At a time when the issue of preserving forests to combat global warming is central to the COP28 debates, President Lula marks a break with his predecessor and calls on world leaders to "take concrete action and respect climate agreements". In a country where agribusiness has destroyed almost 50% of the vegetation cover, one of the main challenges of the new presidential term is to increase the agricultural area without cutting down trees. The date has been set for the COP30 in Belem. At the same time, the country's commitment to fiscal and budgetary reform is expected to put public finances on a sounder footing as it embarks on a major structural macroeconomic turnaround. Everything is in place to attract international investors.

Strategist viewpoint

Investors have become more optimistic about Brazil. Rating agency Fitch has upgraded the external sovereign rating to "BB", two notches below the "Investment grade" status the country lost in 2016, during its worst recession since 1980.

An agricultural superpower

Brazil is a major producer and exporter of agricultural raw materials, which have enabled it to record a significant trade surplus. China accounts for 39% of its agricultural exports and 70% of its soybean exports.

Its main asset is its central bank

By raising its Selic rate from March 2021 and as in 2013, before the Fed, inflation rapidly decelerated from 12% in April to 4.8% in September, right on target. Core inflation, at 5.5% in October, slowed faster than in other money markets.

Fiscal consolidation and tax reform underway

President Lula is keen to turn the page on the 2014-2016 period once and for all. His new Finance Minister, Fernando Haddad, has proposed two major reforms that should put Brazil back on track for sustainable growth: simplification of the tax system and control of public spending.

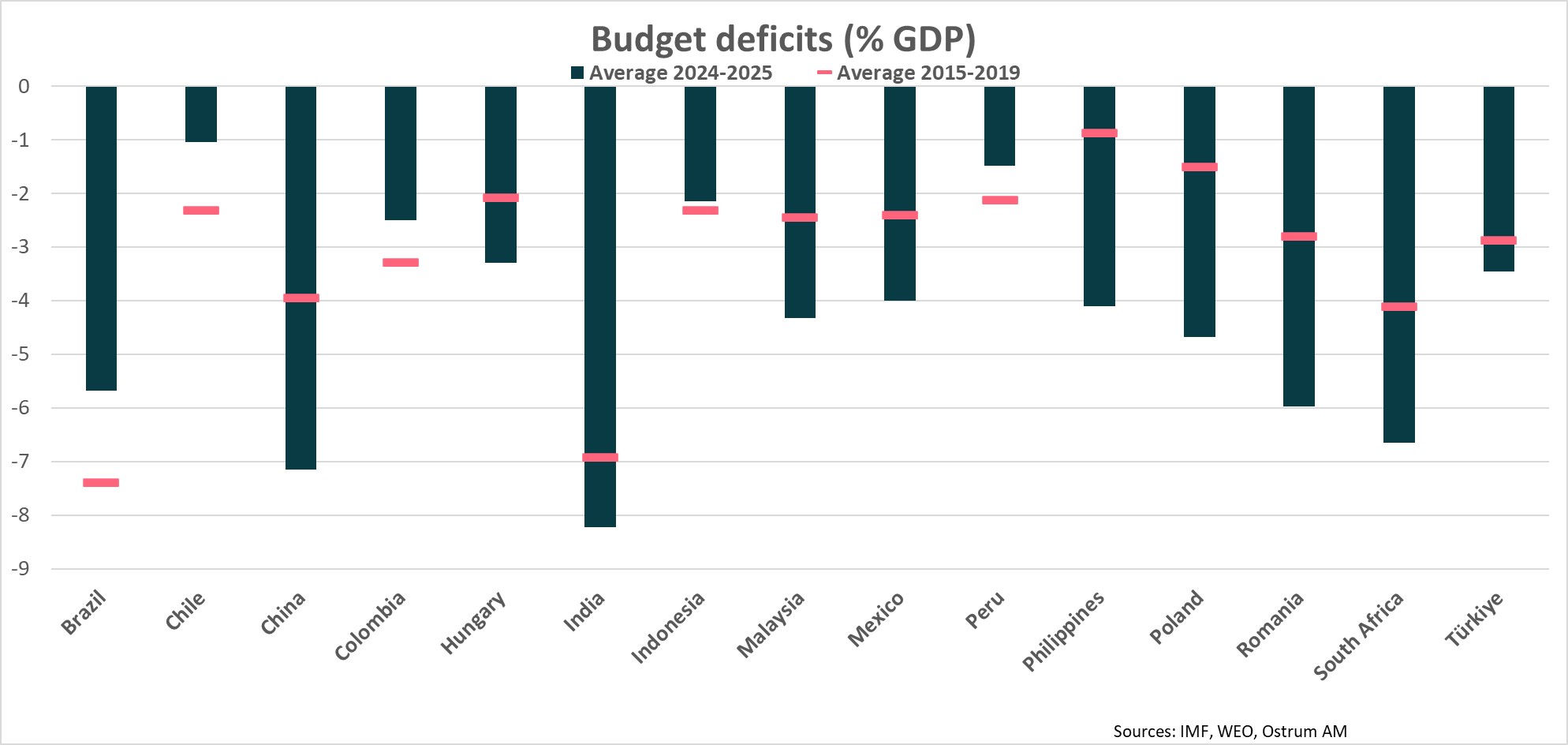

The budget deficit should be reduced by 2024-2025, compared with its pre-Covid 5-year average.

A determination to improve its "green" profile

Brazil's "green" profile is poor compared to other emerging countries, due to the deforestation of the Amazon rainforest by the former government. This is a page that Brazil wishes to turn once and for all, by developing hydrogen and other low-emission solutions; renewable energies already account for 80% of the electricity produced in Brazil. However, Brazil will join OPEC+ in 2024, further demonstrating its economic dependence on fossil fuels.

Portfolio Manager viewpoint

At the opening of COP28, President Lula reaffirmed his desire to see Brazil play a major role in the energy transition by reducing its carbon emissions and developing solar and wind energy.

A country highly exposed to climate change

This year, Brazil suffered devastating drought in the Amazon rainforest and torrential rains in the south of the country. COP30 will be held in Brazil in 2025, and a campaign to reduce deforestation and accelerate the Just Transition has already been launched.

First green bond in 2023

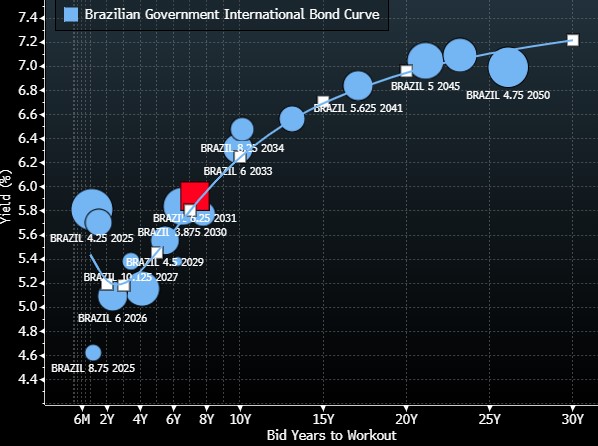

Against this backdrop, Brazil issued its first "green" bond for USD2 billion and a yield of 6.5%, which was met with great success among investors. More than half of the proceeds will be used to finance green projects, with social projects accounting for around 40%. This new bond (in red) is part of Brazil's USD sovereign yield curve.

Growth also sustained by investment flows into green projects

Growth surprised in Brazil in 2023, driven by oil and food exports, enabling current accounts to recover significantly. The Brazilian Real appreciated this year, benefiting from very positive real rates, robust investment flows and a credible central bank. Expected investments in renewable energies and projects to preserve the Amazon rainforest should continue to support Brazil's growth in 2024.

Brazil: Zero deforestation target for the planet’s lungs

Download the insight