Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to podcast (in French only)

(Listen to) Axel Botte’s podcast:

- Review of the week – Financial markets: the return of U.S. stats after the end of the shutdown;

- Theme – House of cards: the stylized facts of speculative bubbles and the AI case.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: House of cards: the stylized facts of speculative bubbles and the AI case

- While it may be rational to participate in a bubble, it is even more important for investors to recognize the characteristic excess signals of speculative bubbles;

- The stylized facts of a bubble are as follows: rapid price appreciation, fear of missing out (FOMO) fueled by a particular narrative, and increasingly unrealistic growth projections. These signals should alert investors;

- The sentiment cycle overlaps with these stylized facts, from the formation of the bubble to its expansion towards peaks that are incompatible with the intrinsic value of the assets, ultimately leading to a final phase of panic selling;

- The performance of stocks in the AI sector exhibits common characteristics with these stylized facts. Price appreciation is based on increasingly optimistic projections and a narrative aimed at invalidating historical valuation references;

- This does not mean that AI will not transform the economy by enabling faster productivity gains. The Internet did indeed facilitate such a transformation, but the bursting of the TMT bubble led to a recession.

Recognizing bubble patterns

Rapid growth, excess optimism and narratives of new paradigms are stylized facts of bubbles

In this section, we review the common characteristics of past market bubbles. There are several recognizable patterns. However, financial market bubbles often become apparent only in retrospect, making them challenging to identify in real-time.

- Rapid Price Appreciation: A defining feature of financial bubbles is the swift escalation of asset prices disconnected from underlying economic fundamentals. In the current environment, we have witnessed non-profitable technology companies achieving significant price increases, raising concerns about the sustainability of such valuations.

- Excessive Optimism and FOMO: Investors often exhibit excessive optimism, driven by a fear of missing out (FOMO). This sentiment can lead to irrational investment behavior, where capital flows disproportionately towards specific sectors or "darlings" of the market, irrespective of traditional valuation metrics. The equity market then resembles a Keynes’ “beauty contest”.

- Unrealistic Growth Projections: During bubble periods, overly optimistic projections for growth become commonplace, providing justification for elevated stock prices. Investors may disregard historical valuation standards in favor of narratives surrounding technological advancement and disruption.

- "This Time is Different" Mentality: The prevailing narrative often suggests that a fundamental shift in the economic paradigm renders previous valuation metrics obsolete. This widespread denial of established financial yardsticks serves as a warning sign of a bubble environment.

- Circular Financing and Speculative Behavior: The interplay of speculative behavior and circular financing arrangements can further amplify the risks of a bubble. As investors seek to capitalize on rising asset prices, they may overlook the underlying financial health of the companies involved.

The Bubble Lifecycle Model

The sentiment cycle – from cautious early optimism to euphoria-driven highs and the unhappy ending of panic selling - is the hardest thing to identify and time for equity investors. Understanding the lifecycle of a bubble is critical for investors attempting to navigate the complexities of financial markets:

- Formation Phase: The initial price increases draw attention to genuine technological advances, encouraging early adopters and savvy investors to join the fray.

- Expansion Phase: As sentiment drives further price gains, investor euphoria can lead to a disregard for traditional valuation metrics. This phase is particularly dangerous, fueled by financial leverage that amplifies speculative buying.

- Peak and Contraction Phase: The eventual downturn often occurs when overly optimistic expectations confront reality, leading to initial selling pressure. As confidence wanes, particularly among leveraged investors, stock prices can collapse dramatically.

- Panic Selling: A feedback loop ensues as the erosion of confidence among “weak hands”— investors who entered the market late and are over-leveraged—exacerbates selling pressure, resulting in a rapid decline in asset prices.

The AI-Productivity Gap

AI adoption and the struggle to get a productivity bump

AI may well be the productivity game-changer for years to come. The diffusion of the internet from 1995 onwards raised U.S. output per hour by about 1 pp per annum for a decade. Yet, according to an MIT study released in August 2025, despite the rapid adoption of AI, only 5% of firms have managed to achieve measurable productivity gains, revealing a gap between technology adoption and concrete business benefits.

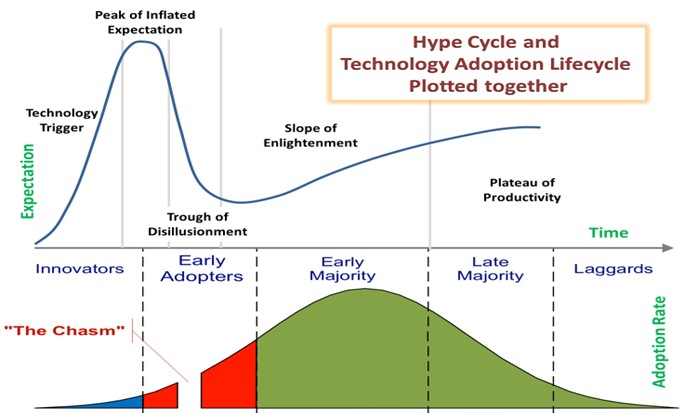

Productivity gains remain elusive as AI struggles with real-world tasks and verification needs. This gap between hype and performance is thus forcing companies to rethink strategy. The MIT study fed a wave of skepticism that AI will produce results at scale. The underwhelming launch of OpenAI’s GPT-5 has provided fodder to the view that AI’s progress is slowing. Gartner has suggested that generative AI is entering its “trough of disillusionment” era—the third step in the firm’s five phase hype framework technological cycle for adoption (source: wordpress.com).

Gartner’s survey of 163 business executives found that half have abandoned plans to dramatically cut customer service staff by 2027. Companies are learning AI cannot simply replace people overnight, but this does not mean that AI technology adoption will not have a meaningful impact on employment going forward. The October 2025 Challenger survey showed the sharpest rise in layoff announcements in over 20 years.

U.S. markets: a bubble checklist

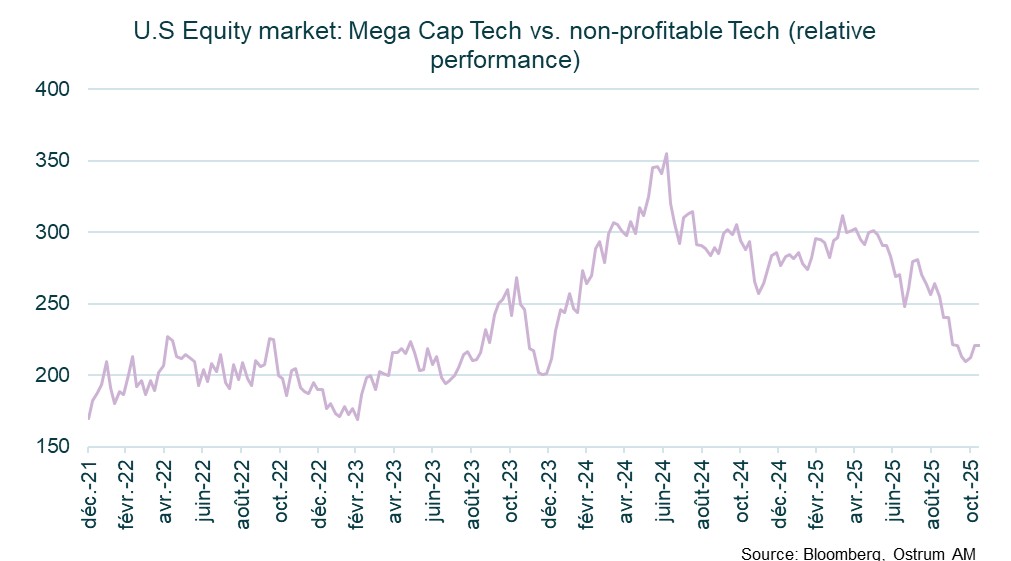

Some outsized price gains in non-profitable tech have started to reverse

Monitoring excess price performance.

As noted above, rapid price appreciation is a sign of financial bubble formation. There is a wealth of examples, in the U.S. stock market, of non-profitable technology companies beating the Magnificent 7 leaders handsomely. Outperforming stocks can be found in sectors such as artificial intelligence, quantum computing or new energy technologies. Lately, quantum computing names have taken a nosedive as market participants lock in outsized profits or begin questioning the sustainability of recent sharp price rises. Many of these firms have market capitalizations north of $10 billion whilst making heavy operating losses.

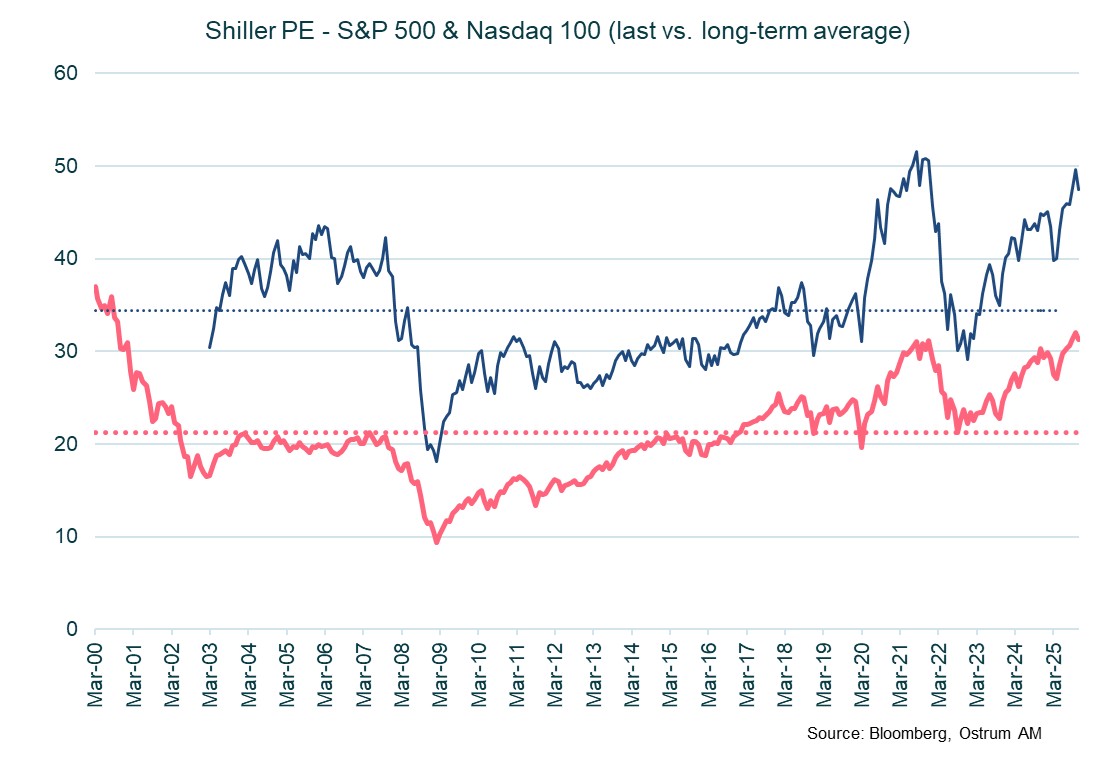

U.S. equity valuations are rich.

Most valuation yardsticks point to richness across US stock markets

On our calculations, the cyclically adjusted price-to-earnings (CAPE) ratio for the U.S. S&P 500, currently above 31x, shows a high reading looking back 20 years. Professor Robert Shiller goes as far as saying that equity valuations are on par with the late 1990s’ dot-com bubble. Sectors such as technology, communication services, and utilities show CAPE percentiles above 90%, indicating excessive valuations. A significant factor in today’s market is the exceptional performance of AI-related stocks, which have contributed to 75% of the S&P 500’s returns and 80% of earnings growth since November 2022.

Optimism, circularity and the risk of investment overhang

The current race for AI dominance is creating a competitive environment where companies face a "prisoner's dilemma": they must either invest heavily to stay competitive or run the risk of becoming obsolete. There are significant risks of overcapacity in AI infrastructure due to massive investments in data centers, expected to reach trillions by 2030. For instance, on Census data, construction spending on data centers has indeed quadrupled since 2021.

The dotcom crisis provides insight about the current situation. Unlike other bubbles based purely on speculation, the dot-com era began with a technological revolution—the internet – that had the potential to transform business models and disrupt entire industries. The "new economy" would benefit first-movers given network effects and early market dominance. Investors had therefore a high tolerance for mergers and acquisitions to the detriment of profitability. In other words, exponential growth potential meant that traditional valuation metrics were disregarded. As the narrative gained traction, the NASDAQ Composite rose approximately 400% over 5 years, much of it concentrated in technology stocks. Traditional blue-chip companies scrambled to demonstrate "internet strategies" to avoid being left behind. Today, concentration is obvious, and many firms similarly advertise their use of AI models to transform their business models.

The current situation is characterized by a high level of interdependence between new AI players and hyperscalers. Outsized investment commitments in the trillions have made headlines. Hyperscalers are funding the startup investment spending bonanza and effectively subsidizing their own “sales” (for instance the OpenAI deals with Nvidia, AMD). OpenAI is obviously a private company where considerable investment commitments have been made possible by sky-high valuations of $500 billion despite close to non-existent revenues. The circularity of the AI investment and financing may turn out to be a house of cards. During Japan’s lost decades after the equity bubble burst in 1990, cross-shareholding appear to have played a role, making the economic and financial downturn worse and longer-lasting.

Furthermore, the marginal return on AI investment is an open question at this juncture, notably due to depreciation charges to be assigned to capital in a fast-changing technological environment. Indeed, if corporations overstate the lifespan of their AI hardware investments, lower depreciation charges will raise earnings. This could be a way to keep the stock market hype running for a while. Starting from around 2020, hyperscalers began extending the depreciable life of servers to about six years from as little as three years, ironing out the hit to earnings. Meta Platforms Inc.’s January decision to adopt a 5.5 year useful life for most of its servers and network assets, up from four-to five years previously, boosted its net income by close to $2 billion in the nine months to September (Bloomberg).

In the dotcom era, goodwill amortization practices only kept valuation afloat for so long… It is hard to tell whether hyperscalers will continue to use accounting gimmicks but, the net capex figures expressed as a percentage of GDP or corporate revenues will surely be an interesting gauge of investment overhang. A key question is whether the effective economic depreciation of capital is aligned with accounting practices.

If hyperscalers do face a depreciation tsunami, cost control measures may result in renewed plans to cut staff. It is quite telling that Amazon, Microsoft and other big names have already announced restructuring despite record profits.

The financing of the AI boom

A quarter century ago, the IPO market went frenzied as investment banks relaxed standards for revenue history or profitability before taking internet startups public.

In today’s market, a large part of funding comes from private credit and equity markets, loan funds and venture capital investment vehicles. Loan covenants have been relaxed to facilitate the financing of data centers for instance. The opaqueness of private credit/equity markets will make it harder to assess the potential fallout of bubble-induced imbalances. It’s worrying that private credit funds are increasingly using GPUs as collateral to finance loans. This includes lending to more speculative startups known as neoclouds, who offer GPUs for rent. Microsoft alone has signed more than $60 billion of neocloud deals (source: Bloomberg). Blackstone and other funds are among those providing such financing. Nvidia, meanwhile, is reportedly looking at using special-purpose vehicles to raise debt to buy and rent chips to customers. Issuing billions of debt to fast-depreciating GPUs, could lead to serious trouble.

Conclusion

The stellar market performance of the AI complex may be a sign of a financial bubble in the U.S. equity market, reminiscent of the dotcom bubble. Market euphoria, hype and great narratives have underpinned sky-high valuations of hyperscalers and many smaller players and startups, even as the AI productivity bump remains elusive. Circular financing, optimistic accounting practices and the use of GPU collateral for private credit represent other causes for concern.

Axel Botte

Chart of the week

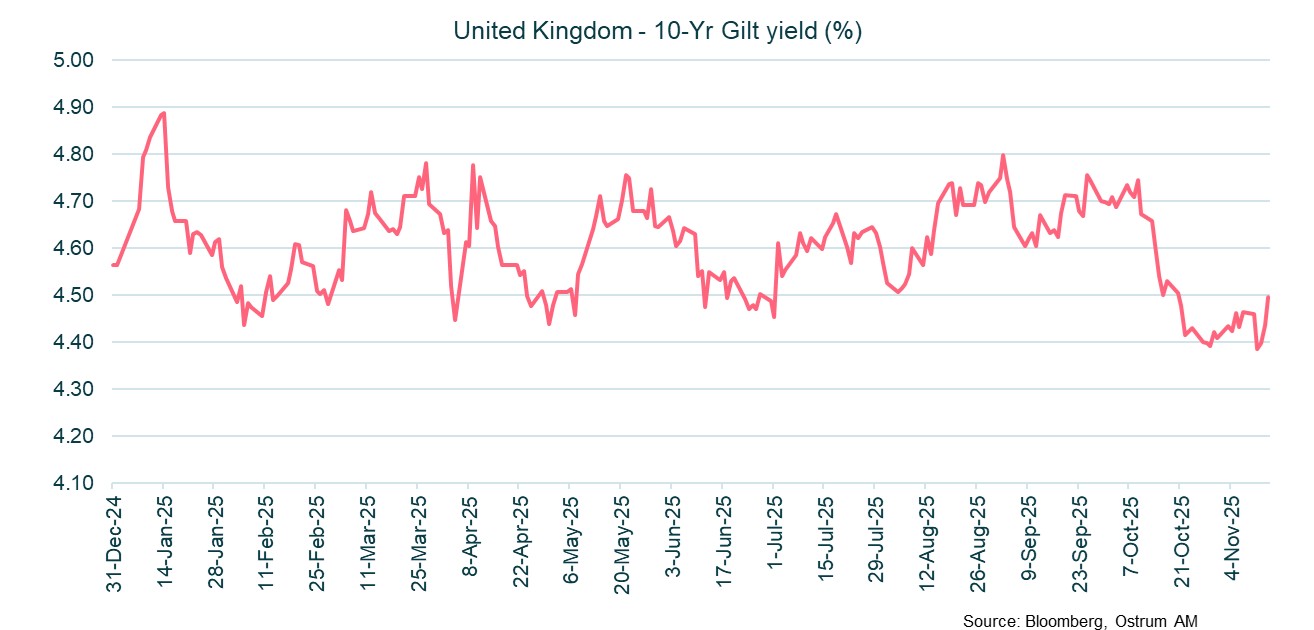

The U.K. budget for 2026 will be announced at the end of November. Like many other countries, the U.K. needs to restore its fiscal credibility. Bond markets are on high alert, reacting to rumors of a potential easing of fiscal policies.

Headlines announcing the absence of an increase in "tax rates" have captured the attention of investors, reviving tensions on long-term bond yields that had been declining over the past month. The 10-year Gilt yield has now surpassed the 4.40% mark once again.

The fiscal gap is estimated to be around £20 billion. The government needs to increase its revenues and has not ruled out imposing higher taxes on high-income earners. A reduction in the thresholds for tax brackets could serve as an alternative to raising tax rates.

Figure of the week

43

The U.S. federal shutdown, that ended November 13th, lasted a record 43 days.

Market review:

- United States: The longest shutdown in history concludes after 43 days;

- Equities: Valuations of the tech sector are under scrutiny amid rising long-term interest rates;

- Fed: The possibility of a status quo remains on the table for December;

- Sovereign and credit spreads remain stable.

In search of Direction

With the government shutdown behind us, fresh concerns are emerging, notably regarding tech valuations and the budgetary challenges facing the United Kingdom.

The conclusion of the shutdown in the United States, coupled with uncertain budgetary orientations in the UK, reignited upward risks for long-term interest rates by the end of the week. Simultaneously, scrutiny over the valuations of AI-related stocks intensified, leading to a decline in American indices over the week. In contrast, European markets demonstrated resilience despite the euro strengthening to $1.16. Sovereign and credit spreads remained stable or experienced slight declines.

The lack of economic data in the United States continues to pose a significant challenge in assessing the deterioration of the labor market. Weekly figures from ADP indicate a loss of 44,000 jobs between September 26 and October 24. Public employment contracted due to early retirements implemented by the Department of General Services (DGS) earlier this year. Regarding the unemployment rate, the household survey could not be conducted last month, as confirmed by the White House. Nonetheless, the Chicago Fed estimates that unemployment rose to 4.5% in October. Inflation data (CPI, PPI) has also been delayed, raising concerns about the indexing of certain household transfers and the calculation of TIPS coupons. The Republican Party's electoral setbacks may have influenced Trump’s decision to ease tariffs on food imports from Central America, even before the Supreme Court ruled on the legality of these tariffs, originally ordered by Trump last spring. In Europe, the news cycle was dominated by disappointing employment and growth figures from the UK. The budgetary situation necessitates corrective measures, which should include raising taxes on higher incomes.

On the financial markets, stock valuations in the tech sector remain contentious in the United States. The Nasdaq retreated ahead of Nvidia's earnings report next week, while small-cap stocks underperformed. Asian markets experienced volatility, with profit-taking observed on the Kospi towards the end of the week. In contrast, Europe posted a solid gain of 2%. On the bond markets, long-term rates resumed an upward trajectory, with the T-note hovering around 4.15% and the Bund surpassing 2.70%. Several members of the Federal Reserve (Daly, Kashkari) appear to favor maintaining the current interest rates in December, contradicting the projections made in September (with the median Fed funds rate at 3.75% by the end of 2025). These statements often come from non-voting members of the FOMC, yet the market is attentive, exerting upward pressure across the yield curve. The Bund is following the lead of the benchmark market, awaiting communication from the FinanzAgentur regarding the 2026 issuance plan. The deficit is expected to increase significantly, which should stimulate growth while creating a relatively high interest rate environment. Sovereign spreads responded favorably to the suspension of pension reform in France, with the OAT narrowing to 73 basis points at the week's low. Generally, interest rate volatility has had little impact on sovereign spreads within the Eurozone. Rachel Reeves's hesitance to raise taxes in the UK reignited tensions surrounding Gilts and Western rates at the beginning of trading on Friday. The initial overreaction later subsided, but the budgetary issue remains central to the trajectory of interest rates in 2026. In the credit market, spreads stabilized around 70 basis points in the investment-grade sector, while high-yield spreads tightened by 2 basis points.

Axel Botte

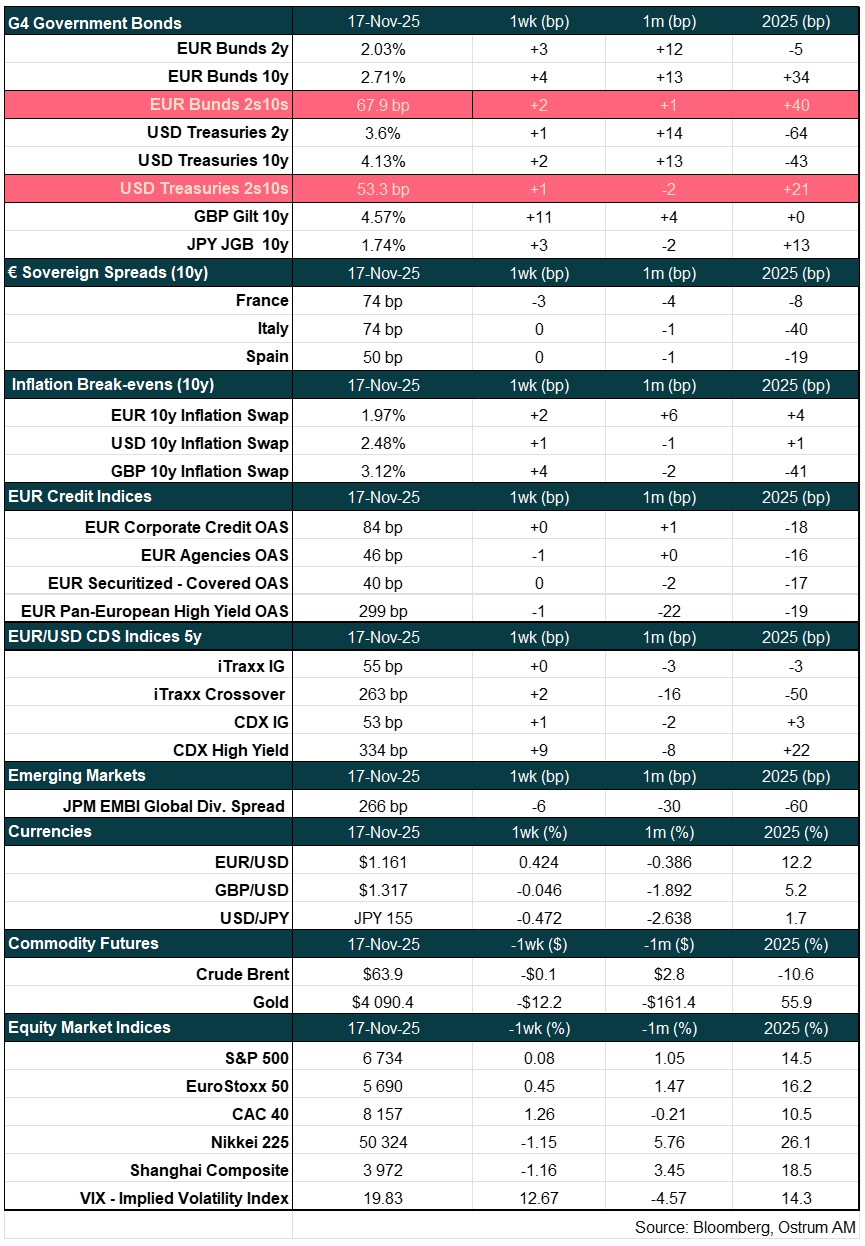

Main market indicators