Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Trillions

- It has been an eventful year for Treasury bond markets, given the debt ceiling issue until May and the subsequent sharp increase in public borrowing as the federal deficit rose to $1.7 trillion this past fiscal year;

- The US fiscal outlook has been back in focus this year with a downgrade from Fitch last summer and considerable volatility in the wake of the Fed’s monetary tightening;

- The US borrowing needs has so far not led to a weaker dollar but global competition for available savings could push yields higher in the coming months;

- A dovish Fed and lower than expected increase in bond auctions sizes sparked the recent bond rally, but all eyes will be on the next refinancing announcement once an appropriation bill pass Congress, hopefully in the next few weeks.

Market review: Warning shot

- Powell insists Fed will stay vigilant on inflation;

- Poor auction of US 30-year bond;

- T-note yields hover about 4.60 %;

- US Tech powers ahead, extends rally.

Chart of the week

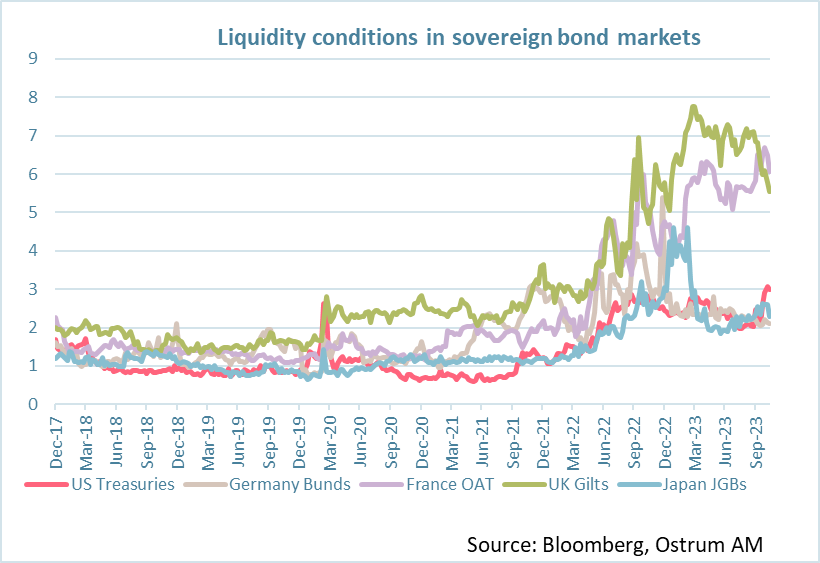

According to Bloomberg estimates, liquidity in major sovereign debt markets has deteriorated over the past two years. The withdrawal of Central Banks with quantitative tightening and the volatility induced by interest rate increases have contributed to widening the rating ranges.

This liquidity index measures the average yield gap for each security with a residual maturity greater than 1 year compared to an interpolated curve. An increase in the index therefore reflects wider valuation gaps and less liquidity.

Figure of the week

8

$8 a pound of beef in the US, an all-time high due to the drought.

MyStratWeekly : Market views and strategy

MyStratWeekly – November 14th 2023Listen to Axel Botte's and Aline Goupil-Raguénès' podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)