Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Stéphane Déo, Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: Greece: the comeback!

- Greece’s rating continues to improve. This is anything but a surprise;

- The trajectory owes much to cyclical aspects and in particular to the rebound from the crisis of the last decade;

- The legacy is heavy, but the debt trajectory is one of the most ambitious and therefore justifies the improvement of the rating;

- There are also developments, particularly on the ESG front, that suggest that Greece has changed dramatically.

Market review: Higher inflation weighs on markets

- Markets reeling from accelerating US inflation;

- They anticipate higher key rates for longer;

- Strong tensions on sovereign yields, especially on the short end;

- Equity markets record their worst week of the year.ally.

Zouhoure Bousbih's podcast

- What to remember from February 20 week;

- Is the spike in food prices behind us?

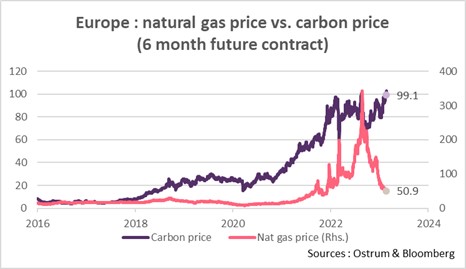

Chart of the week

The price of carbon emissions (improperly called “pollution rights”) exceeded €100 per tonne for the first time last week.

The good news is that this price increase is a strong incentive to decarbonize the economy. It is becoming more and more expensive to use fossil fuels. Good news in the long term.

The bad news is that this increase is partly due to the fact that the gas shortage has led to a significant use of coal and therefore to significant purchases on carbon emissions. Bad news in the short term.

Figure of the week

The word “inflation” is used 94 times in the Fed’s minutes.

The word “recession” 4 times.

MyStratWeekly : Market views and strategy

MyStratWeekly – February 28th 2023Podcast slides (in French only)

Download the podcast slides (in French only)