Read our market review and find out all about our theme of the week in MyStratWeekly and its podcast with our experts Axel Botte, Aline Goupil-Raguénès and Zouhoure Bousbih.

Listen to Zouhoure Bousbih’s podcast (in French only)

Podcast slides (in French only)

Download the Podcast slides (in French only)Topic of the week: Emerging market currencies in the shadow of US elections

- Despite the Fed’s rate cuts, emerging market currencies have not performed;

- This is due to the strengthening of the dollar and to the uncertainty about the U.S. election outcome;

- Trade policy, a reduction in foreign direct investment (FDI) and remittances from migrant workers, are the three main specific risks for emerging market currencies;

- However, beyond the election, fiscal risk remains the main market mover for EM currencies, particularly those in Latin America, such as the Mexican peso, whose growth prospects are deteriorating;

- The volatility in the Brazilian real seems excessive to us, given the improvement in growth prospects and the external position;

- We favor cross-currency strategies rather than those against the dollar.

Market review: Relative Calm Before the Storm

- Markets are focused on the U.S. election;

- The T-Notes is stabilized around 4.2 %;

- Stocks are declining in Europe, with profits under pressure in several sectors;

- Gold as the ultimate safe haven.

Zouhoure Bousbih’s podcast :

- Topic of the week – US rates, Eurozone surveys and Moody’s decision about France’s rating;

- Theme – Emerging Market Currencies in the shadow of U.S. elections.

Chart of the week

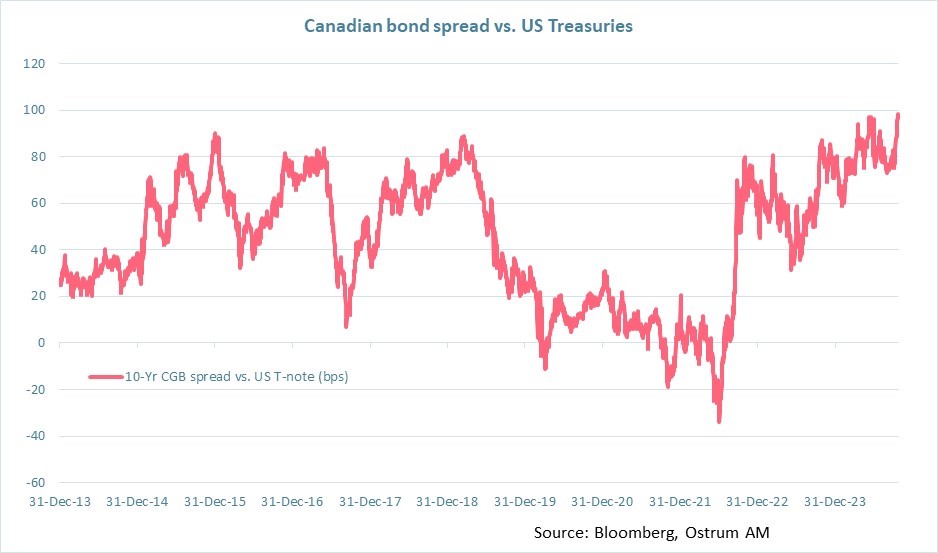

The Bank of Canada has accelerated its monetary easing cycle by lowering its key interest rate by 50 basis points to 3.5%. This follows three previous rate cuts of 25 basis points each.

This has widened the 10-year interest rate differential with the United States to 100 basis points, for the first time since 2013.

Further rate cuts are expected due to the deterioration of growth prospects linked to weak consumption. The bulk of GDP growth in Q2 was driven by government spending.

Figure of the week

6%

This is the forecast for the French budget deficit as a percentage of GDP by 2029 according to the International Monetary Fund, which is the current level. Public debt is expected to reach 124.1% of GDP at that time.

MyStratWeekly : Market views and strategy

MyStratWeekly – October 29th 2024