Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- 2025 Review – Financial markets;

- Theme – no theme this week.

Podcast slides (in French only)

Download the Podcast slides (in French only)Retrospective on 2025

- In April 2025, Donald Trump decided to impose unprecedented tariffs on the entire world, causing a collapse of the markets and a significant slowdown in employment growth in the United States. However, investments in AI have kept U.S. growth close to its potential.

- In response to these tariff tensions and security threats, Europe, and particularly Germany, adopted more expansionary budget policies with significant investments in defense and infrastructure, leading to the beginning of an economic recovery.

- In this detrimental international context, China has also undertaken to restructure its economic model by targeting industrial overcapacities (anti-involution program) while competing with the United States in the most advanced technologies.

- Despite political risks and an unfavorable climate for global trade, markets have shown very high performance in stocks related to AI themes or the recovery of banks in Europe. Long-term rates are tightening without harm to sovereign and corporate credit. The dollar has stabilized after a 10% drop in the first half of the year.

The World reacts to Trump's Tariffs

U.S. : imbalances induced by tariffs

U.S. growth saved by AI spending.

On April 2, 2025, Donald Trump introduced unprecedented tariffs, the first of their kind since the 1930s, affecting countries worldwide. The robust U.S. growth rate of approximately 2.5% at the end of 2024 came to an abrupt halt following the implementation of this policy. The average tariff rate surged from 2.5% to between 17% and 18%, although customs revenues only accounted for about 11% of the value of U.S. imports. These new tariffs compounded existing duties on China, justified by the public health crisis linked to fentanyl, and disregarded trade agreements with North American partners negotiated by Trump during his first term. However, the "Libération Day" tariffs were suspended just six days after their announcement, leading to the initiation of bilateral negotiations with numerous countries, albeit amidst considerable uncertainty regarding the applicability of these sector-specific duties. This disruptive climate, aligned with Trump’s presidential campaign promises, has significantly altered global trade patterns. American businesses preemptively increased imports of non-substitutable goods, particularly high-tech equipment, resulting in a widening trade deficit that led to a contraction in U.S. activity in the first quarter of 2025 before normalizing in the subsequent two quarters.

U.S. job growth stalled after tariff announcements.

The disarray caused by successive announcements has led to a pronounced deterioration in the labor market starting in the spring, with job creation virtually stagnant between May and November (+17k per month). Public sector layoffs initiated by the now-disgraced Department of Government Efficiency (DoGE) overseen by Elon Musk added to the downturn in private employment. Most sectors of the economy are shedding jobs, with only health care, leisure, and, more recently, construction posting increases in employment. Absent substantial technology investments, growth would have been significantly lower; the rise of artificial intelligence has driven considerable investments in infrastructure (data centers), equipment (semiconductors, computers, servers), and software. It is estimated that without these capital expenditures, American growth would not have exceeded 0.5% in 2025. The fierce competition between the United States and China in artificial intelligence and related fields such as robotics has led to export restrictions to China, which counters by disseminating its advancements at lower costs, exemplified by the Deepseek shock. The focus on AI obscures several vulnerabilities within the U.S. economy. Consumers appear to be at their breaking point, except for households in the top decile of income, whose spending now accounts for nearly half of private consumption. Payment delays among the majority of households are rising sharply, reaching levels comparable to the peaks seen during the financial crisis, even as unemployment remains relatively low. Delays in payments over 90 days have hit double digits for credit cards and student debt following the end of the moratorium instituted by Joe Biden. Defaults on auto loans have already caused spectacular bankruptcies among credit institutions in the sector. The plummeting consumer confidence underscores a broader malaise in the American populace. Naturally, tariffs have affected the prices of imported goods, but effective inventory management by companies has helped to spread the shock over time. By year’s end, the decline in oil prices provided some support to consumers through lower gasoline prices. In the housing market, prices fell for five consecutive months before beginning to stabilize in the fall. In fact, sellers are withdrawing their properties from the market, and the acquisition costs remain unattainable for younger buyers without real estate heritage. Mortgage rates exceeding 6% dampen demand and hinder activity in the buying and selling of homes. In conclusion, Trump's policies have led to increasing imbalances within the American economy. Growth remains below potential, compelling the Federal Reserve to respond to the labor market's deterioration. The FOMC consequently lowered interest rates three times in 2025 to 3.75% by December, while also halting its balance sheet reduction and injecting new liquidity into the money market.

Eurozone: Resilience and Fiscal Stimulus in Response to the Tariff War

Germany does its ideological revolution with more proactive fiscal policy.

In Europe, resistance to tariff measures has been organized, especially as Trump appeared to be retreating from the security guarantees enshrined in NATO. Against the backdrop of a growing Russian threat, European nations must modernize their armed forces and reaffirm unwavering support for Ukraine, as American policy diverges from democratic ideals to align more closely with Vladimir Putin’s vision. Necessity indeed compels action. The European Union has committed to increased defense spending under Germany's leadership, which is taking advantage of its newfound budgetary freedom. The constraints on debt have been lifted, with the Merz government announcing ambitions to invest €400 billion in defense over four years and €500 billion in infrastructure over the next decade. As a result, Germany will maintain a public deficit of around 3 4% of GDP for several years. This philosophical shift in Germany is expected to enable France to initiate a public finance recovery policy. However, the lack of consensus and political instability— marked by four prime ministers in 2025—complicates the implementation of fiscal discipline. That being said, bolstered by Germany's momentum and the dynamics within the Iberian Peninsula, growth is gradually rebounding. Interest rate cuts by the ECB are starting to permeate the economy, with the construction sector finally responding to past monetary easing. Real wages are on the rise, and unemployment remains close to historic lows. With the exception of France and Belgium, most countries have regained budgetary leeway. By year’s end, the ECB’s optimism regarding economic conditions continues to grow. The current status quo of 2% rates, which has prevailed since June 2025, remains appropriate and is expected to endure throughout 2026.

China: Revisiting the Growth Model

The precarious restructuring of the Chinese economy between advanced technologies and capacity reduction.

The Chinese economy is grappling with a significant demographic shock. The declining population has unveiled the excess real estate capacity amassed during the 2010s. The construction sector is contracting, leading to a 15% annual decrease in housing investment. Bankruptcies will persist until excess capital is purged from the system. This purge now extends to other industrial sectors grappling with clear production overcapacities, which lie at the heart of trade tensions with the United States and Europe. Nevertheless, Chinese producers are finding avenues for growth in Africa, with exports remaining the primary engine of the Chinese economy. The anti-involution policy announced during the summer aims to eliminate these overcapacities in most sectors to combat deflationary pressures. By the end of 2025, producer prices continue to decline by 2%. The necessary adjustment will require the collapse of "zombie" firms—those that accumulate losses over business cycles—nearly a quarter of which are currently operating in the Chinese industrial landscape. Internal deflation and rising unemployment weigh heavily on consumption, delaying the essential rebalancing of demand. Consumer confidence remains weak, complicating efforts to stimulate spending despite a succession of public initiatives. Despite this grim scenario, China possesses significant assets that continue to reinforce its position year after year. The Middle Kingdom is now at the forefront of technology in many cutting-edge domains. Chinese AI models are more accessible than their American counterparts, while advancements in robotics, biotechnology, and renewable energy are setting new international standards. Though China's semiconductor production lag continues to be substantial, it is beginning to narrow, despite the restrictions on technology transfers from the United States (such as Nvidia chips and other equipment). Thus, China finds itself at a crossroads. A new model based on advanced technologies, also fueled by defense policies, is emerging as overcapacities are dismantled. The adjustment will be painful, and growth is bound to slow.

The Remarkable Resilience of Markets Amid Political Risk

AI investment theme dominates in U.S. markets, while European banks gain 60%.

The financial markets in 2025 have proven remarkable in several respects. Stock performances across major indices surged by 15% to 20%, with spectacular annual returns for American technology stocks, including shares of unprofitable companies, as well as the Korean Kospi and European banks. Bond markets have absorbed the considerable shift in Germany's budgetary philosophy while navigating the political missteps of the Trump administration and avoiding pitfalls from precarious autumn communications within the UK. As the year comes to an end, signals point towards the conclusion of the easing cycle in Australia and Canada, and potentially a monetary tightening in Japan. Broad credit markets, encompassing sovereigns and corporate debt, appear unfazed by bond market volatility. As for currencies, the dollar has fluctuated, while the yuan has stabilized before embarking on a modest appreciation in the second half of the year, and the yen continues its decline. Gold has returned to favor, challenging the presumed safe-haven status of cryptocurrencies, while the Swiss franc has also lost its standing.

"Sell America!" or the Anti-Dollar Reflex Following the Tariff Shock

The U.S. greenback down 10% in the first half of 2025.

The dollar faced a tumultuous first half of the year, depreciating by 10% in the initial months. A unilateral tariff increase was expected to propel the dollar higher, yet the successive reactions from Canada, Mexico, and China reversed the currency's trajectory. Successive tariff truce announcements and the news of trade agreements eventually stabilized the dollar. The approximately $200 billion in tariffs also positively impacted the federal deficit, which stood at $1.775 trillion for the fiscal year ending September 2025. Immediately after the sweeping tariffs were announced, panic gripped Treasury markets, unveiling a triad of phenomena typical of emerging market crises: simultaneous declines in stocks, bonds, and the currency. Trump swiftly announced a crucial truce just six days later, which served as the catalyst for a significant rebound in risk assets. Within six weeks, the crater left by "Liberation Day" was filled, and all major risk asset markets returned to their initial levels. Apart from this "Sell America" episode characterized by intense volatility, markets have generally progressed amid notable calm, especially in the face of persistent geopolitical tensions and the economic uncertainties stemming from increased trade barriers.

Ideological Revolution in Germany

Fiscal stimulus in Germany takes markets by surprise.

In Europe, the announcement of the budget plan in Germany in March had a seismic impact. The ten-year German bond traded at a high of 2.94%, even with the ECB maintaining a status quo regarding its monetary policy. The FinanzAgentur's announcement confirmed that Germany would be the largest sovereign borrower for several years, adding pressure to long-term German bond yields by year-end (notably following the announcement of a new 20-year Bund). The ECB's quantitative tightening has also contributed to rising long-term rates and the maintenance of reduced swap spreads. However, the reform of Dutch pension funds has altered the dynamics of longer maturities. Hedging flows have shortened, and the unwinding of swap positions has contributed to the flattening of the longer end of the euro-denominated yield curve. This theme of rising long-term rates is not unique to Europe; the aging population is leading to decreased demand for long-duration assets. In Japan, the ten-year yield has reached 2%, a level not seen in 25 years. The hesitant Bank of Japan finds itself compelled to respond to the now endemic inflation within the archipelago. Currency markets seem to retain skepticism about the BoJ’s imminent shift to a tightening stance. In credit markets, the prevailing trend has been towards tightening. Valuations may well be excessive, but the enduring economic growth near Europe's potential, coupled with the absence of significant merger and acquisition activity, continues to drive down risk premiums.

Conclusion

The year 2025 will be remembered for Donald Trump's trade policies and their incessant fluctuations, which the market has quickly adapted to. Europe reacted by implementing a more proactive fiscal policy. China embarked on a profound restructuring of its economic model, reducing excess capacities while accelerating its technological competition with the United States. Amid the ongoing turmoil stemming from the war in Ukraine, financial markets exceeded early-year expectations, buoyed by the Federal Reserve's monetary easing and the enthusiastic participation of investors in sectors like AI and the recovery of European banks.

Axel Botte

Chart of the week

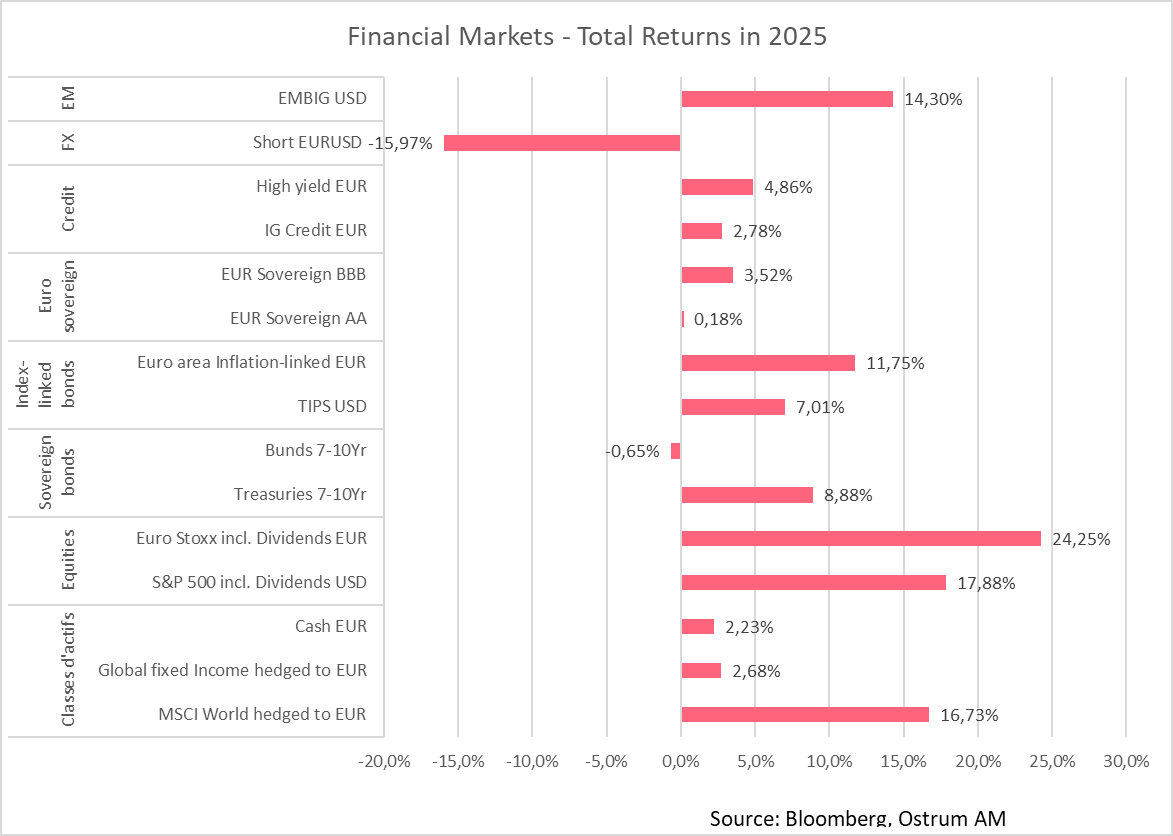

The financial year 2025 was characterized by a significant outperformance of global equities compared to bonds and cash. The dollar depreciated by 16% against the euro.

In terms of equities, Europe posted a total return of 24% compared to 17% for the S&P 500.

In the bond market, emerging market debt significantly outperformed, with 7-10 year Treasuries returning 8.9%, while the Bund posted negative returns. Sovereign BBB-rated bonds (Italy), credit, and high yield also delivered positive performance.

Figure of the week

75

South Korea’s KOSPI stock index returned 75.67% excluding dividends

in 2025.

Market review: The weekly column will resume on January 12th

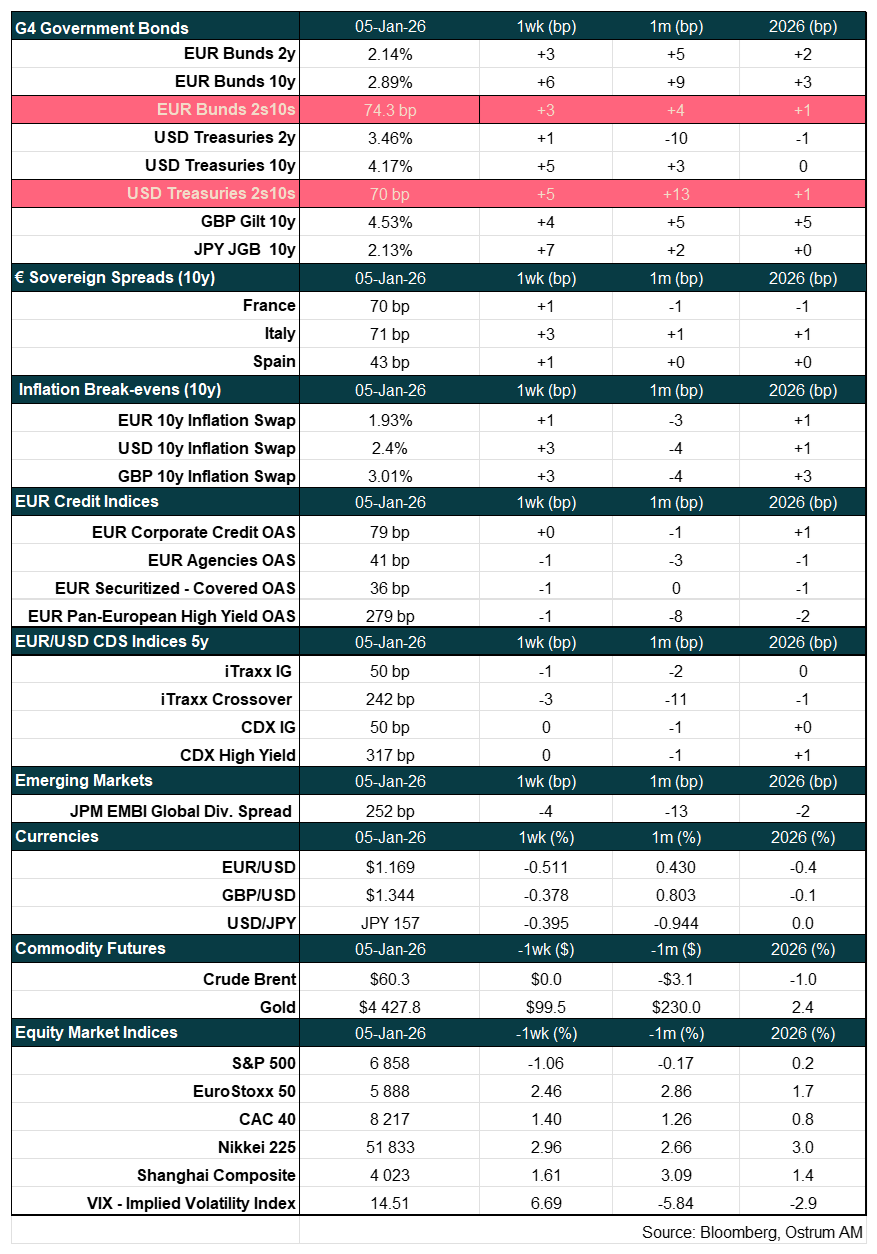

Main market indicators