Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- The European Central Bank (ECB) has imposed an unprecedented fine of €187,650 on the Spanish bank Abanca for shortcomings in its management of climate change-related risks. This is the first sanction of this kind, highlighting the ECB's commitment to enhancing supervision of banking practices related to climate risks. This summer, the ECB had already announced the initiation of several investigations, suggesting that further sanctions could follow. In its statement, the ECB noted that "Abanca did not adequately assess or document the materiality of its environmental and climate-related risks before the deadline.”

- Eurogrid, the German transmission system operator, has recently issued a new green bond, for an amount of €1 bn, under the new European Green Bond Standard (EU GBS). The proceeds are going to finance grid projects (on- and offshore) that allows the integration on renewable energy generation assets into the electricity network in North Europe.

- In August 2025, the Czech Republic disclosed, its new Social Finance Framework in order to finance public expenditures having positive social externalities. It includes access to essential services (healthcare and education), socioeconomic advancement and empowerment and affordable basic infrastructures. This social bond issuance is the third one of the country so far, which makes Czech Republic one of the biggest social bond sovereign issuer in Europe.

- Covered bonds are bank securities backed by high-quality residential mortgage loans. They can be labeled as green or social, aiming to finance, for example, energy-efficient or affordable housing for low- and middle-income households. However, ESG-covered bonds remain a niche market, representing only 9% of the total outstanding volume. This can be attributed to several factors: 1) the limited availability of eligible green and social assets, 2) the lack of data on energy performance certificates, and 3) a preference for senior unsecured ESG bonds.

Figure of the month

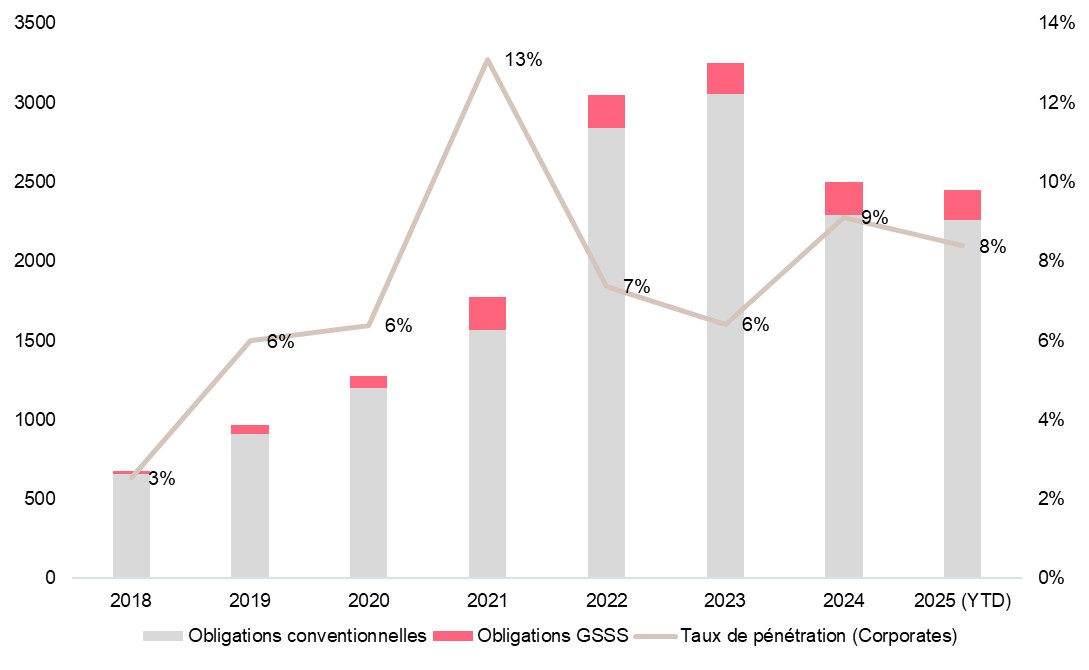

8%

Estimation of the sustainable bond* penetration rate by the end of 2025

Chart of the month

Evolution of the sustainable bond penetration rate* (Europe)

Evolution of the penetration rate of sustainable bonds between 2018 and the estimated end of 2025, for the Corporate sectors (excluding governments and assimilated), within the European zone.

Source: Bloomberg (for data from 2018 to end of September 2025)

* Green bonds, social bonds, sustainability bonds, sustainability-linked bonds