Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

(Listen to) Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Financial markets, inflation in the Eurozone, the credit market "cockroaches";

- Theme – Major upcoming impact of the Dutch pension system reform.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Major upcoming impact of the Dutch pension system reform

- Faced with demographic aging, changes in the labor market, and interest rates that are much lower than they were 30 years ago, the Netherlands has adopted a reform of its pension system;

- Pension funds will transition from a defined benefit system (where they commit to paying employees a fixed amount periodically when they retire) to a defined contribution system (where the funds received at retirement will depend on the contributions made by the employee and the employer, as well as the returns on investments made);

- The investment strategy of pension funds will change radically as it will be based on the life cycle. This will result in a structural decline in the demand for long-term bonds and interest rate hedging instruments, as well as an increase in demand for risky assets such as equities and real assets;

- Given that the assets under management of Dutch pension funds are the largest in the euro area (€1,885 billion), this reform will have major consequences on the markets, particularly on the long-term bond and European swap markets;

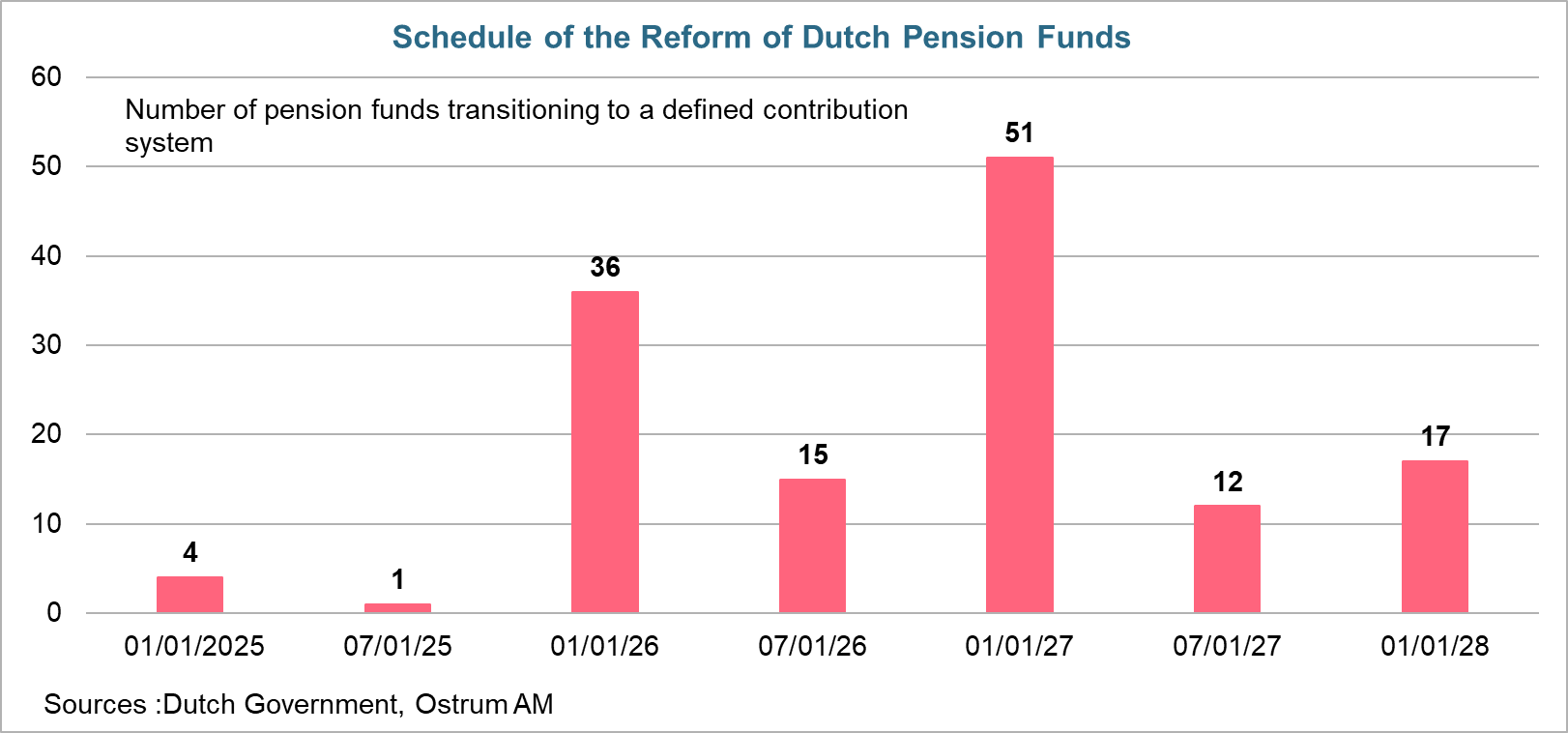

- The reform is taking place gradually and is expected to be completed by January 1, 2028. A significant first wave of pension funds will transition to the new system on January 1, 2026, followed by a second wave on January 1, 2027;

- Volatility is expected to increase at the turn of the year, and the yield and swap curves are likely to steepen further throughout the transition period.

The current Dutch pension system:

The Netherlands has just secured the top spot in the Mercer CFA Institute Global Pension Index 2025, for the third consecutive year, ahead of Iceland and Denmark.

The pension system is based on three pillars:

The first pillar is the basic pension paid by the state under the General Old Age Pensions Act of 1957 (AOW). It stipulates that anyone living or working in the Netherlands must receive a basic state pension starting at age 65. Since then, the retirement age has been raised to 67 for individuals born after 1957. It is adjusted based on life expectancy.

The reform focuses on the second pillar: the scheme administered by pension funds, fully funded, and defined benefit.

The second pillar is the pension that employees must build up through their employers. The reform focuses on this pillar. This scheme, administered by pension funds, is fully funded. Currently, this system is a defined benefit scheme: pension funds promise a certain fixed amount of retirement pay that they will periodically disburse to retirees. Pension funds receive contributions from employees and companies and must make the necessary investments to accumulate sufficient reserves to pay the promised current and future pensions. This mandatory scheme complements the basic state pension (except for self-employed individuals who cannot contribute to pension funds).

The third pillar consists of an individual supplementary pension through voluntary contributions to life insurance products or bank savings plans. It complements the first two pillars.

Vulnerability of the Current System

The system is no longer sustainable due to the aging population, changes in the labor market, and the low interest rates.

The rapid aging of the population and the increase in life expectancy result in a rising number of retirees compared to the number of active workers. This makes it increasingly difficult to finance the basic pensions (first pillar), which relies on a pay-as-you-go system: active workers contribute to fund the pensions of their elders.

Significant changes have also occurred in the labor market, including an increase in self-employed individuals (not covered by the second pillar) and greater mobility. Employees change companies multiple times throughout their professional lives, while the current system assumes that they remain within the same company.

Finally, the significant decline in interest rates that has occurred since the late 1990s, followed by a very slight increase recently, highlights the limitations of a defined benefit system. Pension funds promise fixed payments to employees who contribute, which will be periodically disbursed to them upon retirement. The present value of future payments is calculated using a discount rate that depends on market rates. The decline in rates revalues the liabilities more than the assets. The risk for defined benefit schemes arises especially when the decline in long-term rates is accompanied by a drop in growth and risky assets. Since the current system is no longer deemed sustainable, pension funds will transition to a defined contribution framework.

Reform of the pension system

Transition from a Defined Benefit System to a Defined Contribution System

The pension system will transition from a defined benefit scheme to a defined contribution framework.

After 10 years of debates and negotiations aimed at reforming the pension system, the Dutch Parliament made the decision on December 22, 2022, to transition from a defined benefit system to a defined contribution system. The pensions paid will thus depend on the performance of the investments made and will no longer be fixed. The risk is therefore transferred to the employees rather than remaining with the pension funds. The amounts received upon retirement will depend on the contributions made by the employee and the employer to an individual retirement fund and the returns on the investments made. This reform also increases the transparency of pension allocation and allows for personalization, as each employee can track the progress of their contributions and assets.

A Gradual Reform Marked by Two Significant Waves of Transition

The reform is taking place gradually between January 1, 2025, and January 1, 2028.

The pension reform law came into effect on July 1, 2023. The transition is occurring gradually, following a predefined schedule, from January 1, 2025, to January 1, 2028. Every six months, a number of pension funds will transition from a defined benefit system to a defined contribution system. Many pension funds have postponed their transition dates due to the challenges encountered. Further delays are still possible.

Two significant waves will take place on January 1, 2026, and January 1, 2027.

The Dutch central bank has just announced that to date, only 6 small pension funds have transitioned to the new system. This will be very different on January 1, 2026, as 36 pension funds will make the transition, covering nearly 11 million people out of the 18.5 million involved. A second wave will take place on January 1, 2027, with 51 pension funds. Most have decided to shift all of their existing assets from one regime to the other, and not just the future retirement savings, which makes this transition particularly drastic. In the UK and the US, the shift to a defined contribution system only affected new contributions.

Impact on Financial Markets

Dutch Pension Funds Are the Largest in the Euro Area

With €1,885 billion in assets under management, Dutch pension funds dominate the European market.

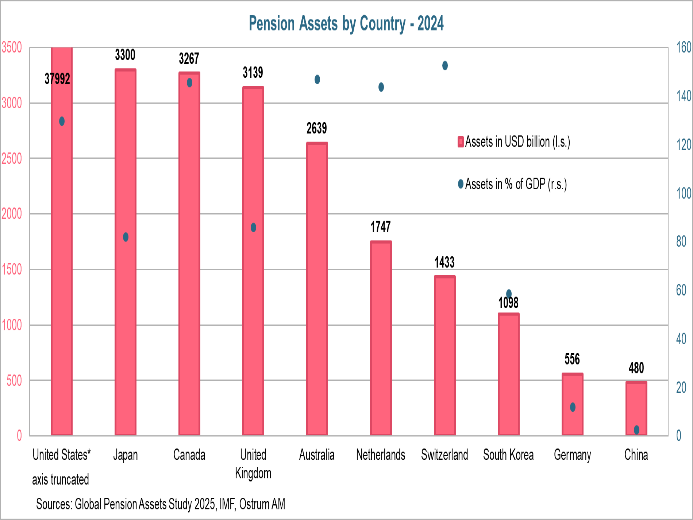

This reform will have significant consequences for financial markets given the considerable weight of Dutch pension funds. With $1,747 billion in assets under management in 2024 (€1,885 billion in Q2 2025), the Dutch pension fund market is the largest in the euro area and the sixth largest globally. The United States is far ahead with $37,992 billion in assets.

Pension funds have a very significant weight in the Dutch economy, as their assets represent 144% of GDP and half of the pension fund assets in the euro area.

On January 1, 2026, the transition will involve €600 billion in assets under management; on January 1, 2027, it will involve €900 billion.

On January 1, 2026, the transition is expected to involve nearly €600 billion in assets under management, and on January 1, 2027, it is expected to cover €900 billion in assets, including those of ABP, the largest Dutch pension fund with nearly €500 billion in assets.

The Investment Strategies of Pension Funds Will Be Significantly Changed

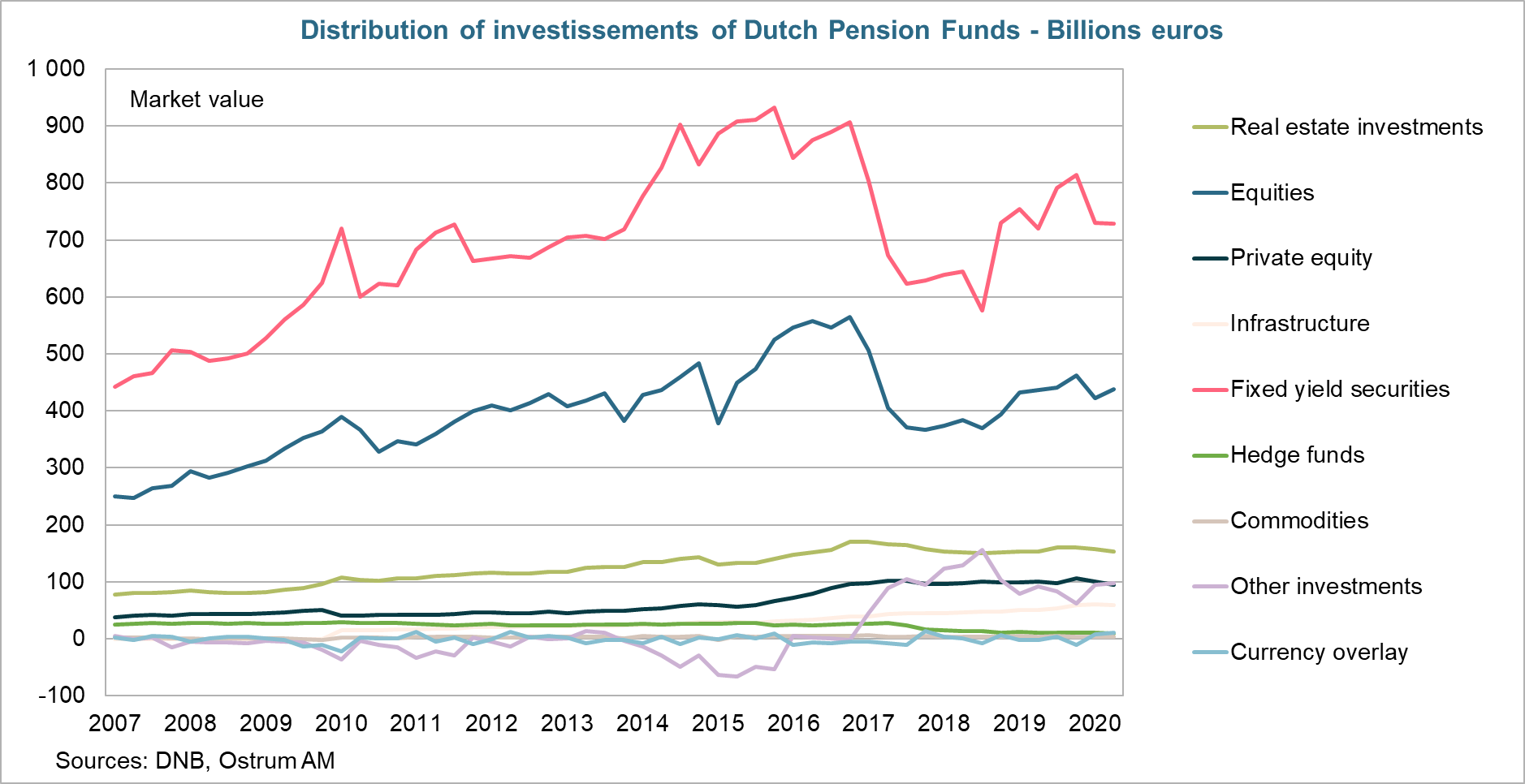

Dutch pension funds are currently predominantly invested in long-term bonds.

The reform will result in a radical change in the investment strategy of pension funds.

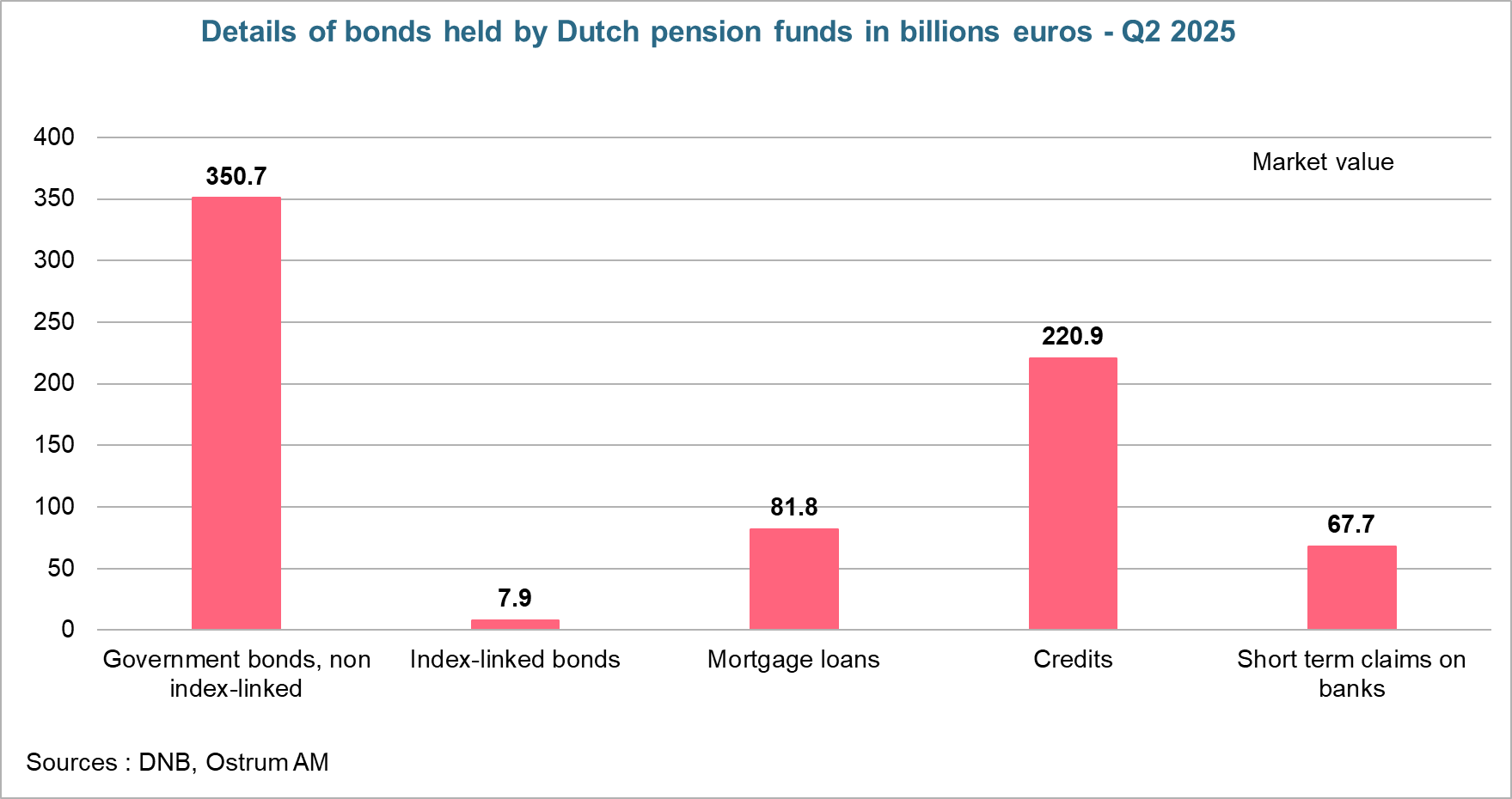

Dutch pension funds are primarily invested in bonds: €729 billion as of the second quarter of 2025, including €351 billion in non-indexed bonds. Equities come in second with €439 billion. They mainly invest in long-term government bonds, 30 years and beyond, as these are a safe asset that allows them to ensure they have the necessary funds in the future to meet their commitments and pay the promised pensions.

Currently, they are heavily invested in long-term bonds and are very active in the swap market to hedge against interest rate risk.

To hedge against interest rate risk, Dutch pension funds are heavily involved in the asset swap markets, particularly for very long maturities.

Transition to Life Cycle Investing

With the reform, the investment strategy of pension funds will adjust the risk profile as the retirement age approaches.

The reform towards a defined contribution system will result in a major change in the investment strategy of pension funds, as they will no longer commit to a fixed amount to be paid in the future. The investment strategy will adjust the risk profile as the retirement age approaches. For younger workers, pension funds will favor riskier investments, such as equities, to enhance investment returns. The distant retirement age allows them time to recover from any potential financial losses. Conversely, for older workers, pension funds will prioritize safer investments, such as bonds that offer stable income, to preserve capital and avoid potential financial losses that they may not have time to recover from.

This is expected to lead to a structural decline in the demand for long-term bonds and hedging instruments against interest rate risk, as well as an increase in the share of risky assets.

The consequence will be an increase in investments in risky assets such as equities and real assets, and a decrease in investments in very long-term bonds, in favor of shorter maturity bonds (10 to 20 years) for those approaching retirement. The need for hedging against interest rate risk will therefore be much less pressing. The need for protection on the very long end of the curve will decrease, while it will be relatively more important on the shorter end for assets closer to retirement.

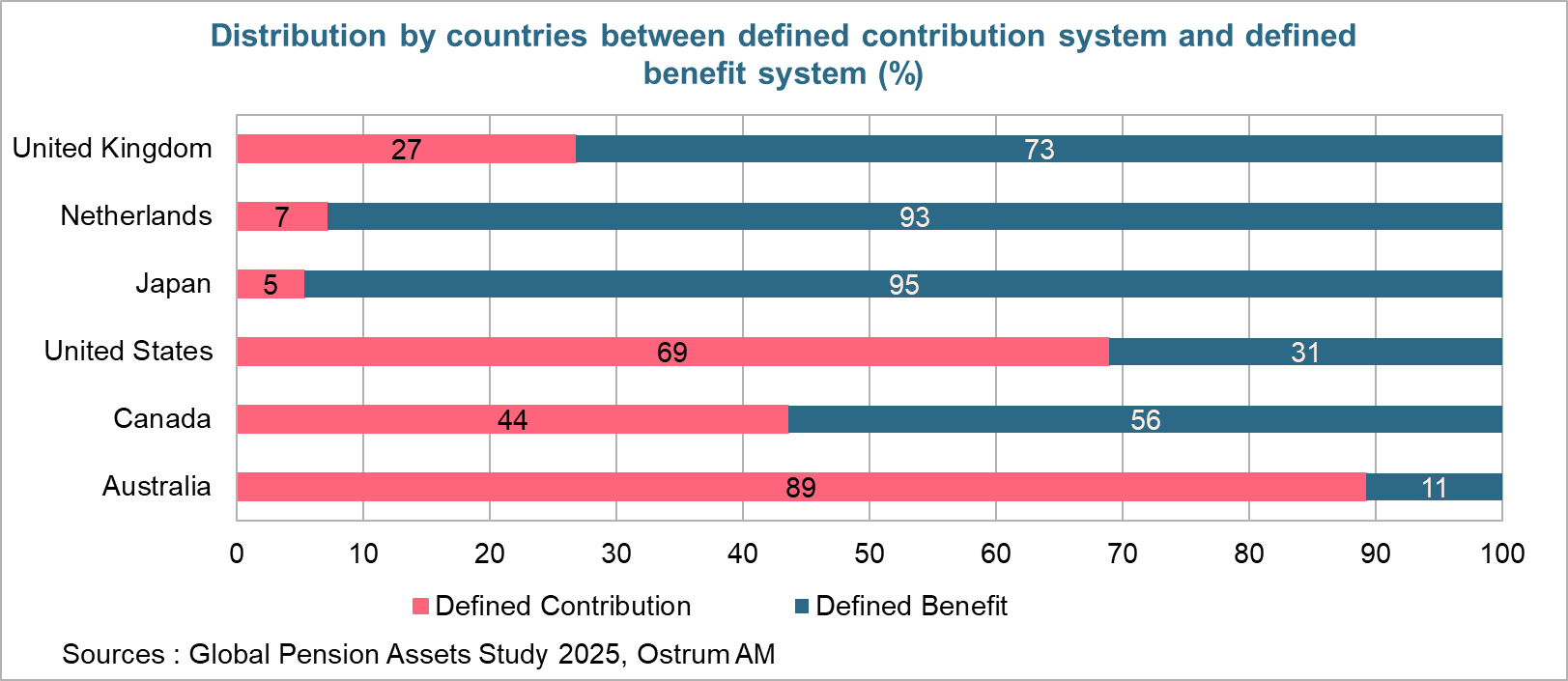

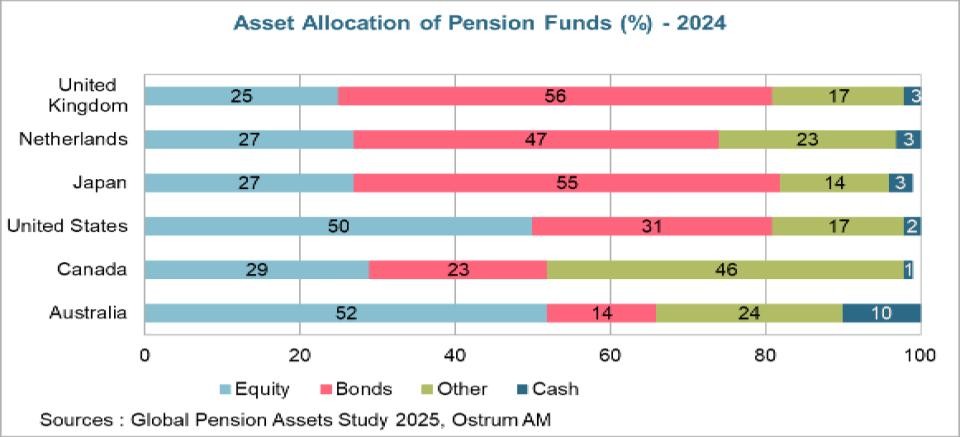

The two following graphs clearly illustrate the difference in asset allocation between the two systems. In a predominantly defined benefit pension system (such as currently in the Netherlands, Japan, or the United Kingdom), the asset allocation of pension funds is more oriented towards bonds. In contrast, in countries where the pension system is predominantly defined contribution (such as Australia and the United States), pension funds favor equity investments.

Consequences: Steepening of Yield and Swap Curves in the Euro Area

The euro yield and swap curves are expected to steepen further.

Dutch pension funds predominantly hold euro area bonds, primarily domestic, German, and French bonds. The structural decline in demand from Dutch pension funds for long-term government bonds will result in an increase in long-term rates relative to short-term rates, leading to a steepening of the yield curve in these countries.

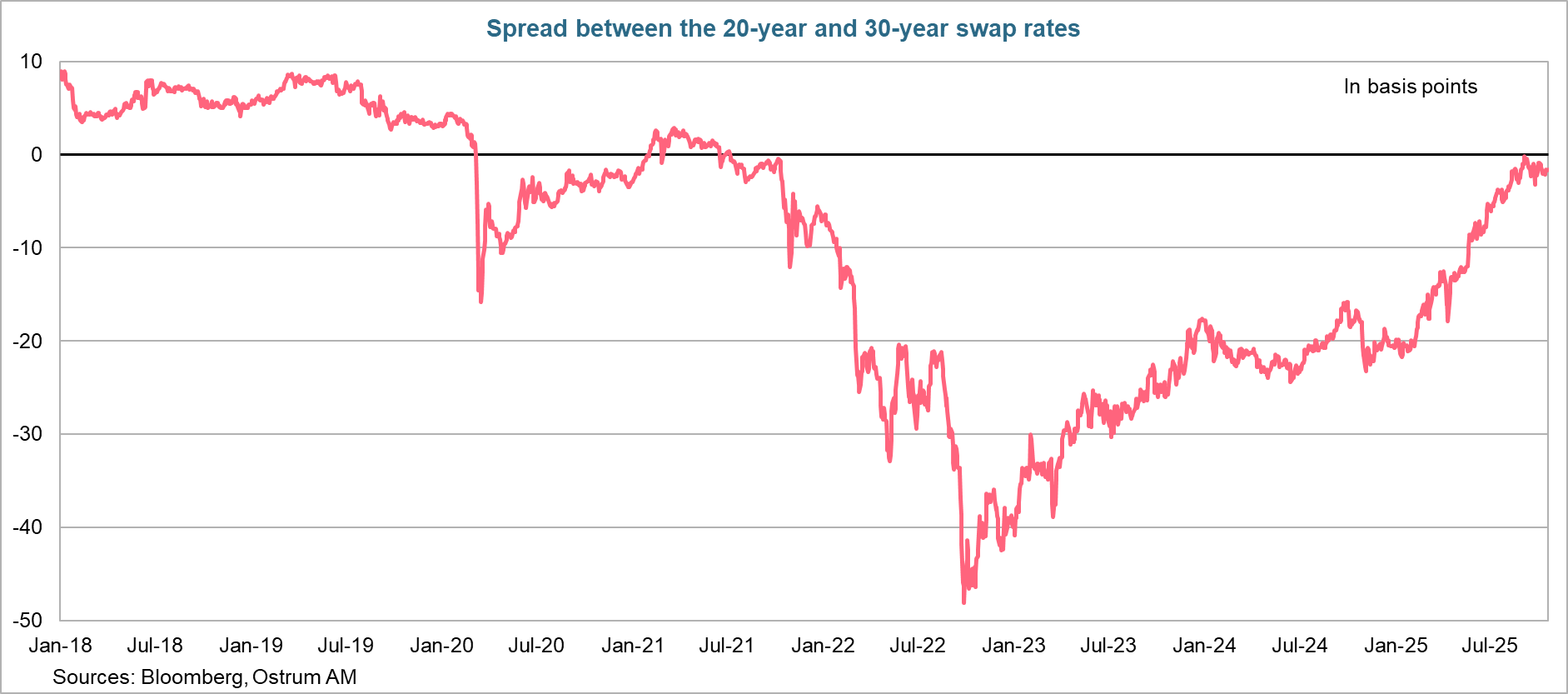

These tensions will be exacerbated by the decrease in demand for long-term swaps, at 30 years and beyond, and the increase in demand for hedging instruments against interest rate risk for shorter maturities, such as the 20-year maturity. As a result, the swap yield curve is also expected to steepen.

Investors Have Already Started to Position Themselves

In anticipation of the first wave of transition occurring on January 1, 2026, investors have begun to position themselves. The euro swap yield curve has significantly steepened between the 20-year and 30-year maturities since the beginning of 2025, as shown in the following left graph.

As the first wave of transition approaches on January 1, 2026, investors have begun to position themselves for the steepening.

This has contributed to tensions in the long-term yield curve in the euro area, particularly to the steepening of the 10-30 year yield curve within the euro area, as shown in the right graph.

.png)

Other factors have also contributed to this.

Other factors beyond the Dutch pension reform have also contributed, such as the German government's announcement of a significant increase in public investment in infrastructure and defense, which will be financed by more public debt. In France, the bond markets are also affected by the political and budgetary crisis, as well as fears of maintaining a high budget deficit that prevents a reduction in the public debt-to-GDP ratio. In the United States, the prospect of a significant increase in public debt with the return of D. Trump to the White House is also weighing on the long end of the yield curve, and in Japan, concerns about a significant fiscal drift have recently intensified following the legislative elections.

To avoid a sudden market adjustment, the government is expected to approve a proposal to give pension funds one year to adjust their portfolios and risk hedges.

To avoid abrupt market movements as the transition wave on January 1 approaches, during a period marked by low liquidity followed by significant issuances in January, the Dutch government is expected to approve a proposal granting pension funds one year to adjust their portfolios and risk hedges. The goal is to prevent a simultaneous unwinding of pension fund hedges in order to limit the impact on the markets.

Nevertheless, the swap markets are expected to be volatile around the turn of the year with the transition of 36 pension funds to the new system. The swap yield curves and sovereign yield curves in the euro area are expected to steepen further as January 1, 2026 approaches, and tensions are likely to persist throughout the transition period.

Conclusion

A major change is taking place in the Netherlands with the pension reform. The current system is no longer sustainable, and pension funds will transition from a defined benefit system to a defined contribution system. Consequently, pension funds will radically change their investment strategy. Currently, they are heavily invested in long-term bonds to pay the amounts promised to retirees. With the reform, they will invest based on the life cycle, which will lead them to reduce their holdings of long bonds and increase their allocation to risky assets such as equities and real assets. The swap market will be significantly impacted, with a structural decline in the demand for hedging against interest rate risk, which will heighten tensions on long-term sovereign rates. Investors have already begun to position themselves accordingly. Volatility is expected to increase in the euro swap markets around the turn of the year, and the yield and swap curves are likely to steepen further as January 1, 2026 approaches, with tensions persisting throughout the transition period.

Aline Goupil-Raguénès

Chart of the week

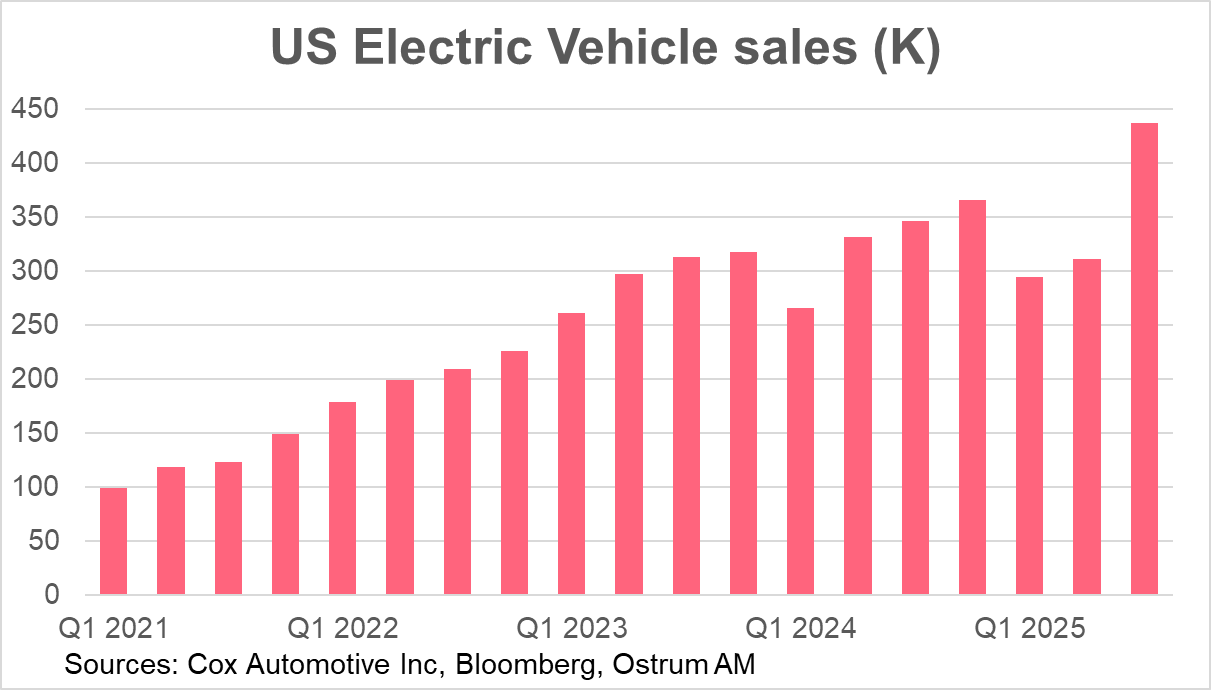

Electric vehicle sales in the United States reached a record high in the third quarter of 2025, with nearly 450,000 vehicles sold, representing a 40.7% increase from the previous quarter and a 29.6% year-over year growth.

Buyers rushed to take advantage of expiring federal financial incentives at the end of the quarter. Without federal tax credits, sales are expected to slow down. Electric vehicles accounted for 11% of car sales in the U.S. in Q3, far from the 50% target set for 2030 by the Biden administration.

Figure of the week

24

24% of Americans plan to postpone or cancel a major purchase (such

as a home or a car) due to the shutdown.

Market review:

- U.S.: 2 regional banks announce loan-loss provisioning linked to loan frauds;

- Euro area: inflation at 2.2, but core inflation accelerates to 2.4%;

- Bonds: Flight-to-safety benefits Bunds, T-notes as gold keeps shooting higher;

- Equities: Nasdaq falls but European markets prove resilient.

Beware of the Cockroaches

Jamie Dimon has highlighted the risk of a "cockroach theory" to describe the recent credit events unfolding in the United States. Regional banks are once again making headlines, two and a half years after the collapse of SVB. In this context, safe-haven assets—such as Treasuries and gold—are fulfilling their role effectively.

Tricolor and First Brands have become the first casualties of the accumulating payment delays on auto loans and the sharp increase in tariffs on auto parts. Two regional banks now report being victims of fraud related to loans to credit funds adversely exposed to commercial mortgage-backed securities. The opacity of private credit funds has been a recognized source of risk for several years. It is challenging to gauge the systemic risks associated with their activities, but once a cockroach appears, there are likely many more hidden away. Although the credit minefield may remain contained, the releases from major regional banks do not currently raise alarms; however, credit quality will remain a focal point. The Fed's announced halt to its balance sheet reduction policy suggests that Jerome Powell is particularly attentive to liquidity conditions.

The government shutdown deprives stakeholders of most economic indicators, which is why investor focus has shifted to these credit events. Manufacturing surveys are mixed, but confidence among builders (as measured by the NAHB index) has risen by 5 points to 37 in October. In the Eurozone, inflation was confirmed at 2.2% in September, but when excluding volatile elements, the price increase was revised to 2.4%.

Since the start of the 4th quarter, the shutdown and credit risk have reignited the flight to risk-free assets. Gold, the ultimate collateral, soared above $4,300 per ounce, pulling most precious metals along in its wake. Central banks and other investors are accumulating gold reserves. Some market participants believe the surge in the precious metal may have become excessive, leading risk-free rates to regain their status as a safe haven. The yield on the Bund fell to 2.53%, while the T-note dipped below 4%. These movements were accompanied by a slight widening of swap spreads (+3 bps on the Bund). The key difference lies in the steepening of the U.S. yield curve, indicating that the Fed has room to ease its monetary policy. Long-term Gilts (4.52% on 10-year bonds) are joining this trend, while £50 billion in savings still needs to be identified to restore the fiscal soundness.

Regarding sovereign spreads, French Prime Minister Mr. Lecornu has secured the Assembly's confidence. The spread on the OAT has decreased to 78 bps. There is also a relaxation concerning Greek debt (66 bps) and, more broadly, on southern European markets. The American risk aversion had no effect on sovereign spreads, likely reflecting reallocations towards the euro, which has rebounded to around $1.17. The yen and, to an even greater extent, the Swiss franc are distinguishing themselves in this environment. The pullback in Brent crude to $61 exerts some downward pressure on two-year inflation swaps (at 1.67%). Meanwhile, the investment-grade credit market has absorbed the latest U.S. news well, maintaining spreads around 70 bps over swaps. However, high yield remains more vulnerable to shifts in risk appetite, with the Crossover stabilizing around 275 bps. On the equity front, volatility has increased despite strong quarterly results from banks and technology companies, with the Nasdaq down approximately 2% over five sessions. European banks underperform, yet overall indices are on the rise.

Axel Botte

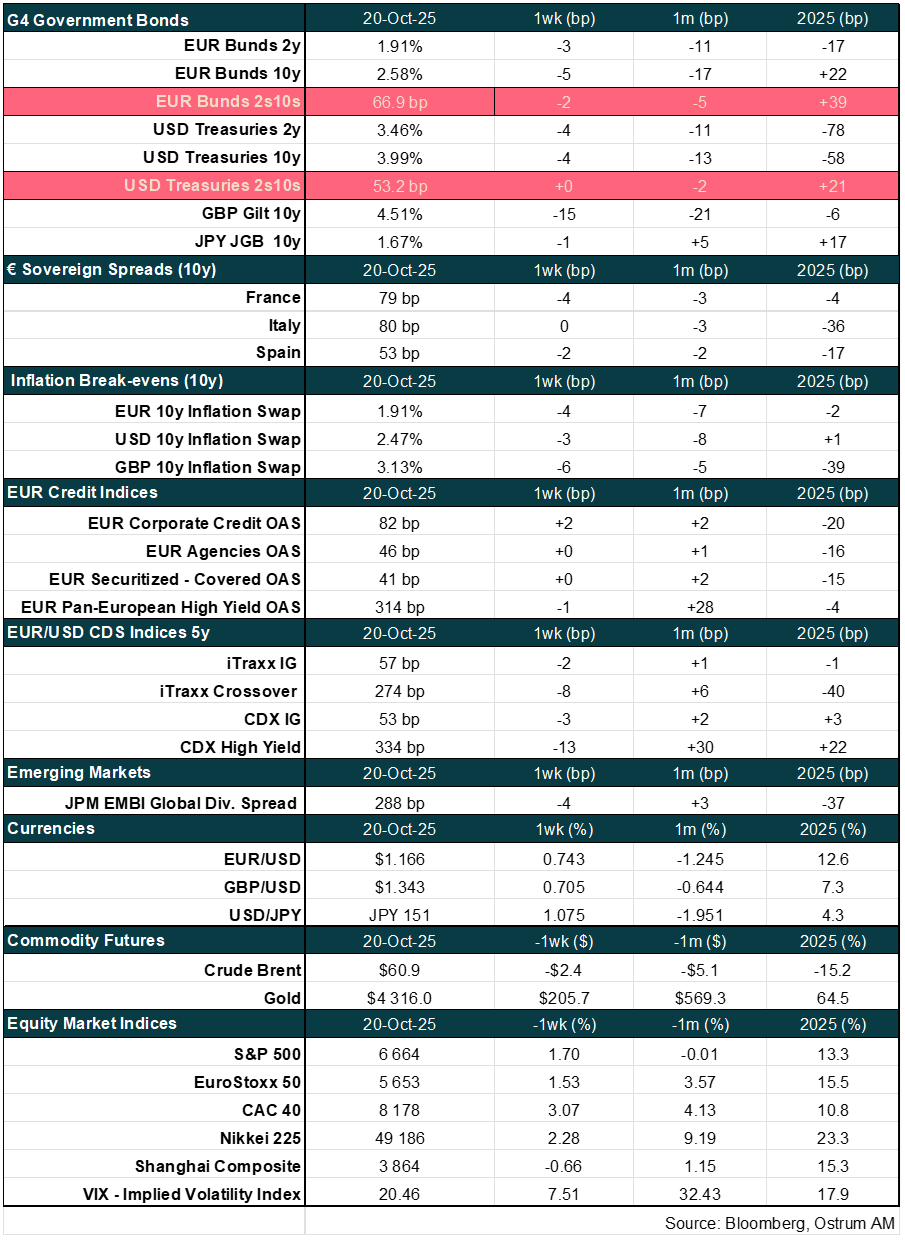

Main market indicators