Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Towards a rapid return of Greek debt to investment grade

- The Prime Minister has a good chance of obtaining an absolutemajority in the second round of the legislative elections on 25th June;

- He will thus continue the reforms and investments necessary to benefit from Next Generation EU funds;

- Sustained growth, fiscal prudence and the very long maturity of sovereign debt bode well for the continued fall in the public debt-to GDP ratio;

- This suggests a rapid return of Greek debt to investment grade. Investors have begun to position themselves in this direction. Moody's will speak on June 9.

Market review: Tensions ease on markets

- Disinflation quickens in Europe;

- Solid job gains in the US;

- 10-Yr note yields rally to 3.60% before a late sell-off on Friday;

- Stocks rally late last week with VIX plunging below 15%.

Axel Botte's and Aline Goupil-Raguénès's podcast

- Review of the week

- Towards a rapid return of Greek debt in quality investment category

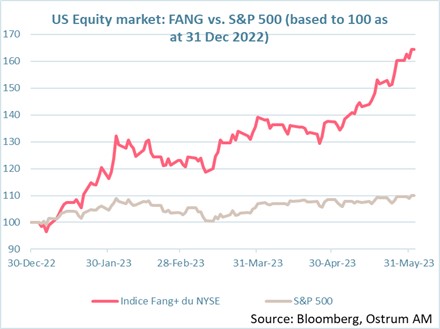

Chart of the week

The US equity market remains driven by the theme of artificial intelligence.The FANG index, which includes 10 leading stocks in the sector, has risen 64% since the start of the year. The broad S&P 500 index gained nearly 10% thanks to the contribution of these mega-cap stocks when in reality most stocks did not show any gain this year. Bear in mind that concentrated performance on a few stocks could spark market sell-off in the event of disappointment in US tech.

Figure of the week

For every dollar invested in fossil fuels, $1.70 now goes to clean energy technologies. Five years ago that ratio was 1:1.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 6th 2023Podcast slides (in French only)

Download the podcast slides (in French only)