Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Stéphane Déo, Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: How to monitor bank liquidity risk

- The SVB and Credit Suisse cases have awakened old and bad memories, but we think the situation is solid;

- Below is a list of indicators that can be used to estimate whether there is a liquidity crisis in the European banking system;

- The data we have is more than reassuring about the possibility of a systemic crisis. For the moment there is almost no sign of abnormal stress. To be continued.

Market review: The risk of financial dominance

- The Fed keeps guidance for higher rates;

- Fed balance sheet up $ 400 Bn in past two weeks;

- Bank stocks under pressure amid confidence crisis;

- Fed injects $165 Bn.

Stéphane Déo's podcast

- What

Chart of the week

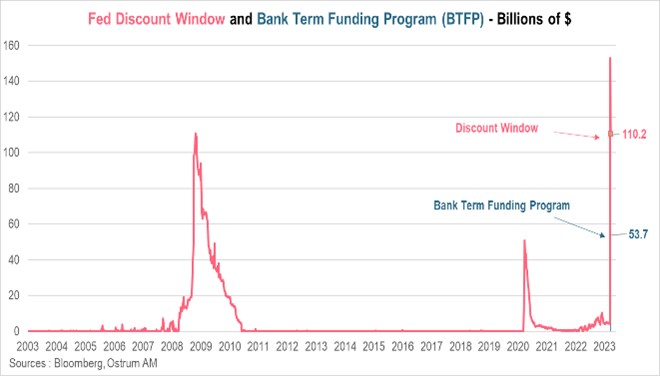

For the second week in a row, commercial banks massively requested the Fed's loan facilities and this for a total amount of $163.9 billion, the week ending March 22, an amount almost identical to the previous week (164.8 billion ).

Banks' recourse to the Fed's Discount Window moderated, after reaching an amount well above the 2008 peak, to remain very high (110.2 billion). Banks, on the other hand, made more use of the loan facility created on March 12, following the bankruptcy of SVB and Signature Bank. The Bank Term Funding Program was requested to the tune of 53.7 billion against 11.9 billion the previous week.

Figure of the week

The European Union plans to produce 40% of its “clean” technology needs by 2030, such as heat pumps, wind turbines, solar panels, renewable hydrogen and CO2 storage. It is a response to the American Inflation Reduction Act.

MyStratWeekly : Market views and strategy

MyStratWeekly – March 28th 2023Podcast slides (in French only)

Download the podcast slides (in French only)