Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: Discussing the bond term premium

- The Treasury market sell-off appears traceable to a normalization of the term premium from negative levels engineered by years of quantitative easing;

- The term premium is a catch-all concept reflecting risk premiums earned by bond investors;

- The term premium is unobservable and must be estimated. The New York Fed’s ACM approach provides a useful framework to estimate the bon term premium;

- The term premium is independent from Fed rate projections and is driven by flows, bond volatility and the bond-equity correlation.

Market review: ECB rates may have reached peak

- High volatility on yield curves;

- Italian BTP spread remains at 200 bps despite the continuation of PEPP;

- The dollar-yen above 150;

- Earnings growth warnings are strongly sanctioned by investors.

Axel Botte's podcast

- Topic of the Week: US Growth, Quarterly Refunding and BoJ;

- Theme: The term premium on Treasuries.

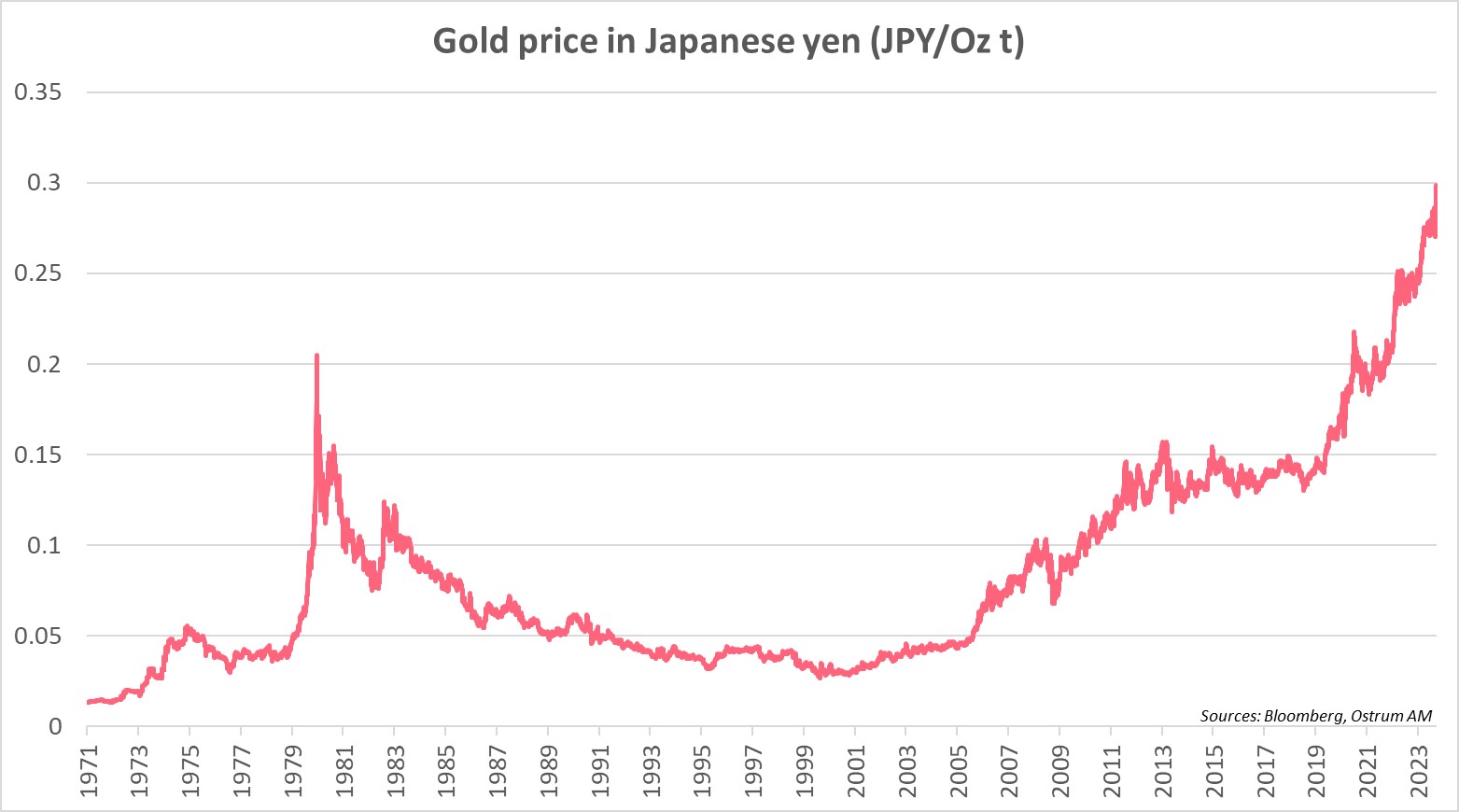

Chart of the week

Since Hamas' attack on Israel on October 7, gold prices have risen significantly (+9%) to $2,000 per ounce. This rise in the price of gold is even more spectacular by converting the price to yen. The price of gold reached an all-time high of 0.3 million yen per ounce. This reflects downward pressure on the Japanese currency against the greenback, linked to the divergence in monetary policy stance between the BOJ and the Fed.

Figure of the week

The Chinese government announced the issuance of 1 trillion ($140 billion) special bonds for local governments to repay their debt.

MyStratWeekly : Market views and strategy

MyStratWeekly – October 31st 2023Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)