Each month we share the conclusions from the monthly strategy investment committee which provides a summary of Ostrum’s views on the economy, strategy and markets.

The CIO Letter

Santa disguised as Powell

We have rarely seen such a downward acceleration in bond yields except in times of financial crises. Jerome Powell's message, at the FOMC on December 13, seemed to validate the rate cut expectations built in markets. However, the economic situation in the United States remains solid and the Fed’s own forecasts confirm this. Political shenanigans in Congress may have weighed in the balance as tensions reappeared on the US repo market as a warning signal ahead of the Treasury refinancing next year. Disinflation alone cannot explain such easing in 10-year yields which dipped below the 4% threshold. In the euro area, the time is still for monetary tightening despite sluggish growth, as productivity sags, raising fears of stagflation. The PEPP will be reduced by €7.5 billion per month from next July. This may delay the ECB's ability to act on rates even though the Fed has clearly opened the door to a cycle of monetary relief.

The prospect of rate cuts has sent risky asset markets soaring. The fall in the dollar, a barometer of risk aversion, fueled this widespread rebound. Equities, particularly parts of the markets that have underperformed since the start of 2023, have rebounded strongly. Investors seem to be repositioning on Europe and small cap stocks. The T-note yield has plunged below 4% while the Bund is close to 2%. Sovereign spreads, particularly Italian BTPs, also welcomed the announcement of a progressive cutback in PEPP holdings. Credit is also contributing to the market rally, particularly high yield, whose tightening since the October high point exceeds 100 bp. Let’s hope that the year 2024 will not invalidate the expectations currently built in the financial markets.

Economic Views

Three themes for the markets

-

Monetary policy

In December, the Fed adopted an accommodative posture with a view to 2024. The FOMC plans three rate cuts but Jerome Powell's speech sounds like a validation of expectations of monetary relief. Disinflation will likely drive policy rates. In the euro area, the reduction in the PEPP will start in H2 2024 to the tune of €7.5 billion per month. Rate cuts are likely in 2024 in parallel with falling inflation. The BoE is having difficulty resisting market pressure demanding monetary relief.

-

Inflation

US inflation moderated to 3.1% in November. Goods inflation has returned to zero, but the prices of services, particularly housing, remain incompatible with a sustainable return of inflation to 2%. In the euro area, inflation fell to 2.4% in November. Energy prices contribute greatly to disinflation. Core inflation is still at 3.6%. However, government measures to cap the cost of energy will suffer a blow in 2024. In China, industrial overcapacity and falling food prices are keeping inflation close to 0%.

-

Growth

US growth will slow to 1.4% in Q4 after a solid Q3 (+5.2%). Fiscal support is expected to be reduced next year but a soft landing remains the central scenario. Stagnation continues in the euro area after a contraction of 0.1% in Q3. Tighter financial conditions and the lack of fiscal stimulus are weighing on European domestic demand. In China, the government is favoring manufacturing as the main growth driver for 2024 to the detriment of domestic demand for 2024.

Key macroeconomic signposts : United States

The US economy is expected to slow down until Q2 2024. On the other hand, recession is not part of our central scenario. Consumption in the 4th quarter is expected to decelerate compared to the 3rd quarter. Inventories will reduce growth by almost 1 pp. The external balance is a little less favorable in the short term. On the other hand, investment should improve.

The federal deficit will be reduced next year with higher household taxation in Q2 in particular. The rise in the markets generates taxable capital gains. However, there is no proactive reduction of the deficit. The increase in household taxes should temporarily weigh on consumption.

The risks of financial crisis appear contained. Household balance sheets remain healthy. Be careful, however, with the poorly regulated non-banking sector.

The unemployment rate is expected to rise as job creation moderates. The Fed would probably “like” to see unemployment rise towards 4.5% to alleviate internal price pressures. The increase in the active population is, however, beneficial.

Disinflation continues. Underlying inflation should decrease towards 2.6% at the end of 2024. Housing costs remain key for monetary policy. Potential inflation shocks for 2024 are a more restrictive OPEC policy (stronger reduction in quotas in Q1), climate effect on food prices.

Key macroeconomic signposts : Euro area

Growth is sluggish in the Euro zone. Internal demand is affected by the increasingly significant impact of the ECB's strong monetary tightening and the continued high inflation while foreign trade is suffering from weak global demand.

The surveys carried out among business leaders do not show any improvement and do not allow us to rule out a slight contraction in GDP in Q4 (after -0.1% in Q3) and thus a technical recession in the 2nd half of 2023.

If the unemployment rate remains at historic lows (6.5% in October) in the Euro zone, job creation is slowing and the unemployment rate is starting to increase in certain countries. The employment component of surveys carried out among business leaders has clearly declined. Faced with the drop in their orders, business leaders are becoming more cautious when it comes to hiring.

Wages are expected to slow more slowly than inflation, which will partially offset the impact of weaker labor market dynamics. Negotiated salaries still increased by 4.7% in Q3 over one year compared to 4.4% in Q2.

Business investment should nevertheless continue to benefit from NextGeneration EU funds and the need to invest in renewable energy.

A slow recovery should begin in 2024 and more particularly in the 2nd half of the year due to a less significant impact of the monetary tightening carried out by the ECB, an increase in real incomes and a strengthening of world trade.

Inflation will slow but still remain high. It will no longer benefit from the strong negative contribution of energy, governments will stop measures aimed at containing the rise in energy prices and wages should moderate only slowly.

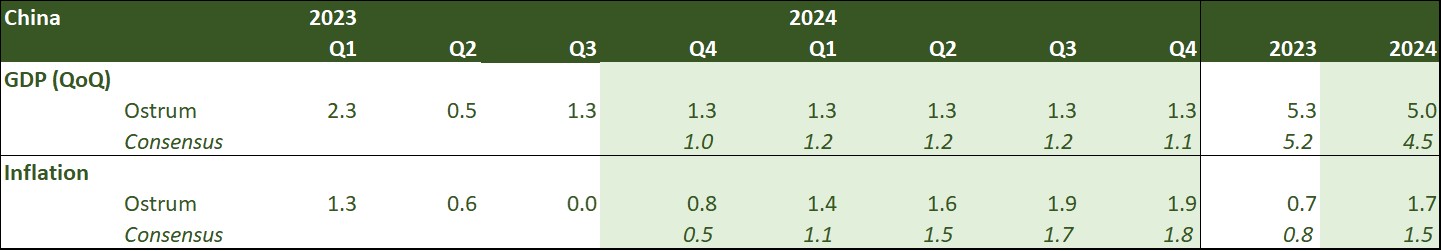

Key macroeconomic signposts : China

We were more optimistic than the consensus on Chinese growth and we were right. Our growth forecast remained unchanged throughout the year, in contrast to the many upward revisions in the consensus, which now converge towards our forecast of 5.3% for 2023. The new 2024 growth target set by the authorities will determine the extent of fiscal and monetary support to the economy. This is a point on which we must be vigilant, especially because of the presidential elections in Taiwan next year.

For 2024, we expect growth around 5%, higher than the consensus forecast. Indeed, Chinese activity is showing signs of stabilization at the end of the year. The recovery remains driven by the consumption of services. Investment in manufacturing and infrastructure is strengthening, replacing real estate investment.

Real estate is still a drag on the recovery but the recent turnaround of the Chinese authorities, now favoring financial support to real estate developers, should limit its negative impact on growth.

Economic policies will also support activity. The government’s three priorities for action are now: the real estate sector, the private sector and direct investment abroad.

A low interest rate environment is emerging to support the private sector. Liquidity injections to avoid cash squeeze episodes related to large central government debt issues should also help keep rates low.

A large part of budget spending (only 75% of the budget used for 2023) is expected to continue to spread in 2024, providing significant support for the activity. The budget deficit is expected to reach 6.8% of GDP in 2024.

Monetary Policy

Divergence between the Fed and the ECB

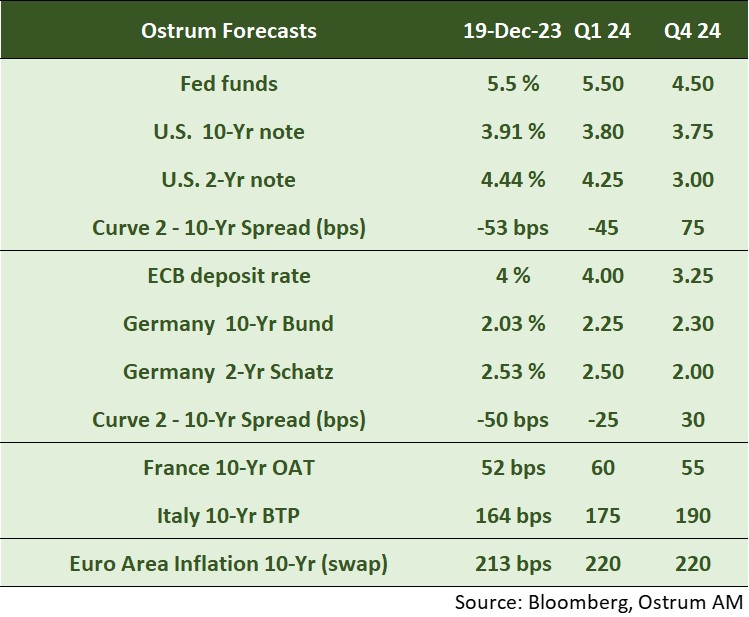

- The Fed begins to talk about rate cuts

On December 13, the Fed left its rates unchanged for the third consecutive time. The highlight was the central bank’s significant change in tone following the stronger-than-expected slowdown in inflation. Median inflation expectations of FOMC members were revised down in 2023 and to a lesser extent in 2024 and 2025 (to 2.8%, 2.4% and 2.1% respectively). The FOMC members anticipate on average 3 rate cuts in 2024 while in September they expected a new increase in late 2023 (which did not take place) and 2 rate cuts in 2024. Jerome Powell went further in the press conference noting that discussions had focused on when it would be appropriate to lower rates. We now expect 4 rate cuts from the Fed funds in 2024, the first one probably taking place in the second quarter. - The ECB doesn’t let its guard down

The ECB left its rates unchanged for the second consecutive time in December. It revised down its inflation expectations in 2023 and 2024 (to 5.4% and 2.7% respectively) and to a lesser extent those for core inflation (5% and 2.7%). Core inflation in 2025 was revised up to 2.3%. Growth prospects were also revised down (0.6% in 2023 and 0.8% in 2024). Christine Lagarde was very clear: the work is not yet finished and this is not the time for the ECB to let its guard down. The central bank will closely monitor data on wages and unit profits during the first half of 2024. Rate cuts were not discussed. The ECB has announced changes to the PEPP. While the reinvestments of the tombs were to continue until the end of 2024 at least, the Central Bank decided to reinvest only half in the 2nd half (at the rate of 7.5 billion euros on average per month) and to put an end to 2024. We anticipate 3 rate cuts from the ECB in 2024, the first probably taking place in the 2nd quarter, after the Fed.

Market views

Asset classes

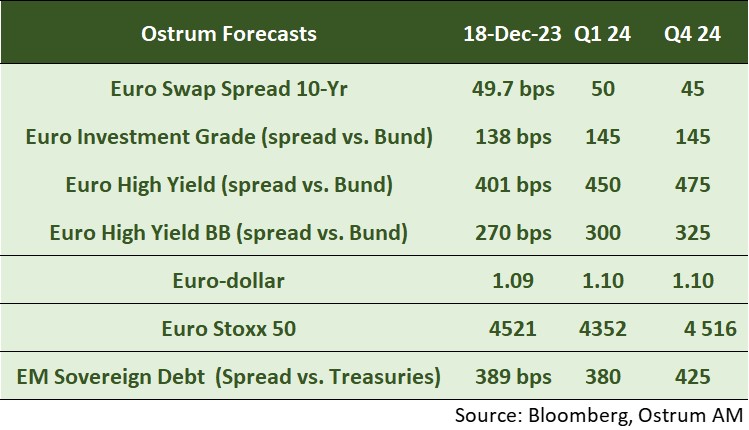

- US rates: the Fed will begin an easing cycle in 2024. Interest rates should slide towards 3.75% at the end of 2024 despite possible tensions due to the debt refinancing of the Treasury.

- European rates: the Bund should normalize somewhat in the first quarter, with the ECB reluctant to act as quickly as expected by the markets.

- Sovereign spreads: a later reduction than expected of the PEPP and the prospect of lower rates eases the pressure linked to degraded public finances.

- Euro area inflation: breakeven inflation rates seem to be anchored at levels slightly higher than the Central Banks' targets.

- Euro credit: credit spreads should remain stable. High yield should be marked by a decompression trend.

- Foreign exchange: the euro should remain around $1.10 due to weak growth in the euro zone.

- Equities: falling margins will be offset by higher multiples.

- Emerging debt: spreads benefit from monetary relief from the Fed.

Ostrum Perspectives December 2023

Download Ostrum Perspectives December 2023