Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte’s and Aline Goupil-Raguénès’ podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Mario Draghi alerts the EU to the urgent need to act to increase productivity

- Mario Draghi's report provides an accurate overview of Europe's decline compared to the United States in terms of productivity and China's rapid catch-up, in a world that has become less collaborative;

- It identifies three areas of action. The most important: reduce the innovation gap with the United States and China, particularly in advanced technologies, develop a common decarbonization and a productivity plan to strengthen defense and reduce dependencies;

- Massive investments are necessary: 750 to 800 billion euros per year in additional investments according to the EC and the ECB. Part of it will have to be financed by the public sector, notably through an increase in common debt;

- Mario Draghi warns of the urgency of acting collectively to avoid “a slow agony” of the EU. The question now concerns the political will of governments to take up this “existential challenge”.

Market review: The Fed in "Risk Management" Mode

- The Fed acts preemptively by cutting rates by 50 bp;

- The BoE and the BoJ maintain status quo on rates;

- Curve steepening resumes;

- Equities and high yield react positively to monetary easing.

Axel Botte’s and Aline Goupil-Raguénès’ podcast

- Topic of the week – Eurozone and US economic conditions;

- Theme – The Draghi plan for the EU

Chart of the week

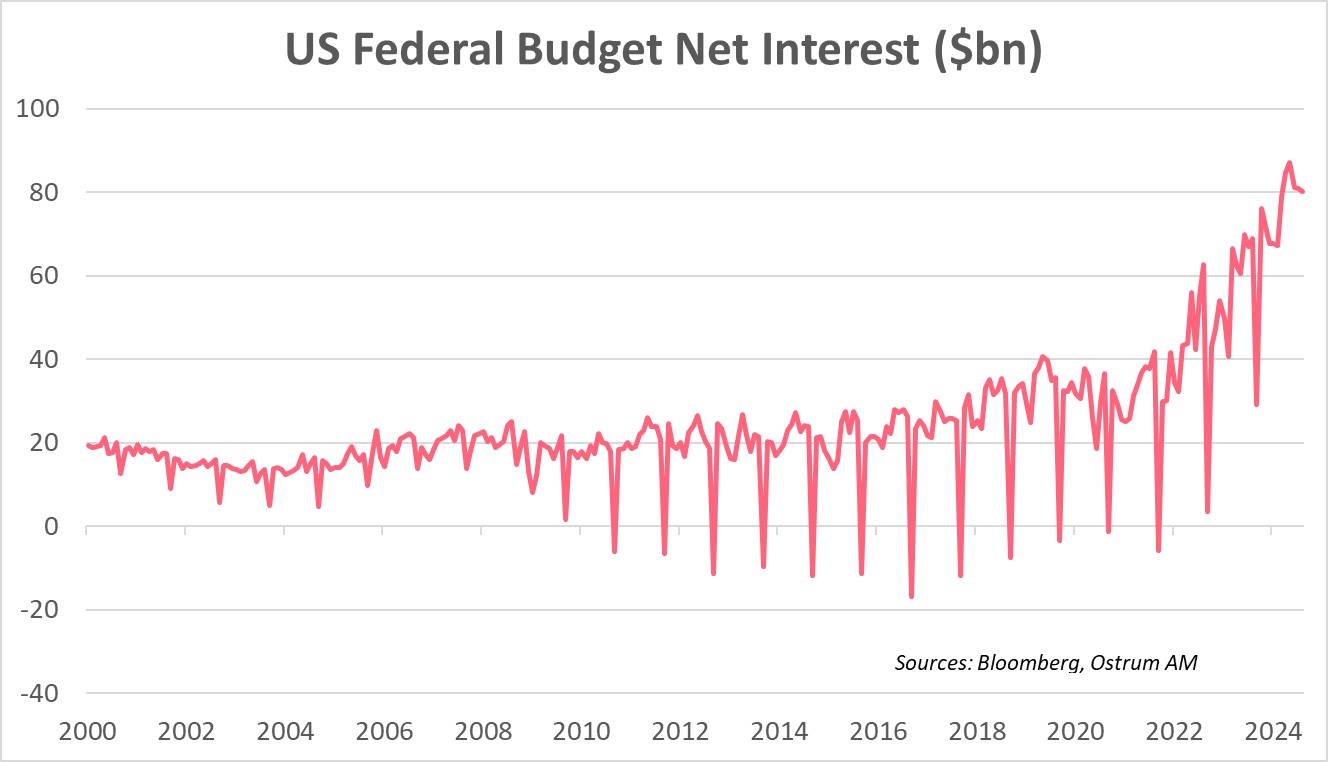

The Fed's decision to opt for a 50 bp rate cut, and not 25 bp, was justified by J. Powell as an insurance to protect against a more marked deterioration in the job market. The reason may also be found in this graph. Government spending on net interest has increased sharply in recent years, reaching $80.2 billion in August compared to $68 billion a year ago. This reflects higher public debt and rising interest rates. By lowering its key rates more quickly, the Fed makes it easier to finance the government's debt service.

Figure of the week

1

Only one Fed member opposed the 50 basis point rate cut: Michelle Bowman. She wanted a reduction of 25 bp. This disagreement is rare for a member of the Board of Governors.

MyStratWeekly : Market views and strategy

MyStratWeekly – September 24th 2024