Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Sluggish growth in the Eurozone + Core inflation still high = ECB status quo extended

- The ECB's monetary policy has an increasingly significant impact on internal demand and inflation;

- Growth has thus slowed significantly to become sluggish;

- Disinflation continues mainly due to a significant base effect linked to energy prices;

- Core inflation still remains high, notably due to continued sustained wage growth;

- The ECB was therefore expected to leave its rates at this restrictive level for a certain time before lowering them in the second half of 2024.

Market review: The paradox of tightening financial conditions

- The Fed opts for monetary status quo citing high long yields;

- The Fed’s signal sparked a broad-based rally and a weaker dollar;

- US job growth decelerates in October, unemployment up slightly;

- Nasdaq rebounded by 6% last week.

Axel Botte's and Aline Goupil-Raguénès' podcast

Topic of the Week: Significant easing in financial conditions, US quarterly refinancing and labour market conditions;

Theme: Growth, inflation and monetary policy in the Eurozone.

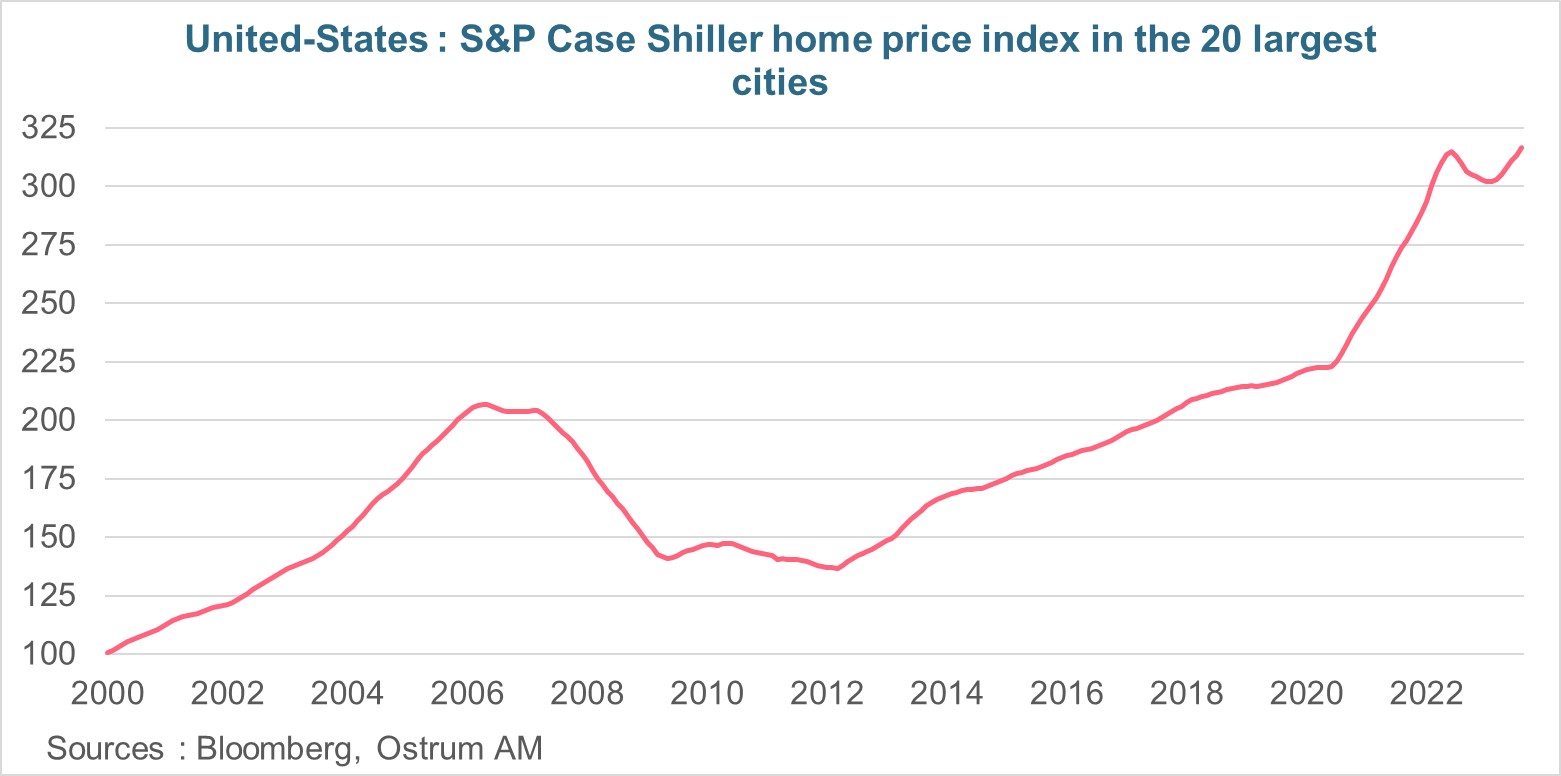

Chart of the week

Real estate prices have been on the rise again in the United States since February, despite the continued sharp rise in mortgage rates. The S&P Case Shiller index of real estate prices in the 20 largest American cities even reached a historic high in August 2023 (latest data available) while the 30-year mortgage rate is at its highest since 2000, at 7.86%. This reflects an insufficiency of supply in relation to demand. It was notably exacerbated by rising material costs and financing costs.

Figure of the week

Job losses in the automobile industry totaled 33,000 in October, reflecting strikes among the main car manufacturers. This explains the significant gap compared to the consensus on private job creation.

MyStratWeekly : Market views and strategy

MyStratWeekly – November 7th 2023Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)