Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets: A Fed that’s hard to read;

- Theme – A new rate target for the Fed?

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: 15th Five-Year Plan of China: A Strategic and Vital Recalibration

- The 15th Five-Year Plan 2026-2030 is a strategic recalibration to achieve the goal of socialist modernization by 2035.

- The priority of this new plan is technological autonomy: China aims to become a Leader in AI thanks to its innovation potential.

- The role of domestic consumption is evolving towards structural autonomy to enable economic stabilization in case of external shocks.

- "Institutional opening up" goes beyond free trade agreements, as Beijing seeks to promote its rules and regulatory standards in environmental, technological, and commercial matters.

- The world and foreign companies will have to quickly adapt and adopt the new Chinese standards. This is the new price to pay for access to its vast domestic market.

Technological Self-Sufficiency at the Top of Innovation

Two important dates for China: the goal of socialist modernization by 2035 and becoming the world's leading power by 2049.

Two dates are important for China: the goal of achieving socialist modernization by 2035 and becoming the world's leading power by 2049, the 100th anniversary of its founding. These two long-term objectives underscore the importance of its five-year plans. Therefore, this 15th plan is crucial to ensure that the efforts made so far are not rendered obsolete.

The first major objective of this new plan is technological self-sufficiency, which is crucial for China's economic development in a context of increased competition and heightened geopolitical tensions. Unlike previous five-year plans that had a general approach to technological innovation, the 15th plan adopts a highly focused approach on "New Quality Productive Forces" (NQPF), the cornerstone of this new plan. The NQPF marks a shift from the old growth model based on real estate to growth driven by technological innovation, particularly artificial intelligence (AI).

Quantum information, brain science, and synthetic biology—China aims to position itself at the forefront of technological innovation.

China has demonstrated its innovation potential by establishing itself in the fields of electric vehicles, lithium batteries, and the photovoltaic panel industry. Recently, high-tech startups such as DeepSeek have attracted worldwide attention, highlighting China's technological advancements. This is no longer just a matter of technological upgrading but of becoming a global leader in AI, not merely a strategic consumer.

The sectors of NQPF are clearly identified in this new plan: quantum information, brain science, and synthetic biology, in which China aims to become a major and indispensable player. There is also a focus on the country's scientific development, particularly education, to sustain technological advancement.

Security is a prerequisite for being a leader in AI, given the intensification of geopolitical tensions. China must secure its technological framework by taking these risks into account. This implies that foreign companies might be required to localize in China for national security reasons if they wish to continue their operations in the country.

Consumption will gain structural autonomy

Consumption is crucial for stabilizing the economy against external shocks and in the context of a trade war with the United States. In 2024, consumption in China accounts for 39.6% of GDP, which is low compared to the United States (69%), Japan (55.5%), and the European Union (51.6%). The weakness of Chinese consumption is largely due to forced savings reflecting the lack of social protection.

Chinese consumption is no longer a cyclical stimulus but must gain structural autonomy.

Indeed, the pre-tax disposable income of Chinese households represents 62% of GDP, aligning with that of South Korea but slightly lower than Japan's (65%). Disposable income after taxes and transfers also remains high at 61%. However, disposable income including social transfers for Chinese households represents 67% of GDP compared to 78% for Japan and over 80% for the United States. This implies significant structural reforms, particularly increasing incomes and improving services.

The 15th Five-Year Plan aims to increase its share of GDP over the next five years while also transforming its role in the economy. Consumption should no longer be a cyclical stimulus but should gain structural autonomy. The plan includes massive investments in health, education, and homeownership to reduce income inequalities.

Institutional Opening up: Promoting Its Regulatory Standards

The 15th plan has clearly emphasized the need to broaden and enhance institutional openness, a major step in addressing international relations tensions, unilateral sanctions, and the global trade war. It is also one of the main drivers of high-quality development.

"Institutional opening up" means that China will promote its regulatory standards to gain a new competitive advantage.

Institutional openness means not only benchmarking against high-level international economic and trade rules but also preserving and leveraging its own institutional advantages.

Through its numerous participations in institutions like the Regional Comprehensive Economic Partnership and actively seeking to join the Digital Economy Partnership Agreement (which aims to establish digital trade rules and collaborations on the digital economy), China demonstrates its interest in participating in the formation of a new international order of global economic governance.

China's goal is to promote the alignment of national rules and standards in key areas with international standards, thereby creating a new competitive advantage for a higher-level economy. This should be accompanied by deep reforms, particularly in clarifying the boundaries between the market and the government.

Institutional alignment with the new Chinese standards will be the new price foreign companies must pay.

Conclusion

China is entering a crucial transition for its economic development. The 15th Five-Year Plan is a strategic recalibration to adapt to an unpredictable world threatening its long-term goals. Thus, the priority is technological autonomy, where China aims to become a leader in AI thanks to its innovation potential. Policies centered on households should enable structural autonomy of domestic consumption to stabilize the economy in case of external shocks. Finally, despite the quest for autonomy and economic refocusing, China continues its active policy of "institutional opening up." This concept goes beyond free trade agreements, as Beijing seeks to promote its rules and standards in environmental, economic, and commercial matters. The world and companies will therefore have to adapt by adopting Chinese standards in environmental, technological, and commercial areas. This is the new price to pay for access to its vast domestic market.

Zouhoure Bousbih

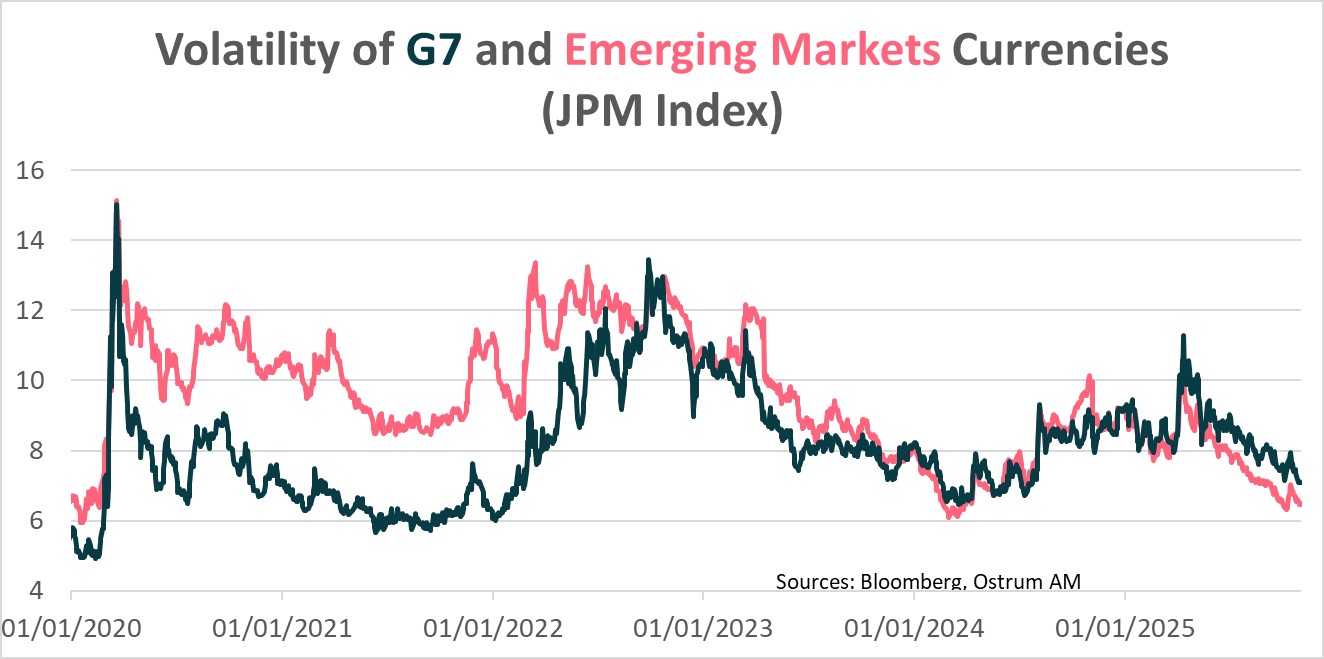

Chart of the week

The volatility of emerging market currencies is lower than that of developed countries, reflecting the maturity of emerging markets.

Despite significant uncertainty related to U.S. trade policy, emerging market currencies have performed well this year.

The strengthening of their monetary and fiscal frameworks, as well as a weak dollar environment, have benefited these currencies, particularly their sovereign debt.

The low currency volatility also reduces the risk of balance of payments crises, thereby contributing to the improved credit profile of external sovereign debt, with the EMBIGD spread reaching a new low of 261 basis points.

The prospect of Fed rate cuts is expected to support EM debt.

Figure of the week

5,000

Nvidia becomes the first company in American history to reach a market capitalization of $5 trillion.

Market review:

- The excellent earnings season continues to boost American equity indexes.

- The Fed does not tolerate a 10-year interest rate below 4% (while inflation is at 3%).

- The ECB is increasingly comfortable with the status quo due to the resilience of growth.

- Trade agreements have supported Asian equities.

European Renaissance

Growing Divergences within the Fed, ECB is "in the Right Place," and Trade Truce.

It was supposed to be a very ordinary FOMC due to the scarcity of economic publications related to the shutdown, which is on track to surpass the 35-day record set during Trump's first term. However, J. Powell seemingly did not tolerate the U.S. 10-year interest rate remaining below 4% while inflation stood at 3% for October. After announcing a 25-basis point cut in its fed funds rates to (3.75%-4%) and the halt of QT on December 1st, the Fed governor indicated during the press conference that a December rate cut was far from guaranteed, suggesting growing divergences within the Federal Reserve. The sell-off was significant in the Treasuries market with a 12-basis point increase in the U.S. 10-year interest rate to 4.1%, led by the rise in the real rate (+10 basis points). META's $30 billion bond sale to finance its AI infrastructure also pushed up U.S. sovereign bond yields. The IG spread widened slightly by 2 basis points to 78 basis points.

U.S. equities continue to be buoyed by an excellent earnings season, particularly in the technology sector, despite persistent nervousness surrounding AI investments. Nvidia becomes the first American company to reach a market capitalization of $5 trillion, more than the French GDP and twice the capitalization of the CAC 40.

In the Eurozone, the ECB maintained its three main interest rates unchanged for the third consecutive month at respectively 2%, 2.15%, and 2.4%. Its comments suggest it is increasingly comfortable with the current direction of its monetary policy. With October inflation at 2.1% converging towards its target, the surprising resilience of Q3 GDP at 0.2% QoQ against 0.1% QoQ in Q2, as well as progress in trade negotiations with the U.S. administration, it stands by its decision. C. Lagarde indicated that the ECB was "in the right place" but not fixed, suggesting the central bank was ready to act if outlooks deteriorated. The surprise rebound in French GDP growth in Q3 to 0.5% QoQ, led by net exports (aerospace), eased budgetary fears and tightened the OAT-Bund spread to 77 basis points.

Despite good news on the growth front, European equity markets ended the week lower, as seen with the DAX (-1.43%) and CAC 40 (-1.43%), due to the appreciation of the euro against the dollar, which hurt the earnings of European companies.

In the foreign exchange market, the dollar strengthened, as reflected by the ICE dollar index, which rose by near 1% over the week, but showing the yen's weakness that supported the Nikkei (6.31%). The acceleration of core inflation in Tokyo in October to 2.8% highlights existing inflationary pressures. However, the BOJ is not inclined to raise its rates due to tariff uncertainty. Japan and South Korea obtained 15% tariff rates in exchange for significant investments in the U.S. amounting to $500 and $350 billion, respectively. The U.S. administration reduced tariffs intended for China related to fentanyl to 10% in exchange for the resumption of Chinese soybean imports and the postponement of rare earth license controls by one year. This represents a one-year trade truce but not an armistice.

Zouhoure Bousbih

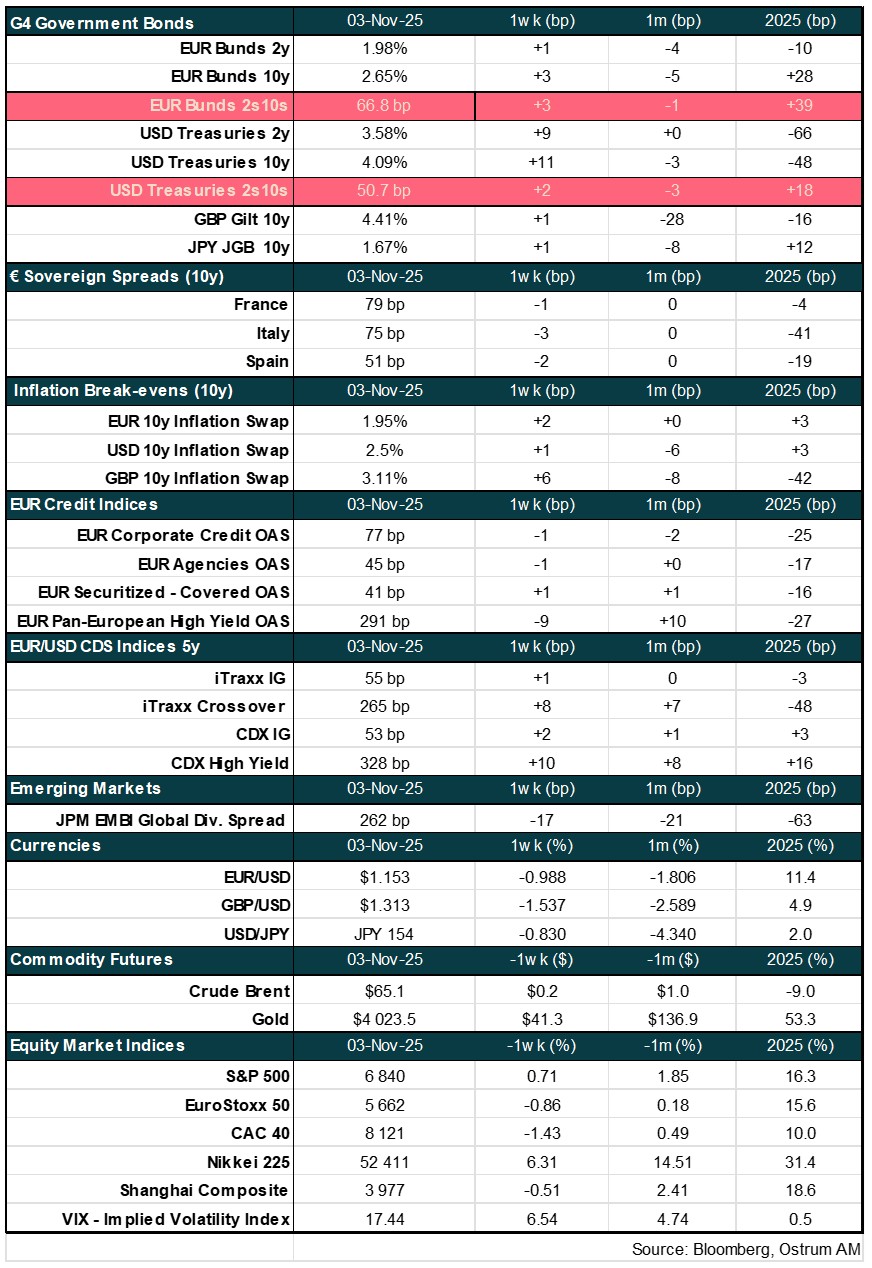

Main market indicators