Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

The Fed backpedals

Central Bank communication adjusts to the reality of strong growth in the United States and a more uncertain disinflation trajectory. A Fed funds rate cut in March has been ruled out even if a cutback in the pace of QT is under study. Employment is upbeat whilst wages remain inconsistent with the 2 % inflation objective, especially as the prices of goods are now affected by a rebound in energy and the rise in freight prices. In the Eurozone, it is also the question of salaries which dominates the debates within the ECB. The historically low level of unemployment is fueling wage demands in a context of weak productivity gains. Domestic inflation thus persists despite flat growth for 5 quarters. The warming of global manufacturing activity nevertheless portends a recovery during the year.

Despite the favorable economic backdrop, the Fed may opt to lower rates 4 times in 2024. The ECB will follow with 3 25-bp cuts. Cutting interest rates in parallel with quantitative tightening will, however, be difficult. The ECB is navigating through troubled waters given the heterogeneity of the euro area. As for Japan, the exit from negative rates remains hypothetical, hence the weakness of the yen.

US bond yields are likely to plateau as long as the Fed continues to project monetary relief. In the euro area, the sovereign primary market activity since the start of the year was well absorbed. Spreads are narrowing, perhaps beyond what fundamentals would suggest. Credit benefits from low spread volatility. High yield spreads continue to rally. European stocks lack a catalyst capable of reviving international flows. The adjustment in margins is nevertheless more than offset by an increase in valuation multiples.

Economic Views

Three themes for the markets

-

Monetary policy

Central bankers have moderated investors' expectations of aggressive rate cuts. Jerome Powell ruled out cutting Fed Funds rates in March. The ECB said wages were an important catalyst for the zone's inflation outlook, pushing against expectations of imminent rate cuts. China adopted a turning point in its monetary policy by announcing a surprise 50-bp reduction in the required reserve ratio, to 10% for large banks.

-

Inflation

Inflation, in particular core inflation, persists despite monetary heavy lifting from the major central banks. In the United States, inflation decelerated to 3.1% in January. Core inflation has stabilized at 3.9% since October, due to the persistent rise in rents. In the euro area, inflation slowed to 2.8%, but service inflation stabilized at a high level reflecting wage pressures. Conversely, in China, inflation was -0.8% for the month of January, as pork prices kept going down.

-

Growth

The US economy is accelerating again at the start of the year. The euro area is escaping recession, but the European Commission lowered its growth forecast for 2024 to 0.8% from 1.2% in October. Japan and the United Kingdom are in recession. The global manufacturing sector is showing signs of recovery at the start of the year, particularly in the United States. In China, activity is stabilizing, thanks to the service sector and a rebound in exports.

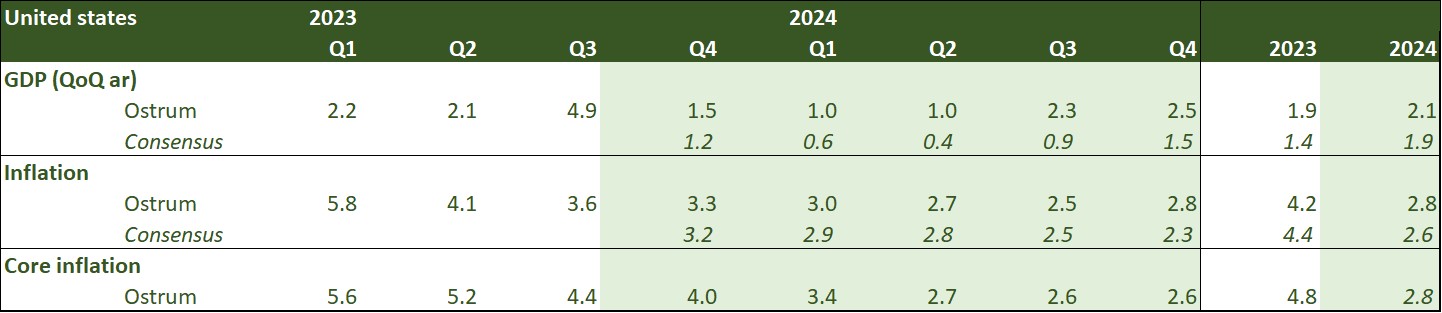

Key macroeconomic signposts : United States

- US growth remained strong at the end of the year with 3.3% growth in the 4th quarter. Consumption and public spending support demand. Investment (equipment, R&D) is up slightly. GDP expansion in the 1st quarter should be around 2%.

- The federal deficit remains under discussion but is expected to be around $1,600 billion in 2024. There is a risk of a government shutdown at the beginning of March. The Republicans killed the budget bill in the Senate which did not provide sufficient funds for securing the Mexican border. Immigration will be the main issue of the November Presidential election.

- The risks of financial crisis appear contained. Household balance sheets remain healthy. Be careful, however, with the poorly regulated non-banking sector. The NYCB episode is a ripple from the Signature Bank event and not a harbinger of a banking crisis.

- The unemployment rate remains below its equilibrium level (4-4.5%). The Fed would probably “like” to see unemployment rise towards 4.5% to ease wage pressures. The increase in the active population is, however, a boon for the economy.

- Disinflation continues. Underlying inflation should decrease towards 2.4% at the end of 2024. Housing and energy are two key items for inflation, but the Fed will focus on the PCE deflator which has a lower weight on housing. The Fed will also facilitate the refinancing of the Treasury.

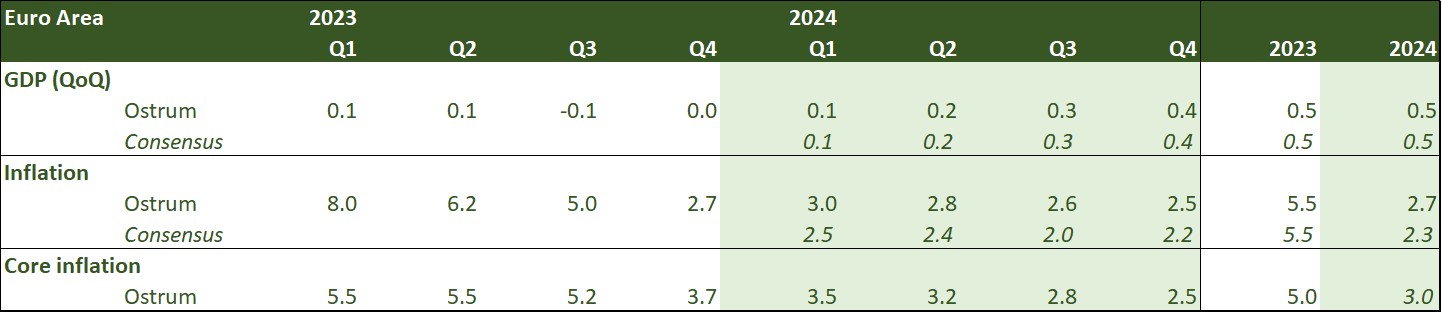

Key macroeconomic signposts : Euro area

- Growth remained sluggish in the Eurozone in the 4th quarter and was only 0.5% on average in 2023. Domestic demand is affected by the strong monetary tightening of the ECB and high inflation while foreign trade suffers of weak global demand.

- Surveys carried out among business leaders reveal an improvement in activity indices since October. The composite PMI index from the global S&P survey nevertheless remains below 50, signaling a contraction in activity at a more moderate pace.

- The improvement in surveys comes from peripheral countries, Spain and Italy in particular, thanks to notable increases in order books. France, on the other hand, has not found a source of stimulus and Germany remains penalized by the consequences of the energy shock and its strong past dependence on Russian energy, as well as by China's disappointing growth which is weighing on exports.

- A slow recovery should begin in 2024 and more particularly in the 2nd half of the year as monetary policy turns less restrictive, real incomes rise and world trade recovers. Fiscal policy will not be supportive.

- Inflation slowed significantly compared to the peak of 10.6% in October 2022 to stand at 2.8% in January 2024. This was mainly linked to the negative contribution of energy prices. The continuation of disinflation will be conditioned by the evolution of domestic prices and in particular those of services which depend more on the evolution of wages.

- In a context of low productivity growth, company margins have an essential role to play in absorbing the increase in unit labor costs.

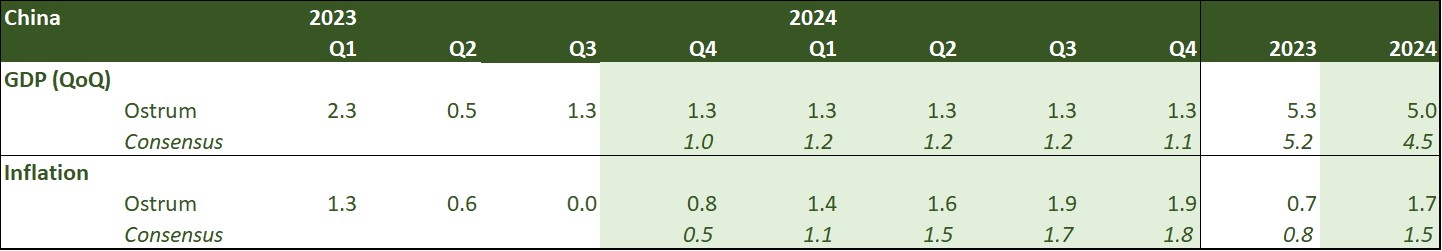

Key macroeconomic signposts : China

- Will the Year of the Dragon be that of the return of China?

- International investors remain cautious about Chinese equity markets due to political volatility.

- The Chinese provinces have published their growth targets for 2024, the weighted average is around 5% as in 2023.

- The official target will be announced in March, during the CCP meeting.

- Inflation (-0.8% in January) has probably reached a low point, linked to the distortions of the Chinese New Year.

- The PBoC made a turning point in its monetary policy by announcing by surprise a 50-bp reduction in the required reserve rates to 10% for large and 8% for small banks.

- Furthermore, the PBoC continues to inject liquidity to reduce liquidity risk and support the real estate sector.

- Thus, recent monetary stimulus measures and prospects of further measures could mark a turning point in investor sentiment as regards Chinese financial markets.

- Investments in industry to the detriment of real estate remain robust, providing support for Chinese growth.

- The real estate sector is expected to stabilize, with social real estate absorbing excess capacity in the sector.

- Disinflationary pressures should subside, given the strengthening of measures to support activity.

- In conclusion, we have not changed our forecasts which already included more proactive economic policies for 2024.

Monetary Policy

The Fed and the ECB facing continued pressure on domestic prices

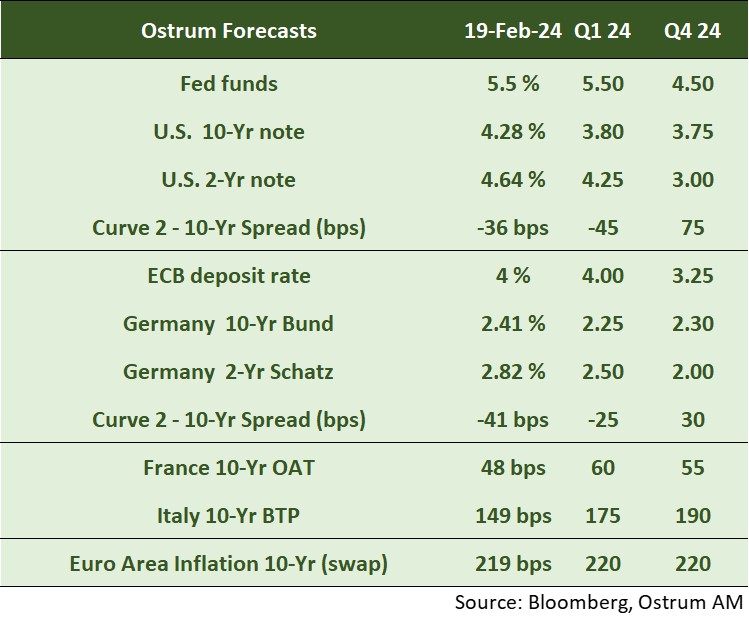

- The Fed is trying to temper expectations of rapid rate cuts…

After generating expectations of strong and rapid rate cuts from the Fed during the December 13 meeting, Jerome Powell was forced to curb investors' enthusiasm. At the January 31 meeting, he ruled out a rate cut as early as March, as the Fed needs to have greater confidence that inflation is moderating sustainably. On the other hand, the Central Bank should probably announce in March the terms of a reduction in the rate of contraction of its balance sheet (QT). The Fed anticipates 3 rate cuts in 2024. We expect the 1st in June, followed by 3 others. - … just like the ECB which calls for caution

The ECB left its rates unchanged for the third consecutive time in January. Christine Lagarde indicated that there was a consensus within the Council of Governors that it was premature to discuss lowering key rates. The disinflation process had to continue in order to strengthen the ECB's confidence in the return of inflation towards 2% in medium term. Christine Lagarde insisted on the importance of data concerning in particular wages and the results of wage negotiations which will be held in the 1st quarter in the Eurozone. The ECB is not expected to cut rates before June. We anticipate 3 rate cuts over the year. At the same time, the contraction of the balance sheet will accelerate from the 2nd half of the year, with the Central Bank reinvesting only half of the PEPP reinvestments from July (at the rate of 7.5 billion euros on average per month) before ending them at the end of 2024.

Market views

Asset classes

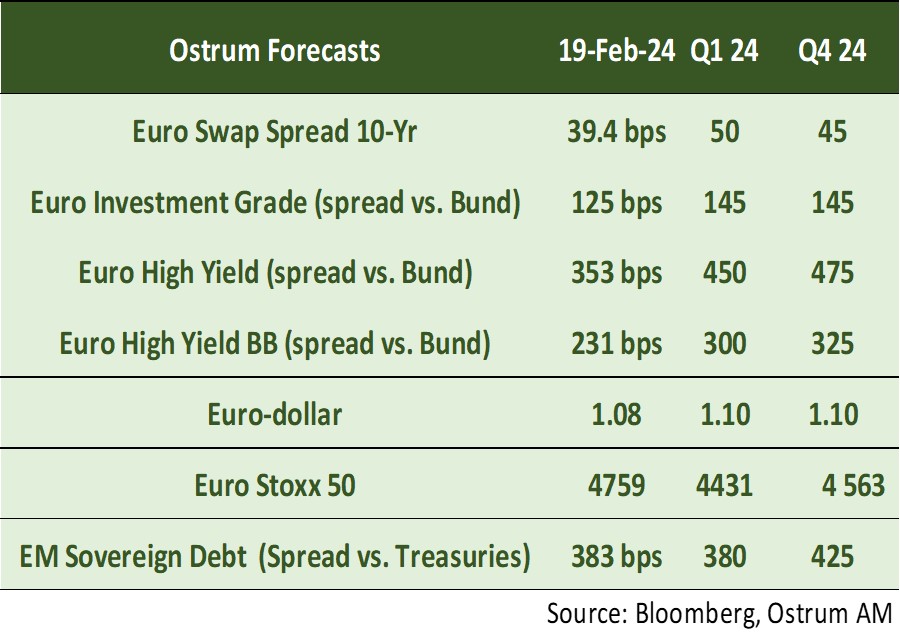

- US rates: the return of the inflation theme and less accommodative Fedspeak are putting upward pressure on long yields. The actual start of the monetary cycle should nevertheless bring the 10-year yield below 4%.

- European rates: the Bund (2.40%) rose slightly beyond our short-term yield targets. The end-of-year target is 2.30%.

- Sovereign spreads: spreads have tightened sharply with the rise in risk-free yields. Italy and France are trading below their equilibrium levels, but offer relative value against swap.

- Eurozone inflation: breakeven inflation rates are in line with our targets.

- Euro credit: swap spreads have continued to tighten through our target levels, as the shortage of collateral has been reduced with the quantitative tightening. IG credit benefits from the low spread volatility compared to bond markets.

- Change: the euro has depreciated towards $ 1.07. The contraction of the ECB's balance sheet may allow a rebound towards $ 1.10.

- Equities: stock markets remain well oriented in 2024 despite expectations of falling margins. The increase in valuation multiples should, however, offset the pressure on earnings.

- Emerging debt: emerging market bonds tightened to around 380 bps, i.e. our end-of-quarter targets.

Ostrum Perspectives February 2024

Download Ostrum Perspectives February 2024