Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Outlook 2024: in Fed we trust!

- Growth remains uneven with solid activity in the US, whilst the euro area tries to escape stagnation and China faces structural headwinds;

- Market equilibrium is highly dependent on a series of Fed rate cuts expected in 2024;

- The risk of bubble induced by a dovish Fed appears significant. Markets are priced for flawless disinflation. Credit offers the best trade-off between yield and volatility;

- Bonds are priced for a full-fledged easing that seems inconsistent with quantitative tightening. Given high government borrowing needs, a resurgence of tensions in the repo market would put an end to QT.

Market review: The hangover

- Job growth still healthy in the US;

- Inflation rose to 2.9% in the euro area;

- Yields bounce as equities fall;

- Very strong activity across primary bond markets.

Axel Botte's podcast

- Topic of the week : Mergers/acquisitions and margins, projection of long rates;

- Theme : Growth and employment in the United States.

Chart of the week

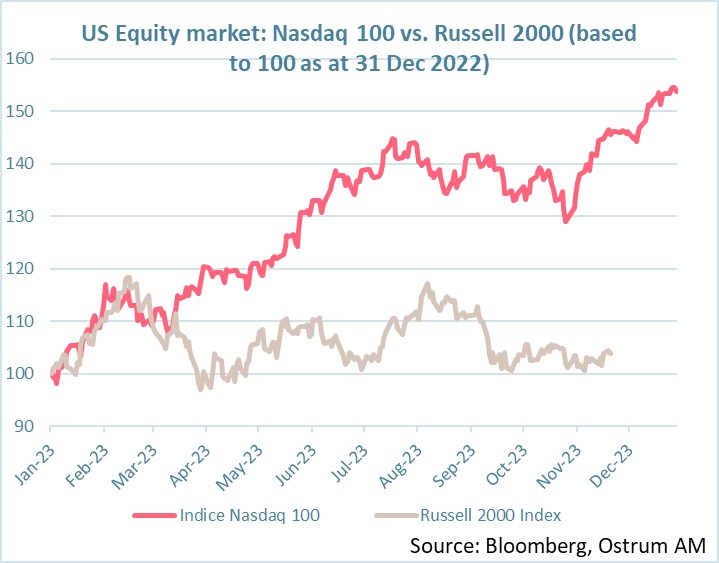

The stock market year ended with a bang in the United States with a final bull run fueled by the expectation of multiple Fed rate cuts in 2024.

The favorable investment theme underpinning growth stocks, which are highly sensitive to long rates, and the rapid development of AI resulted in a very strong outperformance of the Nasdaq compared to the small stocks represented in the graph opposite by the Russell 2000 index. The Nasdaq outperformance is close to 45%.

However, US small caps have seen renewed interest with a 14% price rebound in December which accounts for most of their annual performance in 2023. 2024 will perhaps be the year of rebalancing portfolios towards small caps. values neglected for too long by investors.

Figure of the week

The 2023 price performance in percentage of the equal-dollar weighted FANG index of US-listed powerhouse technology stocks (such as Meta, Tesla, Netflix, Nvidia, Microsoft...).

MyStratWeekly : Market views and strategy

MyStratWeekly – January 9th 2024