Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets, inflation and US activity;

- Theme – French Budget: The Calm Before the Storm.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: French Budget: The Calm Before the Storm

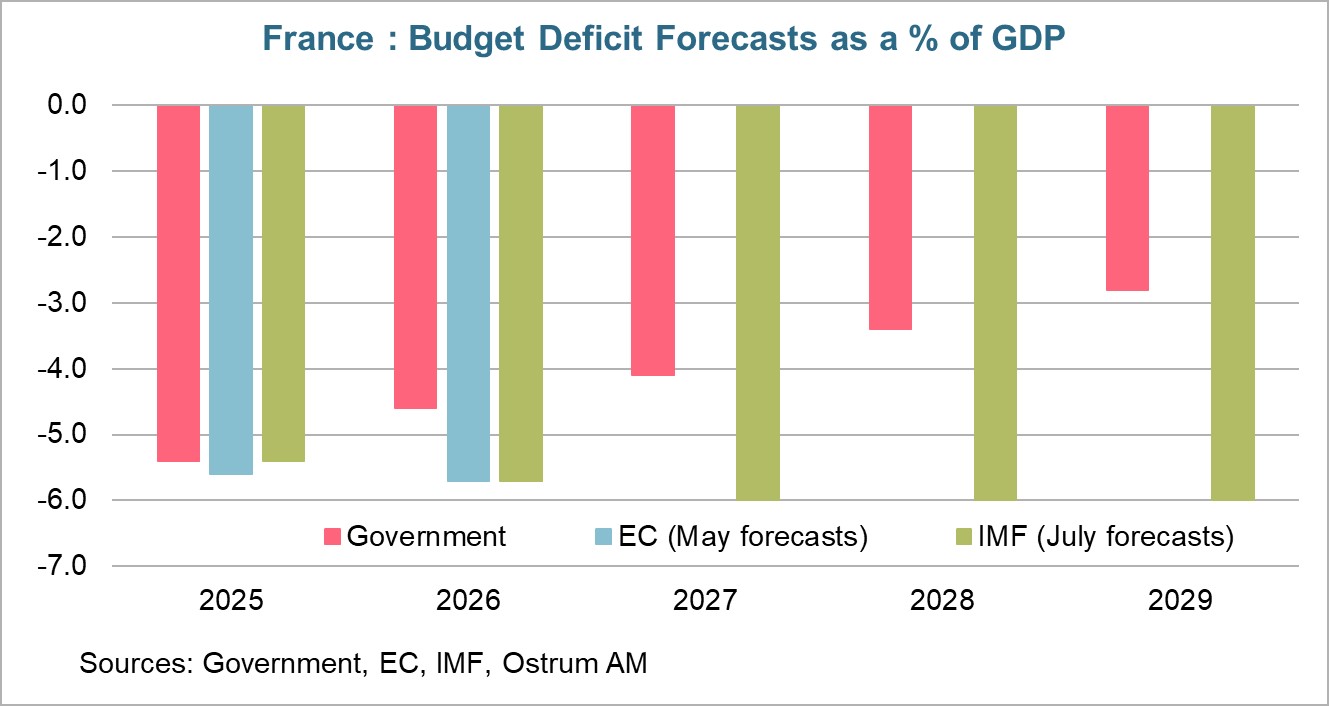

- François Bayrou has outlined the key measures aimed at bringing the French public deficit below 3% of GDP by 2029;

- An effort of €43.8 billion must be made next year to reduce the deficit to 4.6% of GDP;

- The ambitious plan includes a freeze on state spending, social benefits, and pensions, as well as measures aimed at boosting growth, including the elimination of 2 public holidays;

- After the summer break, discussions on the budget are expected to be very lively during the fall. The negotiations are almost doomed to failure given the significant effort required in a context of a highly divided National Assembly.

- The difficulty will be the same as it was for Michel Barnier last December. The risk of a motion of no confidence against François Bayrou is high. One cannot rule out a new dissolution of the National Assembly.

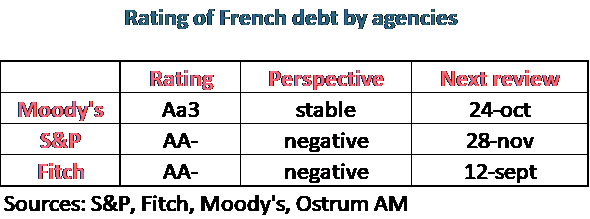

- If the government does not quickly manage to reduce the public deficit, rating agencies will not hesitate to downgrade the French debt rating once again, bringing it down to A+ for S&P and Fitch;

- Tensions are expected to arise on the French spread by the end of the year.

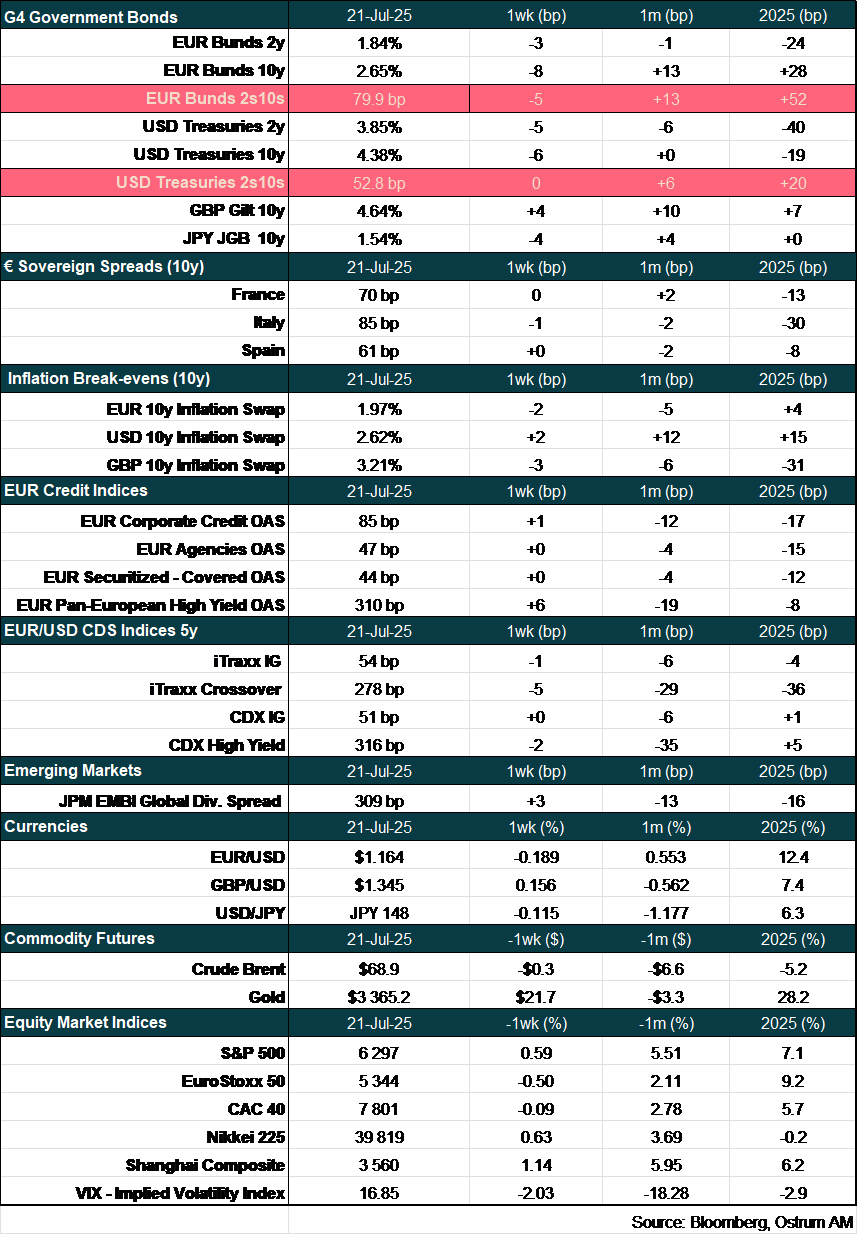

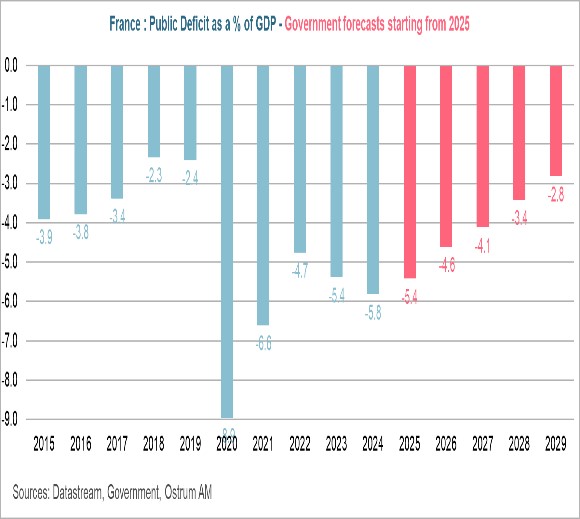

Objectives: Reduction of the deficit and stabilization of the debt.

On July 15, François Bayrou presented a multi-year plan aimed at bringing the public deficit below 3% of GDP by 2029, as he committed to the European Commission. This program will help stabilize the public debt,starting from 2027, which amounts to over €3,300 billion, or 113.2% of GDP in 2024.

The government aims to reduce the deficit to below 3% of GDP by 2029.

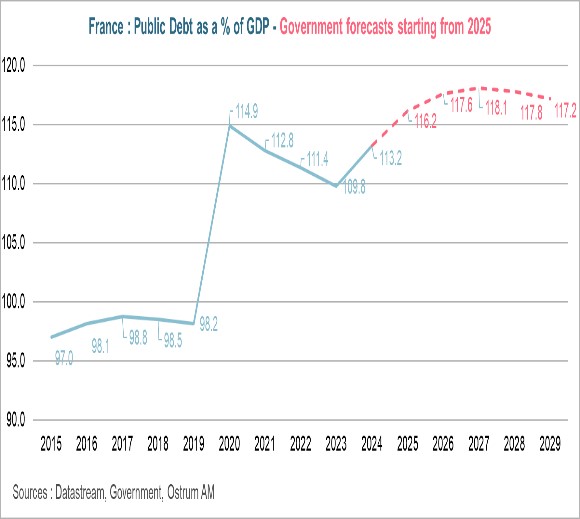

The Prime Minister focused primarily on the 2026 budget. To achieve the target of 4.6% of GDP, down from the 5.4% expected this year, an effort of €43.8 billion is necessary. This figure aligns with the previously mentioned €40 billion and includes the increase in military spending of €3.5 billion announced on July 13 by President Emmanuel Macron.

A budgetary effort of €43.8 billion in 2026.

The plan is divided into two parts: a "Stop the Debt!" plan and a "Forward with Production!" plan.

€43.8 billion in savings to be achieved in 2026.

"Stop the Debt" Plan:

- Control of public spending: €20.8 billion in savings.

State and State Operators: €10 billion in savings.

With the exception of defense, the expenses of the State and State operators will be frozen, with no increase compared to 2025. There will be a reduction of 3,000 civil service positions starting in 2026, and one in three retiring civil servants will not be replaced starting in 2027. Certain agencies of State operators will be eliminated.

Local Authorities: €5.3 billion in savings.

The expenses of local authorities will not increase more than "the resources of the Nation."

Social Expenditures: €5.5 billion in savings.

This will exclusively affect health expenditures including the doubling of the deductible for medication reimbursements.

Freezing of state expenditures, social benefits, and pensions.

- A "White Year": €7.1 billion in savings.

There will be no indexation of benefits to inflation (allowances, pensions) and no salary increases for civil servants. The income tax brackets and the CSG (General Social Contribution) will be maintained at the 2025 levels.

- Social and Fiscal Justice Measures: €9.9 billion.

This includes measures to combat fraud (tax fraud, public aid fraud, healthcare expenditures), the cessation of certain unnecessary and ineffective tax loopholes, a solidarity contribution on the highest incomes, additional measures to combat the abusive optimization of non-productive assets, and a tax on small packages.

Abolition of 2 public holidays.

"Forward with Production" Plan:

Proposal to eliminate 2 public holidays (Easter Monday and May 8) and to initiate new negotiations with social partners regarding unemployment insurance and labor rights. Bureaucratic procedures will also be streamlined and simplified.

The graph below illustrates the breakdown of the budgetary effort required.

High risk of a new motion of no confidence.

This ambitious budget plan has no chance of being approved in its current form by Parliament, given the scale of the savings required and the highly divided National Assembly. The RN (National Rally) and LFI (France Unbowed) have already expressed their desire to censure the government. Meanwhile, the PS (Socialist Party) is preparing its own proposal for the upcoming session.

Discussions on the budget will only begin in October, after the summer break. The negotiations promise to be very turbulent. In December 2024, despite the compromises made by Michel Barnier, he faced a motion of censure.

High risk of a vote of no confidence against the Prime Minister during the autumn, or even a new dissolution of the National Assembly.

Compromises will inevitably need to be adopted, but the risk of a motion of no confidence against François Bayrou is high. The outcome would likely be the appointment of a new Prime Minister or even a new dissolution of the National Assembly and early legislative elections, resulting in an even more divided Parliament.

Upcoming tensions on the French spread.

The European Commission and the IMF anticipate the continuation of a high public deficit.

In this context, the budgetary adjustment is unlikely to be achieved, and the public deficit is expected to be higher than the 4.6% targeted by the government. The European Commission, in its May forecasts, anticipates it to be 5.6% of GDP in 2025 and 5.7% in 2026. The IMF has just released its latest Article IV report on France. The public deficit is projected to be 5.4% of GDP in 2025, 5.7% in 2026, and 6.0% in 2027, which would bring public debt to 121.5% of GDP.

In the absence of a significant reduction in the public deficit, the agencies will not hesitate to downgrade France's rating to A+.

In light of France's inability to reduce its public deficit to stabilize its debt, rating agencies are expected to downgrade the French debt rating once again. The outlook attached to France's rating is negative for S&P and Fitch, which could lead them to lower France's rating to A+ in the coming months, with Moody's likely to follow suit.

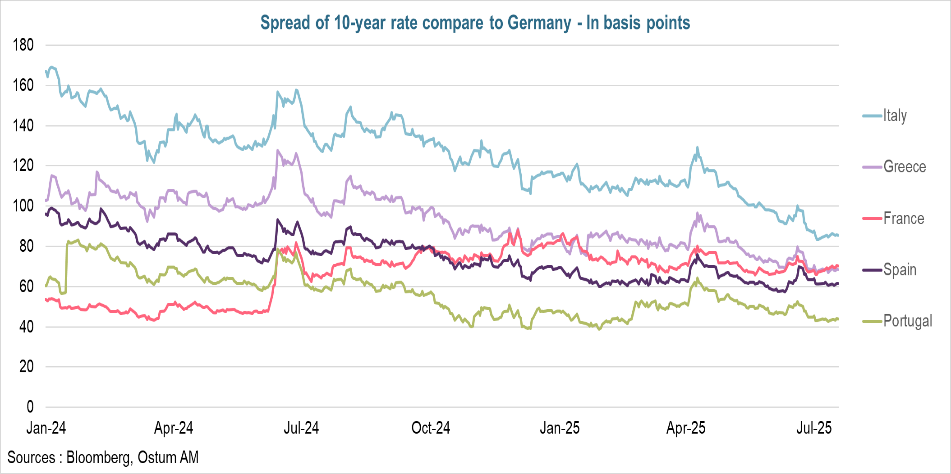

The French spread is expected to widen and return to around 80 basis points by the end of the year.

Tensions are expected to arise on the French spread over the coming months. It remained nearly stable this week, around 70 basis points, despite the government's announcement of a significant proposed reduction in the public deficit for 2026. Investors are skeptical and are waiting for the negotiations that will begin in October. The spread could widen to as much as 80 basis points by the end of the year, similar to what occurred during the dissolution of the National Assembly last summer. The tensions affecting the French spread contrast with the significant tightening of spreads for peripheral countries, reflecting the budgetary progress made by these nations. As shown in the following graph, the spreads of Portugal and Spain are below that of France, while Greece's spread is at the same level. A convergence is expected between the French spread and the Italian spread by the end of the year, moving toward 80 basis points.

Conclusion

After the summer break, budget discussions will begin and are expected to be very difficult due to the scale of the consolidation required and the highly fragmented Parliament, which limits the government's ability to implement the necessary consolidation measures. The risk of a motion of no confidence against the Prime Minister is high. The French spread is likely to widen again and converge toward the Italian spread by the end of the year.

Aline Goupil-Raguénès

Chart of the week

The announcement by Donald Trump of a potential 50% increase in tariffs on copper imports resulted in a significant rise in the price of copper traded in New York. On July 9, the price surged by 13% in a matter of minutes due to the rush to build up American inventories before the tariff increase on August 1.

In contrast, the price of copper traded in London slightly decreased. This led to a dramatic increase in the gap between the price of copper in New York and that in London, which rose from $1,073 per ton to $2,506 per ton between July 8 and 10.

Figure of the week

2

The European Commission has proposed a budget of nearly €2 trillion for the period from 2028 to 2034. This represents a significant increase from the previous budget of €1.2 trillion. It includes a crisis instrument amounting to €400 billion, which would be financed by joint borrowing. Germany, the largest contributor to the EU budget, has opposed this proposal. Negotiations are set to begin for a vote requiring an absolute majority by the end of 2027.

Market review: U.S. stock markets are at all-time highs.

- U.S. economic data is coming in better than expected, but it should be taken with caution;

- U.S. stock markets are reaching new records despite uncertainties (tariffs, Powell vs Trump);

- Tensions are rising on U.S. long-term rates due to expectations of higher inflation;

- Widening of euro high-yield credit spreads.

U.S. stock markets are hitting new records driven by better-than-expected statistics and a strong start to the earnings season. European rates are easing while U.S. long-term rates are facing higher inflation expectations.

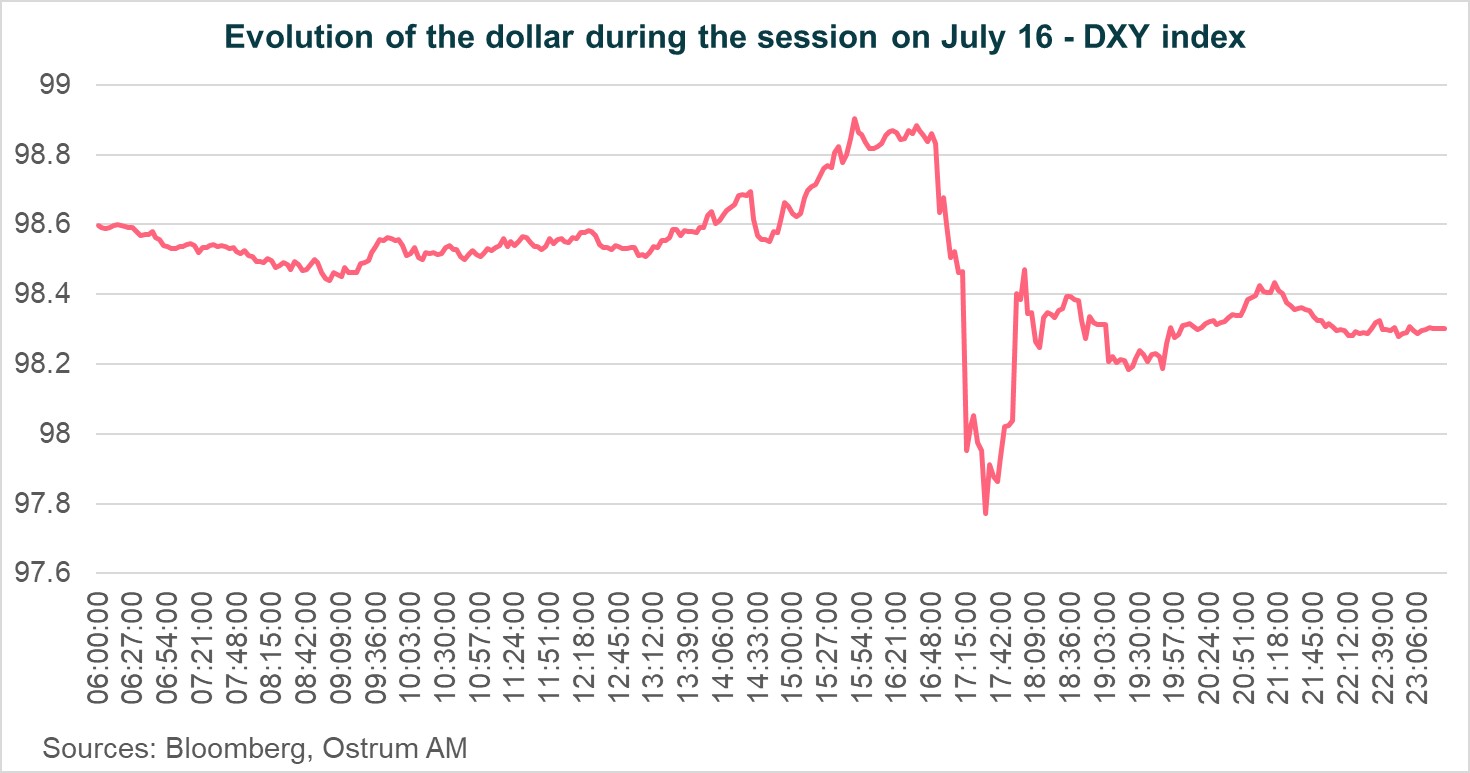

The week was marked by the release of better-than-expected economic data from across the Atlantic, which should be taken with caution, and a turbulent session on July 16 following fears of J. Powell's potential dismissal by D. Trump. U.S. retail sales exceeded expectations for June, with a 0.5% increase in the control group (which excludes volatile items). However, this figure should be tempered by the downward revision for May (0.2% compared to 0.4%) and the fact that it is not adjusted for inflation. The inflation rate came in weaker than expected on a monthly basis for the core index (0.2% in June compared to a consensus of 0.3%), but prices for certain goods are beginning to be affected by the impact of higher tariffs. This is particularly true for furniture, household appliances, and toys. Weekly unemployment claims were lower than expected, but this must be balanced by the stabilization of continuing claims at a high not seen in over three years. Consumer confidence from the University of Michigan improved for the second consecutive month but remains significantly below its long-term average (61.8 compared to 84.4). Finally, the NAHB index for home builders (33 in July) continues to indicate a contraction in construction activity, affected by high mortgage rates and significant uncertainty.

In this context, U.S. long-term rates increased over the week, particularly the 30-year yield (+5 basis points to 5%), due to expectations of higher inflation resulting from policies enacted by D. Trump. It even exceeded 5% during the week, influenced by rising fears of J. Powell's possible dismissal by D. Trump, which were quickly denied by Trump but not entirely dismissed. An investigation is underway regarding the mismanagement of renovations at the central bank, which could provide an excuse for the White House to dismiss him. The dollar and short-term rates dropped amid these fears before quickly rebounding after Trump's intervention. Short-term U.S. rates eased over the week (-1 basis point on 2 years) mainly due to Waller's comments suggesting it would be appropriate to lower rates as early as July, given signs of weakness in the labor market. He is in the minority on the Board of Governors, as only he and Bowman advocate a rate cut as soon as July. Inflation swaps in the U.S. rose (+5 basis points on 10 years) due to concerns over rising tariffs. In the eurozone, rates eased, with both 2-year and 10-year rates dropping by 3 basis points to 1.87% and 2.70%, respectively. The EU is negotiating with the U.S. to avoid a 30% tariff starting August 1, while preparing retaliatory measures in case talks fail, targeting U.S. services exported to the EU. The announcement of the budget framework by F. Bayrou had no impact on the French spread. Eurozone credit spreads widened over the week, particularly for high-yield bonds (+6 basis points). Finally, stockmarkets in the U.S. reached new highs, disregarding fears of higher tariffs and pressure on the Fed from D. Trump, driven by technology stocks. The Eurostoxx 50 slightly declined over the week (-0.45%). In Japan, markets were awaiting the results of the Upper House elections on July 20.

Aline Goupil-Raguénès

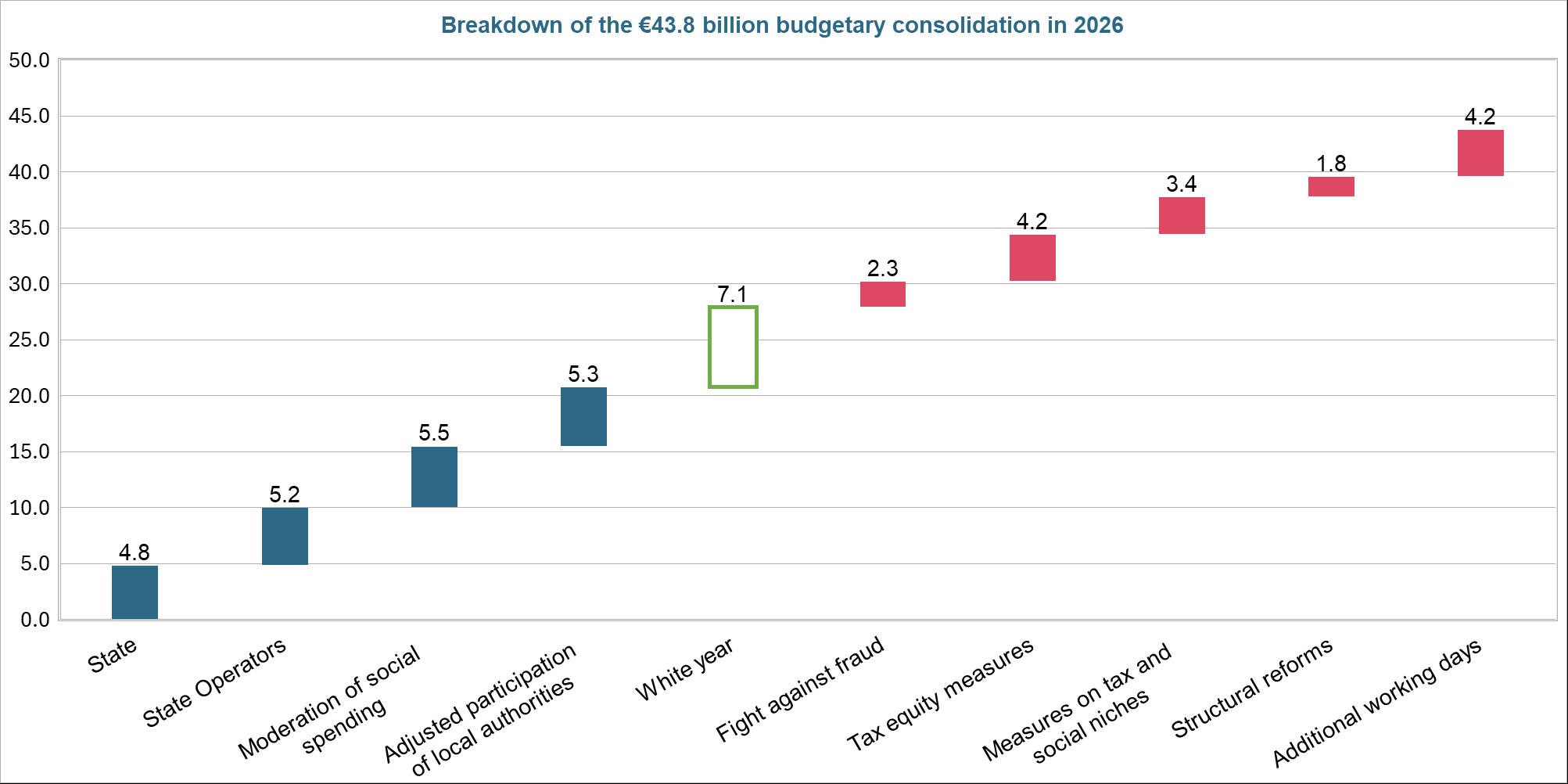

Main market indicators