Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Zouhoure Bousbih’s podcast:

- Review of the week – Financial markets impacted by short Thanksgiving week, are short covering rallies deceptive?;

- Theme – End of Fed's QT: A Quiet Green Light for Emerging Markets.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: End of Fed's QT: A Quiet Green Light for Emerging Markets

- This December 1st marks a turning point in American monetary policy. The Fed will stop reducing its balance sheet and therefore cease the withdrawal of liquidity.

- Since the 2008 financial crisis, the unconventional monetary policy of the U.S. Federal Reserve has significantly influenced global liquidity and capital flows to emerging markets.

- Quantitative easing (QE) programs have increased the global liquidity supply and capital flows, particularly portfolio flows—namely, purchases of debt or equity securities by non-residents—toward emerging markets (EM). Conversely, a tightening, as seen in 2013 during the "Taper Tantrum" episode, reduces global liquidity and triggers massive capital outflows from emerging markets, threatening their financial stability.

- The end of the Fed's quantitative tightening therefore creates a favorable environment for global liquidity conditions and is expected to reduce volatility in the long end of the U.S. yield curve.

- This financial backdrop is positive for EM external sovereign debt, whose flows have been modest compared to EM local sovereign debt. EM High Yield is likely to attract the most flows and offer a spread pick up over US high yield.

Impacts of U.S. Unconventional Monetary Policy on Global Liquidity Conditions

The end of the Fed's quantitative tightening creates a favorable environment for global liquidity conditions.

Since 2008, the Federal Reserve's balance sheet has evolved in response to various shocks to the U.S. economy and the implementation of unconventional policies such as quantitative easing (QE) and quantitative tightening (QT). The introduction of these policies during the 2008 financial crisis marked a new era for global liquidity.

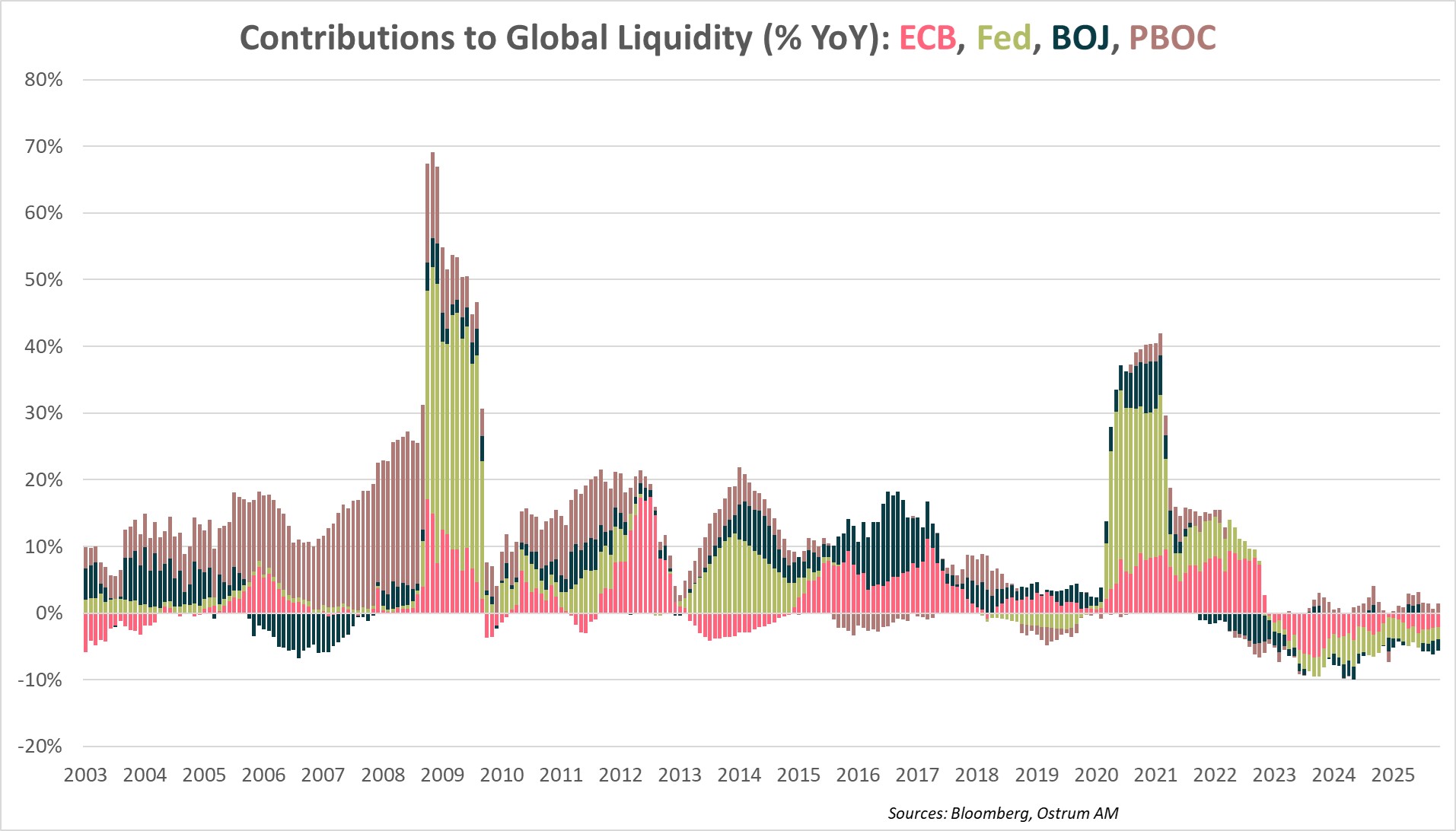

The accompanying chart illustrates the contribution of major central banks to global liquidity, measured by the sum of the balance sheets of the Fed, the ECB, the BOJ, and the PBOC.

The Fed's contribution is significant, accounting for nearly 30% of global liquidity. This liquidity began contracting in 2023 following the Fed's implementation of QT in June 2022 to address the inflation shock. This also led to a stronger dollar, further tightening global liquidity. The end of QT could therefore slow the pace of global liquidity contraction.

Spillover Effects of U.S. Unconventional Monetary Policy on Portfolio Flows to Emerging Markets (EM)

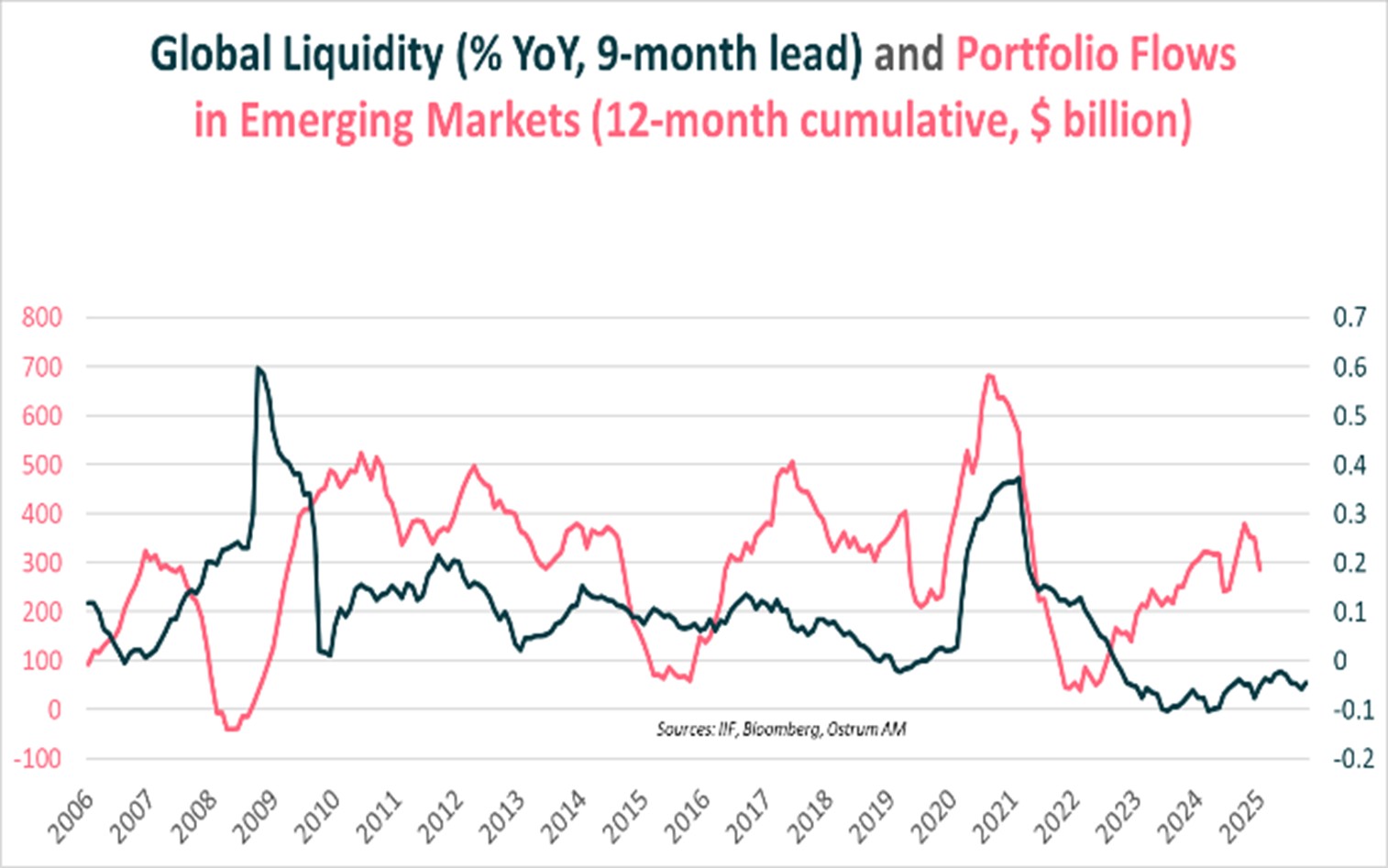

Capital flows to emerging markets are influenced by both international and domestic factors. However, since the 2008 financial crisis, the unconventional monetary policy of the U.S. has had contagion effects on capital flows to emerging markets, particularly portfolio flows, which include non-resident investors purchasing debt or equity securities.

The chart shows that the years 2009-2011, following the 2008 crisis, were marked by a massive influx of capital into emerging markets. The represented portfolio flows originate from the Institute of International Finance (IIF), covering 25 emerging countries.

The unconventional monetary policy of the United States has caused a structural shift in portfolio flows to emerging markets.

The abundance of liquidity drove investors to seek higher yields, and shifts in risk appetite became a source of volatility.

Historically, such a reversal signals incoming flows into emerging markets.

The contagion effects of U.S. unconventional monetary policy are also asymmetric when QE is reduced, as evidenced by the "Taper Tantrum" in 2013.

When the Fed hinted at slowing its pace of asset purchases, financial markets panicked, leading to a sharp depreciation of emerging market currencies, reflecting capital outflows. This episode coincided with a very low level of global liquidity.

This unconventional monetary policy, intended as an exceptional measure, was reactivated 14 years later during the COVID-19 pandemic. The resulting financial shock in advanced economies led to massive capital outflows from emerging markets, with unprecedented speed and magnitude. The reactivation of QE by major central banks and emerging central banks contributed to the return of flows to emerging markets by 2021.

Thus, quantitative easing (QE) programs increase the global supply of liquidity and portfolio flows to emerging markets. Conversely, tightening measures, such as in 2013 during the 'Taper Tantrum' episode, reduce global liquidity and trigger massive capital outflows from emerging markets, threatening their financial stability. The end of the U.S. Federal Reserve's quantitative tightening should therefore support flows to emerging markets in 2026.

EM Sovereign debt is expected to be the main beneficiary of the end of QT

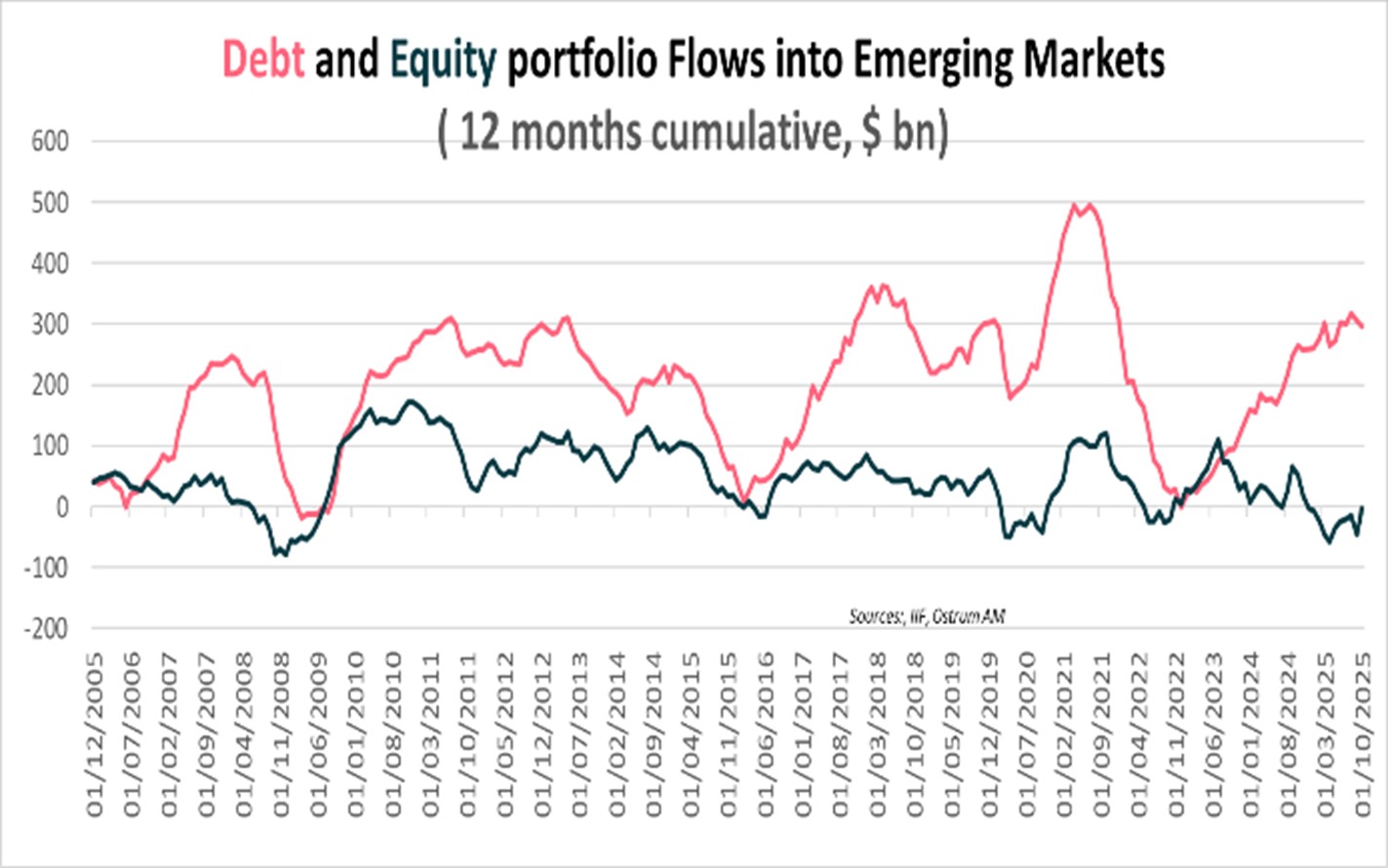

EM local debt attracted international investors in 2025, benefiting from the weak dollar.

There has been a rebound in portfolio flows to emerging markets from the lows of 2022, primarily targeting local sovereign debt, as shown in the chart below.

EM Local debt has fully benefited from the weakness of the dollar, which has supported the appreciation of emerging market currencies. International investors have also been drawn to the improved visibility of fiscal prospects compared to those of so-called advanced countries.

In contrast, flows toward EM external sovereign debt have remained subdued due to volatility in U.S. interest rates, influenced by the lack of prospects for Fed rate cuts.

In 2026, EM external sovereign debt is expected to attract more flows than EM local debt.

We anticipate four 25 basis point rate cuts from the Fed, including one in December. This will strongly support the asset class, whose duration of over 6 for the JPM EMBIGD index is the highest within the global bond universe.

The end of quantitative tightening (QT) should primarily benefit external debt. Thus, the end of QT is likely to reduce volatility in the U.S. sovereign bond yield curve. Regarding potential tensions related to the U.S. Treasury's financing needs, the Federal Reserve decreases the amount of debt the Treasury needs to issue by keeping $4 trillion in Treasury securities on its balance sheet. This also helps reduce volatility on long-term interest rate.

In 2026, EM external sovereign particularly EM High Yield, is expected to attract more flows than EM local debt.

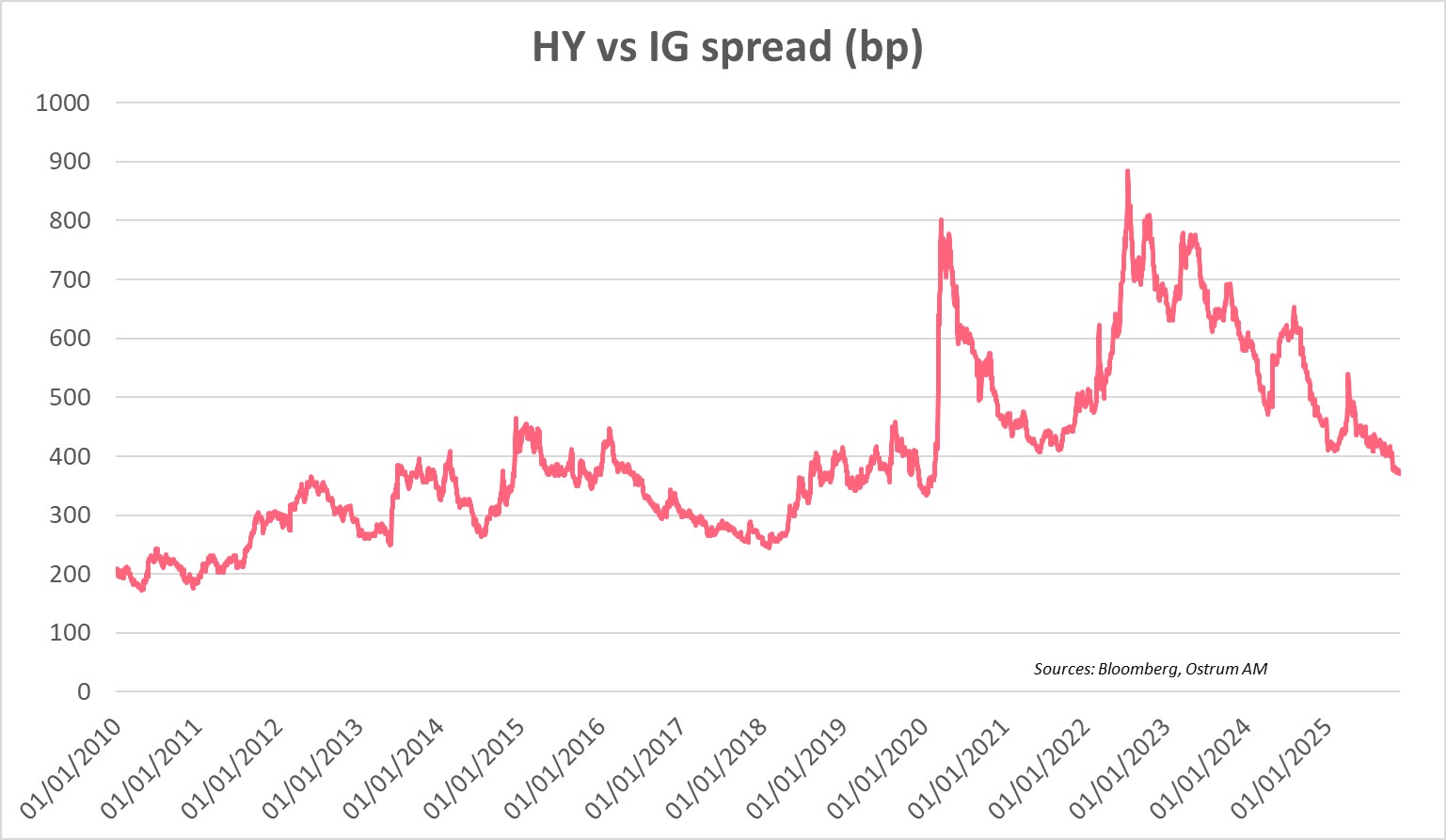

We favor the "High Yield" (HY) segment of EM external debt. The spread between the EM "Investment Grade" (IG) and EM HY could narrow. The superior yield of 8.7% offered by HY EM external sovereign debt compared for U.S. HY could also attract international investors.

Conclusion

The end of the Fed's quantitative tightening is a strong signal of easing financial conditions and a discreet green light for risky assets. Historically, such a reversal in U.S. unconventional monetary policy heralds incoming flows to emerging markets. External sovereign debt is expected to benefit the most compared to local debt, particularly the "High Yield" segment, which offers higher returns than U.S. HY credit. The busy electoral calendar in 2026 for emerging countries, U.S. interest rates, and the dollar remain the main risks for this asset class. Therefore, the end of the Fed's QT allows emerging markets to approach 2026 with greater confidence.

Zouhoure Bousbih

Chart of the week

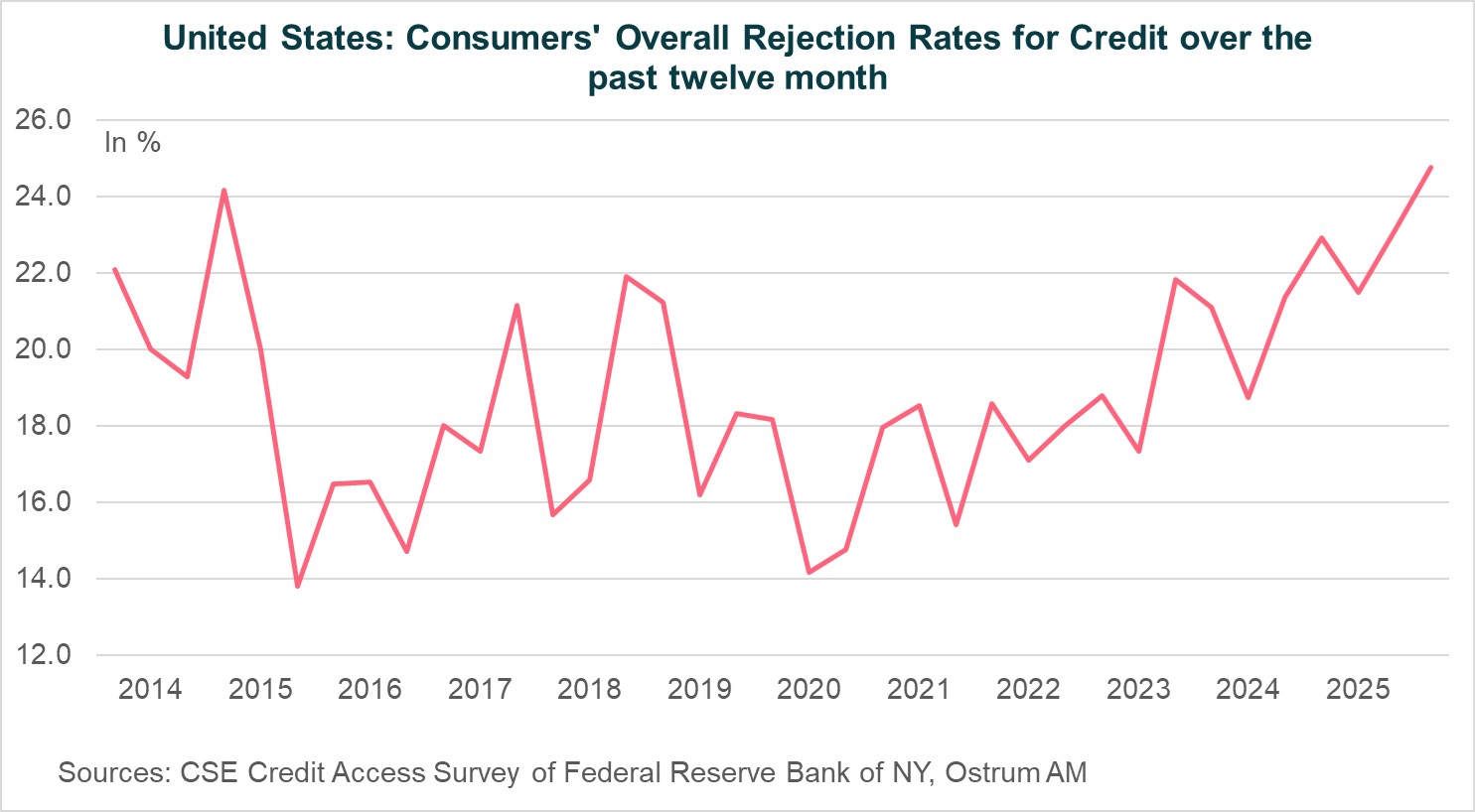

New York Fed Reports Significant Rise in Rejection Rates for U.S. Consumer Credit Applications.

The overall rejection rate has climbed to 24.8%, marking the highest level since the data series began in 2014. The housing sector is the most impacted, with the refinancing rejection rate increasing to 45.7%, setting a new historical record, while the rejection rate for new mortgage applications reached 23%, the highest since 2015.

Amid economic uncertainty, American banks are tightening their credit standards. This situation supports the case for Fed rate cuts to prevent a hard landing for the U.S. economy.

Figure of the week

26

£26 Billion! That's the amount of tax increases announced by R. Reeves for the UK's 2026 budget.

Market review:

- A peace agreement is taking shape in Ukraine;

- United Kingdom: The budget and the DMO's issuance strategy reassure investors;

- Bonds: Long-term rates hover around 4% in the United States;

- Equities: Stock markets rebound after a challenging week.

Hope for an end to the war in Ukraine Fuels Stock Rebound

After a challenging week, markets have rebounded on the prospects of a ceasefire in Ukraine. However, trading volumes remain subdued during this Thanksgiving week in the United States.

The U.S. peace plan resembles a form of capitulation for Ukraine, a scenario that Europe, caught in the crossfire of Trump-Putin relations, had dreaded. The markets’ short-sightedness has turned this development into a catalyst for a rebound in stock prices and a fresh easing in oil prices. Yields have stabilized at around 4% on the 10-year Treasury note. In Europe, the Gilt has reacted positively to the fiscal consolidation promised by Rachel Reeves. Conversely, high Australian inflation and the RBNZ rate cut, limited to 25 bps, have led to a rise in yields and a rebound of the AUD and the NZD. Following a brief episode of risk aversion, markets thus seem to be regaining momentum.

From a cyclical perspective, U.S. data reflect ongoing challenges in the labor market. Job losses are reemerging in the private sector, according to ADP figures, which report a decline of 52,000 jobs over four weeks, consistent with layoffs reported in the October Challenger survey. Meanwhile, retail sales indicate a downturn at the end of Q3, with spending decreasing by 0.1% in September when excluding volatile items. Consumer confidence does not suggest any respite in the coming months. The detrimental effects of the shutdown and rising unemployment are likely to herald a period of low growth this winter. However, housing prices are showing a slight uptick for the second consecutive month after five months of declines. This fragile growth environment calls for another move from the Fed in December, potentially a 25 bp cut, as quantitative tightening approaches its conclusion. In the Eurozone, survey data point toward a gradual recovery in growth. The German economy, which stagnated in Q3, is expected to regain momentum in 2026, particularly due to public orders. Inflation remains close to the ECB's target, with prices decelerating to below 1% in France but remaining firmer in Spain at 3%. Absent a significant economic or financial shock, monetary policy in the Eurozone is expected to remain unchanged until the end of 2026. In Australia, inflation appears to be more persistent, suggesting that the end of monetary easing is on the horizon. The RBNZ, which has been very active until now, has only cut its rate by 25 bps. A shift in the monetary cycle may originate from Asia. Despite the Chinese economic environment marked by falling investment, the Chinese yuan has strengthened by 0.4%, following the trends of oceanic currencies.

In financial markets, the 10-year German and U.S. Treasuries are oscillating around pivotal points of 2.70% and 4%, respectively. Yield curves are flattening, while swap spreads beyond ten years are widening moderately. The U.K. budget has led to a decline in long Gilt yields, although most of the adjustment will occur after the next general elections in 2029. The significant easing in 30-year yields, down 16 bps, is primarily attributed to the DMO’s issuance strategy, which will alleviate long-dated issuance. Measures on gasoline and electricity prices will help the BoE to continue lowering rates. Sovereign spreads also tightened, with OATs trading on par with BTPs around 73 bps. Credit spreads have stabilized at 71 bps over swaps, whilst the covered bonds hover near 25 bps. Equity markets have erased the previous week's correction linked to technology stocks, with the Nasdaq recovering 2.9% in three sessions. The Nikkei is trading above 50,000 points.

Axel Botte

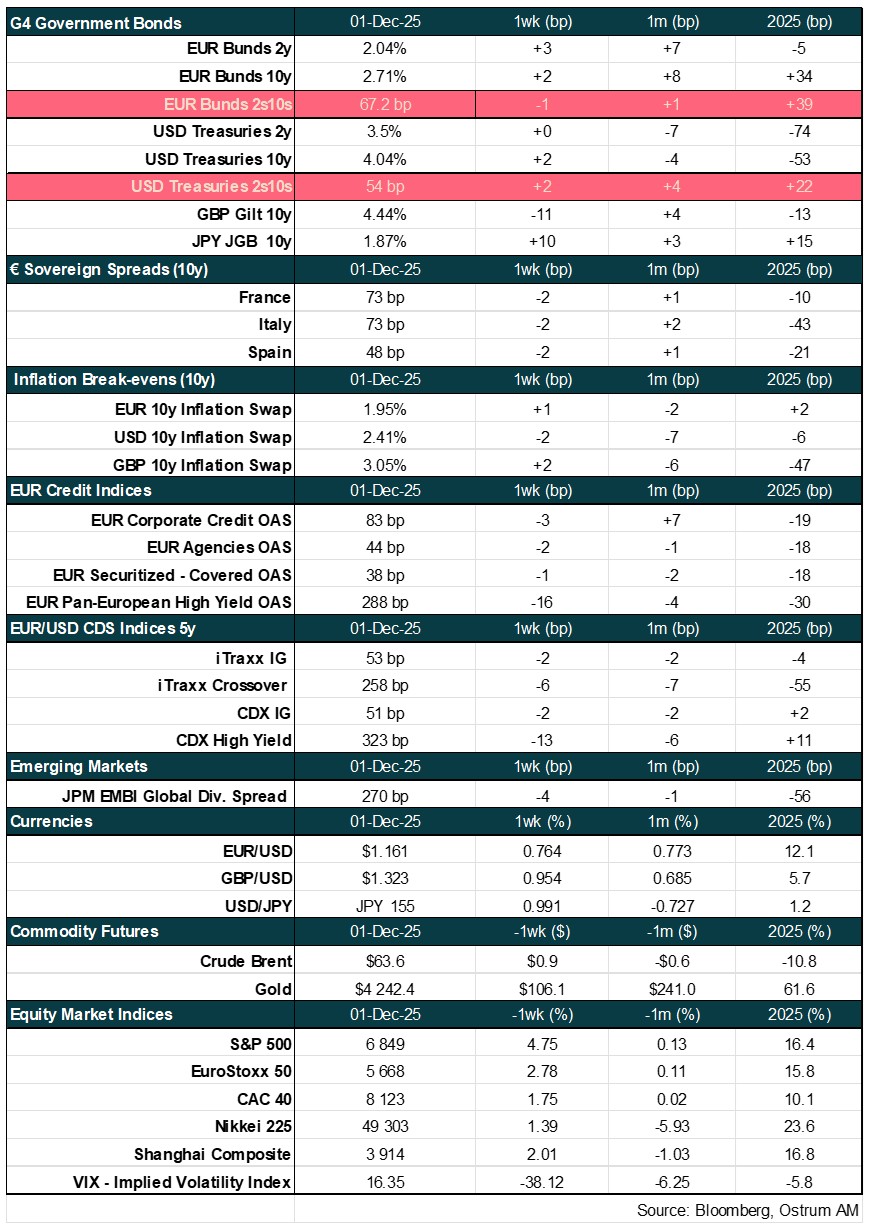

Main market indicators