Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Brazil: Heading towards the «BBB»!

- Brazil is entering a major structural macroeconomic shift;

- Its strong agricultural capacity allows it to rapidly improve its external position;

- Its main asset is its central bank, which strengthened its credibility after the Covid-19 crisis;

- Tax and fiscal reforms are important milestones in the country’s economic agenda;

- Long a major player in hydroelectricity technologies and biofuels, Brazil wants to be a «green» power in hydrogen and other low-emission solutions.

Market review: Early Christmas

- US inflation (3,2%) comes in below expectations in October;

- Fed: markets expect 50 bp of easing in the first half of 2024;

- Widespread rally in risky assets amid dollar weakness;

- Sovereign spreads resume their decline.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week : US rates, sovereign ratings in the Eurozone and oil;

- Theme : Brazil's back!

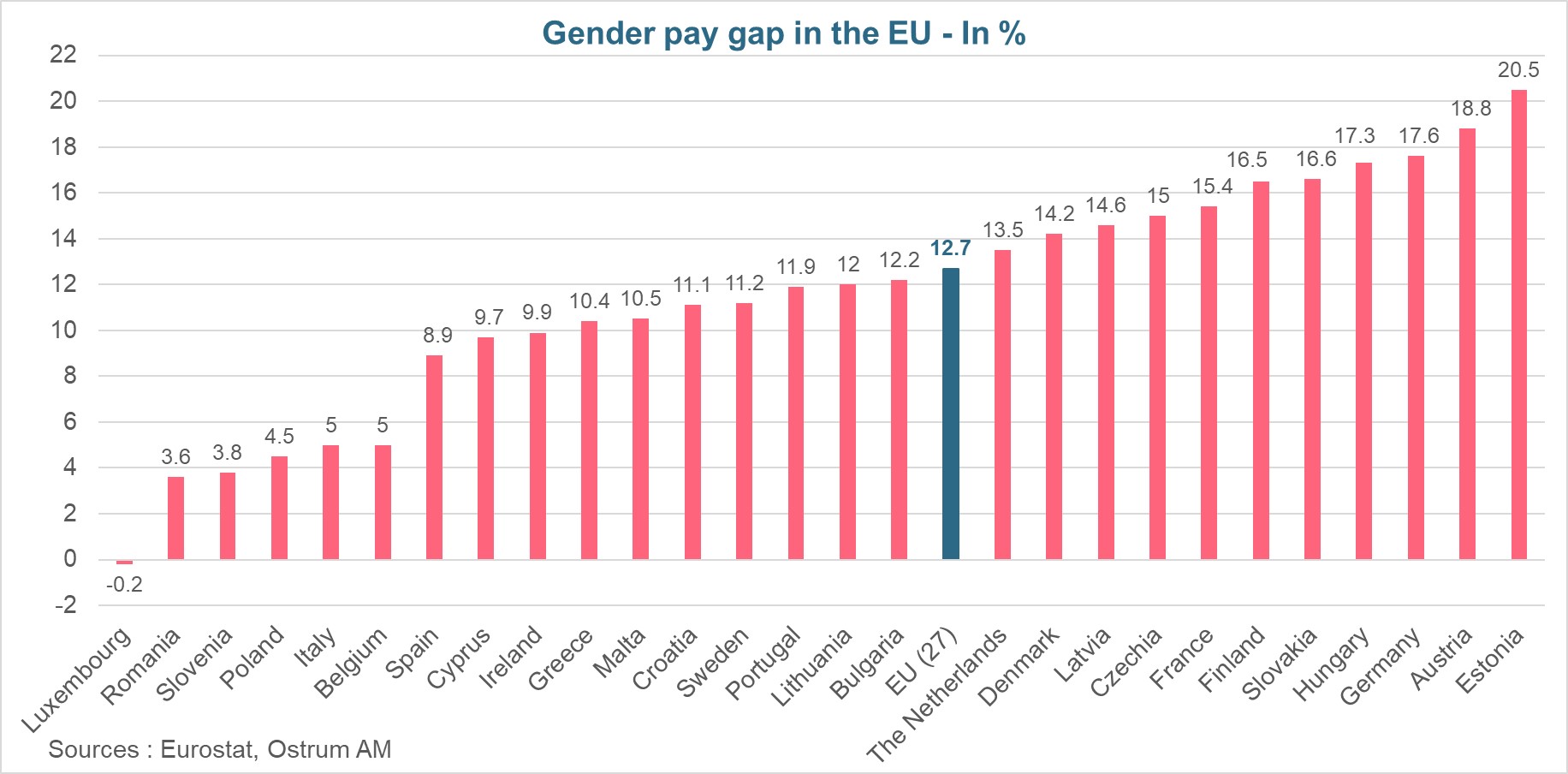

Chart of the week

Women earn 13% less than men in the European Union, according to Eurostat. This gap stabilized in 2021 and has only narrowed slowly before. Equal Pay Day (the date that symbolizes the number of extra days women must work until the end of the year to earn the same salary as men) is November 15. There are strong disparities. Among the large countries, the wage gap is very large in Austria (18.8%), Germany (17.6%) and France (15.4%) while it is relatively smaller in Italy (5%), in Belgium (5%) and in Spain (8.9%). However, it is necessary to put into perspective, in certain countries, a small gap may come from a lower employment rate of women and the arrival on the labor market of women with relatively higher incomes.

Figure of the week

The Karlsruhe Court of Justice in Germany rejected the reallocation of €60 billion of unused Covid loans to the Climate and Transformation Fund, while they were exempt from the “debt brake” rule.