Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Topic of the week: When Grain is Under Pressure…

- The FAO Food Price Index has fallen but remains high compared to previous years;

- We identify 4 factors that should contribute to keep them sustainably high;

- The high concentration of grain and fertilizer markets is a risk in a context of increased geopolitical shocks;

- Upside risks stem from China’s willingness to improve food security, climate change and the decarbonization of food supply chains;

- This involves significant social issues, in a context where food inflation (real) is higher than inflation in 81% of the world’s countries (World Bank).

Market review: On the verge

- Yield curve keep steepening;

- Profit taking across risky asset markets as quarter-end looms;

- Disinflation gaining traction in the euro area;

- Dollar eases somewhat, as pressure mounts on the Japanese yen.

Axel Botte's and Zouhoure Bousbih's podcast

- Topic of the Week: BoJ and MoF face Yen weakness;

- Theme: When grain is under pressure…

Chart of the week

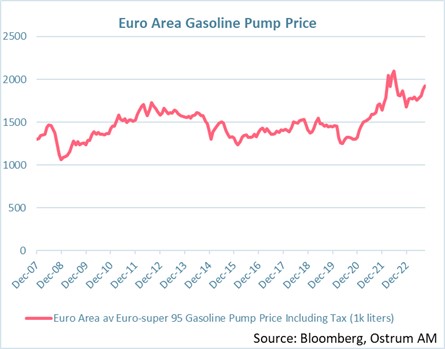

The price of gasoline regularly makes headlines as it appears to be a determining factor in households' perception of inflation.

That being said, a liter of gasoline is close to €2, taxes included, on average in the euro zone. Current levels are close to the highs seen in the first few months of Russia's invasion of Ukraine.

This price is therefore higher than in 2011 when oil reached $110 per barrel. The rise in crude oil obviously plays a major role, but it is refining margins and Russian diesel export restrictions that seem to explain the current high price levels.

Figure of the week

This is the increase in basis points in the yield on 30-year US bonds during the 3rd quarter. The 30-year yield is trading at 4.70%.

MyStratWeekly : Market views and strategy

MyStratWeekly – October 3rd 2023Listen to Axel Botte's and Zouhoure Bousbih's podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)