Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Financial markets, US employment metrics can be misleading;

- Theme – Isabel Schnabel outlines the upcoming evolution of the ECB's balance sheet.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Isabel Schnabel outlines the upcoming evolution of the ECB's balance sheet

- Isabel Schnabel provided additional information regarding the new operational framework of the ECB presented in March 2024;

- By characterizing the gradual reduction of the ECB's balance sheet, through the non-reinvestment of maturing assets in the context of the APP and the PEPP, as "quantitative normalization" rather than quantitative tightening, Isabel Schnabel sets a high bar for a change in its pace. This balance sheet normalization "is still far from complete";

- The ECB is primarily awaiting a durable and widespread increase in banks' demand for liquidity from the central bank through the main refinancing operations;

- Only after that it will launch structural operations to address the increased liquidity demand from banks for regulatory reasons and precautionary motives;

- Long-term structural refinancing operations will initially be launched...

- ... followed by a structural portfolio of assets with a short maturity to avoid interfering with the monetary policy stance, to allow the ECB to purchase long-term bonds if necessary, and to limit the ECB's asset exposure to interest rate risk. This argues for a steepening of the yield curve.

"Quantitative normalization" of the ECB's balance sheet.

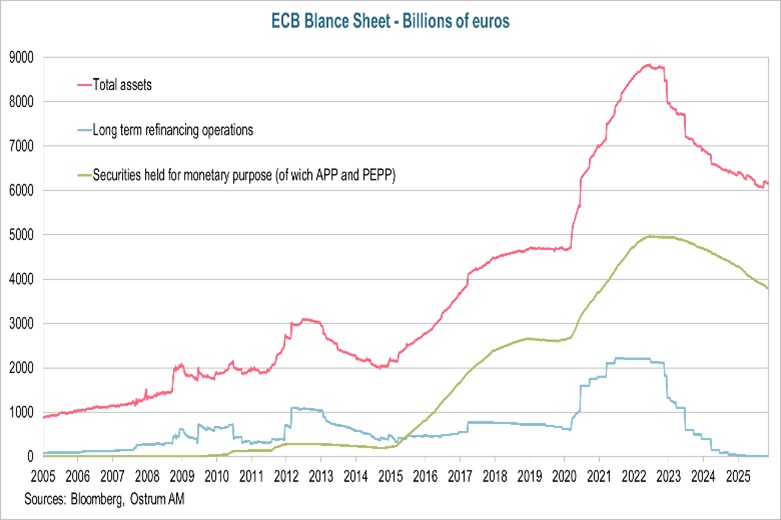

The ECB's balance sheet has evolved since 2008 in response to various shocks that have affected the euro area and the unconventional policies adopted to address them.

Since the global financial crisis of 2008, the size of the ECB's balance sheet has increased significantly, similar to that of other central banks such as the Fed, the BoE, and the BoJ. Given that interest rates had reached very low levels, further rate cuts were very limited, if not nonexistent, when rates became zero or even negative. This is why central banks resorted to so-called "unconventional" monetary policies, massively purchasing sovereign and private bonds (quantitative easing) and responding to banks' refinancing requests without limit. Through these instruments, central banks were able to exert influence over the entire yield curve, which helped ease financing conditions for households and businesses—a necessary (but not sufficient) condition to increase loan demand and stimulate a recovery in domestic demand to achieve the inflation target set by central banks (and full employment for the Fed).

The extensive targeted longer-term refinancing operations and massive purchases of sovereign bonds have made monetary policy even more accommodative.

The size of the ECB's balance sheet thus steadily increased from 2007 to 2014, before rising significantly from 2015 to 2019 due to bond purchases aimed at combating the risk of deflation under the asset purchase program (APP). The ECB's balance sheet then saw a sharp increase between March 2020 and June 2022 with emergency measures to address the consequences of the Covid-19 crisis. The ECB launched its Pandemic Emergency Purchase Programme (PEPP) and implemented targeted longer-term refinancing operations (TLTRO 3) to encourage commercial banks to lend to households and businesses by offering very favorable refinancing conditions. The TLTRO 1 and TLTRO 2 programs were launched in 2014 and 2016, respectively. As a result, between March 2020 and June 2022, the ECB's balance sheet nearly doubled (+ €4.130 trillion), reaching a peak of €8.835 trillion.

After a brief stabilization phase, the size of the ECB's balance sheet began to decrease starting in November 2022, currently standing at €6.160 trillion, representing a decline of €2.675 trillion. Commercial banks have repaid the targeted longer-term refinancing operations, and the repayments of maturing bonds held by the ECB under the APP and then the PEPP are no longer being reinvested.

The ECB is not ready to change its balance sheet policy.

The gradual reduction of the ECB's balance sheet through the non-reinvestment of maturing assets is referred to as "quantitative normalization" by Isabel Schnabel, minimizing its impact on financial conditions.

In her speech, Isabel Schnabel indicates that "quantitative tightening" (QT) is not the appropriate term to describe the gradual reduction of the ECB's balance sheet through the non-reinvestment of maturing assets. She prefers the term "quantitative normalization" (QN) given that the average weighted 10-year yield in the euro area is still estimated to be 60 basis points below the level that would have prevailed in the absence of the ECB's asset purchases (quantitative easing, or QE, starting in 2015). This QN is thus intended to remove the residual monetary stimulus that is still present in the system.

This gradual normalization "is still far from complete".

Isabel Schnabel also reiterated the view that the passive balance sheet reduction via the non-reinvestment of maturing assets (QN) "is proceeding smoothly, with solid liquidity positions of banks and an abundance of excess liquidity," while specifying that "the normalization of the balance sheet is still far from complete." These factors do not suggest an upcoming change in the pace of the ECB's balance sheet reduction, as the Fed recently did before ending it on December 1.

While the ECB's balance sheet reduction will continue gradually in a passive manner, Isabel Schnabel provides details on its forthcoming evolution and a sequence for the next steps.

The size of the balance sheet will depend on the liquidity demand from banks.

The size of the balance sheet and its composition will increasingly depend on the liquidity demand.

According to the new operational framework presented in March 2024, as the ECB passively reduces its financial assets, the size of the balance sheet will increasingly depend on the liquidity demand from banks. Secured loans to banks will gradually become the main asset on the ECB's balance sheet, as they were in the past, before the implementation of unconventional monetary policy.

Liquidity Surpluses Remain Very Significant.

Excess liquidity, although significantly reduced, remains very high at €2.5 trillion.

Under normal circumstances, the size of the ECB's balance sheet is determined by the monetary base on the liability side. This includes banknotes in circulation and central bank reserves that commercial banks use to settle interbank payments. The massive bond purchases by the ECB from commercial banks, along with targeted longer-term refinancing operations, have flooded the market with liquidity and increased the excess reserves of banks. These are the reserves that commercial banks place with the ECB over and above the required reserves. With the reduction of the balance sheet, these excess reserves are decreasing but remain very high. They currently stand at €2.5 trillion, compared to €4.75 trillion in November 2022 and €1.7 trillion in March 2020.

As the balance sheet continues to reduce through the non-reinvestment of maturing assets, liquidity surpluses will continue to decline up to a certain point.

The size of the ECB's balance sheet cannot return to pre-crisis levels. The amount of money in circulation was approximately €630 billion in 2006; it is now €1.6 trillion due to increased demand for banknotes. The amount of excess reserves cannot revert to the levels that prevailed before the adoption of unconventional policies, they were virtually nonexistent. Today, banks wish to hold more liquid assets for regulatory reasons and to create a cushion of precautionary reserves, particularly to address technological changes with the emergence of instant payments and digital banking services.

ECB staff estimate that excess reserves should range between €600 billion and €2.2 trillion.

According to the scenario analysis from the ECB's services, the demand for excess reserves is expected to range between €600 billion and €2.2 trillion. The lower end is based on banks holding 10% of high-quality liquid assets (HQLA) in reserve and assumes a decrease in the liquidity coverage ratio (LCR) to 130% (down from 158% currently). The upper end assumes reserves representing 30% of HQLA and a slight decrease in the LCR.

As the balance sheet is reduced, banks will gradually increase their demand for liquidity from the central bank through secured lending operations.

The ECB will not rely solely on short-term refinancing operations to provide liquidity to banks; it will also rely on structural operations.

In accordance with the new operational framework, Isabel Schnabel indicates that the ECB will not rely solely on short-term refinancing operations to provide the liquidity demanded by banks. Focusing on a single instrument to provide liquidity to banks would generate operational risks and require a significant amount of collateral. The ECB therefore intends to utilize structural liquidity provision operations through new long-term refinancing operations and engage in asset purchases as part of a new structural asset portfolio. These instruments will significantly address the structural liquidity needs of banks.

Sequence of Operations and Maturity:

The timing of the launch of these operations is uncertain as it will depend on the pace of contraction of excess liquidity and the banks' response to this reduction.

Sustained Increase in Main Refinancing Operations…

First and foremost, the ECB wants to observe a sustained and widespread increase in banks' demand for main refinancing operations.

Before launching structural operations, the ECB must observe a sustained and widespread increase in the use of main refinancing operations. The timing, scale, and pace of these operations will provide essential information about banks' demand for reserves.

As the balance sheet is reduced through the non-reinvestment of maturing assets, there will come a point when the circulating reserves will no longer be sufficient to meet the demand from banks through the redistribution of reserves. At that moment, overnight repo rates could rise further, and the reliance on short-term refinancing operations could increase. According to Isabel Schnabel, this will not signal stress in the money market, but rather indicate an increased use of the ECB's lending facilities in line with the new operational framework.

... followed by the launch of structural operations.

Targeted long-term structural refinancing operations will follow thereafter.

The ECB will then launch its structural operations, as indicated in March 2024. The details of these operations have been clarified: long-term structural refinancing operations will occur first. A portion of the demand for standard refinancing operations can be shifted to long-term structural refinancing operations, taking place at regular intervals. The amount can be revised over time. The maturity of these operations has not been specified. However, Isabel Schnabel referred to the regulatory constraints faced by banks and indicated that borrowing from a central bank with a residual maturity of over six months counts towards the liquidity coverage ratio (LCR) and the net stable funding ratio. The characteristics of structural operations must align with the ECB's operational framework: the marginal utility of liquidity must be provided by standard refinancing operations.

Only after this will a new structural securities portfolio be launched.

They will be followed after a certain period by a new structural portfolio of securities...

The ECB states that the portfolios of securities held by national central banks that are not related to monetary policy, like euro-denominated asset portfolios, will also help meet the structural liquidity demands of banks. Isabel Schnabel clearly indicates that the time when the ECB will start purchasing assets as part of the structural portfolio is still far off, given the passive amortization of the balance sheet. She reiterated the importance of integrating climate change considerations into the structural securities portfolio.

The Structural Securities Portfolio Will Be Oriented Towards Shorter Maturities.

... with short maturities.

Isabel Schnabel outlines three principles for this. The first is the neutrality of the monetary policy stance. Purchases of securities in the structural portfolio should not interfere with the ECB's monetary policy stance. Isabel Schnabel references the bond purchases made by the Fed before 2008, which had an average maturity of 3 to 4 years. The second principle is to leave room for the ECB to significantly purchase long-term bonds in the event of risks to price stability while policy rates are at low levels or risks regarding the transmission of monetary policy. The third principle concerns the financial soundness of the ECB: under normal circumstances, the exposure of the ECB's assets to interest rate risk should remain limited. These three principles thus argue for a portfolio with shorter maturities.

Conclusion

Isabel Schnabel has clarified the forthcoming evolution of the ECB's balance sheet. The size of the balance sheet will be determined by the liquidity demand from commercial banks through short-term refinancing operations. As banks' need for liquidity is greater than before the financial crisis, for regulatory reasons and precautionary motives, the ECB will also launch structural operations. However, it must first observe a durable and widespread increase in the demand for short-term refinancing from banks. Long-term structural refinancing operations will only take place after that. They will be followed after some time by asset purchases as part of a new structural portfolio with shorter maturities. This argues for a steepening of the yield curve.

Aline Goupil-Raguénès

Chart of the week

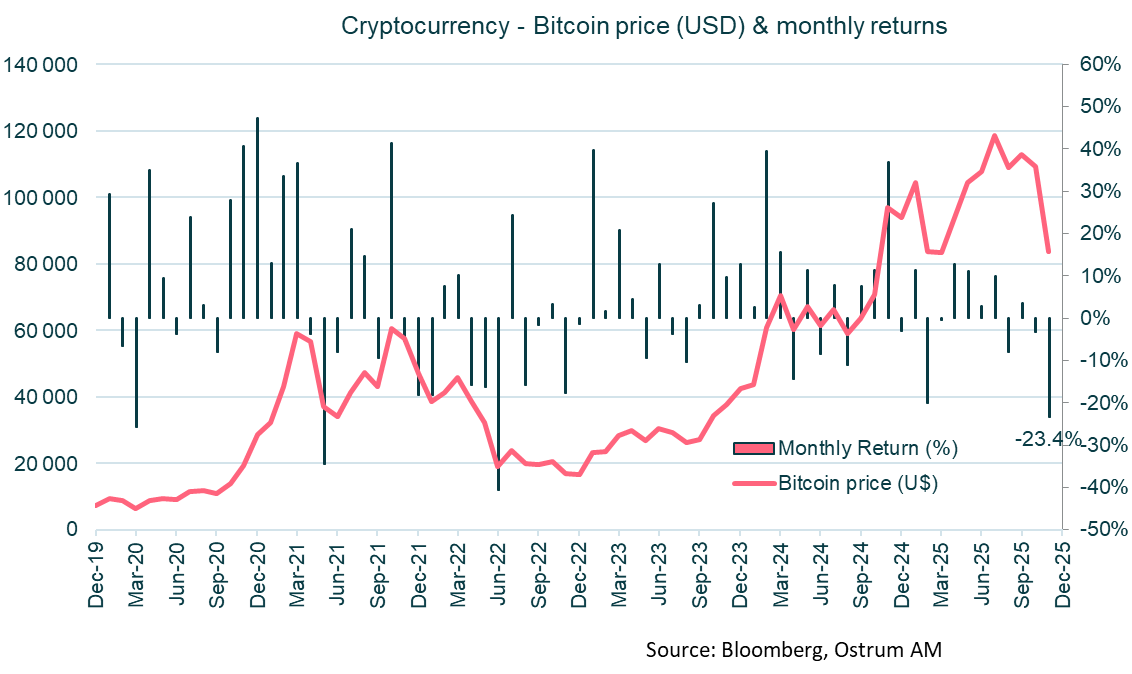

Bitcoin has experienced a significant correction since its closing peak on October 6, exceeding $126,000. The virtual currency has plummeted to around $83,000, which reflects the average levels observed at the onset of the trade war initiated by Donald Trump.

The decline of the leading cryptocurrency has dragged down the entire ecosystem and related assets that have accumulated similar positions. Cryptocurrencies collectively account for approximately $2.5 to $3 trillion. Their extreme volatility and ongoing challenges related to securing portfolios undermine the narrative surrounding their status as a store of value or hedge against various risks. Risk aversion in equity markets continues to exert downward pressure in the digital realm.

Figure of the week

21.3

The Japanese government has adopted a massive budget stimulus of 21.3 trillion yen (135 billion dollars), the largest since the Covid-19 crisis, to boost growth and protect households from the rising cost of living.

Market review:

- United States: Employment rose by 119k in September, but unemployment is on the rise;

- Equities: A warning shot across global stock markets despite strong earnings from Nvidia;

- Japan: The budget support plan leads to a surge in long-term rates;

- Credit: Despite the prevailing volatility, credit spreads remain nearly stable.

The Return of Risk Aversion

Risk assets, including equities and cryptocurrencies, experienced a downturn last week following mixed employment data from the United States. Nvidia’s impressive earnings report was insufficient to quell fears regarding a potential bust in the AI bubble.

Stock indices plummeted by over 3%, despite a mid-week rally spurred by Nvidia's results. The speculative bubble looms large in investors' minds, yet those positioned to benefit from the "picks and shovels" of the gold rush appear to be the best off. Notably, Nvidia's stock saw a dramatic reversal, opening up 5% but closing down 3%. European and Asian markets followed Wall Street's lead and also fell. Amid these fluctuations, the anticipated rate cut in December is hotly debated within the Fed, as fiscal policies continue to exert upward pressure on 30-year yields, from the UK to Japan. Safe-haven assets are becoming scarce due to the high prices of gold and the Swiss franc, prompting a retreat into T-notes and the dollar.

U.S. data releases resume. The September employment report indicated 114k new jobs, better than expected but tempered by revisions of -33k for the previous two months. A transient rebound in public employment occurred but the DOGE layoffs will kick in in October, and only a few sectors contributed to job growth. Furthermore, the unemployment rate rose to 4.4% in September, with new jobless claims suggesting a prolonged upward trend above the FOMC's projection of 4.4% in 2026. The next BLS report will be released on December 16, six days after the next Fed’s meeting. Central bankers appear divided on the prospect of a new rate cut, although the Board seems inclined toward a reduction of 25 bps. In the Eurozone, the PMI surveys point to a fragile manufacturing sector, while service activity remains more robust. Negotiated wages are moderating, falling below 2% to 1.87% in Q3.

In financial markets, risk aversion has surged, despite the positive knee-jerk reaction to Nvidia's earnings announcement. The VIX index recorded an intraweek high exceeding 28%. Caution has prevailed, with major indices declining by 3-4% last week. Asian markets are similarly affected by investor concerns regarding AI. The technology sector dragged the entire market lower, with small-cap U.S. stocks underperforming relative to the S&P 500 during this reversal phase. Compounding these concerns is the announcement of yet another budget plan in Japan, contributing to rising long-term yields. The 30-year JGB now offers a yield surpassing its German counterpart. The combined weaknesses of the yen, bonds, and Japanese equities echo the "Sell America" trade that followed the announcement of tariffs in early April. The Bund plays its marginal role as a safe haven, resulting in a moderate widening of 10-year swap spreads to 5 bps. The recent easing on the OAT appears to be reversing, with the French spread widening again by 4 bps to 77 bps. The decline in oil prices following the U.S. proposal for peace in Ukraine has reduced inflation expectations for shorter maturities (2.55% on the 2-year inflation swap in the U.S.). The Gilt is anxiously awaiting Rachel Reeves' autumn statement regarding the 2026 budget, with the latest fiscal data indicating a higher deficit of €17.4 billion in October. Meanwhile, credit volatility remains significantly lower than that of equities, with euro-denominated investment-grade credit trading at 71 bps above swaps.

Axel Botte

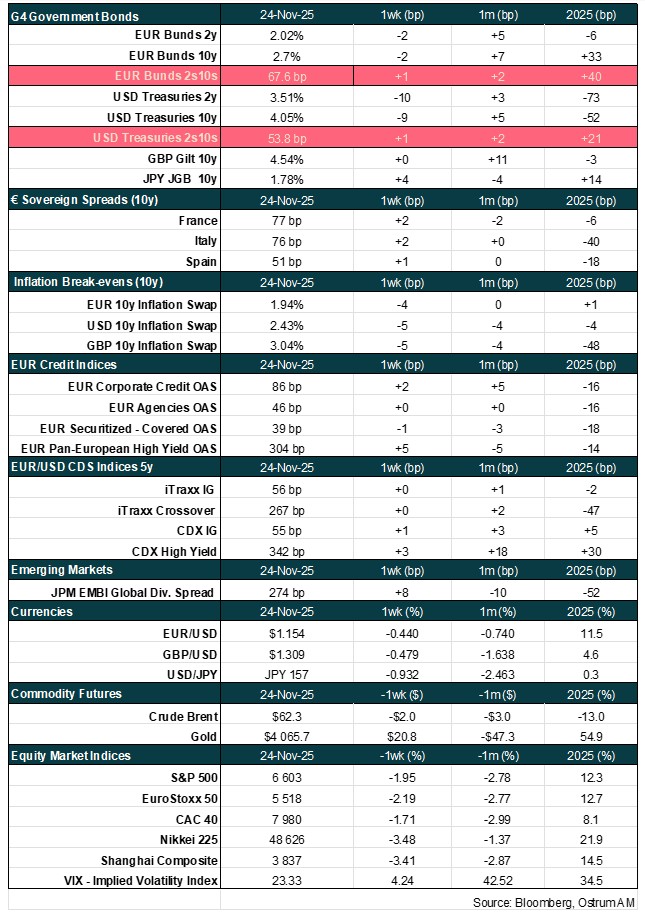

Main market indicators