Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: ECB: one last hike

- The ECB raised its rates by 25 bps due to inflation expected to remain “too high for too long”;

- The important point comes from the change in communication suggesting that this increase is probably the last;

- The ECB should opt for an extended status quo until mid-2024;

- At the same time, monetary policy will become more restrictive through the end of reinvestments of reimbursement under the APP and TLTRO reimbursements;

- The objective is to firmly anchor inflation expectations.

Market review: The ECB had no choice

- ECB raises deposit rates to 4%;

- ECB cuts growth forecasts amid sticky inflation;

- The Fed may tighten policy further;

- Higher yields having little impact on risky assets.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the Week: Oil Market;

- Theme: A final rate hike.

Chart of the week

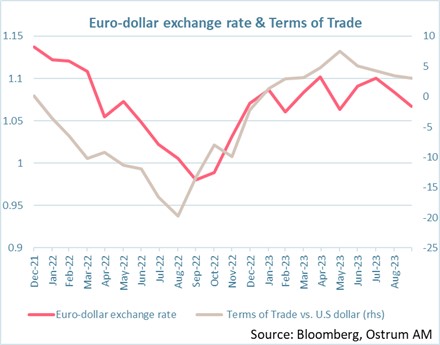

The euro depreciated towards $1.06 despite the ECB's 25 bp rate hike. The weakness of economic surveys in the eurozone and the significant growth gap with the United States are contributing to the decline of the single currency.

In addition, the rebound in oil, and more generally in imported raw materials, is deteriorating the eurozone's terms of trade. In 2022, the surge in gas had reduced the euro below parity.

Figure of the week

Spending from climate-related events has accounted for 32% of US GDP growth since 2016, according to Bloomberg intelligence.

MyStratWeekly : Market views and strategy

MyStratWeekly – September 19th 2023Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)