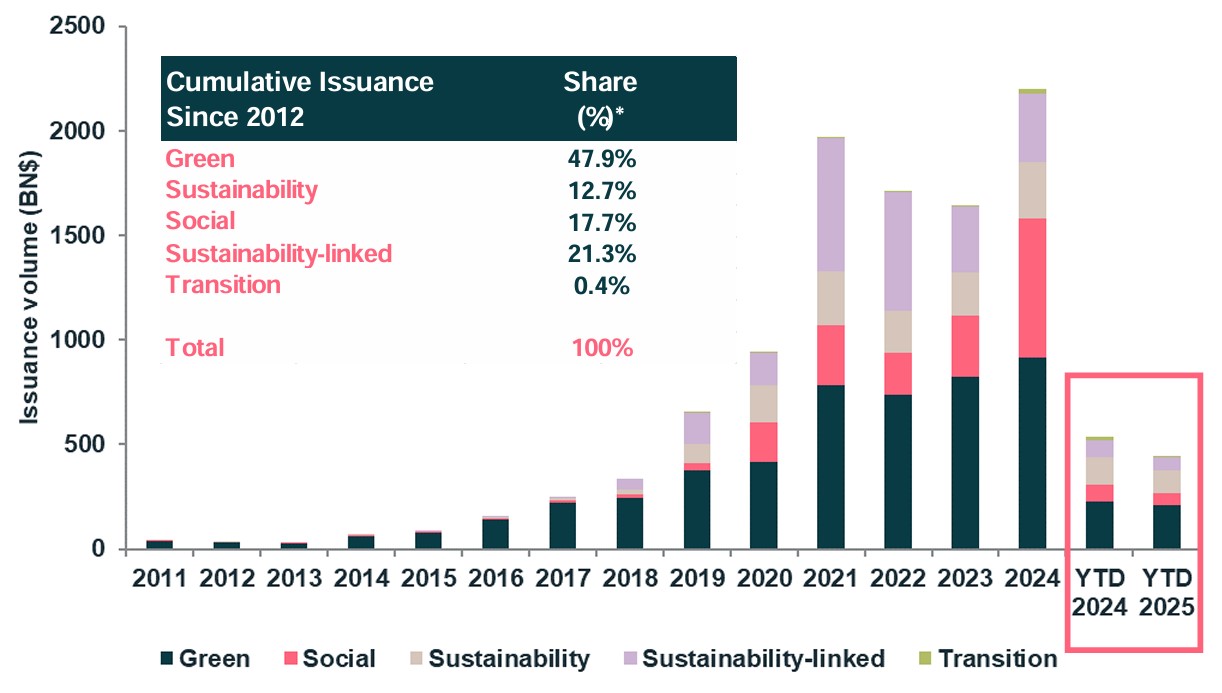

Yearly issuance by labeled sustainable bonds

The cumulative level of sustainable debt reached a record high in 2024, with 48% consisting of green bonds.

Source: Ostrum AM, Bloomberg Intelligence, March 2025