Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum AM's views on the economy, strategy and markets.

The CIO letter

Climbing a wall of worry

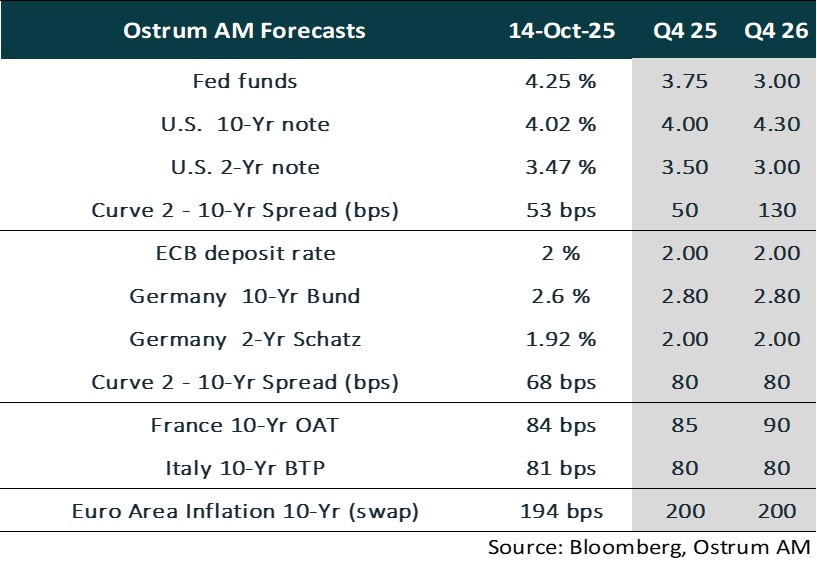

Financial markets, blinded by the speculative bubble surrounding artificial intelligence, continue to overlook the U.S. government shutdown and the political crisis in France, while overreacting to the election of Sanae Takaichi, who may draw inspiration from Abe's policies in Japan despite limited maneuvering room due to persistent inflation. Trade policies remain tense, with China announcing new export restrictions on rare earths just as Donald Trump threatens further tariffs in response. Cyclical conditions indicate that investments in AI are masking a precarious situation for the U.S. economy, with employment poised to contract as the fourth quarter begins. In the Eurozone, the German industry has yet to benefit from the announced budgetary efforts, and France is grappling with political uncertainty, the economic cost of which could reach at least 0.2 percentage points of growth according to the Bank of France. In this context, the Fed is expected to make regular adjustments to bring its rate down to around 3% by the second quarter of 2026, while the ECB will likely observe a prolonged period of status quo at 2%. Inflation is projected to hover around the ECB's target in the coming months.

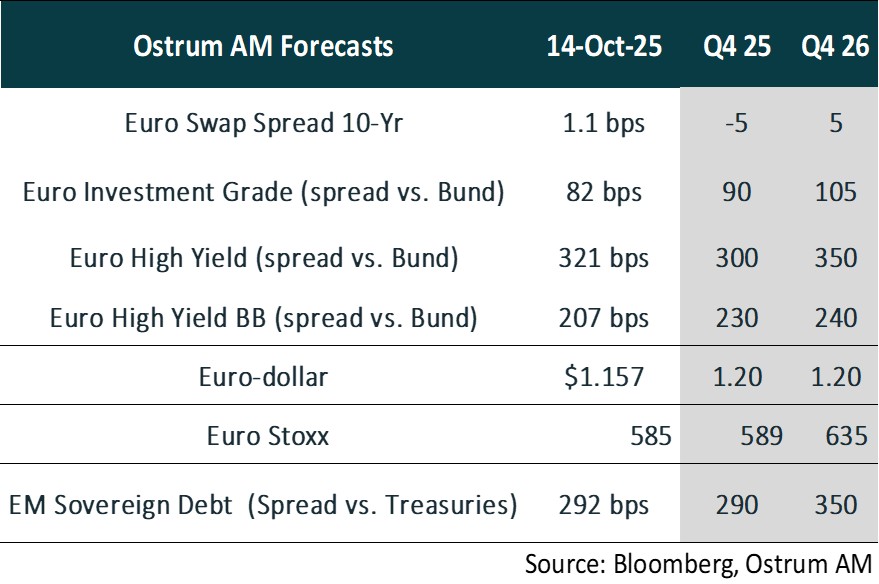

On the markets, excessive stock valuations pose a significant risk. Identifying turning points remains challenging, but financial performance is misaligned with underlying economic growth. Central banks can cushion the shock, but inflation somewhat limits their maneuverability. Bond yields are expected to hover around 4% for the T-note and 2.80% for the Bund. A return of risk aversion would adversely affect equity markets and high yield, which are currently near five-year lows in spreads. Gold serves as a universal safe-haven asset against major currencies but also carries a speculative dimension, similar to most metals.

Economic Views

THREE THEMES FOR THE MARKETS

-

Growth

Private consumption and spending related to AI will keep growth above 2% in Q3. Activity is expected to weaken in Q4 2025 due to a slowdown in employment. In the Eurozone, growth will experience a recovery that is weaker than previously estimated. The German industry is contracting and has yet to benefit from public investments. The political crisis in France is also weighing on activity. In China, the weakening data at the beginning of Q3 does not alter the forecast for 2025. However, the reduction of overcapacity will have an impact.

-

Inflation

U.S. inflation registered at 2.9% in August. Price increases are expected to remain around 3% in the last quarter. It is worth noting that the shutdown is delaying the publication of price indices. In the Eurozone, inflation is close to the ECB's target of 2%, but service prices remain high due to wages (3.5-4%). Combating deflation is a priority objective for the Chinese government with its anti-involution policy. Consumer prices decreased by 0.4% in August.

-

Monetary policy

Following an initial rate cut, the Fed, under the influence of the Trump administration, is expected to reduce its rate to around 3% by 2026. The focus is on the employment situation, raising the risk of inflation spiraling out of control. The ECB is likely to maintain the status quo at 2% until the end of 2026. Mrs. Lagarde does not intend to react to inflation that temporarily falls below the 2% target. The PBoC continues its accommodative policy. The bias among other major global central banks remains toward easing.

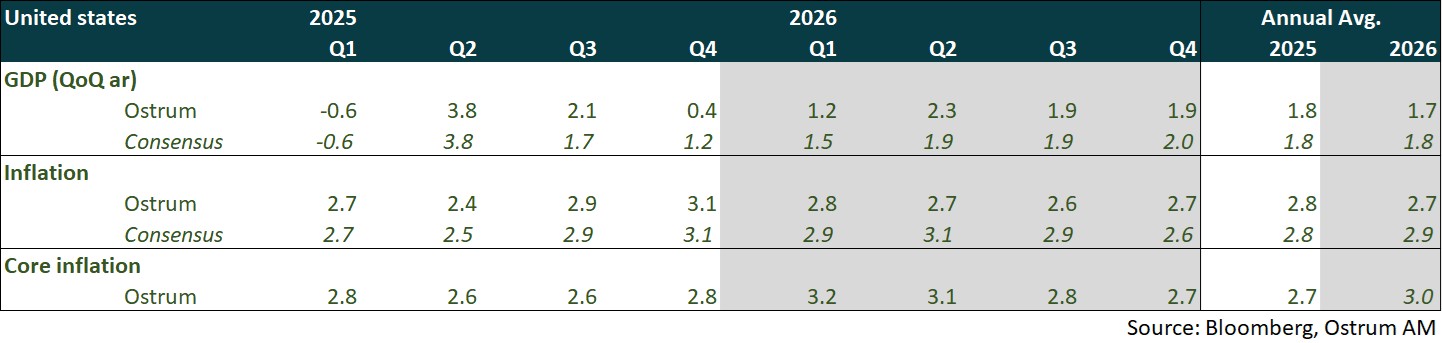

ECONOMY: UNITED STATES

Revised Q3 Outlook (Consumption) Amid Significant Labor Market Deterioration and Real Estate Risks.

- Demand: Growth remains highly unbalanced, primarily driven by investments related to AI (data centers, equipment, software, etc.). Household consumption appears surprisingly resilient in Q3, projected at around 3-3.5%, likely bolstered by spending from the top 10% of earners, who account for 50% of total consumption. However, other forms of investment, such as construction and non-technological equipment, are contracting. The external balance is expected to deteriorate, and Q4 is likely to be weak.

- Labor Market: The labor market is paralyzed, characterized by declining participation rates and reduced hiring and layoffs. The ADP reports job losses in August and September. The unemployment rate is expected to rise, despite a slowing labor force.

- Fiscal Policy: Democrats are refusing to vote for a temporary budget, leading to a tumultuous shutdown that could result in drastic federal job cuts.

- Inflation: Energy prices (excluding electricity) and adjustments in rents are limiting the impact of tariffs. However, the inertia of service prices, particularly in healthcare, will likely keep inflation above target in 2026.

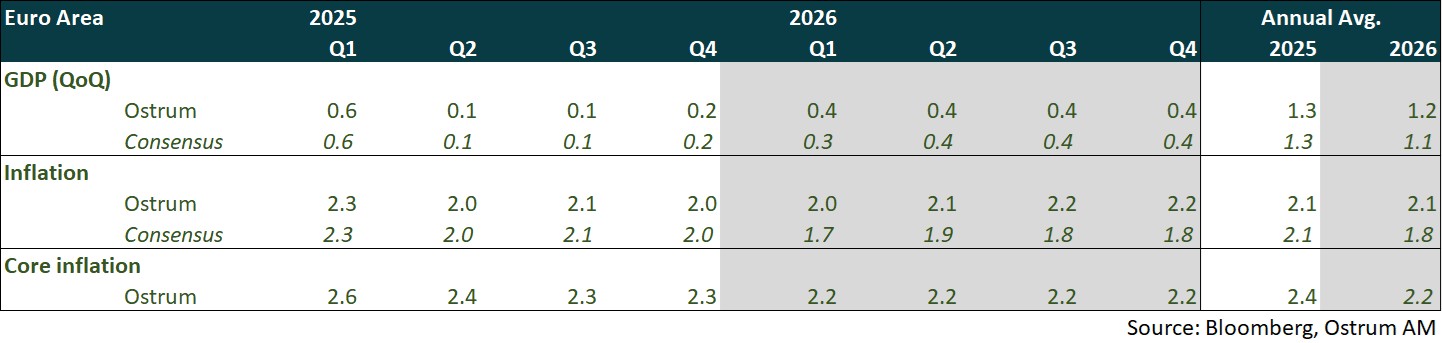

ECONOMY: EURO AREA

Growth in the second half of the year has been revised slightly downward due to disappointing figures in Germany and a slower-than-expected implementation of the infrastructure plan. Growth is expected to strengthen in 2026, driven by Germany.

- Activity: The production and orders figures for the German industry have been disappointing. Surveys conducted with business leaders in the euro area indicate a very modest increase in activity and a relative stability of new orders. Growth is expected to strengthen in 2026 with the implementation of German plans and the rise in military spending in the euro area.

- Domestic demand: Consumption is expected to remain moderate, benefiting from the impact of the monetary easing implemented by the ECB, between June 2024 and June 2025, and from gains in purchasing power, albeit more modest ones. In France, the rise in political uncertainty is reflected in a wait-and-see attitude among households and businesses, which limits the dynamics of spending, investment, and employment. In Q4, public investment is expected to increase driven by Germany, and then accelerate in 2026. Peripheral countries should also benefit from disbursements from the NextGenerationEU funds, which are set to conclude at the end of 2026.

- Fiscal policy: In France, persistent political instability increases uncertainty about the country's ability to reduce its budget deficit and stabilize its debt, leading credit rating agencies to downgrade France's credit rating. This contrasts with Italy, which plans to return to a budget deficit of 3% of GDP as early as 2025. Germany, after years of fiscal caution, is set to significantly increase its military and infrastructure spending.

- Inflation: Inflation is expected to remain close to the ECB's target of 2%. There is a risk of an influx of highly competitive Asian products.

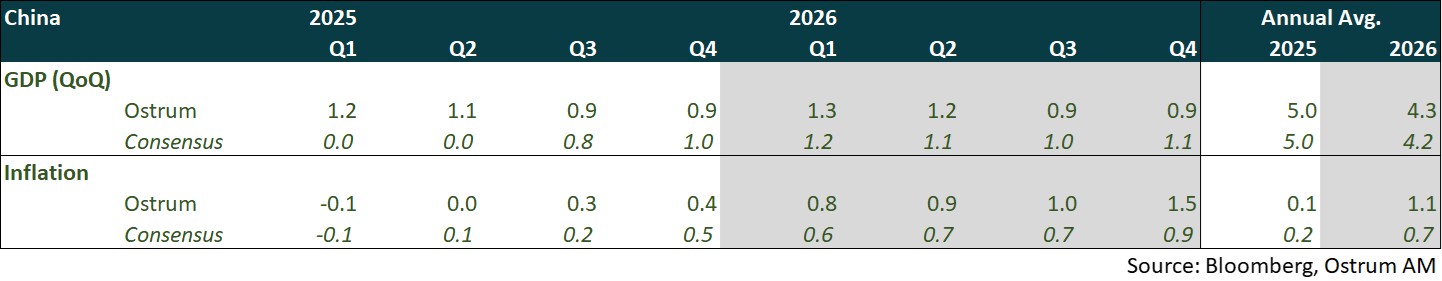

ECONOMY: CHINA

One year after the pro-growth pivot, the results for the Chinese economy are mixed. China will hold the 4th Plenary Session from October 20 to 23, 2025 and will publish the recommendations for the preparation of the 15th Five-Year Plan (2026-2030).

- There was a slowdown in activity in July and August, linked to the "anti-involution" campaign. However, the PMI surveys published for September indicate an improvement towards the end of Q3, due to the export sector.

- Exports: foreign trade remains robust. Exports, primarily of capital goods to emerging markets, particularly to Africa, significantly compensate for those to the United States.

- Demand: growth in investment slowed to 0.5% year-on-year in August, along with retail sales related to the "anti-involution" campaign. The 4th Plenary Session is expected to emphasize consumption by improving social protection. A new urbanization plan will help absorb unsold housing stock by migrant workers.

- Inflation: the producer price index stabilized in August at -2.9% year-on-year for the first time since February, which is an encouraging signal for the "anti-involution" policy that needs to be confirmed in the coming months. Inflation was at -0.4%, but core inflation continued to rise to 0.8%, linked to services reflecting consumption support programs.

- Monetary policy: fiscal measures have taken over from monetary policy to support activity. However, we believe that the PBOC may lower its rates by the end of the year as real rates remain high.

- We do not believe that the authorities will resort to devaluing the yuan as they did in 2015 to reverse deflation. They are instead prioritizing the stability of their currency to focus on the trade war.

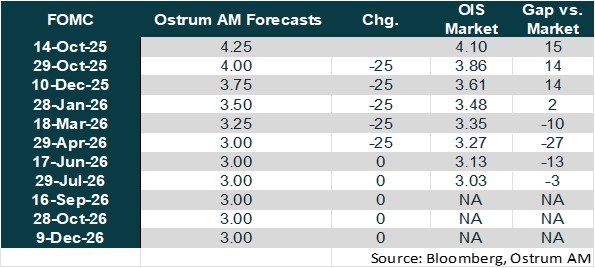

Monetary Policy

Divergence between the Fed and the ECB

- The Fed is resuming its rate-cutting cycle

The Fed has decided to lower its rates by 25 basis points, bringing the federal funds rate to the range of [4.00 – 4.25%]. This marks the resumption of its rate-cutting cycle (-100 basis points between September and December 2024) after a 9-month period of maintaining the status quo. This decision was motivated by increased downside risks to employment, following data revealing a significant slowdown in job creation over the past three months. While inflation risks remain tilted to the upside, the impact of tariffs is considered to be temporary. Members of the monetary policy committee anticipate, on average, two more rate cuts by the end of the year (compared to just one during the June meeting), followed by further cuts in 2026 and 2027. We expect two more rate cuts by the end of the year and three additional cuts in 2026, aiming to return to the neutral rate, given the ongoing deterioration in the labor market and significant risks in the real estate market.

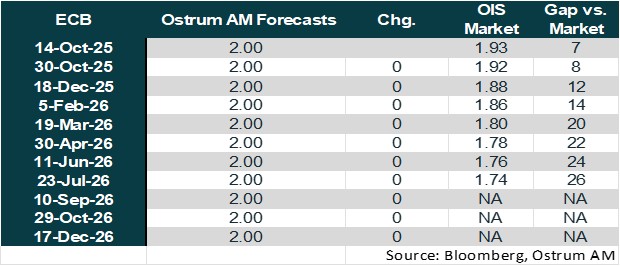

- Extended status quo of the ECB

After lowering its rates 8 times over the course of a year (-200 basis points between June 2024 and June 2025), the ECB has kept its rates unchanged for the second consecutive meeting on September 11. Christine Lagarde indicated that the disinflation process is complete and that the ECB is still in "a good position" due to resilient growth, a strong labor market, and inflation expected to remain close to the 2% target in the medium term. The risks to growth are considered more balanced following the trade agreement signed with the United States, although this agreement does not eliminate all uncertainties. The ECB will determine its rate policy meeting by meeting, based on incoming data. This suggests that rates will likely remain unchanged until the end of 2026. A final rate cut would only be considered in the event of a negative shock to growth.

Market views

- U.S. Rates: The Federal Reserve responded to the deterioration in employment starting in September, despite upside risks to inflation. Fiscal risks may continue to weigh on long-term yields.

- European Rates: The ECB will keep rates unchanged at 2% until 2026. The 10-year Bund forecasted at 2.80% reflects a more ambitious fiscal policy in Germany.

- Sovereign Spreads: OAT spread forecasts reflect both political and fiscal woes. BTP spreads should be more stable.

- Eurozone Inflation: Inflation expectations remain anchored around the 2% target.

- Euro Credit: Investment-grade credit spreads have tightened significantly. A modest widening from current rich levels appears likely.

- Euro High yield: Valuations in the high-yield sector are expected to normalize over the coming year. However, the default rate remains low and below the historical average.

- Exchange Rates: Distrust in the dollar has propelled the euro higher, with the single currency expected to approach $1.20 by the end of 2025.

- European Equities: Tariffs are likely to weigh on margins, but the positive sentiment factor is likely to propel valuation multiples higher.

- Emerging Debt: Emerging market spreads may remain close to current tight levels in the near term.