Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

Aline Goupil-Raguénès’ podcast:

- Review of the week – Market overview;

- Theme – Reciprocal tariffs are back in the spotlight.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Reciprocal tariffs are back in the spotlight.

- 25 letters were sent by the Trump administration to certain trading partners to inform them of the reciprocal tariffs that will apply to their exports in the absence of a trade agreement with the United States;

- The deadline for their implementation has once again been postponed. It is set for August 1, whereas the reciprocal tariffs were initially scheduled to be applied starting April 9 and then postponed to July 9;

- Les nouveaux tarifThe new reciprocal tariffs are mostly close to those announced on April 2, with the notable exception of Brazil (50%, whereas it was not initially targeted by these tariffs) and the EU (30% compared to 20% announced on April 2);

- The EU prioritizes negotiations and states that it is prepared to adopt retaliatory measures if necessary. At the same time, it is strengthening trade agreements with other partners, such as Indonesia this weekend;

- Donald Trump is wielding the threat of reciprocal tariffs to increase pressure on trading partners in order to secure a favorable agreement by August 1;

- While the most likely outcome appears to be a trade agreement in principle between the EU and the United States by August 1, or a new postponement of the deadline to finalize it, we cannot completely rule out the implementation of tariffs higher than the current 10%. This could increase uncertainty, weigh more heavily on growth prospects, and generate a rise in volatility in the financial markets.

New deadline for reciprocal tariffs set for August 1.

The reciprocal tariffs announced by Donald Trump on April 2 and implemented on April 9 were suspended a few hours after their introduction due to the debacle in the financial markets, particularly in the U.S. bond market. In the absence of an agreement with trading partners, the July 9 deadline that had been set for their reinstatement has once again been postponed, this time to August 1.

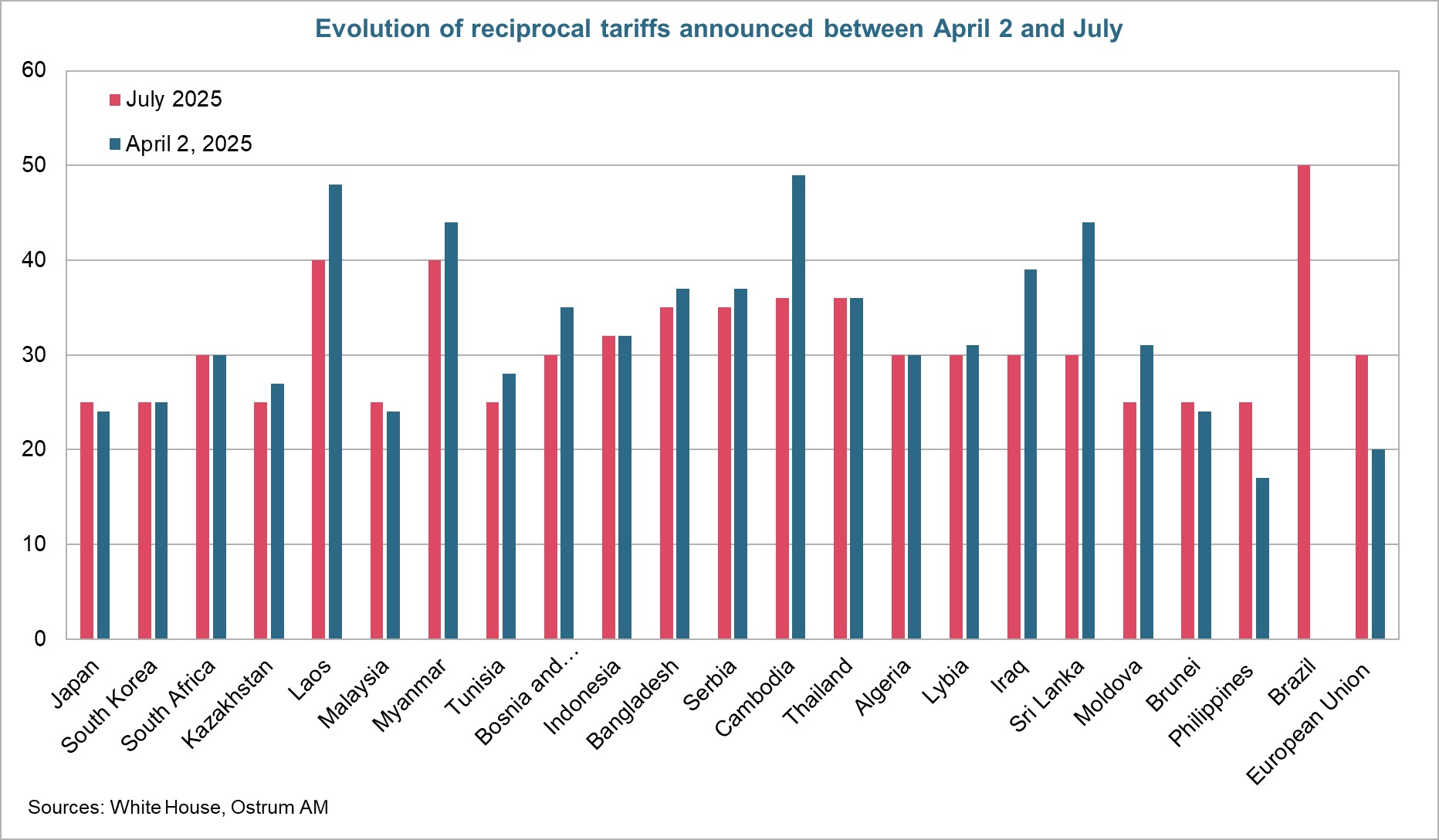

The Trump administration sent 25 letters to the affected countries to inform them of the reciprocal tariffs that will apply to their goods exports to the United States. As shown in the following graphic, these tariffs range from 17% to 50% and are generally close to those announced on April 2: 25% for Japan and South Korea, among others, with notable exceptions.

They are somewhat less significant than the reciprocal tariffs announced on April 2 for Laos, Cambodia, Iraq, and Sri Lanka, among others. The European Union and Brazil stand out with higher tariffs. For the EU, they would be 30% as of August 1, compared to 20% announced on April 2. However, they are lower than the threat of 50% tariffs that Donald Trump had previously mentioned. Brazil was not among the countries targeted by the reciprocal tariffs on April 2. For this country, exports of goods to the United States were initially only subject to a base tariff of 10%, which applies to the majority of exports to the United States. However, Donald Trump has just indicated to Brazil that its exports would be subject to 50% tariffs due to the "unfair treatment" of former President Jair Bolsonaro. He wishes for the legal proceedings against him, relating to an alleged coup attempt, to be halted, denouncing it as a "witch hunt".

The occupant of the White House has also threatened to raise customs tariffs to 35% on imports from Canada and 30% on those from Mexico. Currently, exports that do not comply with the USMCA rules are taxed at 25%. The "remaining countries" (those that did not receive a letter) would face tariffs of 15% to 20%.

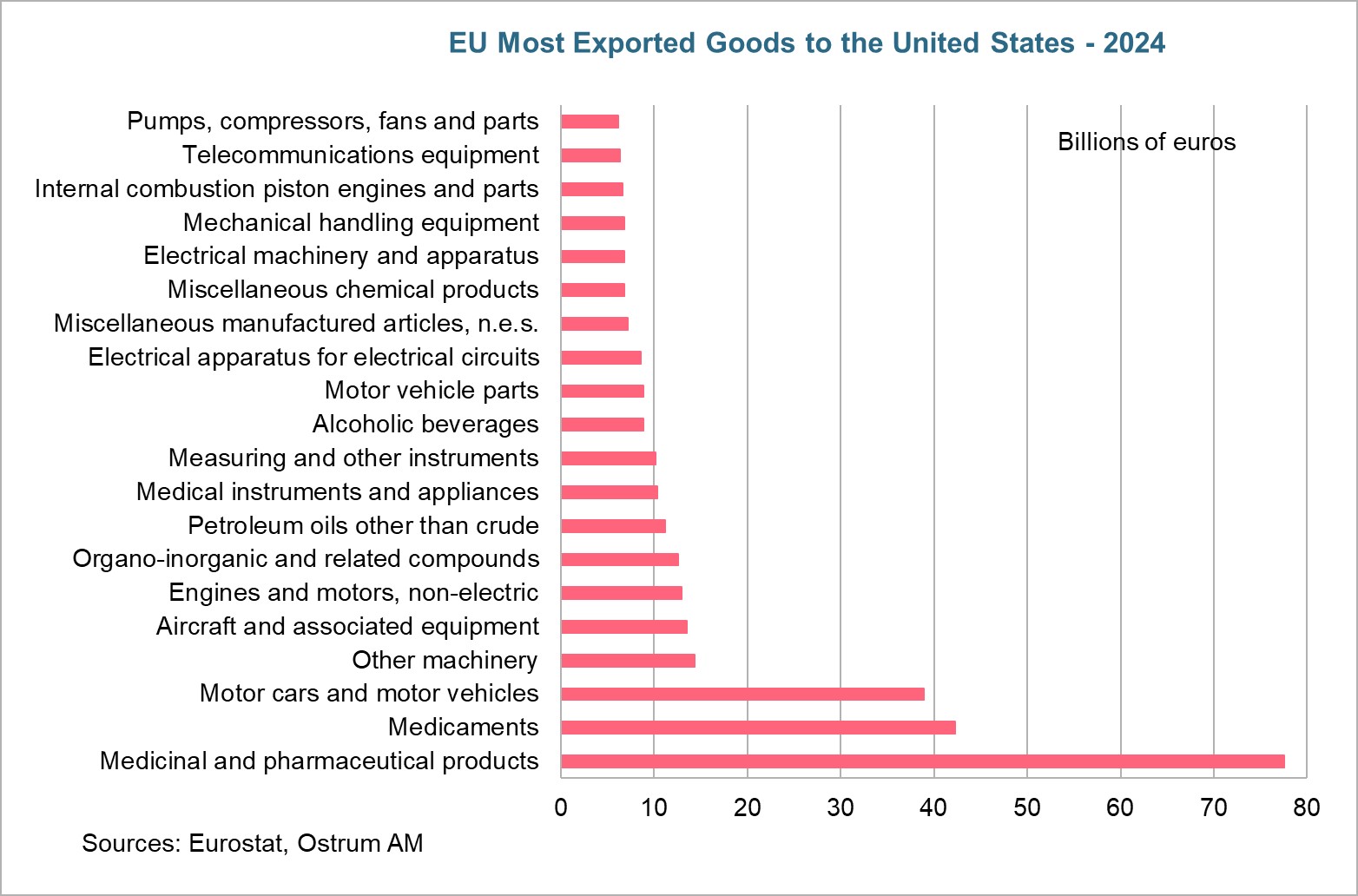

Donald Trump has also threatened to impose 50% tariffs on copper exports to the United States starting August 1. This follows investigations by the U.S. administration into certain products for which massive imports could pose a serious threat to U.S. security. No details have been provided on the results of this investigation. Tariffs of 200% on imports of pharmaceutical products were also mentioned last week, set to be applied within 12 to 18 months if companies do not relocate their production to the United States by then.

China, the United Kingdom, and Vietnam previously concluded trade agreements with the United States, setting customs duties at 30%, 10%, and 20%, respectively.

Reaction of the European Union

In a statement, Ursula Von Der Leyen, the President of the EU, indicated that 30% tariffs would disrupt essential transatlantic supply chains, to the detriment of businesses, consumers, and patients on both sides of the Atlantic. The EU prioritizes negotiations and states that it is ready to continue working to reach an agreement with the United States by August 1. The retaliatory measures against U.S. exports, in response to the increase in U.S. tariffs of 25% on steel and aluminum (now 50%), which were to be implemented starting at midnight on July 14, have been postponed to August 1. They will be applied if necessary and will affect €21 billion worth of goods.

Additional potential retaliatory measures have just been finalized, amounting to €72 billion, due to the 10% base tariffs imposed on goods exports to the United States and the 25% tariffs on cars and auto parts. These measures particularly concern imports of Boeing airplanes, cars, and bourbon.

Ursula Von Der Leyen also stated that the EU would strengthen its trade partnerships firmly rooted in the principles of international trade based on rules. In this context, the EU has just announced a political agreement with Indonesia for a free trade agreement, after 9 years of negotiation. It is expected to be finalized in September and then ratified by a qualified majority of the member states and the European Parliament.

Reciprocal Tariffs: A Negotiation Tactic

Reciprocal tariffs resemble a negotiation tactic by Donald Trump aimed at increasing pressure on trading partners to secure a favorable agreement for the United States by August 1.

The European Union hopes to reach an agreement by August 1

Negotiations with the United States were well advanced before July 12. The EU is seeking an agreement that would prevent it from facing reciprocal tariffs and limit U.S. tariffs to a base rate of 10%. It also aims to reduce taxes on key sectors such as steel and aluminum (currently taxed at 50%), cars and auto parts (taxed at 25%), and pharmaceuticals, which could be subject to additional tariffs (200% mentioned last week). In exchange, the EU could notably increase its purchases of certain American products, including liquefied natural gas, and may reduce tariffs on some U.S. products, as it had previously proposed.

As shown in the following graphic, EU exports to the United States primarily consist of pharmaceuticals, medications, and cars.

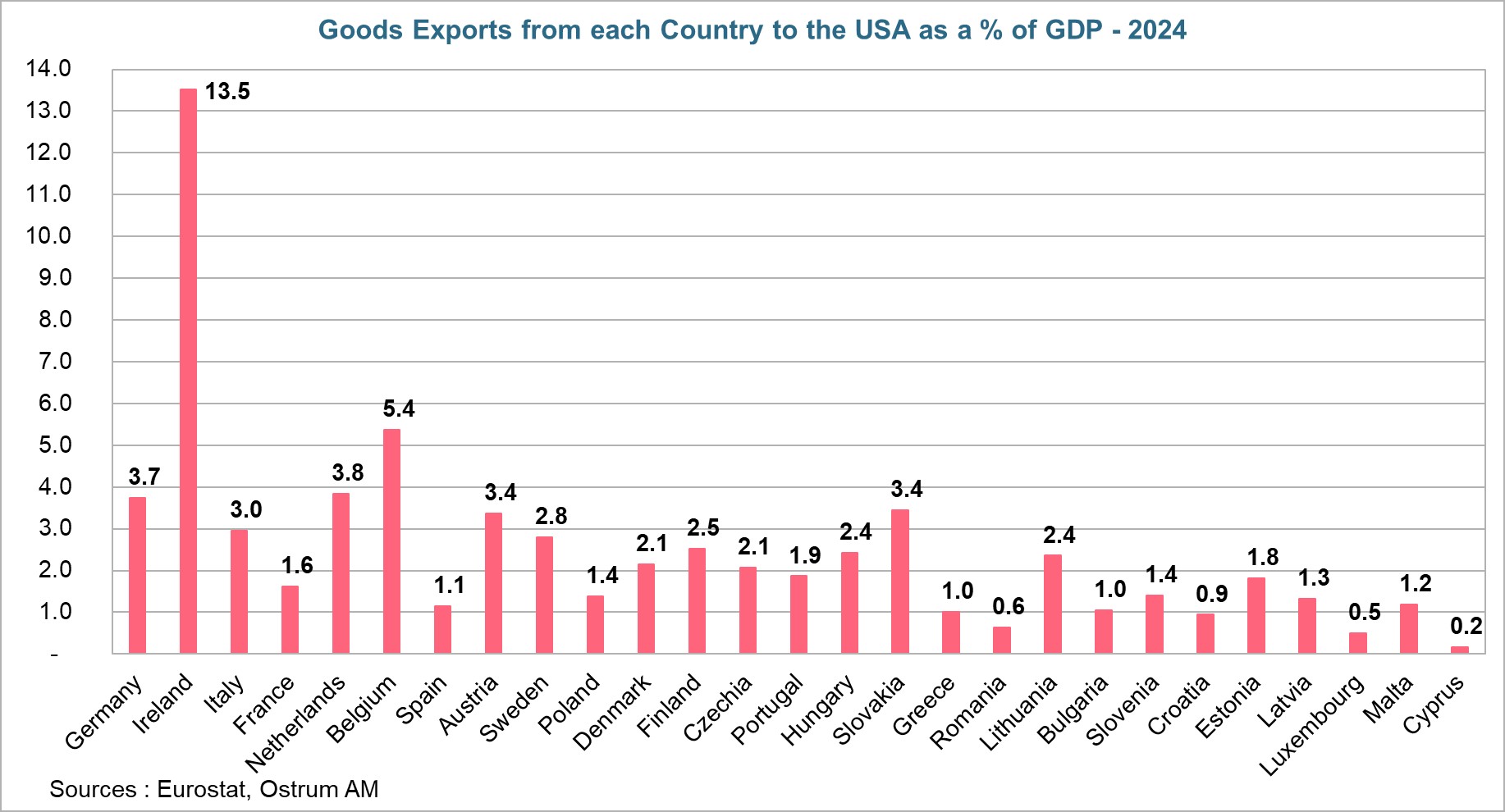

By country, Ireland would be the most affected by higher tariffs due to the significance of its goods exports to the United States (13.5% of GDP in 2024). These exports are primarily composed of pharmaceuticals.

Markets are adopting the "TACO" strategy.

Markets do not believe in Donald Trump's reciprocal tariffs, adopting the strategy known as "TACO," an acronym for "Trump always chickens out," . Indeed, the reciprocal tariffs that were initially set to take effect on April 2 were postponed to July 9 and then to August 1. Thus, markets anticipate an agreement with some trading partners by August 1 or another postponement if necessary.

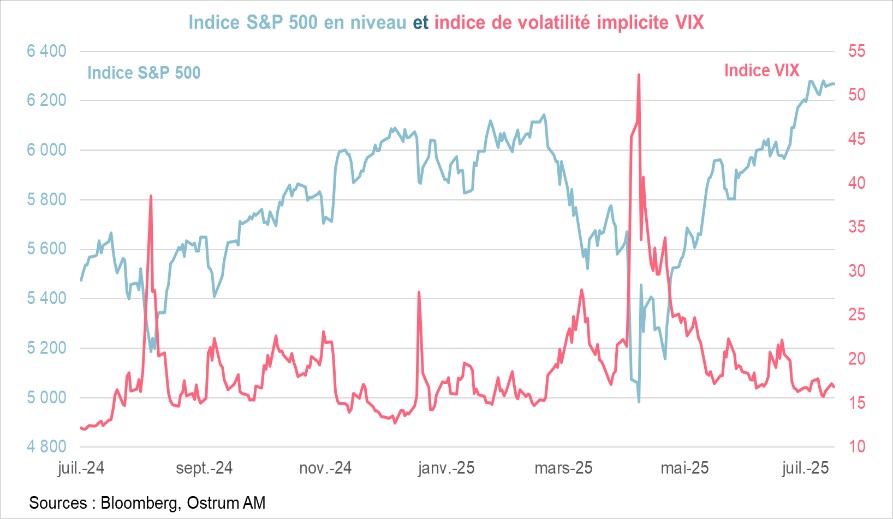

Stock markets have thus remained resilient to the letters sent by Donald Trump, particularly U.S. stock markets, as the S&P and Nasdaq indices reached new historical highs last week. This was accompanied by a slight decline in the implied volatility index (VIX), which remains at low levels, contrasting with the spike in volatility recorded on April 2 during "Liberation Day".

Conclusion

The new deadline for the implementation of U.S. reciprocal tariffs is set for August 1. Donald Trump is wielding this threat to increase pressure on trading partners in order to secure a favorable agreement by then. The European Union prioritizes negotiations while stating that it is ready to retaliate if necessary. While the most likely outcome appears to be a trade agreement between the EU and the United States by August 1, or a new postponement of the deadline to finalize it, we cannot completely rule out the possibility of higher tariffs being implemented. This could increase uncertainty, weigh more heavily on growth prospects, and generate a rise in volatility in the financial markets.

Aline Goupil-Raguénès

Chart of the week

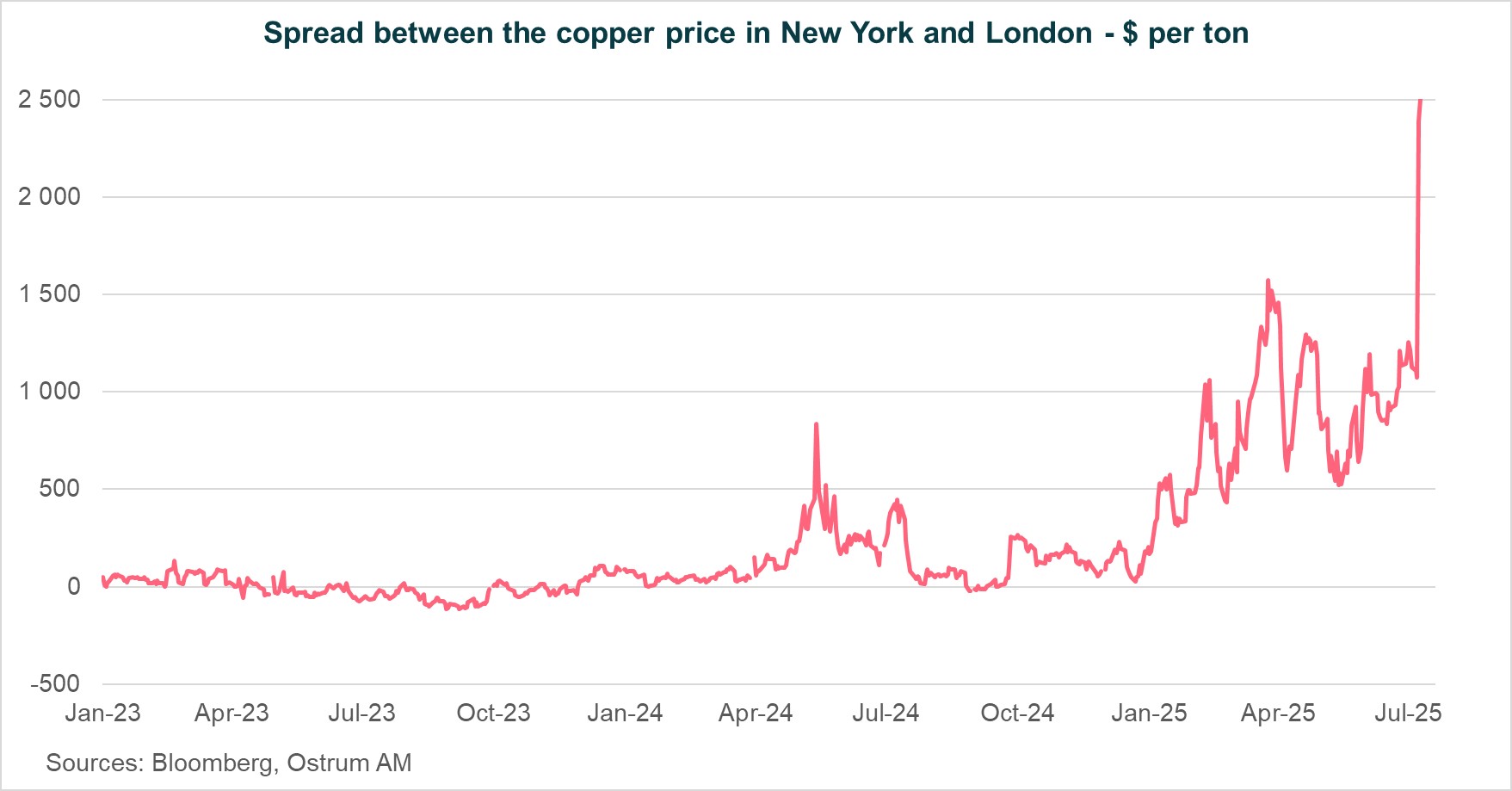

The announcement by Donald Trump of a potential 50% increase in tariffs on copper imports resulted in a significant rise in the price of copper traded in New York. On July 9, the price surged by 13% in a matter of minutes due to the rush to build up American inventories before the tariff increase on August 1.

In contrast, the price of copper traded in London slightly decreased. This led to a dramatic increase in the gap between the price of copper in New York and that in London, which rose from $1,073 per ton to $2,506 per ton between July 8 and 10.

Figure of the week

2.81

Western Europe experienced its hottest June on record. Temperatures were 2.81°C higher than the average from 1991 to 2020. According to Copernicus, such an "exceptional heatwave" is likely to become more frequent, more intense, and affect more people in Europe due to climate change.

Market review: The markets do not believe in Trump's reciprocal tariffs.

- The imposition date of the reciprocal tariffs has been postponed to August 1;

- U.S. stock markets are setting new records, unaffected by Trump's announcements;

- Rates are tightening, especially on the long end, and more noticeably in Europe;

- Credit spreads continue to tighten significantly.

The markets have shown resilience to the resurgence of threats of reciprocal tariffs imposed by Donald Trump. The deadline of July 9 has been postponed to August 1, allowing time for negotiations before a possible further delay. Historical records have been set in the U.S. stock markets and in some European markets, while tensions have arisen in the bond markets.

The week was marked by the sending of letters from the U.S. administration to inform certain trading partners of the reciprocal tariffs that would be applied to their exports. The deadline, initially set for April 2 and then postponed to July 9, has been pushed back once again to August 1, allowing more time for negotiations and the possibility of further postponement. The reciprocal tariffs are mostly similar to those announced on April 2 (25% for Japan and South Korea in particular). Brazil stands out with a tariff of 50%, even though it was not subject to these reciprocal tariffs on April 2. The EU had to wait until Saturday, July 12, to receive its letter: tariffs of 30%, compared to the 20% announced in April.

Rates tightened on both sides of the Atlantic, more markedly on the long end, resulting in a steepening of the curves. The U.S. 10-year rate rose by 6 basis points to 4.41%, while the 2-year rate increased by 1 basis point to 3.89%. The Fed Minutes confirmed significant divisions within the monetary policy committee regarding the future evolution of Fed Funds rates. The economic agenda was very light. While weekly unemployment claims decreased for the fourth consecutive week, continuing claims stabilized at a three-and-a half-year high, revealing the difficulties in finding employment for the unemployed. In the eurozone, rates tightened more than in the United States. The German 10-year rate increased by 12 basis points over the week to reach 2.73%, and the 2-year rate rose by 8 basis points to 1.90%. Investors are factoring in the upcoming increase in issues from Germany to finance extensive infrastructure and military spending. The long end was also affected by a Financial Times article indicating that Dutch pension funds are preparing to sell €125 billion in sovereign bonds due to pension system reforms. The 10-year spreads remained relatively unchanged. For the first time in 20 years, the 5-year spread between Italy and France became negative, reflecting political stability in Italy and the budgetary progress made, in contrast to France. Investors are awaiting the major outlines of the 2026 budget, which F. Bayrou is expected to announce on July 15. Inflation breakevens slightly increased over the week, particularly in the United States, due to fears of rising tariffs. Credit spreads tightened again, more markedly for European high yield. Over the week, the dollar appreciated slightly (+0.7% for the DXY index) but still shows a significant decline since the beginning of the year (-8.4%) due to investor distrust in the policies of the occupant of the White House. The Brazilian real fell sharply against the dollar (-2.5%) following the announcement of 50% tariffs, while the price of copper quoted in New York rose significantly due to the threat of 50% tariffs. The S&P and Nasdaq stock markets reached new records during the week, driven by major tech stocks, particularly Nvidia, which surpassed $4 trillion in market capitalization. The German DAX index also reached a high. The implied volatility index VIX remained relatively stable at a low level, as investors do not believe in D. Trump’s reciprocal tariffs.

Aline Goupil-Raguénès

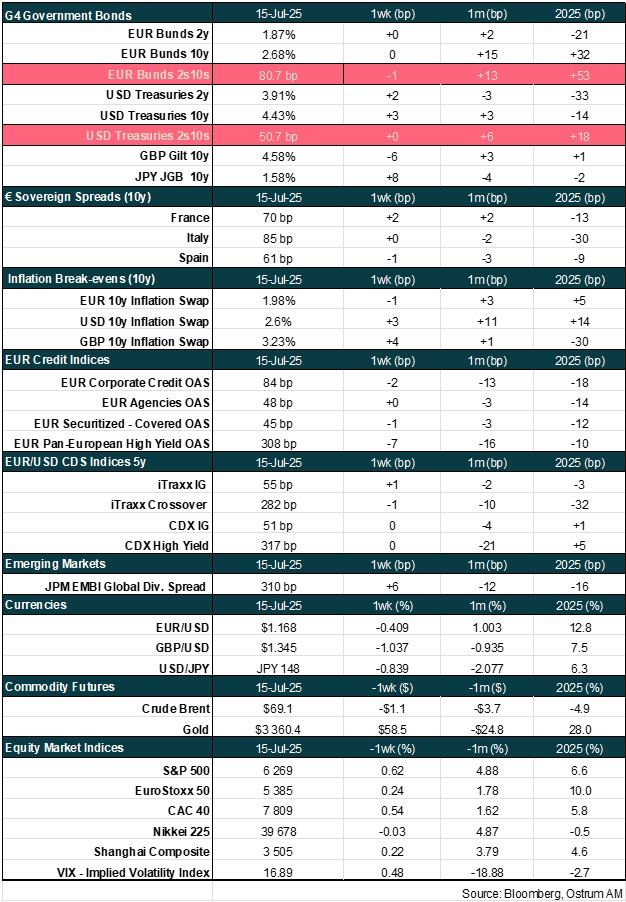

Main market indicators