Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to podcast (in French only)

Axel Botte’s and Aline Goupil-Raguénès’ podcast:

- Review of the week – Downgraded U.S. growth outlook, Eurozone inflation forecast.

- Theme – Opportunity to strengthen the international role of the euro.

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Opportunity to strengthen the international role of the euro.

- The chaotic policies of Donald Trump, both in terms of global trade and the questioning of institutions and strategic alliances, are affecting the global economic order and weighing on confidence in the dollar;

- Investors are thus tending to disengage from American assets, which presents an opportunity for Europe;

- For Christine Lagarde, "This is the time for a 'global euro';" for Kristalina Georgieva, the Managing Director of the IMF, it's "a tremendous opportunity" for the euro, and "Strengthening the international role of the euro" was on the agenda of the latest European summit;

- To achieve this, the EU must deepen the single market to increase its productivity, create a union of savings and investments to establish a deep and liquid capital market, and develop the European bond market so that they become the benchmark safe asset and compete with U.S. Treasury bonds.

Decrease in confidence in the dollar.

The dollar has fallen by 10% since the beginning of the year, reflecting reduced confidence among investors due to Donald Trump's chaotic policies.

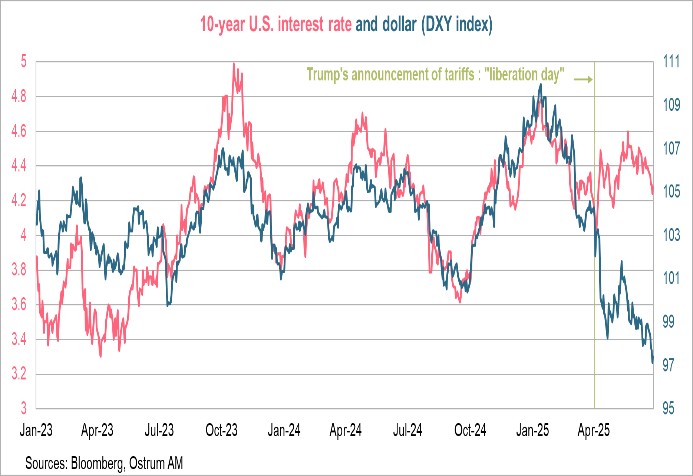

Donald Trump's erratic trade and economic policies have weakened the dollar. Since the beginning of the year, the DXY index (the dollar's exchange rate against a basket of 6 currencies) has fallen by 10.4%. A turning point occurred on April 2nd with "liberation day" and Trump's announcement of a significant increase in tariffs against all his trading partners. Since then, the dollar and interest rates have followed divergent paths, while they are usually well correlated. The DXY index has dropped by 6.4% since April 2nd, while the 10-year U.S. Treasury yield has fluctuated between 4.2% and 4.6%. The decline of the dollar reflects investors' concerns regarding the U.S. economy since Trump's return to the White House. Long-term rates have not decreased due to fears surrounding Trump’s "great and beautiful budget law" and the colossal increase in deficits and public debt it will generate.

Investors are disengaging from American assets.

According to the Financial Times, net outflows from U.S. long-term bond funds reached nearly $11 billion in the second quarter, the largest since early 2020 and the outbreak of the COVID-19 crisis. This contrasts with the previous 12 quarters, during which net inflows averaged $20 billion.

International reserve managers wish to reduce the share of the dollar in favor of the euro, among others.

In the same vein, the latest survey from OMFIF (Official Monetary and Financial Institutions Forum) on global public investors reveals that reserve managers from central banks are looking to gradually disengage from the dollar in favor of other currencies such as the euro and the yuan. The dollar is the only currency for which net demand decreased in 2025, while demand increased for other currencies, particularly the euro: 16% of surveyed managers wish to increase their euro reserves over the next 12 to 24 months, up from 7% in 2024. For the dollar, this percentage has fallen to 5% in 2025, down from 18% in 2024. For 80% of reserve managers, geopolitical risk is one of the top three factors affecting their long-term investment decisions, ahead of inflation, real interest rates, and technological change.

For the moment, there is no credible alternative to the dollar.

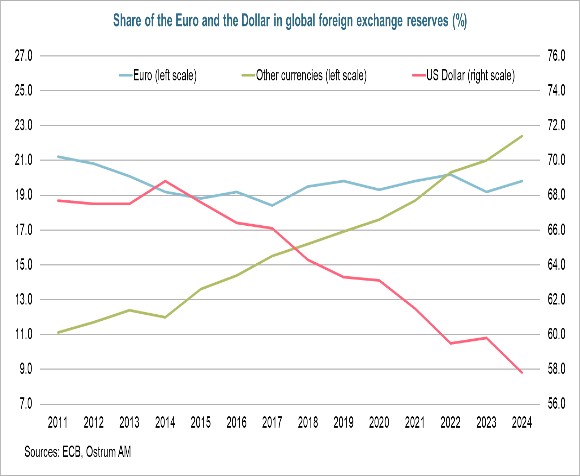

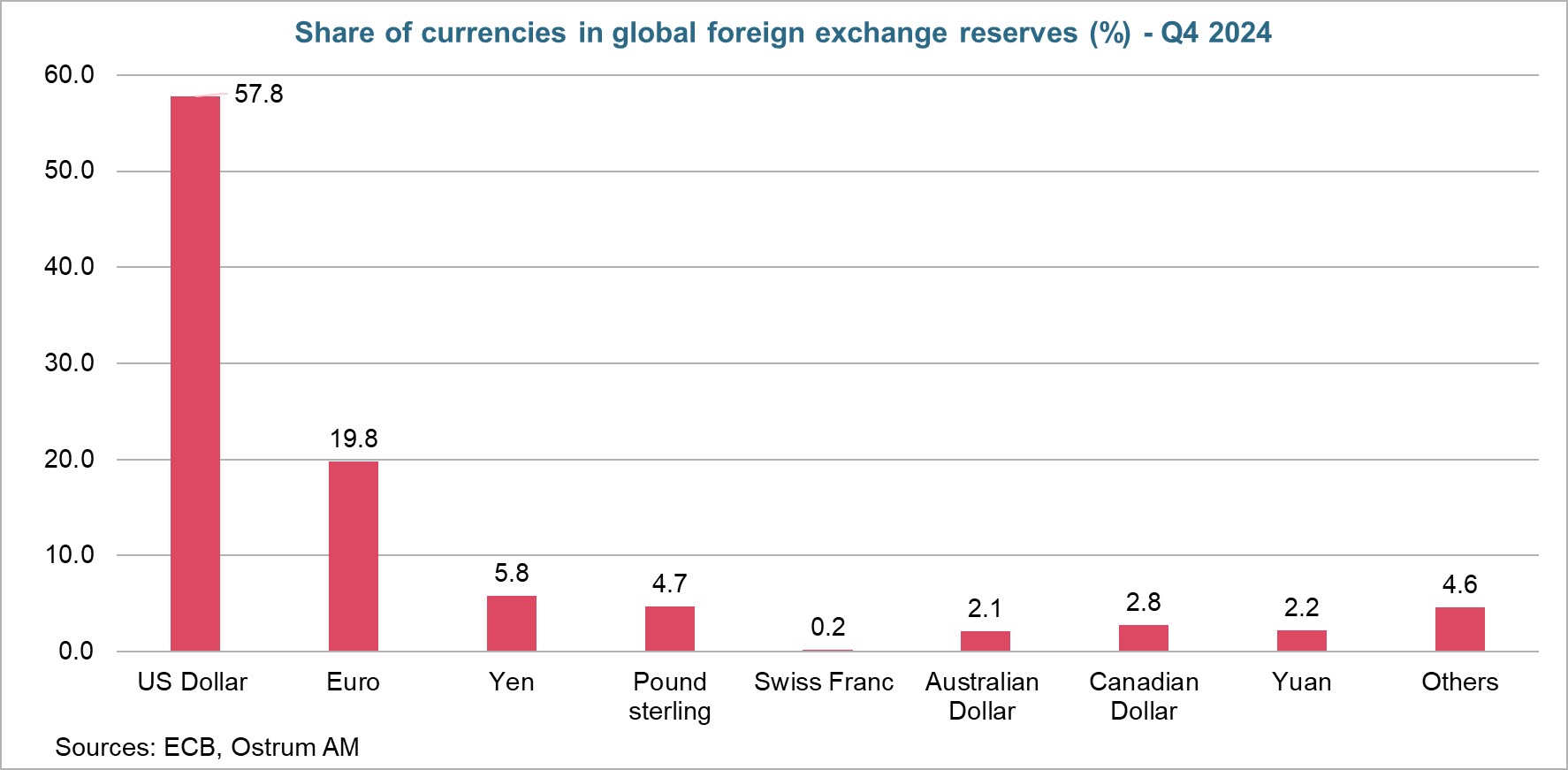

While the share of the dollar in foreign exchange reserves is decreasing, it remains predominant at 58%, compared to 20% for the euro.

While investors tend to disengage from the dollar, they currently do not have any credible alternatives. According to the latest report from the ECB on the international role of the euro, the share of the dollar in reserve currencies has been declining since 2011, but it remains predominant. The greenback represented 58% of international foreign exchange reserves in 2024, down from 68% in 2011. This is the lowest level since 1994. The euro ranks second with 20% of foreign exchange reserves. Its share has remained relatively stable since 2011, without benefiting from the decline of the dollar's share. The shares of the yen and the yuan have increased, representing 5.8% and 2.2% of global foreign exchange reserves, respectively. The share of reserves in non-traditional currencies, such as the Canadian or Australian dollar, has significantly increased since the COVID-19 crisis and the invasion of Ukraine, as these countries exhibit strong economic fundamentals and account for 60% of the global supply of AAA-rated sovereign bonds in 2024.

Central banks favor gold after the dollar, with the euro in third position.

Taking valuation effects into account, gold surpasses the euro and ranks second in foreign exchange reserves.

Taking valuation effects into account, gold ranks second in foreign exchange reserves, behind the dollar and ahead of the euro. According to the ECB, the share of gold is 20% in 2024, compared to 18% for the euro. This reflects strong demand from central banks and a 30% increase in the price of gold per ounce over the year. Central banks hold almost as much gold as they did in 1965 during the Bretton Woods era.

Thus, while central banks are disengaging from the dollar, they are not necessarily favoring the euro, which maintains a relatively stable share in foreign exchange reserves. Instead, they are opting to increase their holdings of gold.

Necessity of reforms to strengthen the international role of the euro.

In a speech delivered on May 26 in Berlin and later featured in an article in the Financial Times, Christine Lagarde highlighted that the euro has all the ingredients to strengthen its international role. However, she emphasized the need for reforms to bolster three fundamental pillars: geopolitical credibility, economic resilience, and legal and institutional integrity.

Strengthening Geopolitical Credibility

The EU can enter into more trade agreements based on a win-win arrangement.

Europe plays a significant role in global trade, which is one of the conditions for becoming a global reference currency. It is the world's largest trading partner: the EU is the primary trading partner for 72 countries, accounting for nearly 40% of global GDP. The euro's share in invoicing currencies is 40%, comparable to that of the dollar and double the euro's share as foreign exchange reserves. A currency that gains importance in commercial invoicing sees its role in the banking sector and as a reserve asset strengthened in a self-reinforcing manner. The increase in demand for this currency enhances its reputation as a store of value and encourages more investors to adopt it.

To strengthen this pillar, the EU can enter into more trade agreements by promoting free trade based on win-win arrangements, in contrast to the current approach of the United States.

In this context, Ursula von der Leyen proposed on June 26 that the EU join the 11 other countries of the CPTPP (Comprehensive and Progressive Agreement for Trans-Pacific Partnership) to form an institution aimed at replacing the WTO, which has shown its limits by failing to contain trade tensions. This would enable free trade with large number of countries based on adherence to common rules.

The ECB aims to facilitate cross-border payments in euros and provides euro swap lines to key trading partners.

The ECB also aims to increase the euro's share in invoicing by facilitating cross-border payments in euros and developing a potential digital euro. Furthermore, the ECB provides swap and repo lines to key trading partners to protect them from euro liquidity shortages abroad and ensure the transmission of its monetary policy. This encourages them to conduct more transactions in euros.

Military alliances increase the share of a currency in a partner country's foreign exchange reserves by 30 percentage points according to certain estimates.

Another very important geopolitical factor is the ability of a country to establish strong military partnerships. In a paper from the NBER (National Bureau of Economic Research) https://www.nber.org/system/files/working_papers/w24145/w24145.pdf, B. Eichengreen, A.J. Mehl, and L. Chitu find that military alliances increase a currency's share in a partner country's foreign exchange reserves by 30 percentage points. The security guarantees provided by the United States to its trading partners have clearly contributed to the dominance of the dollar since World War II. Today, the reduced presence of the United States in NATO and the commitment of EU countries to increase their defense and military expenditures to 5% of their GDP by 2035 support the case for strengthening the euro on the international stage.

Strengthening Economic Resilience

This is the area where the EU needs to be most active, given the extent of the reforms required. Christine Lagarde indicates that to develop the international role of the euro, the EU must have "strong growth to attract investment; deep and liquid capital markets to support large transactions, and a sufficient supply of safe assets."

Deepening the Single Market

Since 2000, U.S. productivity has increased nearly twice as fast as that of the eurozone, and American markets have offered average returns nearly five times higher than those of European markets.

However, as clearly revealed by Mario Draghi's report, the growth of the eurozone is consistently slower than that of the United States, while China is experiencing significant catch-up. This is linked to a more pronounced slowdown in productivity within the EU, due to an innovation gap that is particularly evident in advanced technologies. Since 2000, U.S. productivity has increased nearly twice as fast as that of the eurozone, and American markets have offered average returns nearly five times higher than European markets. Therefore, a deepening of the single market for goods and services is necessary.

Creating a Union of Savings and Investments.

Strong growth alone will not be sufficient to attract foreign capital. The capital market must be deep and liquid. However, it remains highly fragmented within the EU: "60% of households' stock investments go to the markets of their home country, even though there may be better opportunities abroad." The EU needs to "ease regulatory constraints and build a robust capital market union" by creating a union of savings and investments. This would enhance the flow of capital across member states, optimize resource allocation, and ultimately foster economic growth and stability within the eurozone. By creating a more integrated financial environment, the EU can better compete on the global stage and strengthen the role of the euro.

Making EU Sovereign Bonds a Benchmark Safe Asset.

Necessity to develop the EU bond market to have a benchmark safe asset.

Christine Lagarde refers to estimates indicating that the amount of sovereign debt rated at least AA represents over 100% of the GDP of the United States, compared to just under 50% in the eurozone, while the public debt-to-GDP ratio is 124% in the United States and 89% in the eurozone. According to her, joint financing of strategic assets, such as defense, could create more safe assets. In this regard, it seems that she does not emphasize enough the central role that a benchmark safe asset should play in attracting foreign capital and strengthening the international role of the euro.

The end of NextGenerationEU in 2026 creates uncertainty for investors…

European bonds issued by the EU could fulfill this role, but the market, although significantly growing since 2020 with the Next Generation EU and SURE programs, remains limited in size. By the end of 2026, when the Next Generation EU program concludes, the EU is expected to have issued nearly €1 trillion, which is equivalent to the size of the Spanish market. The SAFE program, aimed at financing military expenditures for countries wishing to allocate part of their budget to this purpose, could start as early as 2025 and will end in December 2030. Its size is limited to €150 billion.

... and does not allow them to be included in sovereign bond indices.

Although rated AAA by five rating agencies, including Fitch and Moody’s, European bonds are trading at the same level as Portuguese rates: 2.97%, compared to 2.59% for German rates. This is due to the fact that net issuances of Next Generation EU will end in late 2026, creating uncertainty for investors beyond that date, with repayments concluding in 2058. This is why EU bonds are classified as supranational bonds by ICE and MSCI and are not included in sovereign bond indices, which reduces demand from investors and results in higher yields.

Mario Draghi has recommended continuing to issue safe common assets to finance investments in defense and climate.

To finance the massive public investments needed in the fields of defense and climate, Mario Draghi has recommended continuing to issue safe common assets, but on a more regular basis, modeled after NextGenerationEU. He also suggested postponing the repayments of Next Generation EU to increase the resources available to the European Commission.

Olivier Blanchard and Angel Ubide propose replacing a portion of national bonds with EU bonds.

According to Olivier Blanchard and Angel Ubide, it is necessary to go further by creating a liquid and deep market for EU bonds that can rival the U.S. Treasury market (https://www.piie.com/blogs/realtime-economics/2025/now-time-eurobonds-specific-proposal). To achieve this, the size of the EU bond market must be significantly increased. The rise in issuances related to financing military expenditures would not be sufficient, as it would only increase the market size by 1% of the EU's GDP per year.

The authors propose replacing a portion of the stock of national bonds with EU bonds, which would be considered "senior." They suggest exchanging national bonds for "blue bonds" up to 25% of GDP, amounting to €5 trillion, in order to ensure sufficient liquidity without creating safety concerns.

Institutional and Legal Integrity

Investor confidence in a reserve currency depends on the institutions and policies that support it. Christine Lagarde highlights the strengths of the EU in this regard: adherence to the rule of law and the independence of institutions, such as the ECB. This stands in contrast to the current pressures exerted by Donald Trump on the Fed and the disregard for certain laws in the United States.

Christine Lagarde proposes qualified majority voting in certain key areas.

To avoid blocking key decisions for the EU, Christine Lagarde suggests reforming the institutional framework by employing qualified majority voting in certain areas so that a single veto does not threaten the interests of the other 26 member states. "This would enable us to act decisively as a united Europe. We would then be in a much stronger position to defend and uphold our values and, consequently, to defend and maintain global confidence in our currency."

Conclusion

The decline in confidence in the dollar linked to Donald Trump's erratic policies presents an opportunity to strengthen the euro on the international stage. To achieve this, the EU must deepen the single market to enhance productivity, create a union of savings and investments to establish a deep and liquid capital market, and make European bonds the benchmark safe asset to compete with U.S. Treasury bonds.

Aline Goupil-Raguénès

Chart of the week

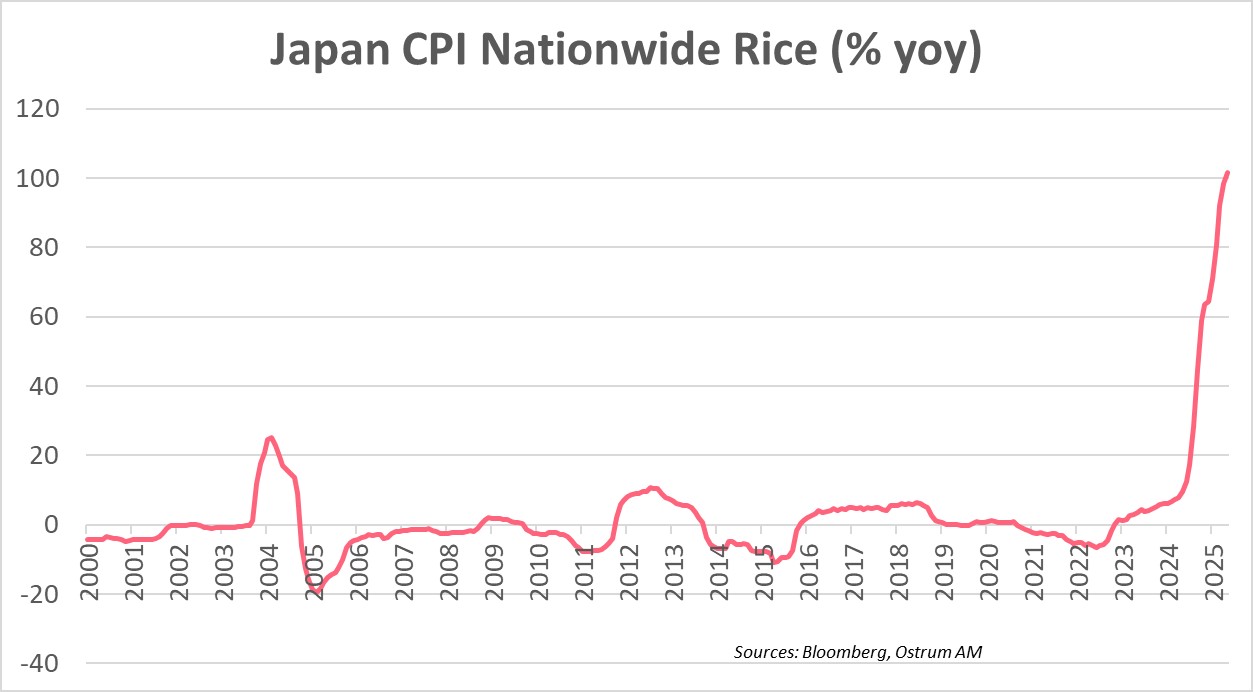

The price of rice in Japan more than doubled in May, rising by 101.7%, marking the largest increase in 50 years. This is linked to a shortage of the grain due to poor harvests in 2023 and high consumption driven by tourism, favored by the depreciation of the yen. Rice is a hot button issue in Japan, which even cost the Agriculture Minister his job after he boasted about distributing rice for free to his supporters.

However, the rice crisis seems to be easing thanks to American and South Korean rice, which should help lower prices. In April, Japan imported South Korean rice for the first time since 1999! The rice crisis may also impact the elections scheduled for July.

Figure of the week

11

Net outflows from U.S. long-term bond funds reached nearly $11 billion in the second quarter, the largest since early 2020 and the outbreak of the COVID-19 crisis. This contrasts with the previous 12 quarters during which net inflows averaged $20 billion.

Market review: Markets make new highs ahead of mid-year close

- U.S. GDP growth revised down to -0.5 % in 1Q 2025;

- Fed: Bowman joins Waller in signaling potential rate cut as early as July;

- Yield curve steepening remains a key trend in bond markets;

- Risky assets react favorably to hopes for Fed easing.

Financial markets continue to overlook the fragility of the geopolitical landscape and the economic challenges facing the United States, bolstered by hopes for a more accommodative Fed. The U.S. strikes in Iran quickly gave way to a phase of relaxation in the financial markets. Comments from Fed officials (Bowman, Waller), suggesting a potential rate cut as early as July, have also supported risk assets alongside curve flattening. The T-note is trading below 4.30% as investors await the outcome of trade and budget negotiations. Credit (sovereign and corporate) is holding up well despite the increasingly apparent economic downturn in the U.S.

US. GDP growth has been revised to -0.5% for the first quarter, with the threat of tariffs causing a sharp halt in growth that had previously been at 2.8% in the second half of 2024. The notable slowdown in service spending reflects households making adjustments ahead of the tariff announcements in April. The confidence shock experienced by consumers is now evident in the relentless rise of unemployment, with the number of beneficiaries approaching 2 million and the duration of unemployment increasing. Concurrently, the housing sector seems to be at an inflection point, with home prices (CoreLogic, FHFA) declining since March. This will likely impact demand for durable goods and employment in construction, which continues to rise despite falling housing starts and a restrictive immigration policy. Growth is expected to remain below potential. In the Eurozone, German IFO and PMI indicators signal an improvement in activity, contrasting with stagnation in France. Eurozone inflation is projected to tick up slightly according to early June data, yet this will not change the ECB's risk assessment.

The Fed’s monetary scenario is refining. Comments from Michelle Bowman have reinforced those of Christopher Waller, suggesting that a rate cut in July is not off the table. The SLR reform championed by Bowman and passed 7-2 by the Board seems aimed at capping bond yields. Markets are taking note of this shift in tone, with the 10-year yield plunging below 4.30%. The challenge to a prolonged status quo on rates currently favors a flattening dynamic. This flattening is echoed in Germany, where the revision of the borrowing program for Q3 (an additional €19 billion in borrowing, including €15 billion in bonds) also heightens pressure on long maturities. The Bund trades between 2.50% and 2.60%, aligning with our targets for the end of Q3 and the year. While the Bund is at its price, rumors of a new 50-year bond weigh on the 30-year yield. Short-term index-linked bonds are experiencing a pullback in the wake of falling oil prices following the ceasefire in Iran. Meanwhile, credit remains a source of outperformance, as the convergence of Italian and Greek spreads towards the Franco-Belgian pair continues. The 10-year BTP is trading under 90 bps. Investment-grade credit spreads remain stable at 85 bps, outperforming high yield. The fundraising for credit remains highly favorable as the end of the semester approaches. Despite a heavier speculative debt market, the iTraxx Crossover has tightened by 13 bps over the week to 291 bps.

U.S. equity markets are reaching new highs, once again driven by technology stocks and potentially supported by a weaker dollar. The greenback has retreated by 1.3%, allowing the euro to temporarily surpass the $1.17 mark. It remains to be seen whether the euro's appreciation will prompt a shift in the ECB's monetary policy in the coming months.

Axel Botte

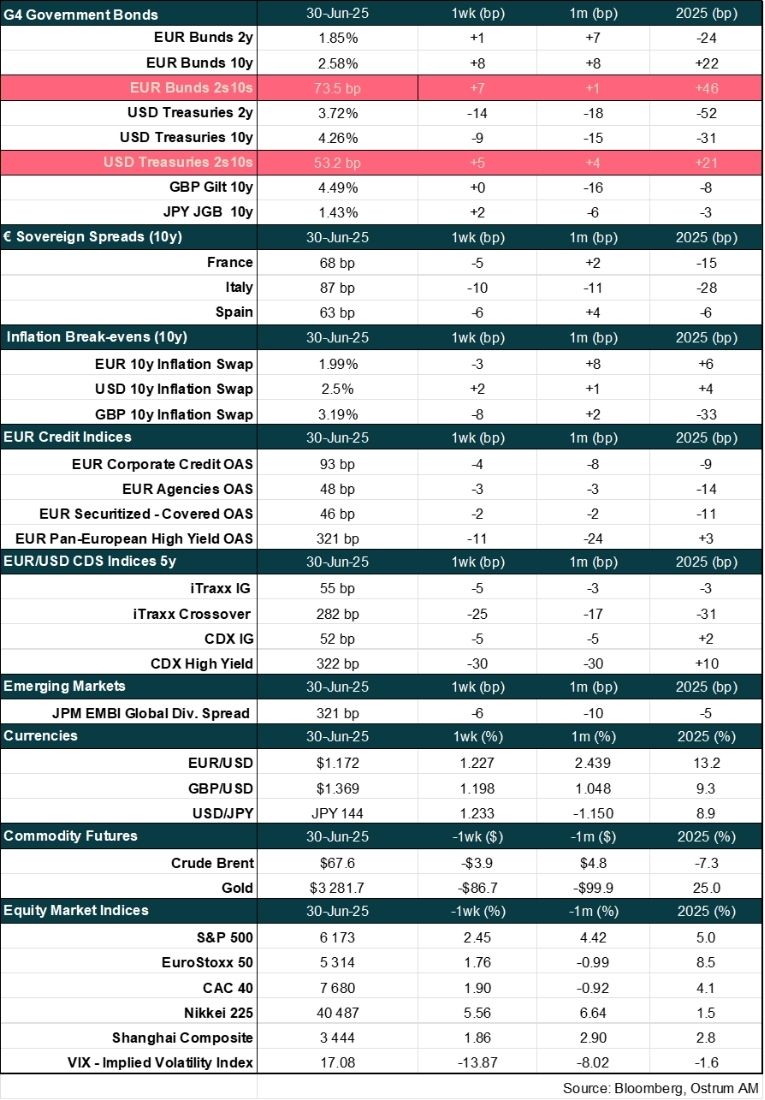

Main market indicators