Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: The thematic research piece will resume next week

Market review: US CPI prints remain the key market mover

- Euro area activity surveys keep improving;

- BoE notes progress on inflation;

- T-note yields hovering about 4.50%;

- Italy: demand for BTP Valore wanes somewhat.

Chart of the week

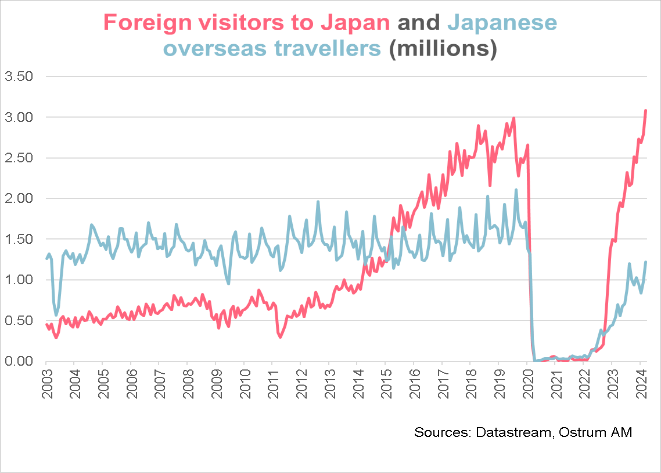

The Japanese tourism sector has been booming in the past few years. Of course, the covid epidemic interrupted growth in the tourism sector from 2020 to 2022 but the weakness in the yen continues to spur foreign demand for Japan stays.

The number of tourist arrivals hit 3 million in March. Conversely, the number of Japanese tourists overseas remain well below pre-Pandemic levels.

Figure of the week

100%

100%, which represents a quadrupling of US tariffs on Chinese electric vehicles to be signed into law this week.

MyStratWeekly : Market views and strategy

MyStratWeekly – May 14th 2024