Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Zouhoure Bousbih's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: On labor hoarding

- The US labor market is tight by most measures;

- US businesses have been reluctant to fire workers fearing difficulties and costs to rehire, a practice known as labor hoarding;

- The Okun’s law framework helps to identify subpar responses of unemployment to slower growth;

- Low readings on initial jobless claims and layoff announcements show the extent of firms’ reluctance to let go workers;

- Besides hiring costs, reasons for labor hoarding include retaining key hard and soft skills including IT capabilities, time management and leadership.

Market review: Summer in April?

- The ECB fails to convince markets betting on April cuts;

- US growth remains strong at 3.3% in 4Q 2023;

- Yield curves re-steepen;

- Good performance from equities and credit.

Zouhoure Bousbih's and Aline Goupil-Raguénès' podcast

- Topic of the week : Growth, inflation in the Eurozone and ECB ;

- Theme : End of BTFP, China, Energy…

Chart of the week

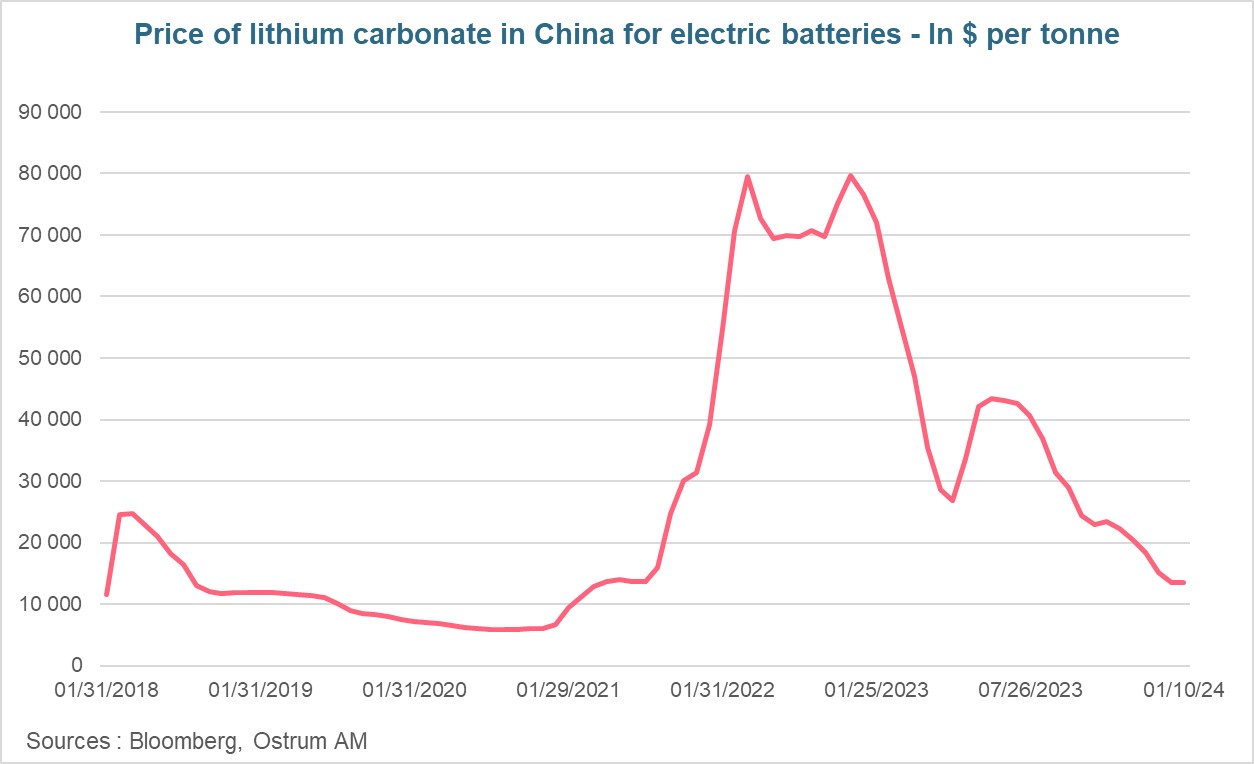

In China, the price of lithium carbonate used for electric batteries fell by more than 80% year-on-year, returning to the lowest since 2020, at $13,300 per tonne in mid-January, compared to $72,000 per tonne a year ago and peaking at almost $80,000 at the end of November 2022.

This is linked to the lesser demand of the world's largest electric vehicle market: China. After increasing by 84% in 2022, sales of electric vehicles have slowed significantly to increase by 25% in 2023. This sharp drop in lithium prices has led some producers to scale back their production expansion plans.

Figure of the week

In order to achieve carbon neutrality by 2050, the European Union would have to invest nearly 1.5 trillion euros per year, between 2031 and 2050, according to a draft European Commission document seen by the Financial Times.

MyStratWeekly : Market views and strategy

MyStratWeekly – January 30th 2024