Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Summary

Listen to Axel Botte's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: US equities at the crossroads?

- S&P 500 is down 5% quarter-to-date after a monster 28% rally since Waller signaled Fed cuts last fall;

- Powell’s second thoughts on inflation could spell trouble for growth stocks that have led the market higher;

- Markets may require new catalysts to resume rising as most forecasts point to a flat equity market until the end of the year;

- M&A activity and share buybacks will continue to underpin valuations;

- Individual investors look fully invested whilst high rates should keep tons of money on the sidelines;

- Positioning, excessive optimism and the lack of a private equity bid could pose downside risk.

Market review: Inflation or the pebble in the shoe

- Core PCE inflation at 2.8% tests Powell's confidence in disinflation;

- Weaker-than-expected growth in the United States;

- T-note yields test 4.70% ahead of the FOMC and Treasury refinancing;

- Risk assets hold up thanks to buoyant earnings releases.

Axel Botte's podcast

- Topic of the week: Market news, FOMC between status quo on rates and QT reduction, 1T GDP;

- Theme: US equities at the crossroads?

Chart of the week

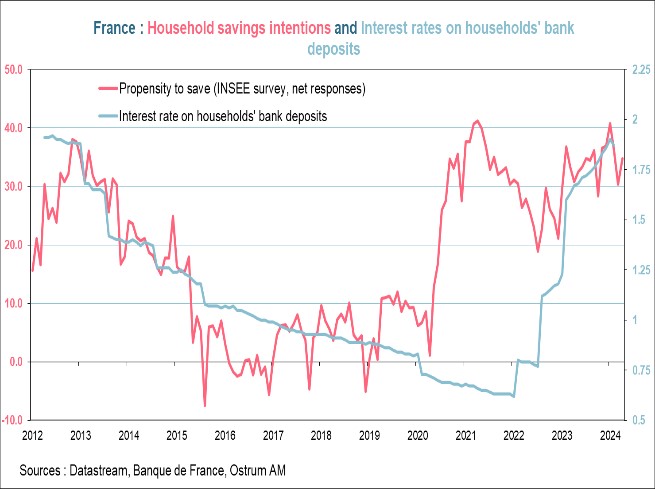

The French savings rate is among the highest in developed countries. The scenario of gradual recovery is partly based on the assumption of a reduction in household savings in France. The INSEE survey reveals a propensity to save close to record highs.

The increase in ECB rates since 2022 has strengthened the trend towards precautionary savings that emerged during the COVID crisis. The interest rate on bank deposits averages 1.87%, with many more lucrative alternatives such as money market funds.

Figure of the week

20%: the forecasted share of electric vehicles in global car sales in 2024 according to the EIA.

MyStratWeekly : Market views and strategy

Download MyStratWeekly – April 30th 2024