Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Stéphane Déo, Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Topic of the week: The Bank of Japan at a turning point

- The BoJ created a surprise by widening the fluctuation band framing the 10-year rate;

- This generated expectations of monetary policy tightening;

- For the moment, the BoJ is buying time, leaving the heavy task to the next governor;

- More flexibility should be given to the 10-year rate in April;

- Wage growth remains too moderate to anticipate a rapid withdrawal of the negative interest rate policy;

- The yen will be the big winner from the normalization of monetary policy.

Market review: Lost in translation

- Central banks losing control of markets;

- Risky assets ignore multiple rate hikes;

- Robust US job creation at +517k in January;

- Nasdaq up 16% YTD.

Stéphane Déo's podcast

- Are France’s budget and trade deficits sustainable?

- According to INSEE, the rise in consumer prices accelerated slightly in France last month, while inflation in the euro zone has been slowing for two months. Is France exposed to a continued rise in inflation with a delayed effect?

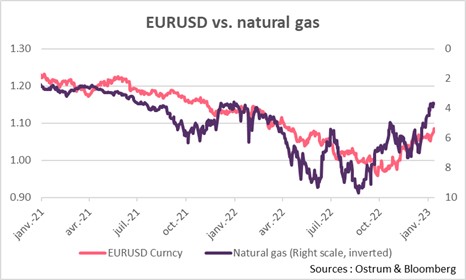

Chart of the week

The Euro and natural gas prices continue to move in sync as they have since 2021 and throughout the energy crisis. The increase in the price of gas, but also of other energies, has weighed on European growth and thus contributed to depreciate the euro.

Conversely, the fading energy crisis is helping the Euro to recover. However, we must keep in mind the proportions: natural gas, at the time of writing, is priced at almost 60 EUR/MWh, a huge decrease compared to a peak of over 300 reached in August. This remains well above the 2020 level or earlier, closer to 20.

Figure of the week

Billions of dollars invested in the renewable in 2022, up 17% from 2021 ($423 billion), including solar ($308 billion, up 36% from 2021).

MyStratWeekly : Market views and strategy

Download MyStratWeekly – February 7th 2023Podcast slides (in French only)

Download the podcast slides (in French only)