Every month, find out all about the sustainable market bonds news in our newsletter "MySustainableCorner".

This month in a nutshell

- COP 30, the United Nations global climate conference, took place last month in Brazil, with the main objective of accelerating the implementation of the Paris Agreement. The discussions resulted in a consensus text that strengthens cooperation and financing for vulnerable countries while emphasizing a just transition. However, the lack of clear binding commitments on phasing out fossil fuels led many observers to conclude that the outcome was useful but insufficiently ambitious.

- The Sustainability-Linked Bonds (SLBs) asset class is struggling to convince sustainable issuers. In the third quarter, only €0.68 bn were issued in Europe, representing a 77% decline compared to 2024. In the first nine months of 2025, Italian companies, with €5.5 bn, significantly dominated the market, while French companies issued €2.2 bn.

- Climate Transition Bonds (CTBs), are bonds intended to finance the gradual reduction of emissions from carbon-intensive issuers. They are defined and governed mainly by ICMA (International Capital Markets Association) through the Climate Transition Finance Handbook and the Green Bond Principles. Their credibility relies on a measurable transition pathway aligned with the Paris Agreement, rather than the immediate "green" nature of the financed projects. The recommendations include criteria for the use of funds, project evaluation, and communication of results to ensure the integrity of initiatives. A non-exhaustive list of categories for climate transition projects is also provided, including carbon capture and storage, as well as the shift to less polluting fuels.

Figure of the month

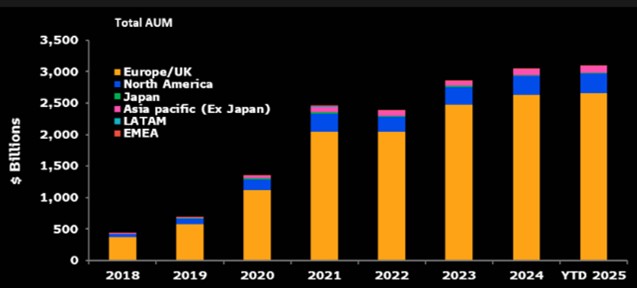

$3500 bn

Total assets in ESG-labeled funds worldwide

Chart of the month

ESG-Labeled funds: assets by region of domicile

In 2025, ESG-labeled funds are nearing $3.5 trillion in assets, driven predominantly by Europe, which remains by far the leading market region, confirming its pivotal role in global sustainable finance.

Source: Bloomberg, December 2025