Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Stéphane Déo, Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: European equity outlook after January surge

- After a historical surge in January, analyst forecasts imply little upside for European equities looking out to end 2023;

- Investor sentiment improves as the European economy may avoid recession, spurring equity fund inflows;

- Rebalancing away from US growth leadership favors Europe;

- Earnings revisions dip crossing higher stock prices;

- Margins at historical highs may be hard to sustain but inflation backdrop provides some leeway for corporates.

Market review: Silence is gold

- Central banks faced with easing in financial conditions;

- T-note yields back above 3.5%, Bund yields near 2.25%;

- Sharp bounce in Nasdaq now up 10% YTD;

- Credit resists widening pressure on swap spreads.

Stéphane Déo's podcast

- Is there a risk of overheating with China’s rebound?

Chart of the week

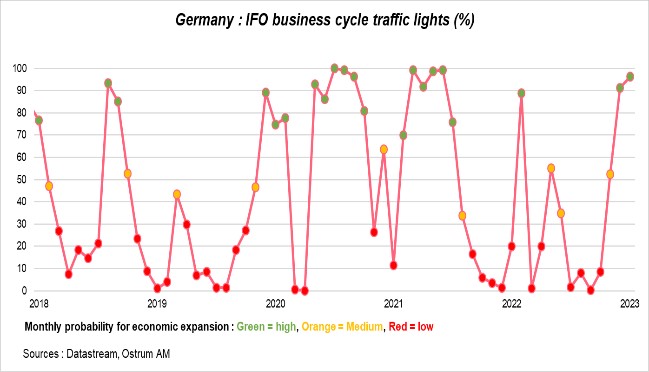

Germany should avoid a regression given the figures available and the improvement in surveys since the end of the year. The IFO calculates each month the probability that the economy will expand. It has risen sharply since December to well above 66%. This is the result of a sharp fall in the price of natural gas, via a high level of stocks and abnormally mild temperatures, but also colossal measures taken by the government to protect households and businesses from the energy shock. Bruegel estimates them at 260 billion euros (between September 2021 and November 2022), or 7.4% of GDP, compared to 600 billion euros for the whole of the European Union.

Figure of the week

It is the annual growth rate of the US M2 monetary aggregate, which recorded its first annual contraction since the first releases in January 1960.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – January 31st 2023Podcast slides (in French only)

Download the podcast slides (in French only)