We continue our series on elections around the world with India. The second most populous country in the world, representing 10% of the global population and 970 million voters, will head to the polls on April 19th to elect the 543 members of Parliament and its Prime Minister. The results of the election will be announced on June 4th. What are the stakes of these elections for the Indian economy and financial markets?

The emerging market Strategy view

The Indian elephant is not yet ready to compete with the Chinese

Since coming to power in 2014, Indian Prime Minister Narendra Modi had promised the economic development of his country. Today, India is attracting foreign companies from around the world. Since the Covid-19 pandemic, companies have been seeking alternatives to China to secure their production chains.

Geopolitical tensions have also been a trigger for relocating part of their production chains outside the country. Mexico and Vietnam have benefited from this. However, what attracts foreign companies to India is its vast domestic market characterized by a young population.

The country has quickly become one of the main destinations for foreign direct investment (FDI) amounting to $70.9 billion, ranking 8th in the world for FDI in 2023. This has helped revitalize Indian growth. In 2023, India contributed 17.5% to global growth, behind China (31%) but ahead of the United States (12%).

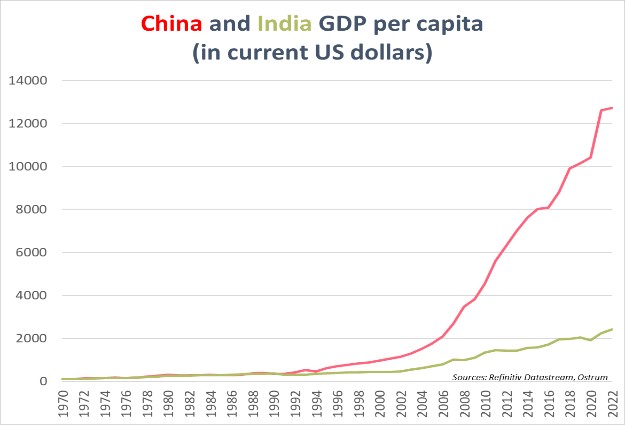

The strong Indian growth has fueled speculation about India's economic supremacy over China. India's per capita GDP is at the same level as China's in 2006 at $2,417, as shown in the graph below (2022 data).

This means that India is still a low-income country, according to the World Bank's classification. To be able to compete with China, India must overcome its obstacles. With its young population, the country has a demographic advantage, but India does not create enough jobs due to its low urbanization rate of 36%, compared to 64% for China. However, the most important obstacle and main strength of China is infrastructure. To attract more FDI, India must develop and modernize its infrastructure by improving the country’s business environment.

India is also seeking to develop its bond market (sovereign and corporate) with the aim of decarbonizing its economy, which still heavily relies on coal. The Indian central bank has established a framework for "green" bond issuance in 2021 and issued its first green bond in early 2023. A deep and liquid bond market can significantly contribute to the country's growth and financial stability.

The Portfolio Manager view

India has the third largest sovereign bond market among emerging markets

Elections in India should not be a game changer: Narendra Modi, at the head of the BJP is supposed to be the winner and to be reelected for a third mandate.

Investors like continuity in the management, furthermore when it is related to a company with strong results or a country with solid growth. And when it comes to India many risk metrics are positive: robust growth, inflation under control, orthodoxy of the central bank, large foreign direct investments.

Nevertheless, two elements remain negative: high budget deficit, and negative current account. The latter may partly explain the relative underperformance of the Indian rupee. But partly only as one needs to know that the currency is partly controlled…

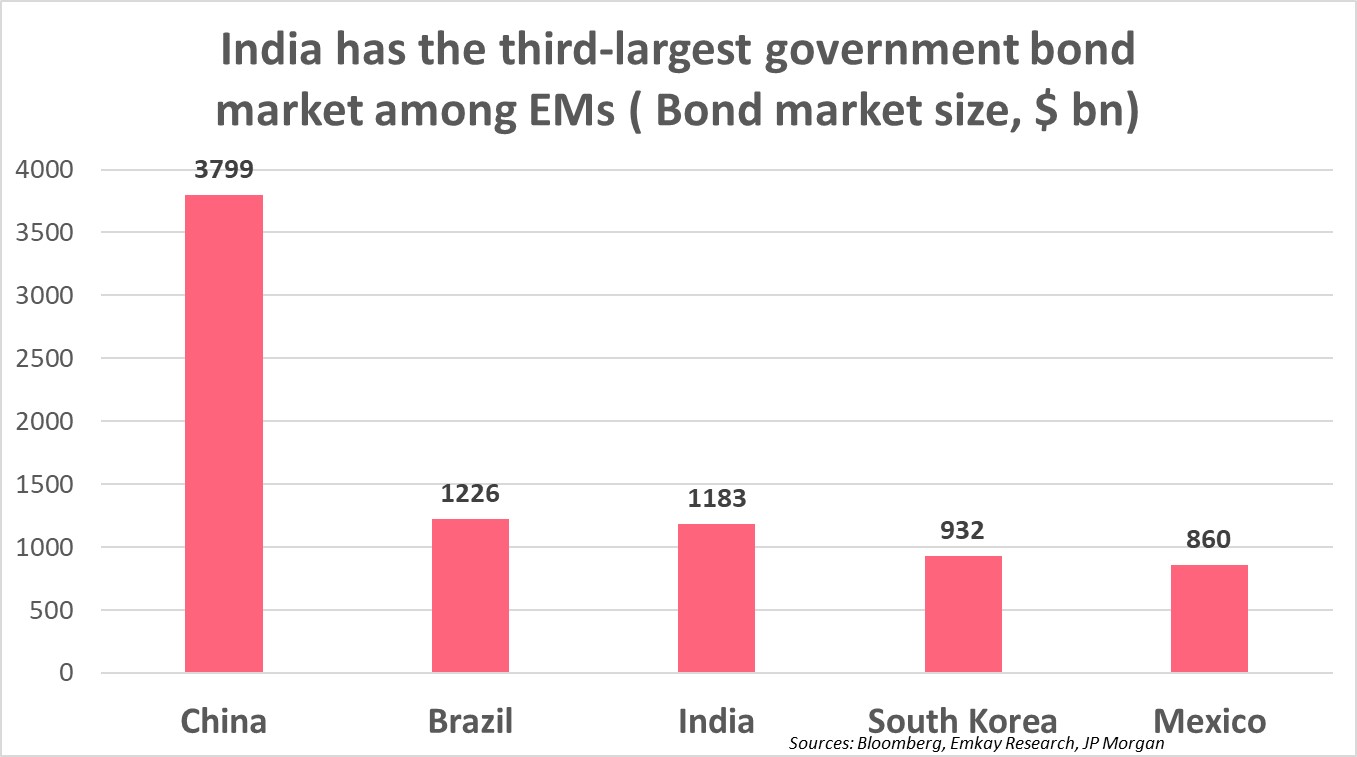

If the government has decided to attract foreign direct investments, it is also targeting fixed income investors. With a size of 1,183 billion dollars, India is the third largest sovereign bond market among emerging countries, as shown in the graph below.

India, as a sovereign does not issue international debt that is debt issued in hard currencies (ex USD). It relies only on its domestic market to finance its large deficit. However, like China a few ago, it has decided to open its market to foreign investors and to facilitate their access.

The achievement of this strategy is the inclusion of the sovereign Indian debt denominated in India Rupee, in the most representative index of the Emerging local debt: the JP Morgan GBI EM Global Diversified index. The process of inclusion will start end of June 24 to be ended in April 2025. At this moment the equivalent of $330 bn of eligible Indian sovereign bonds will be included, a weight equivalent to China, Mexico, or Brazil.

From June, it will totally be part of the international fixed income investment universe. India has been known by equity investors for many years. The third largest bond market in the world is now entering the market, through the front door, with issues in its own currency!