Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: US banks: health check two months after SVB

- Deposit outflows have hit small banks in March and then larger institutions as savers shift holdings into money market funds;

- Outflows have slowed recently but aggregate bank deposits are down about 5% year-to-date;

- Investors feared a credit crunch would tip the US into recession. Weekly credit data have been rather reassuring;

- Banks have used reciproqual deposit schemes to expand the share of deposits insured by the FDIC;

- Money market funds have attracted savings by offerring higher returns and banking on high rates at the Fed’s reverse repo facility;

- The Fed should tweak the RRP to stem risks of bank runs and channel MMF assets back into Treasury bill markets.

Market review: Fed: pause and active thinking

- Fed: rates unchanged but restrictive bias;

- Euro zone: technical recession between Q4 and Q1;

- Risky assets resist the rebound in long rates;

- Credit and high yield benefit from the low level of equity volatility.

Axel Botte podcast

- Review of the week

- Towards a rapid return of Greek debt in quality investment category

Chart of the week

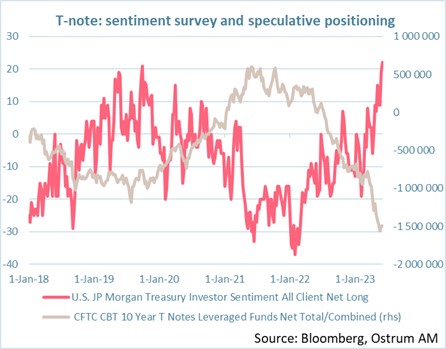

The positioning on the Treasuries market is difficult to read. Sentiment surveys describe a clearly long positioning of investors (at the highest since 2019) which constitutes a bearish signal on the market. Conversely, hedge funds have unprecedented net short positions. Speculative accounts are thus betting on a rise in long rates. These exposures can also represent credit hedges or strategies playing on the narrowing of bases between securities and derivatives, for example.

Figure of the week

This is the abyssal exchange rate of the Turkish Lira for one US dollar on Friday. The depreciation has accelerated since the results of the Presidential elections.

MyStratWeekly : Market views and strategy

MyStratWeekly – June 13th 2023Podcast slides (in French only)

Download the podcast slides (in French only)