Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Zouhoure Bousbih's podcast:

- Review of the week – U.S. inflation, Eurozone PMI Surveys;

- Theme – China’s 15th Five-Year Plan for 2026-2030: Connecting the Past to the Future.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Will the Fed’s target rate change?

- The Federal Reserve is considering modernizing its interest rate target, traditionally based on the federal funds rate, to better reflect current conditions in the money market;

- The Fed funds market has diminished in importance due to the concentration of activity among a smaller set of institutions as new regulations discourage unsecured borrowing;

- Rates such as the Overnight Bank Funding Rate (OBFR) and Treasury repo rates, notably the Tri-Party General Collateral Rate (TGCR), are considered more robust measures of funding costs and liquidity;

- Treasury repo rates are viewed as more effective for transmitting monetary policy, given their secured nature and broad participation in the market;

- A proactive shift to a new target rate would enable the Fed to manage monetary conditions more effectively while reducing volatility risk.

Has the Fed funds rate become irrelevant?

Unsecured loans in the Fed funds market are no longer as relevant to gauge broad liquidity conditions.

The Federal Open Market Committee (FOMC) is pivotal in shaping U.S. monetary policy, primarily through its target range for the federal funds rate. This operating target acts as a crucial tool for influencing economic conditions, steering bank actions, and offering a transparent benchmark for assessing the monetary policy stance. However, as financial markets evolve and the introduction of ample reserves following the Great Financial Crisis (GFC) becomes more pronounced, questions have emerged regarding the continued appropriateness of the fed funds rate as the target for short-term interest rates.

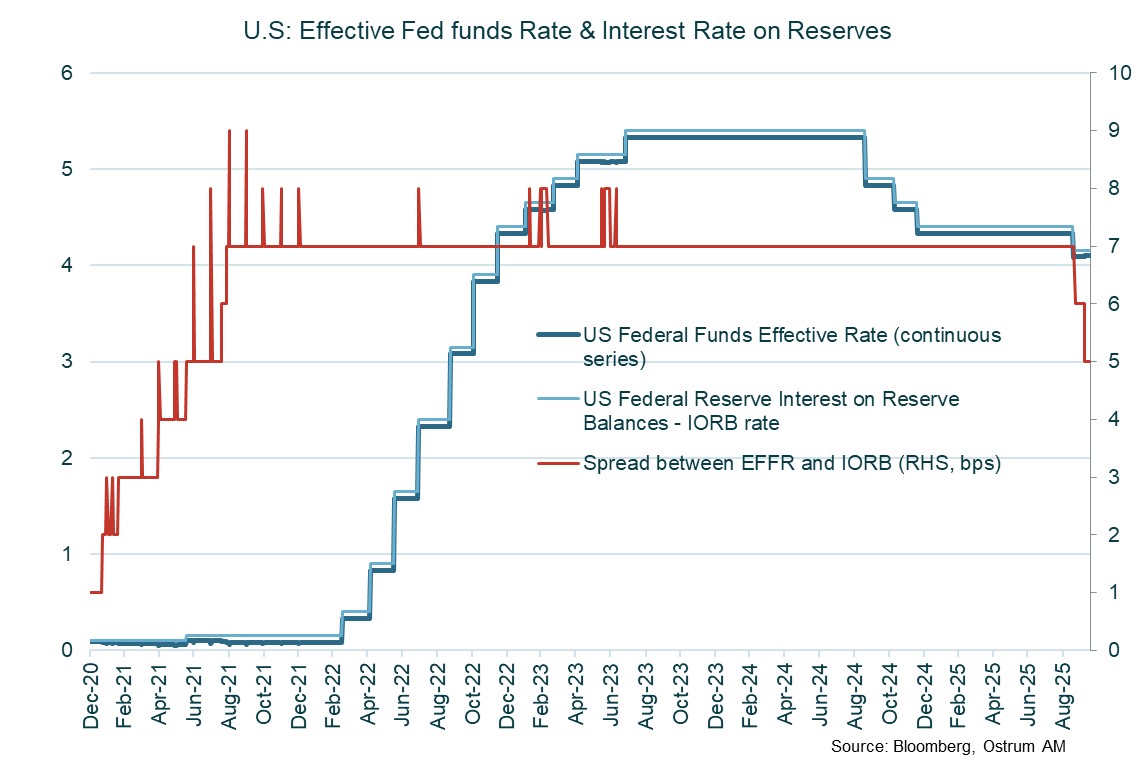

Since the GFC, the market structure has undergone significant transformation. The fed funds market, which previously facilitated unsecured interbank loans, has diminished in importance due to new regulations discouraging unsecured lending. In the aftermath of the GFC, the Fed began paying interest on reserves, fostering an environment characterized by ample reserves rather than scarcity. This shift has fundamentally changed the dynamics of the Fed funds market, rendering it less effective as a target for influencing monetary conditions.

In the current environment, though the fed funds rate remains a viable operating target, its links to broader money markets have become increasingly tenuous. In a scarce reserve system, liquidity is always a little bit short fostering lending in the unsecured interbank market at the Fed’s target rate. The market mechanics have changed under quantitative easing and ample reserves. Markets adapted to the abundant reserve supply. Bank borrowing needs declined, as they nearly stopped trading actively in the market. The Fed funds rate thus evolved within a wide range, typically 25 bps between the upper and lower bounds.

Fed funds activity is dominated by regulatory arbitrage.

The concentration of activity among a limited number of lenders, notably the Federal Home Loan Banks (FHLBs), has weakened the resilience of the Fed funds market. The Fed funds rate evolved into a mere interest rate arbitrage between one set of lenders (FHLBs) and one set of borrowers (mainly non-U.S. banks) borrowers. FHLBs cannot earn interest on cash balances at the Fed (by law) and thus sell their cash into the Fed funds market. Branches and agencies of foreign banks, dominate Fed funds borrowing activity. Foreign banks do not have to pay deposit insurance to the FDIC and therefore have lower balance sheet costs. Foreign banks earn the spread between the interest rate on reserve balances (IRRB) and the effective Fed funds rate which has been quite stable around 7 bps. Consequently, the uncollateralized Fed funds market is dominated by regulatory arbitrage. The interplay between the Fed funds rate and other money market rates may no longer serve as a reliable indicator of broader economic conditions.

Evaluating Alternative Operating Targets

Repo rates are a more robust measure of liquidity.

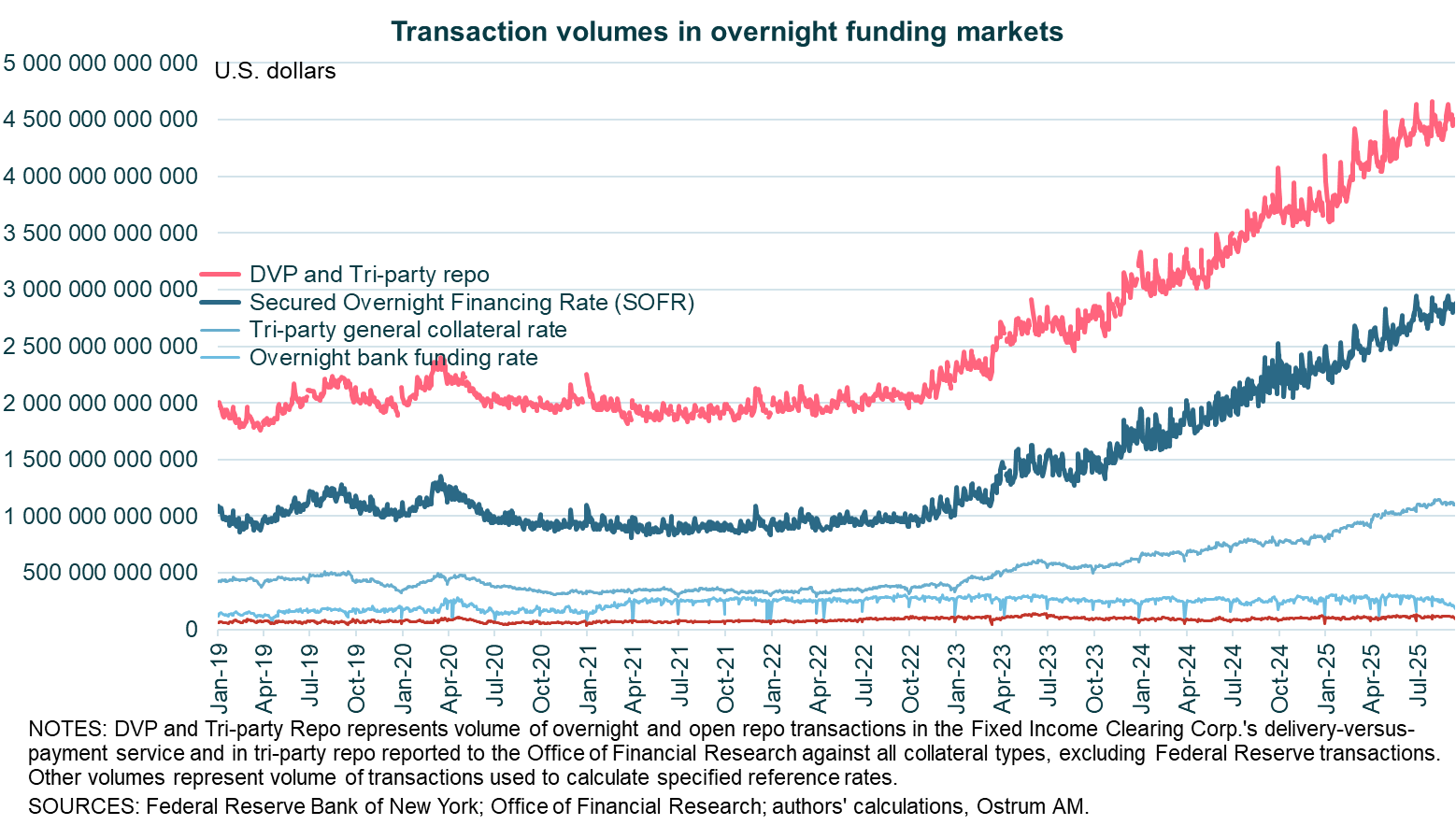

Given these challenges, there is a compelling argument for the FOMC to consider transitioning to alternative operating targets. Potential candidates include targeting a repo rate, such as the tri-party general collateral rate (TGCR), which would provide a more robust measure of liquidity and could enhance the ability of the FOMC to influence monetary policy effectively. Indeed, transaction volumes in repurchase agreements dwarf unsecured lending, especially as money markets have transitioned from LIBOR-based unsecured lending to secured lending in 2022-2023.

Option 1. Keeping an Uncollateralized Rate Reference: Overnight Bank Funding Rate (OBFR)

The Overnight Bank Funding Rate (OBFR) is a measure of the cost of unsecured overnight borrowing by banks. It reflects the volume-weighted average of rates on Fed funds transactions, as well as certain Eurodollar transactions, and other unsecured wholesale bank funding. OBFR covers a broader range of transactions than the Fed funds including loans to banks from institutions ineligible to hold reserves at the Fed, such as non-bank financial institutions and non-financial corporations. Hence, OBFR offers a more comprehensive view of bank funding costs. Another advantange is that the Fed’s existing tools are effective in controlling the OBFR, which typically remains closely aligned with the Effective Federal Funds Rate (EFFR).

However, the primary drawback of targeting OBFR is that the majority of U.S. money market activity occurs in secured rather than unsecured markets. Targeting OBFR requires relying on the transmission from unsecured bank funding to repo markets, which could weaken during periods of financial stress or if banks reduce their use of unsecured funding. Risk premia may indeed impede policy transmission.

Option 2. Moving to a Secured Rate: Treasury Repo Rates

Treasury repo rates are interest rates derived from repurchase agreements (repos) collateralized by Treasury securities. In a repo transaction, one party sells a Treasury security to another with an agreement to repurchase it at a specified price on a future date, effectively creating a short-term, collateralized loan. The New York Fed publishes three different overnight Treasury repo reference rates:

- Tri-Party General Collateral Rate (TGCR): This rate covers transactions conducted on the Bank of New York Mellon’s tri-party platform, primarily connecting large cash investors, such as money market funds, with large securities dealers.

- Broad General Collateral Rate (BGCR): BGCR includes the transactions covered by TGCR, along with a small set of centrally cleared transactions in the GCF Repo Service.

- Secured Overnight Financing Rate (SOFR): This is the broadest measure, incorporating TGCR and BGCR transactions, as well as a large set of repos that are centrally cleared at the Fixed Income Clearing Corp. (FICC).

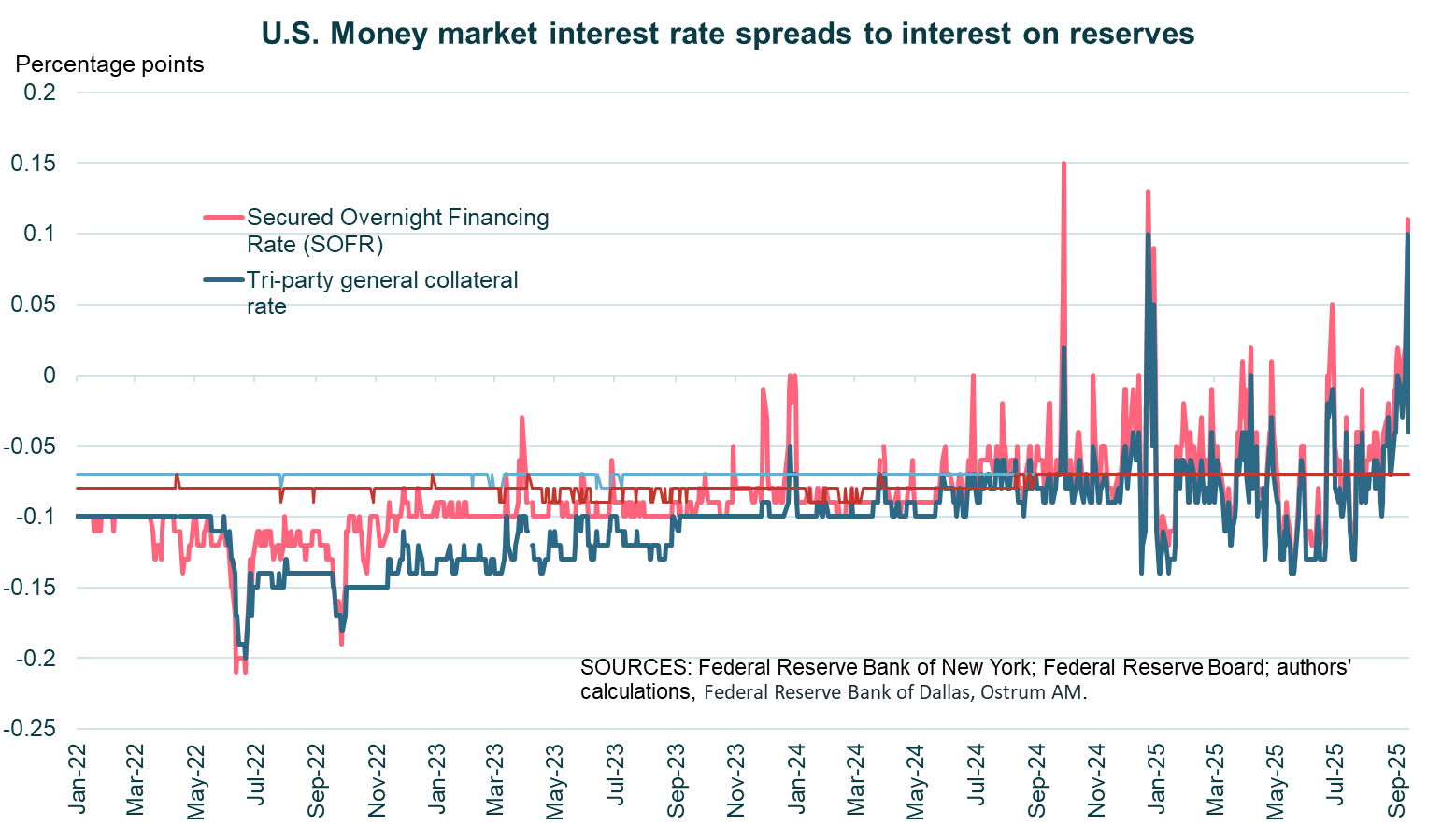

Treasury repo rates are directly linked to the core of U.S. money markets, providing a more reliable transmission mechanism for monetary policy than unsecured lending rates. Repo rates are essentially risk-free, which allows policymakers to focus on underlying monetary conditions rather than risk premiums. Treasury repo markets also involve a wide range of participants, facilitating effective transmission to and from broader monetary conditions. Given their sizes, Treasury repo markets have historically functioned relatively smoothly, even during periods of stress when other markets have been disrupted. This does not mean that Teasury repo rates are less volatile than the fed funds rate. Indeed, the amount of collateral and funding available in repo markets may vary, due to Treasury settlements, mortgage-backed securities payments, and balance sheet management by foreign banks.

2.1. Tri-Party General Collateral Rate (TGCR)

TGCR is a specific Treasury repo rate that reflects transactions on the Bank of New York Mellon’s tri-party platform. It provides a clean measure of the marginal cost of funds and the marginal return on investment for a wide range of borrowers. TGCR is well-connected to other money markets and robust to changes in the behavior of small groups of participants. The FOMC's existing tools already effectively control TGCR. The establishment of the Standing Repo Facility (SRF, worth $500 billion of overnight lending capacity) has further strengthened the ceiling on TGCR. There is acaveat. As market participants implement the SEC’s mandate to centrally clear a broader set of Treasury repo transactions by June 30, 2027, the relative strengths and weaknesses of TGCR could change. This transition may reduce activity in the tri-party market that TGCR measures.

2.2. Secured Overnight Financing Rate (SOFR)

SOFR is the broadest measure of overnight Treasury repo rates, encompassing transactions in both the tri-party repo market and centrally cleared repo markets. SOFR covers a wide set of overnight Treasury repo transactions, typically exceeding $2.5 trillion a day, which supports its transmission to broad monetary conditions. SOFR has been broadly adopted as a reference rate in dollar funding markets following the phasing out of LIBOR. The USD rate futures market is largely dominated by SOFR contracts.

SOFR combines two distinct market segments (tri-party repos and centrally cleared repos), potentially leading to a distribution of rates with multiple peaks and making it difficult to obtain a clear reading on the cost of funds. For instance, some repo transactions may reflect collateral specialness (CUSIPs). Large dealers have some market power in intermediating between these segments, meaning the centrally cleared segment of SOFR can reflect this market power rather than a pure reflection of the cost of funds. For this reason, the FOMC’s current tools may not be as effective in controlling SOFR as they are for TGCR.

Conclusion

In conclusion, while the fed funds rate has historically served as a cornerstone of U.S. monetary policy, the evolving financial landscape necessitates a reevaluation of this operating target. By considering alternatives like OBFR, TGCR, and SOFR, the Fed must consider factors such as market coverage, transmission effectiveness, controllability, and the potential for future market structure changes. Ultimately, the Fed’s decision will depend on its ability to adapt to new financial realities and maintain effective influence over monetary conditions. Proactively modernizing the operating target presents an opportunity for the FOMC to strengthen its influence over monetary conditions and better serve the U.S. economy.

Axel Botte

Chart of the week

Beef prices in the United States have been steadily increasing for the past five years after a period of relative stability between 2014 and 2019. A pound of beef now costs $6.30, representing a 60% increase since December 2020.

However, the rise has accelerated this year due to Donald Trump's tariff policy, which raises the costs of inputs and Brazilian imports. Immigration restrictions are also increasing production costs for the industry.

The U.S. Treasury's $20 billion bailout of Argentina is the final blow. The agreement comes with a commitment to import Argentine meat, which has angered American producers who have traditionally supported Donald Trump.

Figure of the week

2

Panda bonds are renminbi-denominated bonds issued in the onshore market by overseas institutions. The total outstanding size of offshore renminbi bonds and panda ponds has reached about 2 trillion yuan ($280.6 billion), data from the PBOC showed.

Market review:

- China/United States: New escalation in the trade war;

- United States: September inflation comes in at 3%;

- The Fed is expected to cut its rate by 25 basis points;

- Stocks buoyed by strong quarterly earnings in the United States.

Earnings Support Equities' Rise

Despite ongoing trade tensions and geopolitical strains, risk assets continue to advance as the Federal Reserve prepares to implement interest rate cuts.

The trade war is far from over. The U.S. president consistently responds to potential embargo threats on rare earth minerals—with the Chinese holding a near-monopoly on refining—by resorting to tariff threats. Paradoxically, the current escalation between the US and China could lead to a détente following an upcoming meeting in Korea between Xi Jinping and Donald Trump. Recent sanctions targeting Rosneft and Lukoil have also pushed oil prices back up to $66 (Brent), while industrial metal prices (copper, aluminum) reach new heights.

The U.S. government shutdown, now the second longest in history, appears to have no end in sight. Limited data points to a lackluster growth environment outside the technology sector. Despite the closure of the Bureau of Labor Statistics (BLS), the Consumer Price Index (CPI), which serves as a basis for social transfer indexing, has been released. US inflation stands at 3% for September. Tariffs are impacting clothing and transportation prices, but disinflation is confirmed in the housing sector. Electricity and gas prices have risen by 5% and 11.7%, respectively, reflecting the negative externalities of the AI boom. A decline in gasoline prices is expected to be reflected in October’s CPI. Existing home sales remain stagnant (around 4 million) despite a decline in mortgage rates since May 2025 (down 60 basis points on the 30-year). In the Eurozone, French surveys (INSEE) reveal a resurgence of optimism, while Germany's Services PMI shows signs of improvement. Economic activity is expected to pick up towards the end of the year. In the UK, consumer spending is strengthening, suggesting GDP growth of +0.3% in the third quarter. Meanwhile, Japan's economic policy under Sanae Takaichi is decidedly expansionary, with inflation maintaining around 3%. The Bank of Japan remains noncommittal regarding a potential rate hike in October as the yen falls to 153 per dollar.

The Federal Reserve convenes this week, and despite inflationary pressures and statistical uncertainties, a 25 basis point rate cut appears certain. Central bankers may also respond to recurrent tensions in the money market by halting the reduction of their balance sheet. This measure would inject $30 billion each month through reinvestments in Treasuries. An accommodative stance should keep the 10-year yield around 4%. In the Eurozone, the European Central Bank is expected to maintain the status quo following the upward revision of core inflation to 2.4%. This should facilitate a return of the Bund to the 2.60-2.80% range, especially as fears regarding US banking risks have rapidly dissipated. Additionally, the French spread recently moved back above the 80 basis point threshold. The risk of government censorship persists as the downgrade of the credit rating is now well integrated into the market.

On equity markets, the earnings season in the United States has been robust, alleviating concerns surrounding regional banks. Over 85% of quarterly earnings reports have surpassed consensus estimates on the S&P 500, which is trading at historical highs. In Europe, indices have risen approximately 1.5% over the week, with small and mid-cap stocks outperforming. The $5 rebound in oil prices and the rise in commodity prices benefit the energy and basic materials sectors. Asian markets (Nikkei, Kospi) are buoyed by the yen’s weakness. Concurrently, the credit market exhibits remarkable stability, with the average spread for high-quality credit hovering at 70 basis points.

Axel Botte

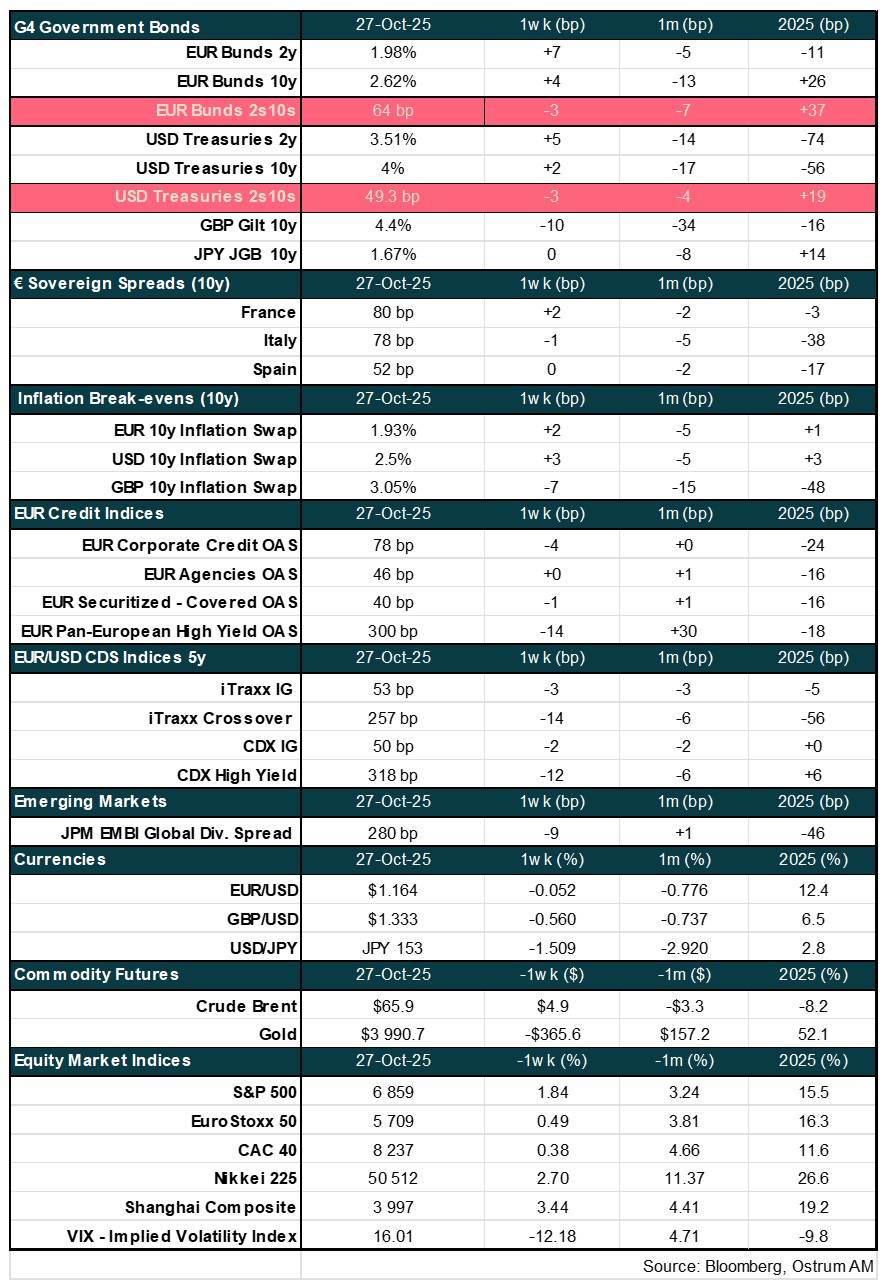

Main market indicators