Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: EM Sovereign Debt 5.0: Nature and Climate!

- Funding to reach the 1.5°C target is very insufficient;

- Poor countries are the most vulnerable and have limited fiscal room to invest;

- In the face of stalled restructuring negotiations, interest in the natural debt exchange has increased;

- These instruments were an integral part of the Latin American debt restructuring and can be part of the solution.

Market review: Hawkish turn before summer

- Fed: 50 bps of additional tightening in 2023;

- ECB: towards a deposit rate of 4% in September;

- Long-term yields proving insensitive to hawkish rhetoric;

- Strong performance out of credit and equity markets.

Axel Botte's and Zouhoure Bousbih's podcast

- Review of the week – Fed & BCE strong money markets scenario revisions;

- Emerging Debt – Emerging Sovereign Debt 5.0: Nature and Climate!

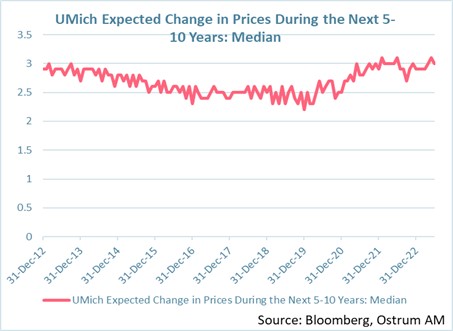

Chart of the week

Inflation expectations are a key variable for monetary policy. The message from the Fed is that further tightening is likely needed to ensure inflation converges to the target. Indeed, when agents anticipate inflation, they include it in their offers (of labor or of goods and services), which tends to perpetuate price adjustments. It is therefore crucial for central banks to convince them of the common benefit of keeping inflation at a low and stable level. So far, medium-term household expectations are still at levels (around 3%) incompatible with the definition of price stability.

Figure of the week

The increase in wages expected by companies over the next 12 months according to an ECB survey. In addition, firms anticipate a 6.1% increase in their selling price.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 20th 2023Podcast slides (in French only)

Download the podcast slides (in French only)