Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: August 5: Blame it on the carry trade?

- The volatility shock on August 5th was surprising in its speed and intensity;

- The peak of volatility at unusually high levels led to the unwinding of carry trade strategies, resulting in the appreciation of the yen;

- High-yield currencies, particularly the Mexican peso, were penalized;

- The foreign exchange swaps market facilitated carry trade strategies on the yen;

- These foreign exchange transactions are accounted for off-balance sheet, making it difficult to quantify the carry trade on the yen, estimated at 40 trillion yen by the BIS;

- The severity of the "sell-off" in global stock markets indicates that other factors also exacerbated the volatility, such as risk management through "Value at Risk" models and the increase in margin calls.

Market review: US job market to dictate market direction

- US job growth at 142k in August, with unemployment ticking down to 4.2%;

- Fed policymakers seem to favor a 25 bp reduction in September;

- French OAT spreads below 70 bps after the nomination of Mr. Barnier as PM;

- Equities fell last week amid higher high yield spreads.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the week: US Employment & the Fed, ECB meeting;

- Theme: August 5: Blame it on the carry trade?

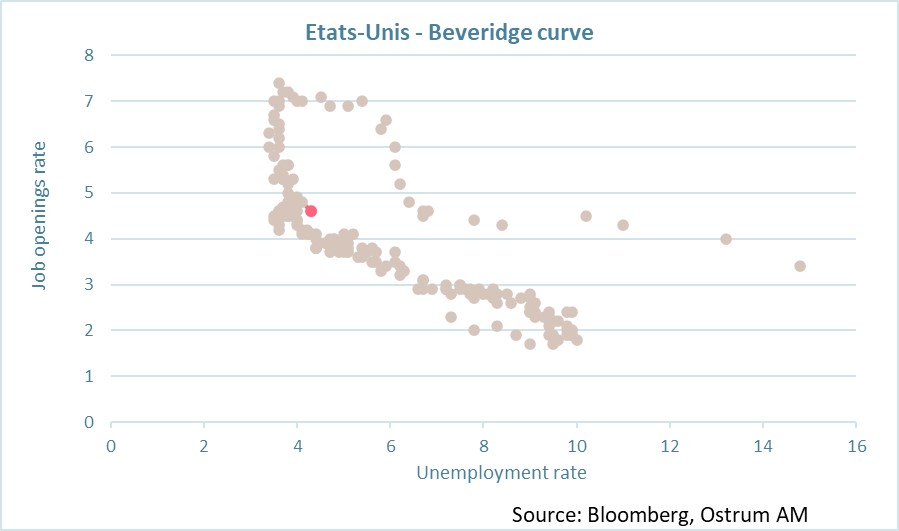

Chart of the week

The US labor market is at the forefront of investors' concerns. The excess demand for labor following the COVID pandemic had made the relationship between the unemployment rate and job vacancies steep. The long-term relationship between the two variables is rather a decreasing one. The steepness the Beveridge curve is symptomatic of a labor market matching problem, linked to the mismatch between workers' hiring desires and the positions offered. The latest data for July seems to validate the idea of a normalization in which a reduction in labor demand would result in a simultaneous increase in unemployment.

Figfure of the week

This is the decline in German industrial production since its peak in 2017. The contraction is most pronounced in the automotive and chemical sectors, penalized by the energy crisis. Germany heavily relied on Russian gas.

Source: Destatis.

MyStratWeekly : Market views and strategy

MyStratWeekly – September 10th 2024