Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Oil on slippery slopes

- OPEC+ has announced output cuts that have failed to impress energy markets as prices keeps grinding lower;

- The degree of trust and cooperation within OPEC+ is low as many member countries seek to raise output and Russia gets around sanctions;

- Meanwhile US output has jumped to record high 13.2 mbpd thanks to the build-up in capacity in the recovery from Covid now coming off the sidelines;

- Will Saudi Arabia manage to control supply conditions or will it be overwhelmed by excess supply from OPEC+ and non-OPEC producers?

Market review: The return of forward guidance?

- US employment up 199k in November;

- Central banks must regain control;

- The BoJ hints at putting an end to negative rates;

- Risky assets on an upbeat tone.

Axel Botte's podcast

- Topic of the week : Central Banks Meetings Issues;

- Theme : US Shale Oil with a vengeance !

Chart of the week

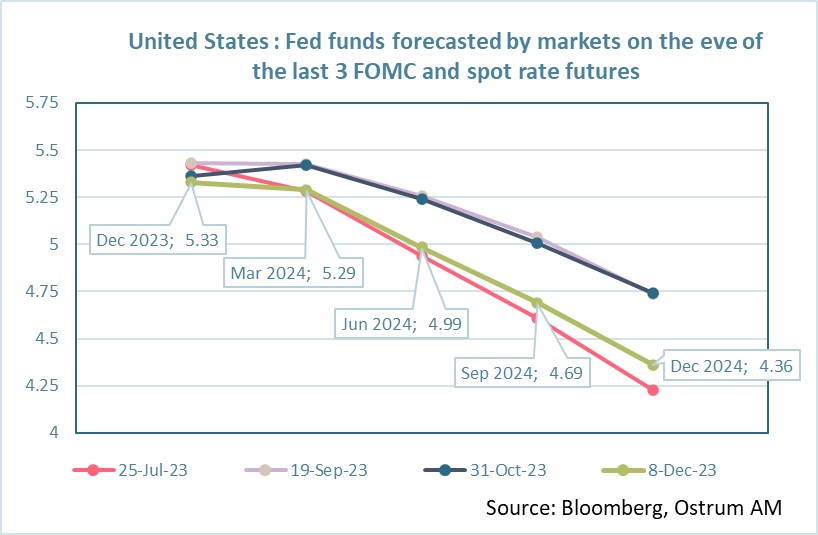

Back to square one! Rate expectations have rarely been so fluctuating. The graph opposite compares the expected trajectories of fed funds on the eve of the FOMCs of July 26, September 20 and November 1 and that of today over five quarterly maturities until December 2024.

The scenario of high rates for a prolonged period caused an upward shift in the Fed funds outlook between July 26 and October 31, when the dominant rhetoric once again became that of imminent easing by the Fed.

For a few months, the markets believed in sustainably high rates before erasing the “higher for longer” scenario and integrating rapid declines accompanying the expected reduction in inflation.

Figure of the week

Air pollution linked to fossil fuels kills 5.1 million people per year worldwide according to a study in the British Medical Journal. Pressure is increasing at COP28 to define an exit strategy from fossil fuels.

MyStratWeekly : Market views and strategy

MyStratWeekly – December 12th 2023