Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s :

- Review of the week – Financial markets, the Fed under influence;

- Theme – Could U.S. housing be the next big risk ?

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Could U.S. housing be the next big risk?

- The U.S. housing sector is currently experiencing a downturn, with home sales at levels comparable to those seen during the Great Financial Crisis (GFC), as many American households have been priced out of homeownership;

- Approximately 15% of pending home sales are falling through, as homebuyers opt to back out during the inspection phase in search of better options, while others hesitate to make significant purchases amid economic uncertainty;

- Following a sharp increase post-COVID, home prices have begun to decline at the national level. About half of the major U.S. cities are now reporting falling prices. Homebuilder confidence has dropped to recessionary levels;

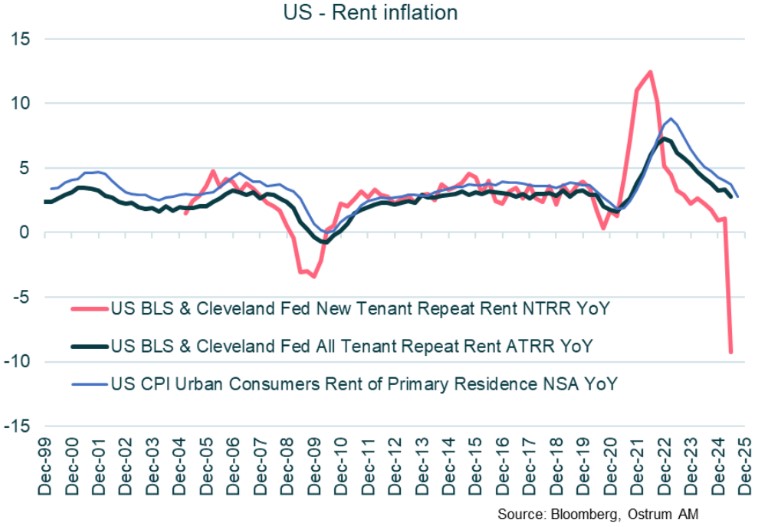

- Vacancies in the rental market have been rising, leading to a sharp downward adjustment in new tenant rents;

- The reduction in rent inflation is poised to impact overall inflation, given the significant weight of housing in the U.S. Consumer Price Index (CPI);

- It is important to monitor downside risks to housing prices, as housing crises are frequently linked to financial stress.

Housing is in a recession

Home sales at GFC low levels

The 20-city CoreLogic house price index, which tracks home resale values) is up 146% from the post- GFC lows in March 2012. By 2018, U.S. house prices had rejoined previous 2006 highs but prices kept on rising at a 7% annual clip since then. A shortage in housing and a prolonged period of monetary expansion indeed have blown up asset prices (coincidentally M2 annual growth stands at 6.5% since 2018). But the tide is now turning.

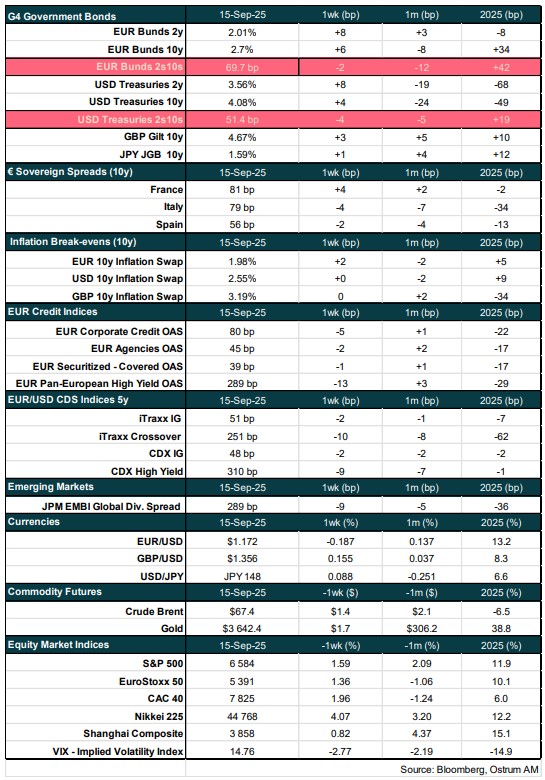

Existing home sales have remained stagnant around 4 million units at an annualized rate since 2023. To provide context, this figure aligns with the lowest levels recorded during the Great Financial Crisis (GFC), a period when the mortgage market was severely impaired and there were 20 million fewer households in the U.S. than today.

Pending home sales are now falling through at a higher rate than before, largely due to the conditions of a buyer’s market.

According to Redfin, 14.9% of pending home sales fell through in June, an increase from 13.9% a year earlier and from 10-12% prior to 2021. Some buyers are choosing to back out during the inspection phase in favor of better options, while others are hesitant to make significant purchases amid economic uncertainty.

There are now hundreds of thousands more home sellers than buyers in the U.S., providing buyers with greater choices and enhanced negotiating power. The highest rates of cancellation are observed in southern states, particularly in Florida and Texas, where high levels of new construction and increased insurance premiums due to natural disaster risks have contributed to the trend.

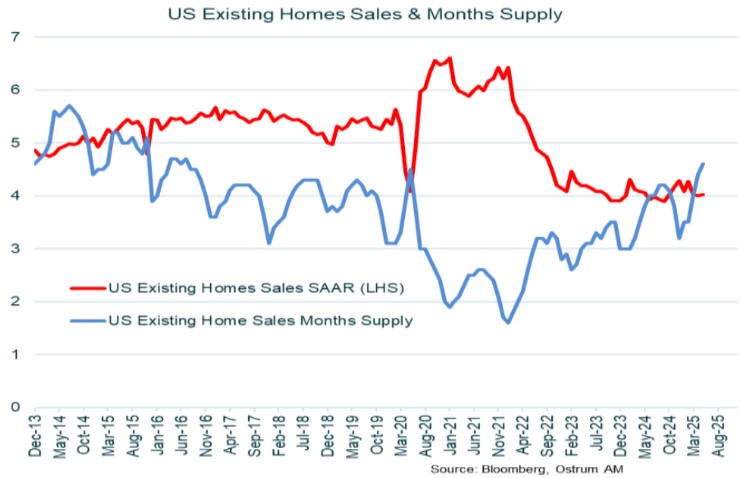

Homebuilders’ confidence at recession levels

On the supply side, the National Association of Homebuilders (NAHB) survey clearly indicates a deteriorating trend. With a reading of 32 in July on a 0-to-100 scale, current homebuilder confidence is at recessionary levels. For context, the NAHB index fell below 10 during the peak of the housing crisis in 2008-09. The number of prospective homebuyers is currently very low, and both current sales and future sales expectations reflect ongoing weakness.

Homebuilders had previously benefited from a constrained resale supply over the last few years, but the backdrop is less favorable now. During the recovery from COVID-19, the lack of available existing homes meant that new builds were the only option. Consequently, new home prices surged, both in absolute terms and relative to existing home prices. However, demand for new homes began to wane in response to these elevated prices, leading to new home sales dropping to just 627,000 units in June, approximately 20% below the peak in 2021. Furthermore, homebuilders now face heightened pricing risks due to increasing resale supply. Growing inventory is expected to compress margins this year and likely into 2026. Although national for-sale inventory remains well below previous peaks, the rate of change is starting to pose challenges. According to Realtor.com data, active listings in the existing-home market surged by 25% compared to last year in July. Additionally, new home prices have declined by 4% over the past two years. The outlook for homebuilders could worsen further if buyers delay their purchasing decisions in anticipation of lower prices and interest rates in the future.

The construction sector is currently facing both supply and demand challenges. The critical question remains whether the supply of new homes will adjust quickly enough to restore balance in the housing market. Declining new home prices will exert pressure on new construction activity. Housing starts have decreased to approximately 1.3 million annually. Anecdotal evidence suggests that tariffs on Canadian lumber, local environmental regulations, and shortages of electrical equipment have all contributed, to varying extents, to slow construction. Additionally, stricter immigration policies complicate hiring for homebuilders, as a majority of construction workers are foreign-born, and about one in five is believed to be undocumented.

The needed supply adjustment comes at a time when there appears to be a structural shortage of housing relative to household formation, with a nationwide deficit estimated between 3 to 5 million homes. It could be the case that this estimate is based on outdated homeownership patterns and demographics. First-time homebuyers are now purchasing their homes later in life, and homeownership is no longer seen as the cornerstone of the consumer-driven U.S. economy. But cyclical forces may clash with long-term housing needs.

New tenant rents in free fall.

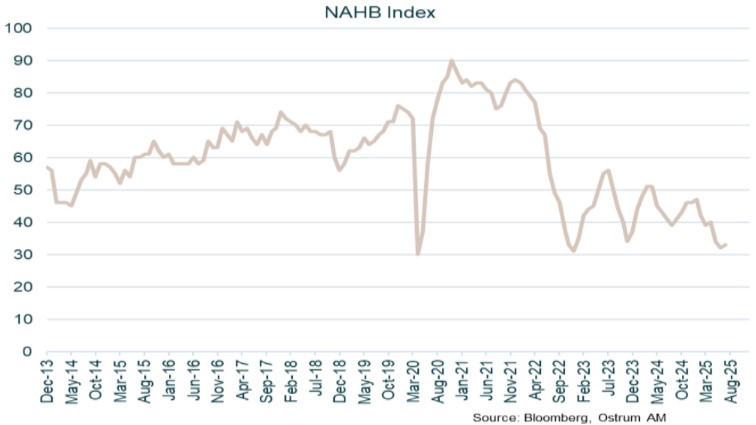

Vacancies lead to falling rents

The rental market is exhibiting signs of weakness as well. With home prices beginning to decline, rents are adjusting to this new reality. The shortfall in housing investment is contributing to downward pressure on rents, compounded by rising vacancy rates. Currently, vacancy rates are 1.4 percentage points above their post-COVID lows. Falling affordability had favoured renting over buying a home in the past few years but rising rental vancancies now emphasize a shortfall in aggregate housing demand. Labor market conditions could be playing a role. New entrants into the labor market are encountering challenges in securing jobs, leading some to extend their stay with their parents. As a result, demand for rental properties is decreasing.

The Cleveland Fed's data on new tenant repeat rents reveals that rental values have declined by 9.3% compared to a year ago in the June quarter. This decline seems to correct the abnormally high rent increases observed in the aftermath of COVID. New tenant rents influence average rents but this effect is felt with a lag of approximately 6 to 12 months as rents reset periodically. The rent component in the U.S. Consumer Price Index (CPI) will thus slow markedly in the first half of 2026. The disinflationary impact will be signifcant as the shelter component of the CPI (rents, owner-equivalent rents, and other lodging) makes up one-third of the headline CPI. There could be further downside risks to shelter inflation if the unemployment rate surpasses 5% or if youth unemployment remains high.

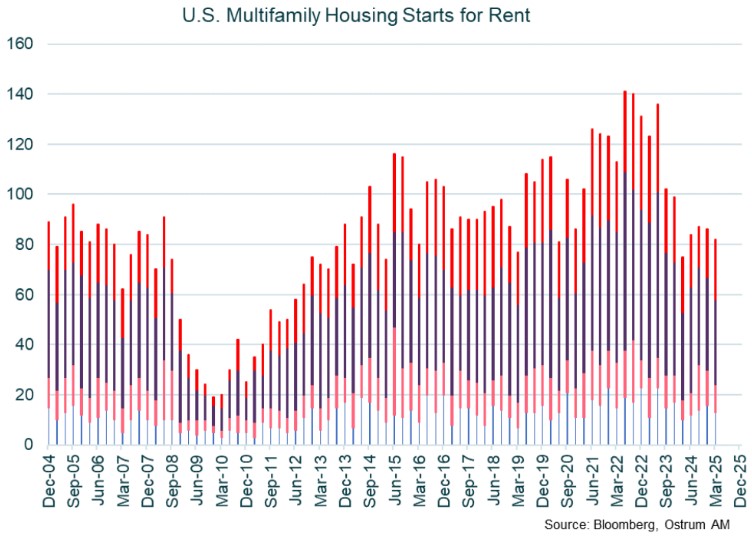

Multi-family starts for rent have declined

As rental yields have decreased, housing investment demand has diminished. Financial headwinds are significant. Multi-family construction is encountering more restrictive financing conditions than that faced by the single-family homebuilders. Double-digit default rates on securitized multi-family debt are reminiscent of the peaks observed during the Great Financial Crisis. This unattractive financial backdrop, combined with rising costs faced by homebuilders—such as tariffs, materials, and labor—is clearly impacting the incremental supply of rental housing. Multifamily housing starts have indeed declined by about a third from the 2022 highs. The drop in new construction intended for rent will eventually put a floor on rental values but it couldtake a while before equilibrium is restored in the rental market. If REITs financial underperformance in 2025 is any guide, there is a long way to go.

Conclusion

U.S. residential investment represent about 5% of GDP. But housing downturns have previously been associated with profound economic crises. Falling homebuilders likely foreshadow an extended period of price weakness. Rental values are also declining. The U.S. economy is not in a recession but the downturn in the housing sector is worth monitoring.

Axel Botte

Chart of the week

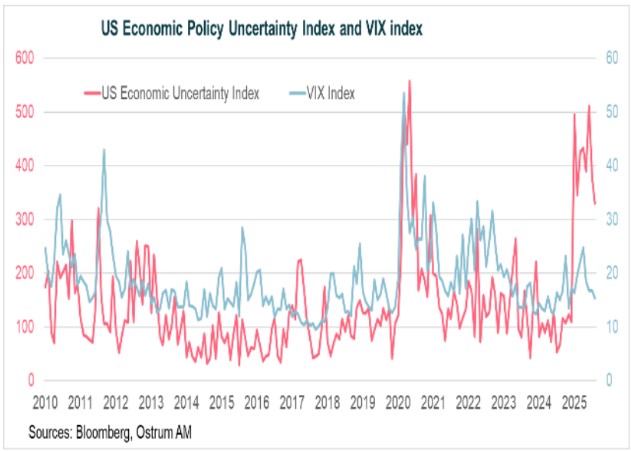

There is a stark contrast between the uncertainty clouding the U.S. economic outlook and the apparent calm across financial markets.

Bloomberg’s policy uncertainty index had been closely aligned with financial volatility. In the chart opposite, the financial volatility proxy is the VIX index which is an implied volatility measure derived from the S&P 500 options.

Implied volatility in the vicinity of 15% depicts a benign environment even as downside risks to the U.S. economic growth are increasing.

Figure of the week

911

911,000 jobs were removed from U.S. statistics following the release of the QCEW (Quarterly Census of Employment and Wages) survey covering the period from April 2024 to March 2025.

Market review

- Central banks: Fed to cut rates by 25 bps, status quo in Frankfurt;

- U.S.: significant downward revisions to job data;

- Oracle’s guidance and AI lead to new highs on S&P 500;

- T-note yields briefly break below 4% as Bunds hover 2.70 %.

Reflation or stagflation ?

Price action in financial markets indicates an inflationary cyclical recovery (stocks, commodities) while stagflation threatens the U.S. economy. The Fed's monetary easing and the powerful theme of AI seem to keep prices buoyant.

A quick reading of market developments suggests that the economy has entered an inflationary recovery cycle. Stocks are hitting historic highs, industrial commodity prices are rising, and long-term rates are being bought back amid monetary easing from a Fed under influence, which overlooks inflation (2.9% in August). Spreads are tightening despite a dynamic primary market. French political risk appears to be a mere epiphenomenon with no signs of contagion.

However, the U.S. economy is operating below its potential. Donald Trump's policies are dampening activity in most sectors, with the exception of technology, which is buoyed by the prospects of artificial intelligence development. Growth remains highly unbalanced. The 911,000 jobs (-0.6%) removed from the statistics for the period from April 2024 to March 2025, the halt in hiring since Liberation Day, and the shift in the number of unemployment benefit recipients reflect this malaise. The bankruptcy of Tricolor, an institution specializing in subprime auto credit, reminds us that payment delays are accumulating despite still low unemployment.

In the Eurozone, the ECB has maintained its rates at 2%. A long period of status quo looms, despite the expected slowdown in inflation (1.9% in 2027). Unemployment is at a record low of 6.2%, and growth appears to be in line with predictions.

In the markets, AI continues to propel U.S. indices to new heights, particularly thanks to Oracle's outlook. Asia is not lagging behind, with significant gains in the Nikkei (4%) and the Kospi (6%). The announcement of reflation policies in China (elimination of overcapacity, stimulation of demand) is likely contributing to this rebound, which concurrently benefits oceanic currencies (AUD, NZD). The reflation of the Chinese economy could become a promising theme, even though Beijing's economic policies have rarely met their objectives since 2020.

In the bond markets, the sensitivity of the T-note to employment data seems to be increasing given Jerome Powell's shift in rhetoric. The 10-year U.S. Treasury briefly broke below the 4% threshold. The Bund remains under more pressure. Besides the stimulus plans, the ECB's balance sheet reduction has a disproportionate effect on German borrowing (-€15 billion in August). The 10-year bond is trading at 2.70% by the end of the week. Sovereign spreads are tightening, with a slight underperformance of the OAT due to the political situation. The appointment of Sébastien Lecornu as Prime Minister temporarily alleviates the risk of dissolution. A credit rating downgrade seems inevitable in the absence of a credible public finance consolidation plan. The launch of a futures contract on EU debt could compete with the OAT. Inflation breakevens rose at the end of the week with the rebound in crude oil prices ($67 for Brent). Expectations remain aligned with the ECB's target (10-year swap at 1.98%). In the credit markets, the tightening trend has resumed, with new issues being significantly oversubscribed. Inflows into credit are accumulating. Appetite for credit is encouraged by the monetary status quo at 2%. High yield is following suit. The iTraxx Crossover near 250 basis points indicates rich valuations.

Axel Botte

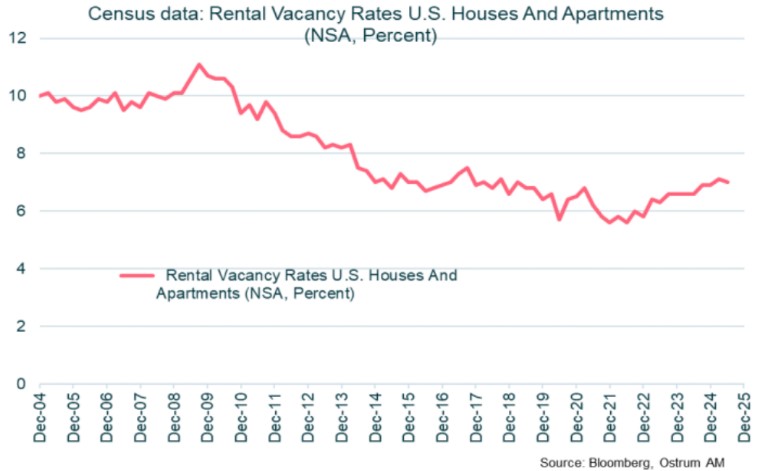

Main market indicators