Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: BBB Budget yields AAA loss.

- The downgrade of U.S. debt by Moody's to Aa1 is expected to shift market focus to ongoing deficit negotiations, with the "One Big Beautiful Bill" exacerbating budget concerns and creating uncertainty about foreign demand for U.S. Treasuries;

- Current fiscal policies are projected to add over $20 trillion to the national debt over the next decade, with the Congressional Budget Office (CBO) forecasting an average deficit of about 6% of GDP, totaling approximately $22 trillion;

- The proposed tax bill includes permanent tax rate reductions, temporary elimination of taxes on tips and overtime, and an increase in the debt ceiling by $4 trillion, while proposing significant cuts to programs like Medicaid, potentially resulting in millions losing health insurance;

- Despite the downgrade, foreign demand for U.S. Treasuries is not expected to collapse. The liquidity and security of these bonds remain unmatched in the global market. That said, long-term yields are on the rise globally, resulting in intensified competition between countries to attract global savings.

Market review: Tensions on global long-term rates

- United States: The budget drives long-term rates higher, leading to a global increase in yields;

- Donald Trump reignites the trade war, threatening Europe with a 50% tariff as early as June;

- Relative calm in the credit and sovereign debt markets;

- Stocks come under pressure from tariffs by the end of the week.

(Listen to) Axel Botte’s podcast:

- Review of the week – Renewed Tensions on Global Long-Term Rates;

- Theme – Big Beautiful Bill, a BBB budget and the loss of the AAA.

Chart of the week

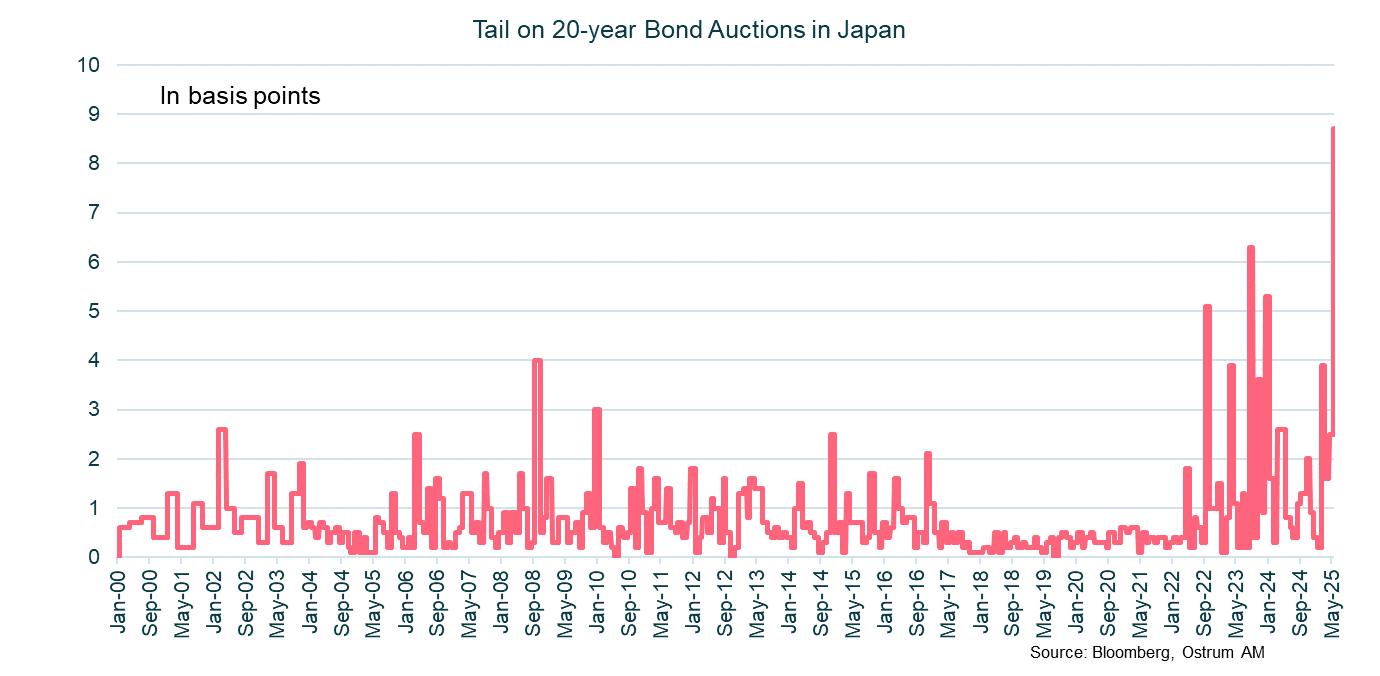

Yields are on the rise globally and it is getting harder for governments to attract savings. This is true also in Japan despite significant excess savings in the economy. The Bank of Japan no longer purchases JGBs in net terms and domestic inflation pressures have increased in the past few years.

In this context, bond auctions attract less demand which shows in larger tails on long bond transactions. The tail shown in the chart opposite represents the yield gap between the highest yield paid at auction and the average. The higher the tail, the more difficult the auction. The tail on the last 20-Yr bond sale was remarkably elevated at more than 8 basis points.

Figure of the week

0.4%

German growth has surprised on the upside in the first quarter, increasing by 0.4% thanks to a rebound in household consumption and strong investment performance.

MyStratWeekly : Market views and strategy

MyStratWeekly – May 27th 2025