Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Impact of TLTRO redemptions on markets

- On June 28, European banks repaid 477 billion euros of TLTRO;

- The high excess liquidity and the early repayments made allowed the markets to perform well;

- Some tensions have however occurred on the money market;

- For the next repayments, the focus will be on Italian banks due to insufficient excess liquidity;

- They will have to resort to ECB loan facilities, borrow on the markets or reduce the size of their assets to make future repayments.

Market review: Commodity prices bounce

- Disinflation faced with a rebound in commodity prices;

- T-note yields rise back towards 3.85% ahead of the FOMC;

- Nasdaq index reshuffling sparks profit-taking on FAANG stocks;

- BTP spreads narrow as UE agrees to pay aid tranche to Italy.

Axel Botte's and Aline Goupil-Raguénès' podcast

- Topic of the Week: UK inflation, food prices and Central Banks this week;

- Theme: Impact of TLTRO repayments on markets.

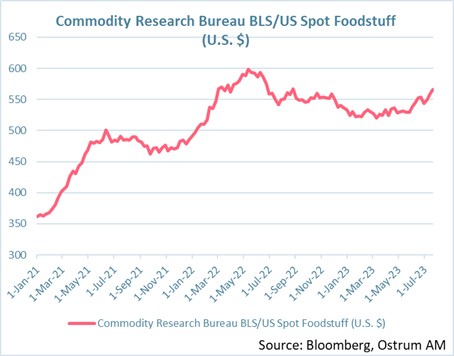

Chart of the week

The price of foodstuffs listed on the markets has shown a sharp rebound since the beginning of June, returning to the levels of September 2022.

Russia pulled out of the agreement allowing wheat exports via the Black Sea, which contributed to a sharp rise in cereal prices. Moreover, the resurgence of the El Nino climatic phenomenon risks disrupting agricultural production in South America, which induces an additional upside risk. India has also intervened to limit its rice exports.

These new tensions could lead to a rise in food prices for consumers within a year.

Figure of the week

18 days: this is the time it takes to sell an old house in the United States given the low stocks available. The deadline was 30 days in January 2023.

MyStratWeekly : Market views and strategy

MyStratWeekly – July 25th 2023