Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Stéphane Déo, Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: External Sovereign Debt EM: Resist!

- Despite the recent episode of volatility, which reminds us of 2022, we are convinced that the global economic and financial environment remains buoyant for the asset class;

- The global economy is showing extraordinary resilience and the cycle of Fed rate hikes is already well advanced;

- The electoral calendar offers investment opportunities;

- The main risk remains geopolitics, but emerging markets are focusing on their domestic demand to support their growth.

Market review: The never-ending story

- Euro area inflation at 8.5% in February;

- ECB’s Wunsch hints at 4% deposit rate;

- Sharp upward move in bond yields and inflation breakevens;

- Spreads resist tensions on Bund, T-note yields.

Stéphane Déo's podcast

- When the market changes view.

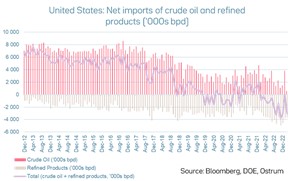

Chart of the week

The energy balance of the United States continues to improve.

Net imports of crude oil and refined petroleum products are trending down thanks to the rise in US production and capacity investments in the refining sector, where margins have recovered since the conflict in Ukraine.

The United States is a net exporter of petroleum products for a total of 3 million barrels per day. This compares to net imports of 7 million barrels 10 years ago. Energy independence is crucial to understanding the extension of the growth cycle in the United States.

Figure of the week

41 million. This is the decline in the Chinese labor force in 2022, equivalent to the total labor force in Germany.

MyStratWeekly : Market views and strategy

MyStratWeekly – March 7th 2023Podcast slides (in French only)

Download the podcast slides (in French only)